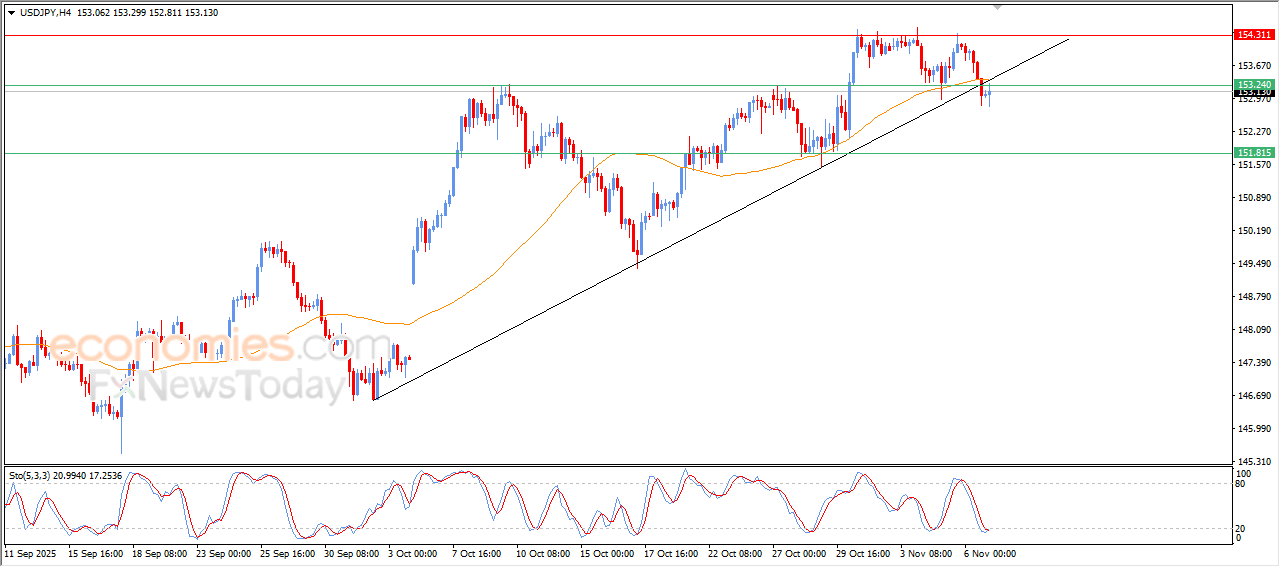

The USDJPY is breaking main bullish trend line-Analysis-07-11-2025

The (USDJPY) witnessed volatile trading on its last intraday levels, where the price is attempting to offload some of its oversold conditions that appeared on the relative strength indicators, accompanied by forming positive crossovers that might support the attempts to settle on near-term basis.

Despite these tentative positive signs, the price remains under clear technical pressure, after breaking main bullish trend line on the short-term basis and its decline below EMA50, which reinforces the likelihood of the decline extension unless the price manages to regain the broken support levels.

VIP Trading Signals Performance by BestTradingSignal.com (20-31 Oct, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for 20-31, October 2025:

GBPUSD price is under negative pressure- Analysis-07-11-2025

The (GBPUSD) price declined in its last intraday trading, affected by reaching the resistance of its EMA50, which forced it to rebound to the downside after a consecutive gains journey to correct the main bearish trend on the short-term basis, amid its trading alongside supportive trendline for this track, besides the relative strength indicators reaching overbought levels that might intensify the negative pressure.

VIP Trading Signals Performance by BestTradingSignal.com (20-31 Oct, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for 20-31, October 2025:

