Revolve price tries to vent off overbought saturation - Forecast today - 03-11-2025

Revolve Group (RVLV) stock declined in its latest intraday trading as it attempts to gain positive momentum that could help it recover and rise again. At the same time, the stock is working off part of its overbought levels on the relative strength indicators, where negative signals have started to appear. The decline found support at the previous 50-day SMA, while the stock remains under the dominance of a short-term corrective bullish trend, with trading along an ascending line.

Therefore, we expect the stock to rise in its upcoming trading sessions, provided that the support level of $21.25 holds, targeting the key resistance level of $24.55.

Today’s stock forecast: Bullish.

Toast price tries to recoup some losses - Forecast today - 03-11-2025

Toast, Inc (TOST) stock rose in its latest intraday trading, attempting to recover part of its previous losses. However, continued negative pressure from trading below the previous 50-day SMA limits the chances of a sustainable recovery in the near term, especially as the stock continues to trade along a short-term descending line. In addition, bearish signals persist on the relative strength indicators, reinforcing the negative outlook.

Therefore, we expect the stock to decline in its upcoming trading sessions as long as the resistance level of $39.75 holds, targeting the support level of $32.70.

Today’s stock forecast: Bearish.

On Holding price deepens losses - Forecast today - 03-11-2025

On Holding AG (ONON) stock continued to decline in its latest intraday trading under the dominance of the main short-term bearish trend, with trading along a descending line that reinforces this direction. The stock remains under ongoing negative pressure from trading below the previous 50-day SMA, while bearish signals continue to appear from the relative strength indicators, despite reaching extremely oversold levels.

Therefore, we expect the stock to continue declining in its upcoming trading sessions as long as the resistance level of $42.00 holds, targeting the key support level of $34.60.

Today’s stock forecast: Bearish.

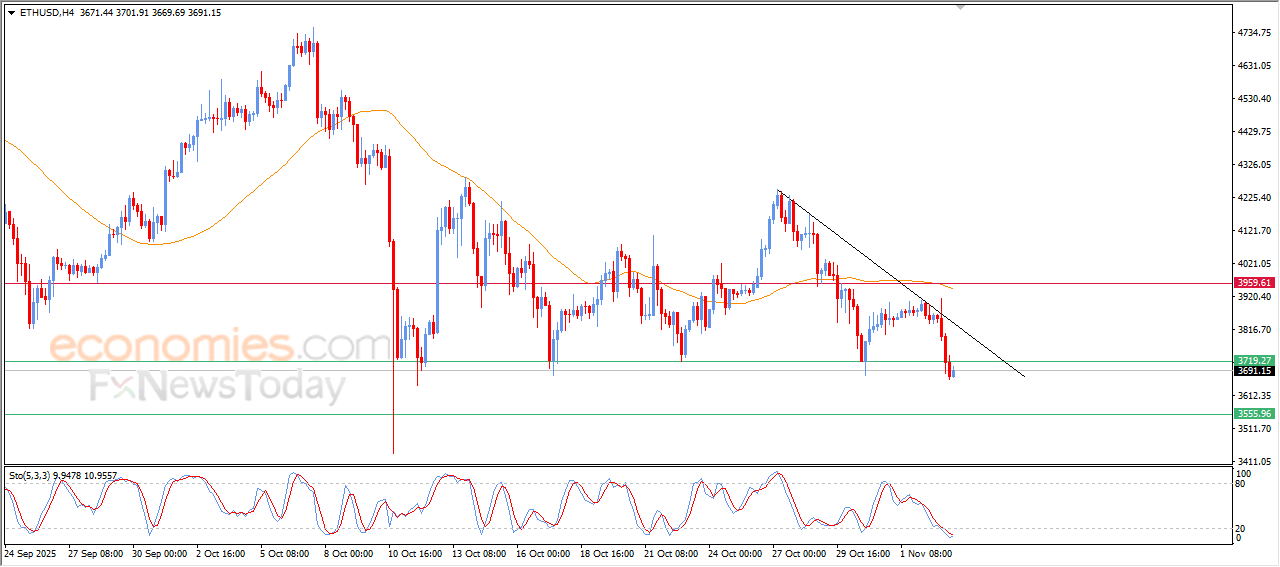

Forecast update for Ethereum -03-11-2025

The price of (ETHUSD) settled with sharp decline in its last intraday trading, to break the key support of $3,720, amid the dominance of the main bearish trend and its trading alongside minor trendline on the short-term basis, with the emergence of the negative signals on the relative strength indicators, despite reaching oversold levels, which might reduce the losses on the near-term basis.

VIP Trading Signals Performance by BestTradingSignal.com (20-31 Oct, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for 20-31, October 2025: