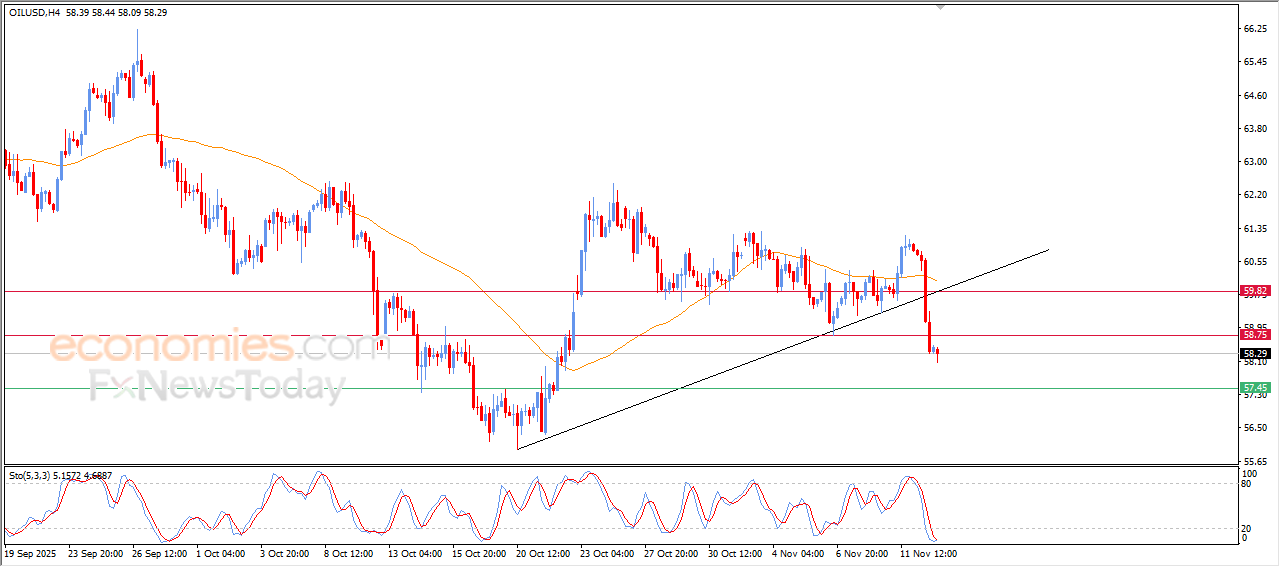

Crude oil price extends its losses- Analysis-13-11-2025

Crude oil prices slipped lower in their last intraday trading, after it failed to keep its technical support that is represented by the EMA50, putting it under growing pressure that pushed it to break the bullish corrective trend line on the short-term basis, this technical break led it lose its bullish momentum and cancel any attempt to resume the rise, which reinforces the dominance of the bearish trend.

At the same time, the negative signals are emerging on the relative strength indicators despite entering sharp oversold levels, indicating the continuation of the selling pressure on the near-term basis, unless showing strong rebound signals that confirm the ability of regaining its balance.

VIP Trading Signals Performance by BestTradingSignal.com (20-31 Oct, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for 20-31, October 2025:

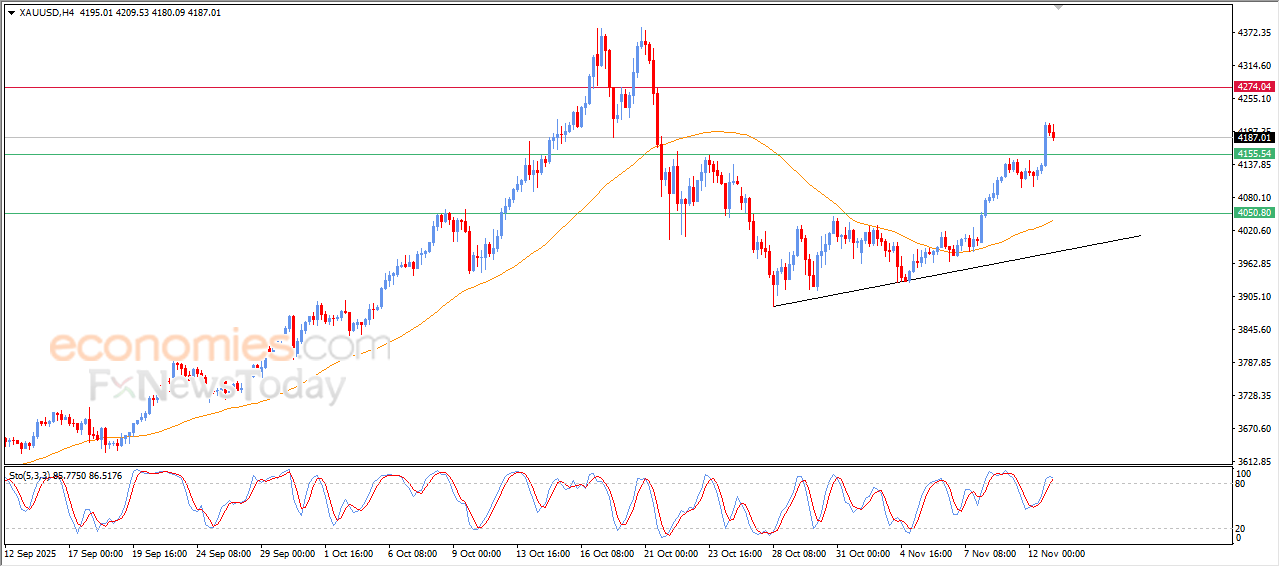

Gold prices are experiencing a well-deserved profit taking phase- Analysis-13-11-2025

Gold price declined in its last intraday trading, in a profit taking phase after the strong gains that achieved previously, where it attempts to gains bullish momentum that might help it to resume the rise in the upcoming period, this decline comes after breaching the key resistance of $4,155, which was our expected main target, indicating the dominance of the bullish wave on the short-term basis.

Gold is moving alongside supportive trend line for this bullish track, supported by the renewed bullish signs on the relative strength indicators, despite reaching overbought levels that might limit the upside movements. Any current decline represents a chance for taking a breather before any new attempt to reinforce the gains.

VIP Trading Signals Performance by BestTradingSignal.com (20-31 Oct, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for 20-31, October 2025:

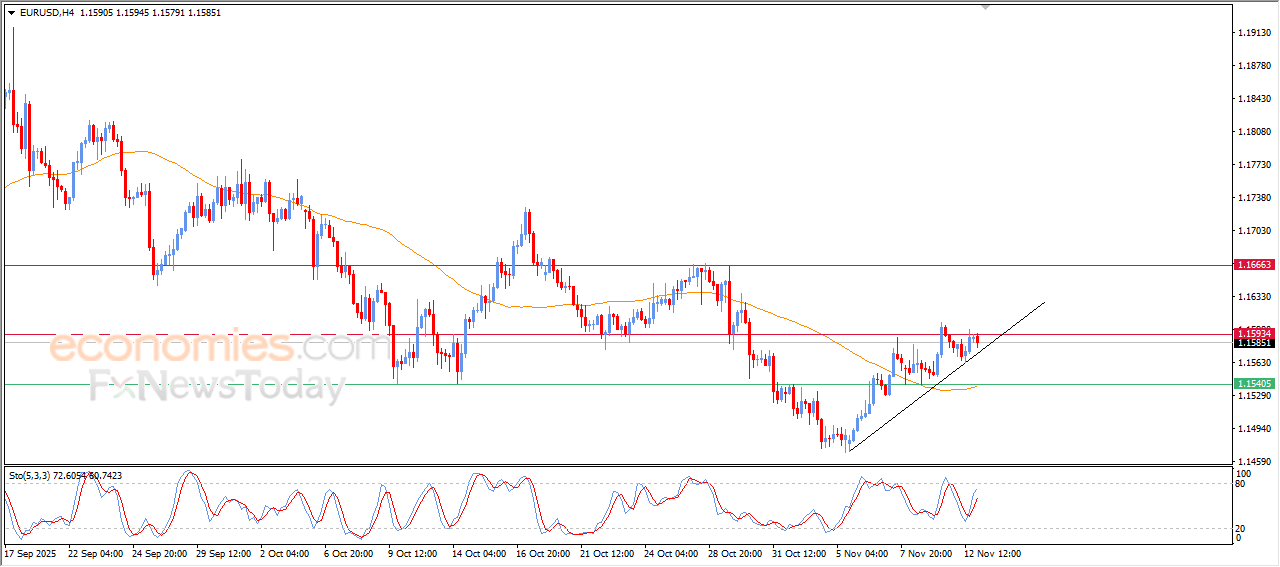

EURUSD price is gathering its bullish momentum-Analysis-13-11-2025

The (EURUSD) price declined in its last intraday trading, due to the stability of the key resistance at 1.1595, indicating a state of anticipation before any attempt to breach this barrier, and the pair is attempting to gain a new bullish momentum that may help it to resume the rise, amid the dominance of bullish corrective wave on the short-term basis and its trading alongside supportive trendline for this track.

The price is supported by the trading above EMA50, besides the renewed positive signals on the relative strength indicators, reinforcing the likelihoods of surpassing the resistance if the bullish momentum continues in its upcoming trading.

VIP Trading Signals Performance by BestTradingSignal.com (20-31 Oct, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for 20-31, October 2025:

Pepe price receives some support - Analysis - 12-11-2025

Pepe (PEPEUSD) rose slightly in its latest intraday trading, after finding support at its 50-period simple moving average, which helped it achieve these modest gains. This was accompanied by the formation of a positive divergence on the relative strength indicators after reaching extremely oversold levels compared to the price movement, with positive signals starting to appear. The price continues to move within a short-term corrective uptrend.

Therefore, we expect the digital currency’s price to rise, especially if it breaks above the key resistance level of $0.00000634, targeting the next resistance at $0.00000744.

Today’s price forecast: Bullish.