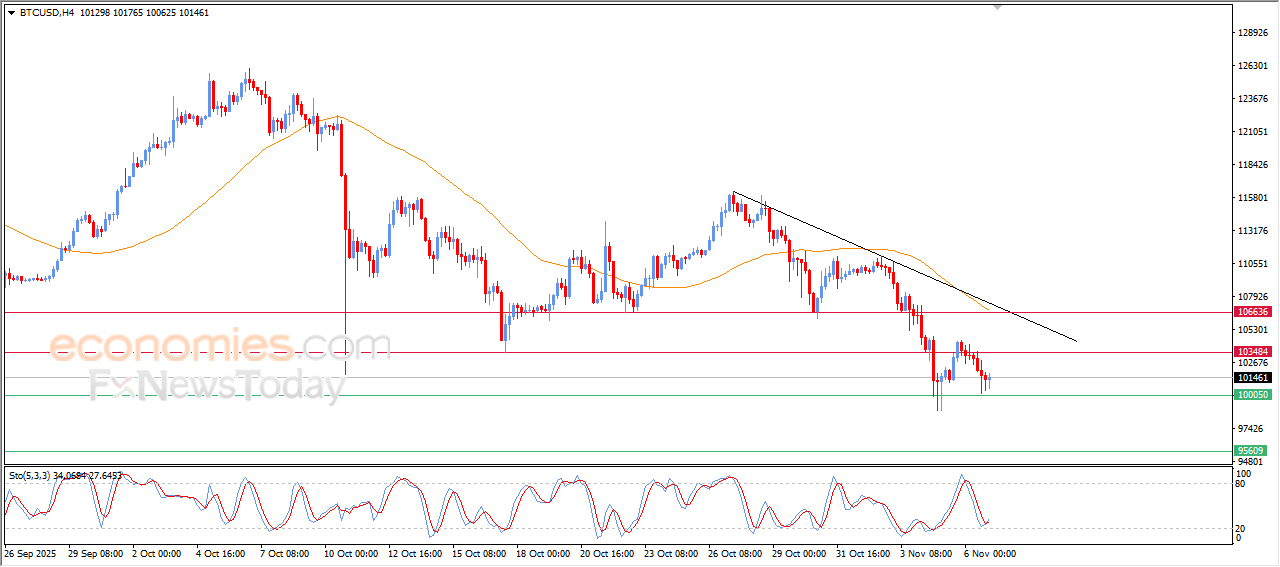

Bitcoin is approaching the psychological support break at $100,000-Analysis-07-11-2025

Bitcoin (BTCUSD) declined in its last trading on the intraday levels, approaching from breaking the main support level at $100,000, amid the continuation of the main bearish trend dominance on the short-term basis and the trading alongside bearish trendline that reinforces this track. Bitcoin keeps trading below EMA50, which keeps the negative pressure valid and limits the chances of a rebound.

There are technical signs that might support the stability attempts, where the relative strength indicators began forming positive crossovers after reaching clear oversold levels, these signs might reduce the strength of the decline in the near-term basis, but it needs confirmation by breaching key resistance levels before suggesting clear trend reversal.

VIP Trading Signals Performance by BestTradingSignal.com (20-31 Oct, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for 20-31, October 2025:

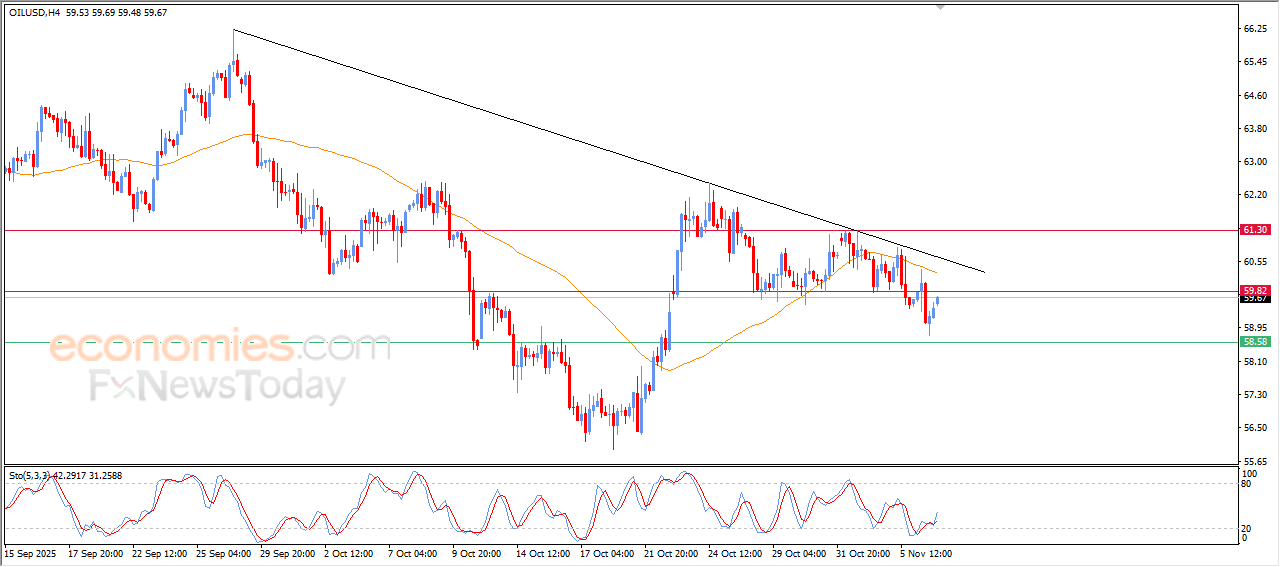

Crude oil price attempts to offload its oversold condition- Analysis-07-11-2025

Crude oil prices rose in their last intraday trading, attempting to offload some of the oversold conditions that appeared clearly on the relative strength indicators, this improvement comes within the price attempts to catch its breath after the last bearish waves.

Despite this limited rise, the negative pressure remains dominant on the price due to its trading below EMA50, besides its trading alongside bearish trend line on the short-term basis, which supports the stability of the main bearish trend unless we witness clear technical breaches above the near resistance levels.

VIP Trading Signals Performance by BestTradingSignal.com (20-31 Oct, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for 20-31, October 2025: