Will Tesla Stock (TSLA) Trading Remain The Best Investment Of The Electric Vehicle (EV) Sector In 2025?

The electric car sector is experiencing rapid development with the increase in environmental awareness and demand for sustainable transportation

At the heart of this race stands Tesla as a leader in the field. Tesla has not just been a car company, but has become a symbol of advanced technology and future vision under the leadership of Elon Musk. There is fierce competition emerging from companies like Rivian, Nio, BYD, and Lucid, in addition to the radical transformation that traditional companies like Ford and Volkswagen are undergoing to meet the increasing demand for electric cars. The competition in this sector is no longer just about who makes the most efficient car, but has expanded to include batteries, charging infrastructure, and autonomous driving software. Tesla remains at the forefront thanks to its rapid innovation capabilities, but it faces major challenges in maintaining this momentum as more major players enter the field.

What are electric cars?

Electric cars are vehicles that operate using electric power instead of traditional fossil fuels like gasoline or diesel. These modern cars operate through an electric motor that relies on a rechargeable battery to store electric energy, which is provided through special charging stations. These cars are considered an environmentally friendly alternative to fuel-powered vehicles, as they help reduce carbon emissions and improve air quality. In addition, electric cars have high efficiency and are quiet during operation, making them a sustainable choice for transportation.

The importance of electric cars

Electric cars are of great importance for several reasons:

- Environmental sustainability: Electric cars reduce carbon emissions, contributing to combating climate change and improving air quality.

- Efficiency: Electric cars are more efficient than traditional cars, as energy is better converted into movement.

- Economical: The cost of operating and maintaining electric cars is lower than that of fuel-powered cars, due to fewer moving parts.

- Reducing dependence on fossil fuels: Electric cars help reduce reliance on oil and its derivatives, enhancing energy security.

- Advanced technology: Electric cars offer technological advantages such as autonomous driving and integration with smart networks.

Fierce competition in the market

While Tesla remains at the forefront of competition thanks to its continuous innovations, such as autonomous driving technologies and the expansion of fast-charging networks, new players are coming up with innovative solutions as well. Rivian, for example, focuses on producing luxury electric trucks targeting a different segment of the market, while Lucid aims to offer luxury electric cars with high technical specifications and longer charging duration. On the other hand, traditional companies like Volkswagen and General Motors are seeking to enhance their presence in the electric car market by investing in developing entirely new platforms for these cars, as well as developing battery technologies and charging infrastructure. The primary goal of traditional automakers is to meet the growing demand for electric cars while improving competitiveness in terms of price and performance.

Challenges facing the industry

Despite significant progress in electric car technology, the industry still faces many challenges. Batteries are the primary obstacle; producing high-capacity, long-range batteries is expensive, in addition to environmental concerns associated with mining the metals needed for these batteries, such as lithium and cobalt. Companies are constantly seeking ways to improve battery efficiency and reduce production costs, which will help lower the prices of electric cars and make them more accessible to a wider range of consumers. Another challenge the industry faces is charging infrastructure. Although charging networks are rapidly expanding in many countries, the infrastructure remains inadequate in some areas, affecting the widespread adoption of electric cars. Therefore, countries need to intensify their investments in establishing public charging stations to encourage more consumers to switch to electric cars.

Promising future

Given the rapid developments in this industry, it is clear that electric cars will be an essential part of the future of transportation. With more countries moving towards imposing strict carbon emission standards and banning the sale of traditional cars by mid-century, it seems that electric cars will become the norm rather than the exception. Moreover, automakers are working on improving the technology used in these cars, such as artificial intelligence and autonomous driving, making them more attractive to consumers. The integration of advanced technology and sustainability will make electric cars the optimal choice for future mobility.

Tesla and industry leadership

When talking about the electric car industry, the significant role played by Tesla in this field cannot be ignored, under the leadership of billionaire Elon Musk. Musk has managed to transform Tesla from a small company into a global giant and a leader in technological innovation. Tesla was among the first companies to prove that electric cars can be stylish, technologically advanced, and have long driving ranges. The "Model S" and "Model 3" series represented a significant leap in consumers' understanding of what these cars can offer in terms of superior driving experience.

About Tesla

Tesla is a multinational American company specializing in the design and development of electric cars and renewable energy systems. The company was founded in 2003 by Elon Musk and a group of engineers with the aim of accelerating the global transition to sustainable energy. Tesla began producing luxury electric cars, and one of the most notable models is the "Model S," which represents a qualitative leap in the electric car market due to its long range and high performance. Tesla is today a global leader in this field, integrating technological innovation with sustainability. Tesla introduced the Autopilot system, adding a new dimension to the future of smart transportation. The company also launched several distinctive models such as "Model 3" and "Model Y," which target a wider range of consumers thanks to their relatively affordable prices. In addition to cars, Tesla has expanded into renewable energy by producing lithium batteries and electrical storage technologies, as well as developing products like the "Solar Roof," which converts solar energy into electricity. Tesla's success has solidified its position as the most valuable car company in the world, making it a symbol of sustainable transportation in the 21st century.

Elon Musk: Pioneer of business and technology

Elon Musk, the world's richest man and one of the most prominent figures in technology and innovation, was born on June 28, 1971, in Pretoria, South Africa. Thanks to his boundless ambition and visionary thinking, Musk has become a model for pioneers of our time, successfully turning his ideas into global projects that have achieved tremendous success and changed many industries.

Early beginnings and success

Musk showed a passion for technology and innovation from a young age, learning to program at an early age and selling his first program at the age of 12. In the early stages of his career, he founded Zip2, an online content management platform, which was later sold for $307 million. From here, his big success came when he founded PayPal, the system that revolutionized the field of electronic payments. After selling PayPal to eBay for $1.5 billion, Musk turned to new and more ambitious fields.

Tesla and changing the car industry

In 2004, Elon Musk joined Tesla, the then-startup electric car company, as chairman of the board and later as CEO. Under his leadership, Tesla led the revolution in the electric car industry, making it one of the largest car companies in the world. The success of cars like "Model S" and "Model 3" made Tesla an example of innovation and sustainability in the transportation sector, with these cars' ability to achieve long ranges and high performance compared to fuel-powered cars. Tesla did not stop at developing electric cars but expanded into renewable energy solutions such as energy storage batteries and solar roofs. Musk's long-term vision aims to make sustainable energy accessible to everyone, reducing reliance on fossil fuels that contribute to climate change.

SpaceX: Opening space

One of Musk's other notable achievements was founding SpaceX in 2002. Musk's goal for this company was extremely ambitious: to make space travel more accessible and affordable, eventually leading to the colonization of Mars. Despite the initial challenges, the company achieved significant successes, becoming the first private company to launch rockets capable of reaching the International Space Station, and the first to commercially reuse rockets. Musk's main dream is to colonize Mars, believing that humanity needs to become a "multi-planet species" to protect the future of mankind. This project is part of Musk's larger ambition to save humanity from the environmental, economic, and political challenges it may face on Earth.

Other companies: Neuralink and future innovations

In addition to Tesla and SpaceX, Elon Musk founded Neuralink, a company focused on integrating artificial intelligence with the human brain. This company aims to develop new technologies to treat neurological diseases and enhance humans' ability to control technology. Musk also founded "The Boring Company," which aims to build tunnels under cities to alleviate traffic congestion.

Controversial personality

Elon Musk is not only an innovator and entrepreneur but also a controversial figure. His behavior on social media and opinions on various issues, from politics to technology, make him a prominent figure in the media arena. Despite this, his impact on the world is undeniable, as he has changed many people's perspectives on the future of energy and transportation.

Tesla profits in Q2 2024

In the second quarter of 2024, Tesla showed mixed financial results. The company saw a 2% increase in revenue compared to the previous year, reaching $25.5 billion, surpassing expectations. However, despite this revenue growth, Tesla's profits saw a significant decline of 45% compared to the previous year, primarily due to the high costs associated with artificial intelligence (AI) projects and a decline in the average selling price of cars. Tesla's net profit for this quarter was $1.48 billion, a sharp drop from $2.7 billion in Q2 2023. This decline was caused by a drop in car deliveries as well as a decrease in average selling prices, as the company made price adjustments to remain competitive in the electric car market.

Tesla profit expectations in 2024 and 2025

2024 expectations: By 2024, Tesla is expected to continue increasing its revenue but at a slower pace compared to previous years. Factors such as fluctuations in raw material prices, increased competition in the electric car market, and the costs of investing in artificial intelligence projects may affect profit margins. Sales and operating profits: Tesla's sales are expected to increase thanks to the expansion in the production of its cars, especially models like "Model Y" and the new generation of "Cybertruck" as it enters new markets. However, the reduced prices that Tesla has adopted in several markets to keep up with the competition may affect its overall profits in 2024. Investment in artificial intelligence: Tesla's investments in fields such as autonomous cars and robots may consume a large portion of the costs, adding additional pressure on profit margins, although these investments open up enormous growth opportunities in the future.

2025 expectations

By 2025, Tesla is expected to benefit more from its investments in artificial intelligence and batteries. These projects may start to generate tangible returns. Sustainable growth: According to some predictions, Tesla may see strong profit growth as it begins producing low-cost electric cars, increasing demand and boosting sales in emerging markets. Additionally, improvements in Tesla's ability to produce batteries may enhance its ability to offer products at competitive prices. Robots and artificial intelligence: Advanced technology, including self-driving cars and robots, is expected to generate new revenues, helping to boost long-term profit margins. The expectation that Tesla will become a leader in this field places it in a strong position to benefit from future technological trends.

Potential challenges

Despite these positive expectations, Tesla faces challenges such as: Intense competition: More traditional and startup car companies are moving towards producing electric cars, increasing competition. High costs: Rising costs of essential materials like lithium and nickel may affect profit margins.

Brief analyses and predictions for Tesla stock

- Tesla stock predictions this week: If the stock succeeds in surpassing the resistance at $271, it will reach new higher levels that it has not seen since 2022.

- Tesla stock predictions for October: The stock is likely to achieve monthly gains in October, thanks to the positive sentiment in the markets, especially after the aggressive reduction of interest rates in the United States.

- Tesla stock predictions for 2024: It is widely expected that the stock will trade above the $300 mark again before the end of this year.

- Tesla stock predictions for 2025: If Tesla's stock surpasses the $400 mark, the next target will be $500 during the first half of 2025, for the first time in history.

Major price stations for Tesla stock:

- July 2010: Tesla's stock recorded its lowest level ever at $0.9987.

- November 2021: Tesla's stock recorded its highest level ever at $414.50.

- August 2010: Tesla's stock recorded its lowest closing level ever at $1.30.

- November 2021: Tesla's stock recorded its highest closing level ever at $381.59.

Best performance of Tesla stock in history:

- Year 2020: The best annual performance ever for Tesla's stock, with a rise of 743%.

- Q2 2013: The best quarterly performance ever for Tesla's stock, with a rise of 183%.

- May 2013: The best monthly performance ever for Tesla's stock, with a rise of 81%.

Worst performance of Tesla stock in history:

- Year 2022: The worst annual performance ever for Tesla's stock, with a decline of 65%.

- Q4 2022: The worst quarterly performance ever for Tesla's stock, with a decline of 54%.

- December 2022: The worst monthly performance ever for Tesla's stock, with a decline of 37%.

Major events in Tesla history:

- June 2010: Tesla's stock started trading on Wall Street at $1.27.

- June 2010: Tesla's stock traded above $2 for the first time ever.

- April 2013: Tesla's stock surpassed the $3 mark for the first time in history.

- May 2013: Tesla's stock traded above $5 for the first time ever.

- August 2013: Tesla's stock surpassed the $10 mark for the first time in history.

- October 2007: Tesla's stock traded above $5 for the first time ever.

- January 2011: Tesla's stock surpassed the $10 mark for the first time in history.

- June 2017: Tesla's stock traded above $25 for the first time ever.

- February 2020: Tesla's stock surpassed the $50 mark for the first time in history.

- July 2020: Tesla's stock traded above $100 for the first time ever.

- November 2020: Tesla's stock surpassed the $200 mark for the first time in history.

- January 2021: Tesla's stock traded above $300 for the first time ever.

- November 2021: Tesla's stock surpassed the $400 mark for the first time in history.

Major predictions for Tesla stock in 2024

- Bank of America: The bank expects Tesla's stock to reach $325 by the end of 2024.

- Goldman Sachs: The group expects Tesla's stock to reach $350 by the end of 2024.

- Morgan Stanley: The group expects Tesla's stock to reach $310 by the end of 2024.

- Citi Group: The group expects Tesla's stock to reach $270 by the end of 2024.

- Wells Fargo Financial Services: The company expects Tesla's stock to reach $300 by the end of 2024.

- UBS: The German bank expects Tesla's stock to reach $280 by the end of 2024.

- JP Morgan: The group expects Tesla's stock to reach $290 by the end of 2024.

- Sanford C. Bernstein: The company expects Tesla's stock to reach $320 by the end of 2024.

- Wedbush: The company expects Tesla's stock to reach $330 by the end of this year.

Factors affecting Tesla stock predictions

Tesla stock predictions for 2024 are influenced by several key factors, including economic, competitive, and technological factors. Some of the most important factors include:

- Pricing and competitiveness: Tesla faces pressure to lower its car prices as competition in the electric car market increases, especially from Chinese companies. These price reductions affect profit margins, leading to an expected decrease in profits, which may put pressure on the stock's performance.

- Production expansion: Tesla is working to expand its production capabilities by building new factories, such as its plant in Mexico. This expansion may boost long-term growth, but it may cause high short-term costs, affecting profit predictions.

- Technological developments: Continuous innovations in electric car and solar energy technologies developed by Tesla can drive demand for its products, especially as it expands its offerings of next-generation cars at lower costs.

- Geopolitical and economic factors: Global markets are unstable, and changes in government policies and tariffs on car imports can negatively or positively affect Tesla's performance. Additionally, rising raw material costs may increase the challenges facing the company.

Frequently asked questions about Tesla

Is Tesla's price suitable for investment?

Tesla's stock is currently trading around $240. In light of most predictions indicating an upward trend until the end of the year, we believe that levels of $235 to $230 are suitable for investment, with a target above $300 in 2024 and near $500 in 2025.

How to invest in Tesla?

Investing in Tesla is one of the most notable opportunities that investors in the electric car and technology sector are interested in. Here are some common ways to invest in Tesla:

- Buying shares directly: Buying Tesla shares (TSLA) on the stock exchange is the most straightforward way to invest. Tesla is listed on the NASDAQ exchange, and its shares can be purchased through a trading account with financial brokerage firms. It is important to pay attention to market fluctuations associated with Tesla's stock, as its prices often experience sharp volatility.

- Investing through exchange-traded funds (ETFs): Tesla can be invested in indirectly through exchange-traded funds (ETFs) or mutual funds that contain Tesla shares in their portfolio. Some of the most well-known funds that include Tesla in their composition are the S&P 500 Index Fund and the ARK Innovation ETF. This type of investment helps diversify the portfolio and reduce risks associated with owning a single stock.

- Long-term investment: Some investors prefer to hold Tesla shares for the long term to benefit from the company's potential future growth. Long-term investment strategies rely on the belief that the company will continue to lead the electric car and renewable energy technology sectors.

- Speculating on the stock: Investors can also use speculative or day-trading strategies to take advantage of Tesla's stock's daily price fluctuations. However, this type of trading requires experience and good market knowledge due to the high risks associated with it.

- Investing in convertible bonds: Tesla issues convertible bonds, which are a type of debt that can be converted into shares. This provides an opportunity for investors to earn bond interest while also having the possibility of participating in future stock price increases.

- Financial options (Options): Some investors prefer to trade financial options on Tesla stock, which give them the right to buy or sell shares at a specific price in the future. This strategy requires a deep understanding of the options market and carries high risks.

