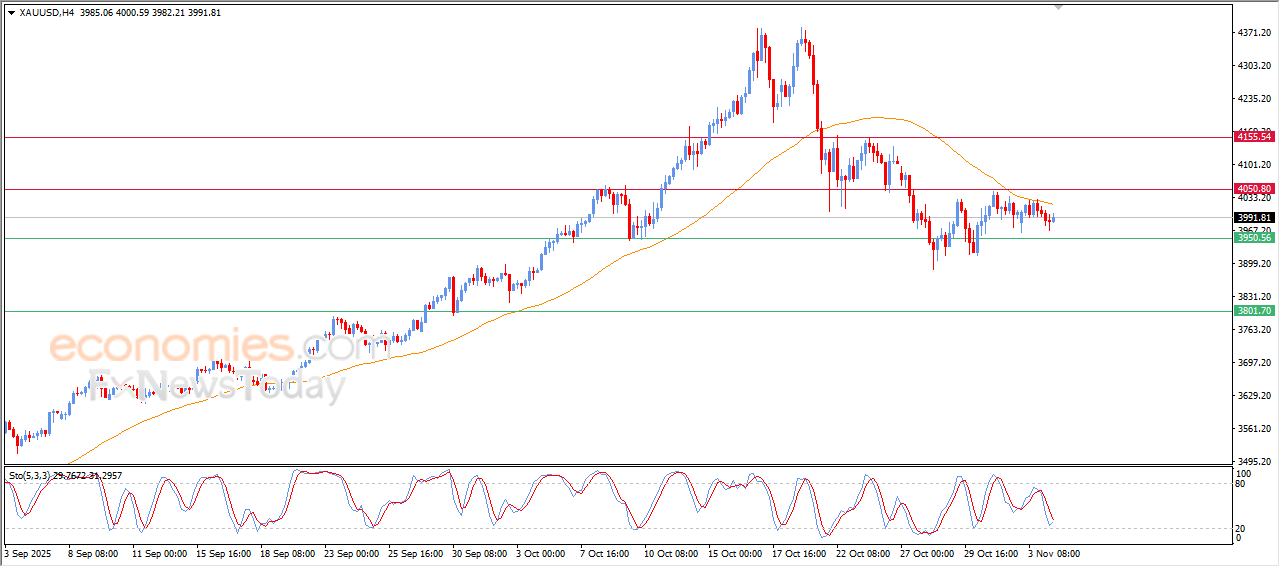

Forecast update for Gold -04-11-2025.

The price of (Gold) rose in its last intraday trading, supported by the emergence of positive overlapping signals on the relative strength indicators, after reaching exaggerated oversold levels compared to the price move, which suggest forming positive divergence that might push it to extend these intraday gains, on the other hand, the price remains under negative pressure that comes from its trading below EMA50, and under the dominance of the bearish corrective trend on the short-term basis.

VIP Trading Signals Performance by BestTradingSignal.com (20-31 Oct, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for 20-31, October 2025:

Forecast update for EURUSD -04-11-2025.

The price of (EURUSD) declined in its last intraday trading, preparing to break the current support at 1.1490, amid the dominance of the main bearish trend on the short-term basis, and its trading alongside supportive trendline for this track, besides the emergence of negative crossover on the relative strength indicators, after offloading the oversold conditions, which intensifies the negative pressure.

VIP Trading Signals Performance by BestTradingSignal.com (20-31 Oct, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for 20-31, October 2025:

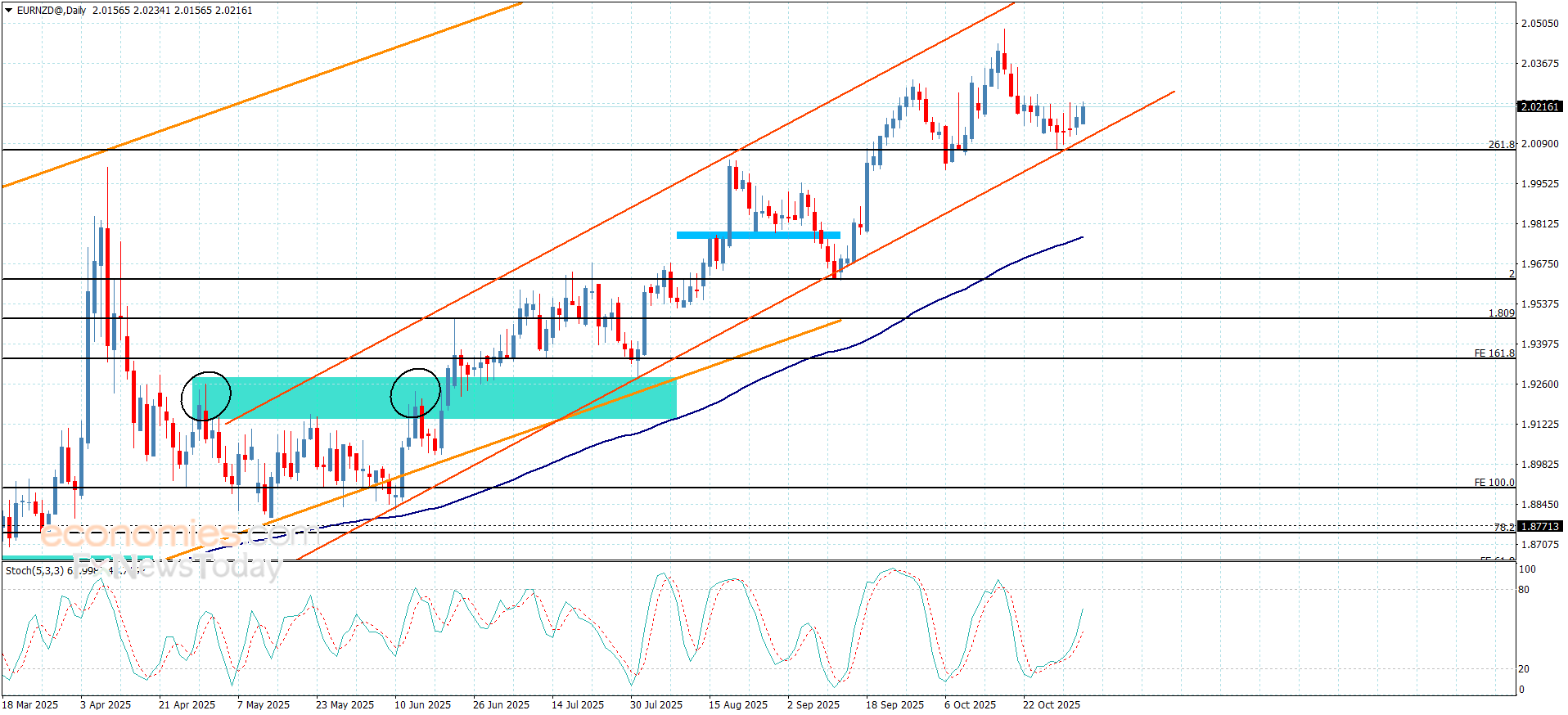

The EURNZD keeps the positivity – Forecast today – 4-11-2025

The EURNZD confirmed the stability of the bullish scenario by providing several positive closes above the minor bullish channel’s support at 2.1055, activating with the main indicators’ positivity, achieving some gains by its stability near 2.0220.

Note that stochastic stability above 50 level will provide extra positive momentum that will allow it renewing the bullish attempts by its rally towards 2.0285 reaching the next target near 2.0348.

The expected trading range for today is between 2.0155 and 2.0285

Trend forecast: Bullish

Natural gas price hovers near the resistance– Forecast today – 4-11-2025

Natural gas prices continued forming strong bullish trading, to approach from the resistance with small margin, reaching $4.314 level.

Forming extra support level at $4.145 level and the continuation of providing positive momentum by the main indicators, makes us expect to renew the bullish attack by surpassing the current resistance and begin recording new gains by its rally towards $4.495 reaching $4.770 level in the medium period trading.

The expected trading range for today is between $4.160 and $4.490

Trend forecast: Bullish