Bitcoin price (BTCUSD) forecast update - 11-11-2024

Bitcoin price (BTCUSD) continues to rise to move away from 81000.00$ barrier, reinforcing the expected positive scenario for today, reminding you that our next target is located at 82500.00$, which breaching it represents the key to rally towards 84655.00$ as a next main station.

Holding above 79250.00$ is important to the continuation of the expected rise, as breaking it will push the price to achieve some intraday bearish correction before turning back to rise again.

The expected trading range for today is between 79500.00$ support and 83500.00$ resistance.

Trend forecast: Bullish

Read more: 5 Best Platforms to Discover Promising Crypto for Investing – Beginner Trader’s Guide

Read more: Missed Yesterday's Crypto Bull Rally? The Trump Effect is Just Getting Started

Update: Calm markets affected by the US markets’ holidays

The major currencies’ pairs and commodities show calm trads since morning, affected by the US markets’ holidays, thus, no change to the morning suggested scenarios, and we recommend reviewing them to check the expected trends and targets for the upcoming period.

5 Best Platforms to Discover Promising Crypto for Investing – Beginner Trader’s Guide

How to Find New Cryptocurrencies for Investment

• Introduction

In the new world of crypto-related investments, the real challenge may be finding a cryptocurrency worth investing in other than the main ones like Bitcoin and Ethereum. Investing in digital currencies is quite different from investing in traditional financial markets, as it requires knowing where to find information and updates and how to analyze them to gauge their future potential. Below are some ways for investors, especially beginners, to discover new promising cryptocurrencies for investment.

Key Points

- Multiple Market Opportunities: The crypto world is filled with investment opportunities due to the flow of money into this market.

- Diversify Sources: It’s best to use multiple sources to assess a cryptocurrency before investing in it.

- Platforms and Tools:

- Exchanges and Data Platforms: These are some of the fastest ways to find new digital currencies.

- Social Media: Can be a useful tool for learning about emerging market trends.

- Tools like KryptView and BSCCheck assist in evaluating cryptocurrencies and choosing the best ones.

- Other Research Methods:

- Non-Fungible Tokens (NFTs).

- Exchange-Traded Funds (ETFs) linked to or holding digital currencies.

- Initial Coin Offerings (ICOs).

Where to Find New Cryptocurrencies?

Before you start searching, you may want to ask yourself some key questions, such as:

- How will investing in crypto affect your financial portfolio?

- Is it a good long-term investment?

- Should you invest in Initial Coin Offerings (ICO)?

- Are Non-Fungible Tokens (NFTs) a good idea?

- What is Decentralized Finance (DeFi), and does it hold interesting investment opportunities?

Navigating the world of cryptocurrencies can be confusing. The lack of measurable reliability and evaluation standards, along with the prevalence of scams, has left potential investors feeling bewildered and anxious. However, despite these challenges, cryptocurrencies may be an asset class worth exploring. They can add diversity to your investment portfolio, and their price volatility may offer good returns.

Crypto Tracking Sources

There are many sources you can monitor to keep track of new cryptocurrencies emerging in the market.

| Source | Description |

|---|---|

| Exchanges | Binance, Coinbase, Crypto.com, Gemini, Kraken |

| Data | CoinGecko, CoinMarketCap |

| Social Media | Discord, Telegram, X (Twitter) |

| Tools | KryptView.com, BSCCheck, TokenSniffer |

| Websites | Trading View, DEX Screener |

| DeFi Platforms | Provide ways to create DeFi apps and may also offer the ability to purchase related tokens or cryptocurrencies. |

| NFT Trading Platforms | OpenSea, Rarible, and SuperRare. Popular markets for finding new NFTs with promising potential. |

Looking for the Best Platforms to Trade Cryptocurrencies?

If you want to invest safely and access the best platforms, click the button below to learn about the best platforms for crypto trading and get the optimal guidance to achieve your investment goals.

Discover the Best PlatformsInitial Coin Offerings (ICO)

These are fundraising events to launch potential new cryptocurrencies. Most of these offerings are preferably registered with regulatory authorities to ensure compliance with the law.

Exchange-Traded Funds (ETFs)

You can indirectly invest in cryptocurrencies through derivatives or investment funds traded on traditional exchanges.

• Exchanges

Crypto exchanges are one of the most reliable sources for finding new investments. For instance, (Coinbase) usually lists new cryptocurrencies on its website, but it’s best to create an account for full access to this information. Similarly, (Binance) provides lists of new cryptocurrencies that you can review and study further.

• Data Aggregators

Data aggregators gather information on specific topics. Thus, crypto data aggregators help you find new cryptocurrencies. For example, (CoinMarketCap) aggregates and displays a list of new cryptocurrencies along with their prices, market cap, and trading volume. This type of service gives you insights into what other investors think about these cryptocurrencies and whether they hold growth potential.

(CoinGecko) is another data aggregator that offers lists of new cryptocurrencies, with similar information to that provided by (CoinMarketCap). Crypto data aggregators may show delayed or inaccurate information from exchanges due to a time lag between trading activity and displayed prices. Therefore, using trading platforms is preferred for real-time price tracking.

• Social Media

Social media is known for its ability to quickly share information. X (formerly Twitter) is one of the fastest responding platforms in the United States. You can easily find crypto developers and founders on X, where they tweet about their tokens whenever changes or new cryptocurrency launches occur.

Setting notifications for specific keywords on X can be particularly useful. If you set alerts for phrases like “new cryptocurrencies,” “crypto launches,” or “crypto tokens,” you’ll receive notifications about any related tweets. Telegram is another instant messaging platform that can provide timely updates on new crypto developments.

• Websites

Several websites are reliable for discovering new digital currencies. Some of the most trustworthy ones include:

- Top ICO List

- Trading View

- CoinMarketCap

These sites provide information on new launches, including prices, market caps, and trading volumes.

• Tools

You can use various tools to verify the safety of cryptocurrencies. For example, KryptView allows investors to enter a token’s name or address to verify it. BSCCheck allows investors to check tokens on the Binance Smart Chain. Each tool displays information on transactions, contracts, holders, and prices, helping you gauge the activity level around that token.

Token Sniffer allows investors to enter a cryptocurrency’s name or address to view a detailed report. For example, a check on Ax-1 Orbit (address 0x0c...b805) on August 8, 2022, showed the following:

- Warning: The token is flagged as part of a scam, issue, or exploit.

- Trade Analysis: The token can be sold with buy/sell fees below 10%.

- Contract Analysis: Verified contract, no previous similar contracts, source is not the owner, no special permissions for the creator.

- Holder Analysis: One wallet holds more than the circulating supply (potentially a scam), the creator holds less than 5% of the supply, other holders own less than 5% each.

- Liquidity Analysis: Insufficient liquidity, 95% of liquidity is burned or locked, the creator holds less than 5% of liquidity.

- Token Similarity: Multiple tokens share 97% or higher similarity with other reported tokens.

• Decentralized Finance (DeFi) Platforms

Decentralized Finance (DeFi) platforms are ecosystems combining blockchain technology, programming, and user interfaces, allowing the creation of decentralized applications (dApps). Some of these platforms may offer crypto exchange and trading services, but most are designed to support DeFi applications such as peer-to-peer lending, borrowing, and liquidity provision.

Many DeFi platforms feature their own native tokens used within their networks to facilitate transactions. Examples of these platforms include:

- DeFi Maker

- Uniswap

- Aave

In addition to being a blockchain, the Ethereum network also serves as a DeFi platform, as it enables users to build any type of dApp on it, including DeFi applications.

• NFT Trading Platforms

Non-Fungible Tokens (NFTs) are digital assets tokenized on the blockchain. Tokenization involves linking encrypted information (hashed) to the token and storing it on the blockchain, ensuring indisputable proof of ownership, as network validators confirm ownership through consensus.

NFTs play a pivotal role in the metaverse, an emerging tech trend embraced by companies working in the digital and crypto landscape.

OpenSea and Rarible are examples of popular NFT marketplaces. Here, you can find NFTs priced from hundreds to tens of thousands of dollars.

There are also specialized marketplaces focused on specific industries or sports. For instance, the NBA has an NFT marketplace called TopShot, while the NFL has partnered with Dapper Labs to produce exclusive digital highlights showcasing legendary moments in its history.

Luxury retailers, like Tiffany and Gucci, also sell NFTs, which are popular among some customers.

• Crypto Initial Coin Offerings (ICOs)

In 2018, Initial Coin Offerings (ICOs) surpassed venture capital as the primary method for fundraising by entrepreneurs. Startups and even established companies jumped on the ICO bandwagon.

Then the ICO bubble burst due to rampant fraud in its ecosystem, and the SEC began investigating and cracking down on ICOs. The SEC now provides substantial guidance on when tokens and ICOs are considered security sales.

ICOs are still available, but they are highly regulated, and only a few remain.

• Exchange-Traded Funds (ETFs)

You can also indirectly invest in cryptocurrencies through derivatives traded on major financial exchanges. Popular crypto futures on the Chicago Mercantile Exchange (CME), including Bitcoin and Ethereum futures, are sought after by investors seeking indirect exposure to cryptocurrencies.

Bitcoin-linked ETFs, based on CME Bitcoin futures, first appeared in the crypto markets in 2021.

In January 2024, the SEC approved long-awaited ETFs that had faced lengthy regulatory battles. These ETFs offer exposure to Bitcoin but are much cheaper since you can buy shares in a fund that holds Bitcoin instead of buying Bitcoin directly.

Shortly after approving Bitcoin ETFs, the SEC approved several Ethereum ETFs.

Top Cryptocurrencies for Investment

New projects are always emerging in the crypto world, meaning there are many options for investment. You can choose to invest in the most popular cryptocurrencies like Bitcoin, Ethereum, and other leading assets in the digital market.

Past performance of cryptocurrencies does not guarantee future results. Additionally, there are many other cryptocurrencies with high growth potential. When assessing investment opportunities, several factors should be considered, such as price, market cap, 24-hour trading volume, public sentiment about the currency, legal issues, government regulations, and reviewing the project’s whitepaper.

Finding New Cryptocurrencies

Technically, cryptocurrencies are products that usually serve a purpose, whether as a mere payment method like (Bitcoin) or a utility token used to perform functions on the blockchain like (Ethereum). Meme coins (e.g., Dogecoin, Shiba Inu) typically don’t have a purpose but have somehow gained fans who value them.

Below are some factors to consider and tools that can help you determine whether a currency is simply a “rug pull” or another form of scam.

A rug pull is a type of cryptocurrency whose developers accept payments for it and then remove it from any platform you purchased it on, keeping the money you paid for it.

Cryptocurrency Use Cases

The Ethereum token (ETH) is used as a payment method on its network, making it an ideal example of a use case that may encourage people to purchase Ethereum, the "second largest cryptocurrency in the world."

Ethereum is designed to be scalable and future-proof, making it an ideal ecosystem for developing decentralized finance (DeFi) applications. Known as the "global virtual machine," Ethereum supports a significant part of the DeFi ecosystem and is rumored to be the preferred choice for developers building Web3 applications.

Bitcoin was initially designed as a pure payment method. However, as investors noticed its rising value, Bitcoin acquired a new purpose.

During the COVID-19 pandemic, when much of the global economy shut down, and stock markets collapsed, Bitcoin became a safe haven for investors looking to preserve value and also as a speculative investment tool.

The more use cases a new cryptocurrency offers, in addition to the supporting blockchain capabilities, the higher its chance of sustainability and long-term growth.

Liquidity

Any cryptocurrency needs a good level of liquidity, meaning there is enough trading volume for you to sell it quickly when needed. If you find a cryptocurrency lacking in trading volume, it may be best to wait and see if it gains more interest over time.

Value

It’s important to determine the value that a cryptocurrency can have now or potentially in the future. If a currency has value to you, others are likely to appreciate it as well. This value isn’t necessarily financial; it can be intangible, like an NFT (non-fungible token) that resonates with you on a personal level.

Additional Factors to Consider

- Future Prospects: If you can identify a cryptocurrency that stands out from others, for example, by offering a solution to a common problem, it may be a good investment as it may have a chance to survive for the long term.

- Supply and Demand: Many cryptocurrencies have a pre-set maximum supply limit. Once this limit is reached, typically through mining, no more tokens will be produced.

- Price and Trading Volume: Updated information on crypto trading is readily available online. Cryptocurrencies with rising prices and trading volume often have momentum.

FAQs

What are the latest cryptocurrencies?

New cryptocurrencies are launched daily, so there are always fresh options. On October 13, 2024, some new coins were listed on "Binance," including:

- Magnet6900

- MIHARU

- PAL

- STI

- Nasdaq 420

Conclusion

The crypto world and the financial products and services related to it are still relatively small and require careful study. If you are interested in investing in digital assets and new cryptocurrencies, it is advisable to consult a financial advisor to determine whether these investments align with your goals and financial circumstances.

Missed Yesterday's Crypto Bull Rally? The Trump Effect is Just Getting Started

Future of Cryptocurrency in the Trump Era

Recently, cryptocurrency markets have experienced a significant uptick following Donald Trump’s return to the U.S. presidency. Bitcoin’s value has surpassed $80,000, setting a new historical high due to expectations that Trump’s victory may lead to a more supportive regulatory environment for digital currencies. Some analysts predict that Bitcoin could reach $100,000 by early next year.

The overall cryptocurrency market surged by 5.3%, and stocks linked to cryptocurrencies, including Robinhood Markets and MicroStrategy, also saw gains, reflecting growing confidence in the market under Trump’s leadership. Trump has praised Bitcoin this year, and pro-crypto supporters achieved major wins in both the House and Senate races, most notably in Ohio, where pro-crypto Republican Bernie Moreno defeated Sherrod Brown, who was known for his skepticism towards the sector.

Return to History

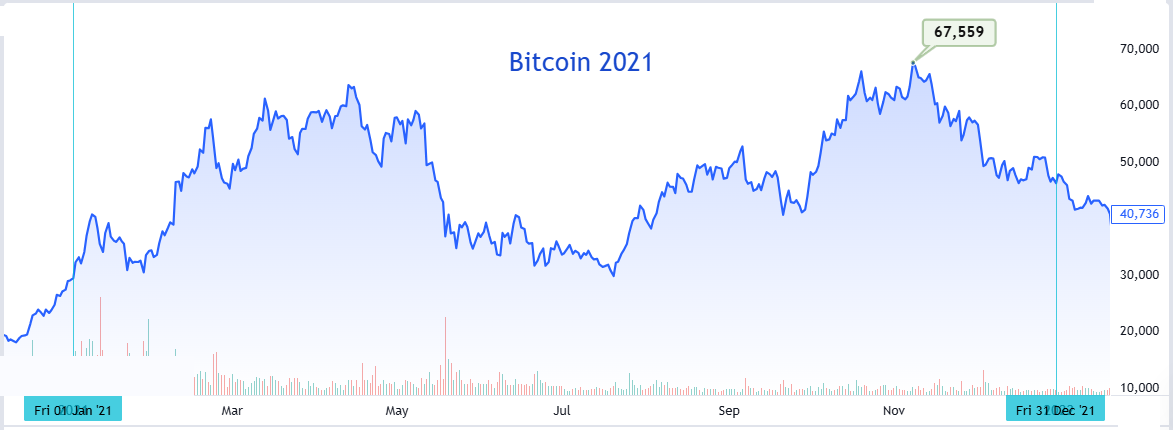

The recent rise in Bitcoin mirrors the increases seen during previous presidential elections. Following the 2020 U.S. presidential election, Bitcoin’s price surged by 369% in the subsequent year, rising from around $13,000 before the election to over $61,000 by November 2021. Many investors anticipate similar growth following the upcoming election results.

Chart showing Bitcoin’s trend in 2021

Historically, the fourth quarter has been particularly profitable for cryptocurrencies. According to Coinglass data, Bitcoin has achieved an average return of 37% in Q4, much higher than any other quarter. Additionally, Bitcoin has yet to respond to the most recent halving event in April (a halving event cuts the reward for mining new Bitcoin by half, thereby reducing its supply).

Trump's Adoption of Digital Currencies

Many cryptocurrency enthusiasts have backed Trump over Harris for various reasons. Although he was skeptical of crypto for years, Trump spoke optimistically about digital currencies during his campaign this year. At the Bitcoin conference in Nashville in July, Trump proposed the idea of creating a Federal Reserve for Bitcoin and emphasized the importance of bringing more Bitcoin mining operations to the United States.

Many crypto enthusiasts are excited about Trump’s alliance with Elon Musk, who has long advocated for digital currencies on social media. On election night, Dogecoin, Musk's favorite cryptocurrency, surged by 25% to $0.21.

Perhaps most importantly, Trump has vowed to remove Gary Gensler, chairman of the SEC, who has filed numerous lawsuits against crypto projects for alleged violations of securities laws. Gensler is widely disliked in the crypto industry, with many accusing him of stifling innovation. Gensler claims his role is to protect consumers from major crypto collapses like those of Terra Luna and FTX in 2022.

Furthermore, Trump has promised to establish a suitable regulatory framework for crypto and make the United States the global capital of digital currencies.

Senate and its Impact

Crypto enthusiasts also welcome the Senate results, which were the focus of most of the industry's political contributions. PAC organizations like Fairshake spent over $100 million to support pro-crypto candidates and oppose anti-crypto candidates, hoping to inspire the new Congress to pass favorable legislation for the industry.

At the federal level, lobbyists had hoped for a bill that would transfer cryptocurrency regulation from the SEC to the Commodity Futures Trading Commission (CFTC), a much smaller agency.

Conclusion

Many analysts and crypto experts anticipate that Trump’s return to power will create a more favorable regulatory environment for digital currencies, potentially leading to sustainable growth in the sector. His commitment to reducing the regulatory burden on digital assets and supporting the crypto industry is expected to drive prices even higher, especially for Bitcoin and Ethereum.

Top Crypto Trading Platforms of the Month

- Pepperstone - Best overall crypto trading broker for beginners. Founded 2010. Multiple regulated licenses. Minimum deposit: $0. 20% discount on deposit.

- Plus500 - Best licensed broker for investing in cryptocurrencies (CFDs). Founded 2008. Multiple regulated licenses. Minimum deposit: $100.

- XM - Top crypto trading platform for educational materials and copy trading. Founded 2009. Multiple regulated licenses. Minimum deposit: $5. Periodic competitions and bonuses.