Investment tips in Tesla:

- Long-term planning: Tesla is an innovative company, but it may face performance fluctuations. Therefore, experts advise thinking about long-term investment.

- Market analysis: Monitor Tesla's financial performance, quarterly reports, and developments in the electric car and battery technology sectors.

- Diversify the portfolio: Do not put all your money into a single stock, even if it is Tesla's stock. Instead, distribute the investment across multiple stocks and sectors.

Will Tesla's stock reach $300 in 2024?

In light of recent developments regarding the future of U.S. interest rates and the current full pricing around two rate cuts in November and December, the technology sector will be the biggest beneficiary of liquidity availability in the market and the decline in borrowing costs. Therefore, it is not entirely unlikely for Tesla's stock to rise to $300 in 2024, with a strong surpassing of this level in 2025.

Is it expected that Tesla's prices will rise in 2024?

Yes, Tesla's stock is expected to continue rising this year. Most institutional, major bank, and expert predictions are stable around the stock being in an upward trend.

Major electric car companies listed on U.S. exchanges

Here is a list of the top 10 electric car companies listed on U.S. exchanges:

- Tesla, Inc Exchange: NASDAQ (NASDAQ)- Ticker: TSLA - Market value: about $800 billion.

- Toyota Motor Corporation Exchange: New York (NYSE) - Ticker: TM- Market value: about $230 billion.

- General Motors Exchange: New York (NYSE) - Ticker: GM - Market value: about $45 billion.

- Ford Motor Company Exchange: New York (NYSE) - Ticker: F - Market value: about $37 billion.

- Rivian Automotive, Inc Exchange: NASDAQ (NASDAQ) - Ticker: RIVN - Market value: about $15 billion.

- Lucid Group, Inc Exchange: NASDAQ (NASDAQ) - Ticker: LCID - Market value: about $12 billion.

- NIO Inc Exchange: New York (NYSE) - Ticker: NIO - Market value: about $20 billion.

- XPeng Inc Exchange: New York (NYSE) - Ticker: XPEV - Market value: about $15 billion.

- Li Auto Inc Exchange: NASDAQ (NASDAQ) - Ticker: LI - Market value: about $25 billion.

- Stellantis N.V Exchange: New York (NYSE) - Ticker: STLA - Market value: about $55 billion.

Largest companies in the world by market value in 2024

- Apple Inc (USA) with a market value of $3.43 trillion

- Nvidia (USA) with a market value of $3.26 trillion.

- Microsoft (USA) with a market value of $3.08 trillion

- Alphabet (Google) (USA) with a market value of $2.07 trillion.

- Amazon (USA) with a market value of $1.91 trillion

- Aramco (Saudi Arabia) with a market value of $1.74 trillion

- Meta (Facebook) (USA) with a market value of $1.49 trillion.

- Berkshire Hathaway (USA) with a market value of $978 billion.

- Taiwan Semiconductor Manufacturing Company Limited with a market value of $963 billion.

- Broadcom (USA) with a market value of $840 billion.

List of companies investing in artificial intelligence:

- Microsoft - Ticker: MSFT

- Alphabet (Google) - Ticker: GOOGL

- Amazon - Ticker: AMZN

- Nvidia - Ticker: NVDA

- IBM - Ticker: IBM

- Tesla - Ticker: TSLA

- Adobe - Ticker: ADBE

- Apple - Ticker: AAPL

- Meta (Facebook) - Ticker: META

- Intel - Ticker: INTC

- Salesforce - Ticker: CRM

- Baidu - Ticker: BIDU

- Oracle - Ticker: ORCL

- Snap - Ticker: SNAP

Best platforms for trading electric car companies stocks

- Pepperstone, the best broker for trading electric car companies stocks. Trusted for beginners. Founded in 2010. Dubai license. Minimum deposit: $0. Get a bonus up to $2000. Withdrawal and deposit options available through Mashreq Bank.

- XM, the best platform for trading electric car companies stocks. Offers educational materials and copy trades. Founded in 2009. Dubai license. Minimum deposit: $5. Competitions and financial bonuses.

