ASML price returns higher - Forecast today - 06-11-2025

ASML Holding N.V. (ASML) stock rose in its latest intraday trading after successfully easing its overbought conditions on the relative strength indicators, giving it more room to record additional gains in the near term. This comes amid continued positive momentum from trading above the previous 50-day SMA and under the dominance of the main short-term bullish trend.

Therefore, we expect the stock to rise in its upcoming trading sessions as long as it remains above the support level of $997.65, targeting the key resistance level of $1,086.00.

Today’s stock forecast: Bullish.

Gamestop price tries to recoup some losses - Forecast today - 06-11-2025

GameStop Corporation (GME) stock rose slightly in its latest intraday trading, as the stock attempts to recover part of its previous losses while also trying to ease its oversold conditions on the relative strength indicators, where a bullish crossover has begun to appear. However, continued negative pressure from trading below the previous 50-day SMA reduces the chances of a sustained recovery in the near term, with the main short-term bearish trend still dominant.

High-risk warning: GME belongs to a group of stocks known as “meme stocks,” which are characterized by high speculative trading activity. As a result, the stock’s movements often deviate significantly from typical technical expectations or financial reports and can be highly unpredictable.

Therefore, we expect the stock to decline in its upcoming trading sessions as long as the resistance level of $24.50 holds, targeting the key support level of $20.75.

Today’s stock forecast: Bearish.

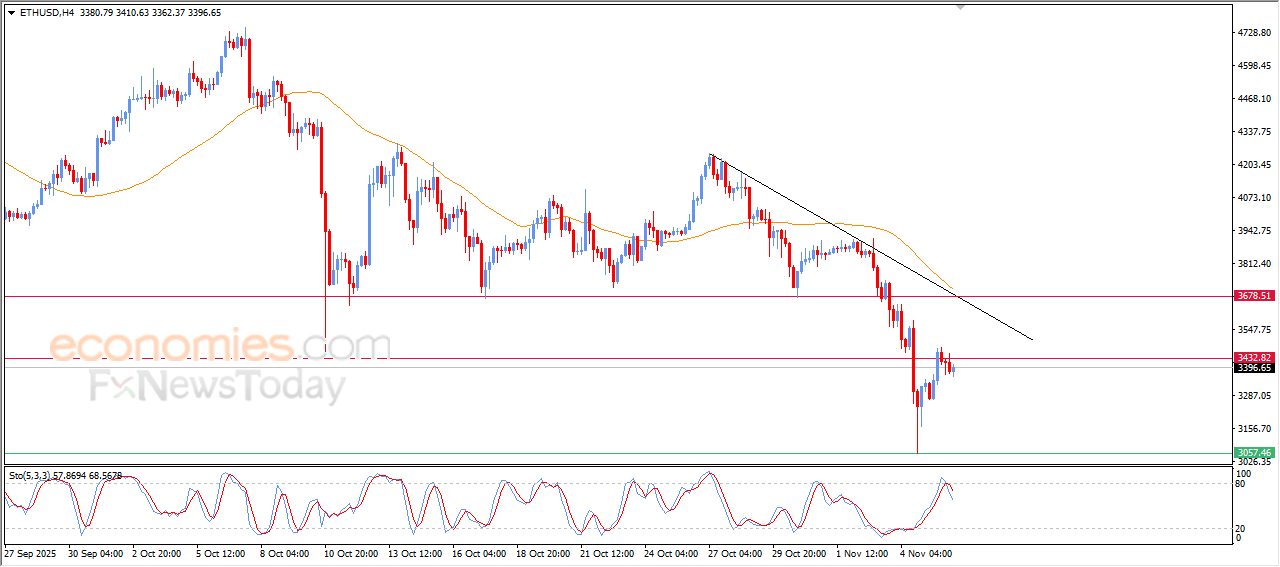

Forecast update for Ethereum -06-11-2025

The price of (ETHUSD) settled with slight decline in its last intraday trading, affected by the negative pressure due to the relative strength indicators reaching overbought levels, exaggeratedly compared to the price move, forming negative divergence that intensified the dominance of the main bearish trend, amid its trading alongside minor trend line on the short-term basis.

VIP Trading Signals Performance by BestTradingSignal.com (20-31 Oct, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for 20-31, October 2025:

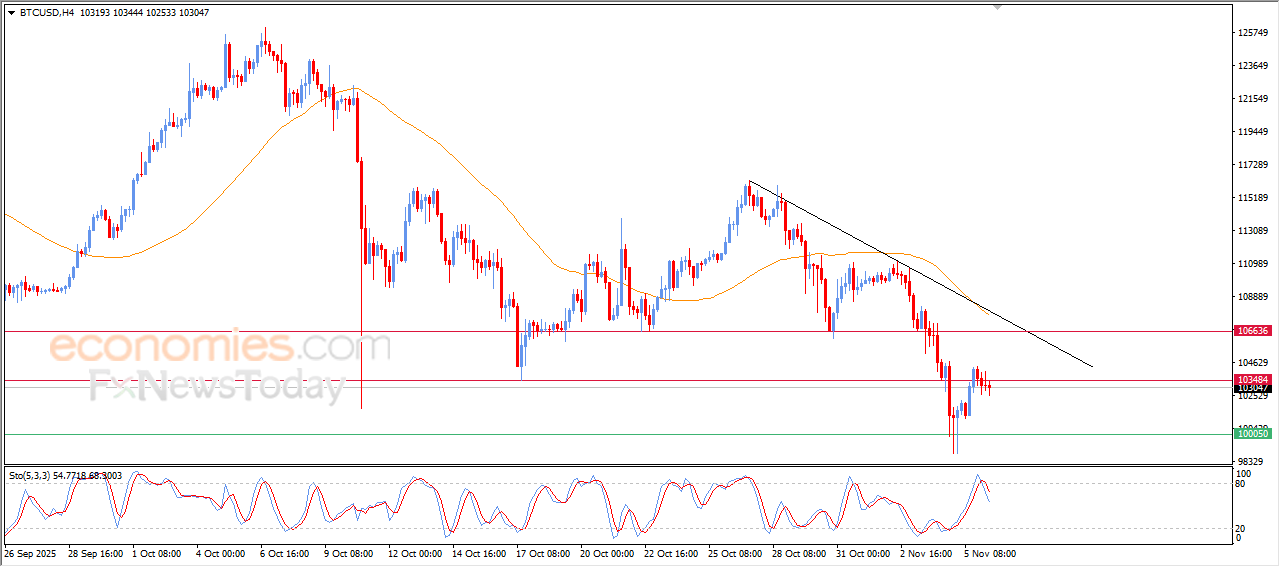

Forecast update for bitcoin -06-11-2025

Bitcoin (BTCUSD) prices declined during their last intraday trading, due to the stability of the resistance at $103,500, with the beginning of forming negative divergence on the relative strength indicators, after reaching exaggerated overbought levels compared to the price move, with the beginning of the negative signals emergence, amid the dominance of the main bearish trend and its trading alongside minor trendline on the short-term basis.

VIP Trading Signals Performance by BestTradingSignal.com (20-31 Oct, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for 20-31, October 2025: