Missed Yesterday's Crypto Bull Rally? The Trump Effect is Just Getting Started

Future of Cryptocurrency in the Trump Era

Recently, cryptocurrency markets have experienced a significant uptick following Donald Trump’s return to the U.S. presidency. Bitcoin’s value has surpassed $80,000, setting a new historical high due to expectations that Trump’s victory may lead to a more supportive regulatory environment for digital currencies. Some analysts predict that Bitcoin could reach $100,000 by early next year.

The overall cryptocurrency market surged by 5.3%, and stocks linked to cryptocurrencies, including Robinhood Markets and MicroStrategy, also saw gains, reflecting growing confidence in the market under Trump’s leadership. Trump has praised Bitcoin this year, and pro-crypto supporters achieved major wins in both the House and Senate races, most notably in Ohio, where pro-crypto Republican Bernie Moreno defeated Sherrod Brown, who was known for his skepticism towards the sector.

Return to History

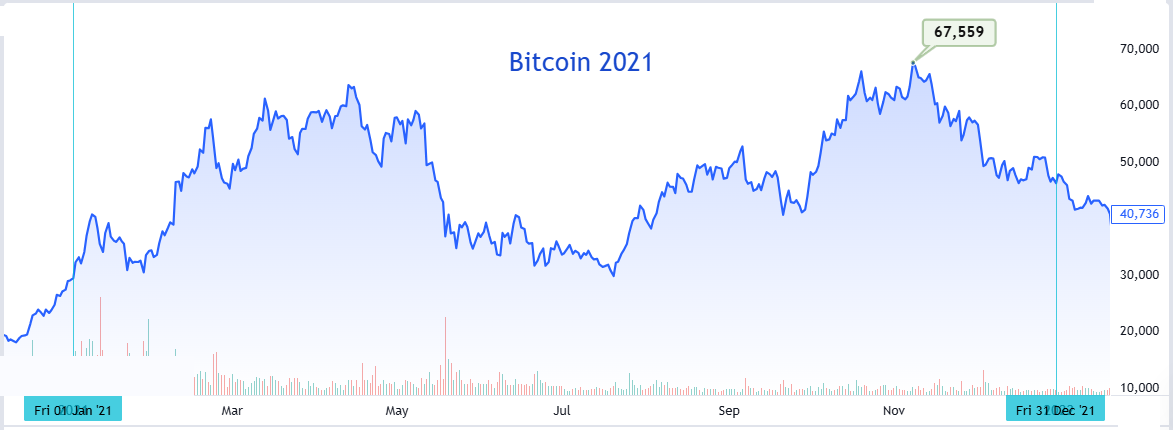

The recent rise in Bitcoin mirrors the increases seen during previous presidential elections. Following the 2020 U.S. presidential election, Bitcoin’s price surged by 369% in the subsequent year, rising from around $13,000 before the election to over $61,000 by November 2021. Many investors anticipate similar growth following the upcoming election results.

Chart showing Bitcoin’s trend in 2021

Historically, the fourth quarter has been particularly profitable for cryptocurrencies. According to Coinglass data, Bitcoin has achieved an average return of 37% in Q4, much higher than any other quarter. Additionally, Bitcoin has yet to respond to the most recent halving event in April (a halving event cuts the reward for mining new Bitcoin by half, thereby reducing its supply).

Trump's Adoption of Digital Currencies

Many cryptocurrency enthusiasts have backed Trump over Harris for various reasons. Although he was skeptical of crypto for years, Trump spoke optimistically about digital currencies during his campaign this year. At the Bitcoin conference in Nashville in July, Trump proposed the idea of creating a Federal Reserve for Bitcoin and emphasized the importance of bringing more Bitcoin mining operations to the United States.

Many crypto enthusiasts are excited about Trump’s alliance with Elon Musk, who has long advocated for digital currencies on social media. On election night, Dogecoin, Musk's favorite cryptocurrency, surged by 25% to $0.21.

Perhaps most importantly, Trump has vowed to remove Gary Gensler, chairman of the SEC, who has filed numerous lawsuits against crypto projects for alleged violations of securities laws. Gensler is widely disliked in the crypto industry, with many accusing him of stifling innovation. Gensler claims his role is to protect consumers from major crypto collapses like those of Terra Luna and FTX in 2022.

Furthermore, Trump has promised to establish a suitable regulatory framework for crypto and make the United States the global capital of digital currencies.

Senate and its Impact

Crypto enthusiasts also welcome the Senate results, which were the focus of most of the industry's political contributions. PAC organizations like Fairshake spent over $100 million to support pro-crypto candidates and oppose anti-crypto candidates, hoping to inspire the new Congress to pass favorable legislation for the industry.

At the federal level, lobbyists had hoped for a bill that would transfer cryptocurrency regulation from the SEC to the Commodity Futures Trading Commission (CFTC), a much smaller agency.

Conclusion

Many analysts and crypto experts anticipate that Trump’s return to power will create a more favorable regulatory environment for digital currencies, potentially leading to sustainable growth in the sector. His commitment to reducing the regulatory burden on digital assets and supporting the crypto industry is expected to drive prices even higher, especially for Bitcoin and Ethereum.

Top Crypto Trading Platforms of the Month

- Pepperstone - Best overall crypto trading broker for beginners. Founded 2010. Multiple regulated licenses. Minimum deposit: $0. 20% discount on deposit.

- Plus500 - Best licensed broker for investing in cryptocurrencies (CFDs). Founded 2008. Multiple regulated licenses. Minimum deposit: $100.

- XM - Top crypto trading platform for educational materials and copy trading. Founded 2009. Multiple regulated licenses. Minimum deposit: $5. Periodic competitions and bonuses.

The GBPCAD activates the correctional bearish track – Forecast today – 11-11-2024

Despite the GBPCAD price consolation within the bullish channel, the frequent stability below 1.8110 barrier confirms its surrender to the domination of the correctional bearish bias, to notice suffering some losses by touching 1.7875 level followed by bouncing towards 1.7970 temporarily.

We expect to form new obstacle at 1.8010 against the current trades which increase the chances of renewing the correctional bearish attempts, to expect targeting 1.7850 level followed by waiting to test the additional support near 1.7780.

The expected trading range for today is between 1.7850 and 1.8000

Trend forecast: Bearish

Natural gas price attacks the obstacle – Forecast today – 11-11-2024

Natural gas price confirmed keeping the main bullish track to notice attacking 2.850$ obstacle that formed the first main target, expecting to get more positive momentum by the major indicators to breach the current obstacle and open the way to record additional gains by rallying towards 2.930$ followed by reaching the next main target at 3.120$.

The expected trading range for today is between 2.790$ and 2.930$

Trend forecast: Bullish

The EURJPY touches the negative targets – Forecast today – 11-11-2024

The EURJPY pair succeeded to target the negative correctional stations by touching 163.42 level, to form new support base followed by bouncing towards the MA55 direct at 164.50.

We expect to provide positive momentum by stochastic to form new bullish rally and attack 165.05 level soon, while surpassing will push the price to achieve additional gains by rallying towards 165.75 and 166.40 levels.

The expected trading range for today is between 163.80 and 165.05

Trend forecast: Bullish