- Plus500, the best licensed broker for trading electric car companies stocks. Founded in 2008. Dubai license. Minimum deposit: $100. Plus 500 is listed on the London Stock Exchange.

Compare the best brokers for trading EV companies stocks

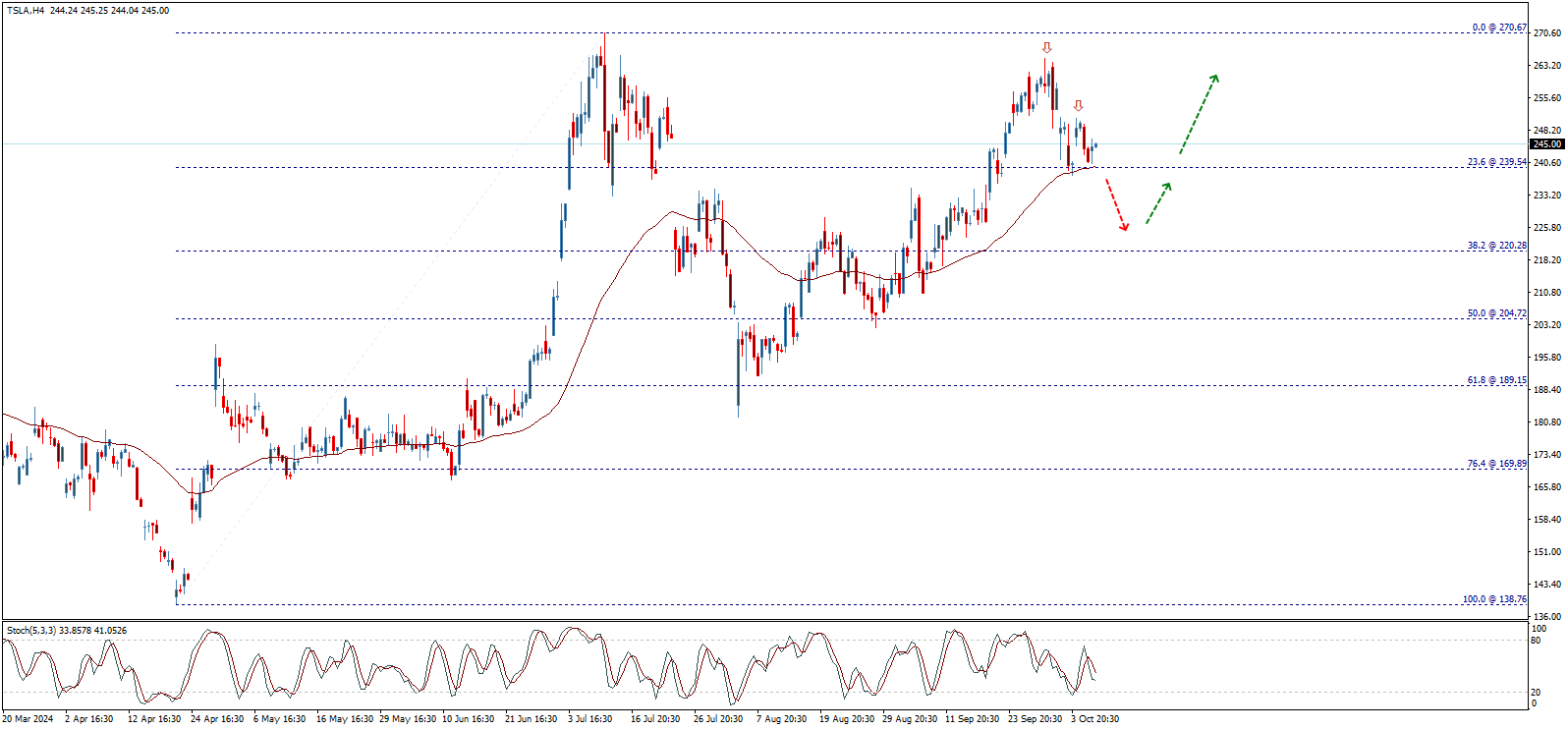

Technical analysis of Tesla stock

When studying the different time frames of Tesla stock, we find that there are conflicting technical factors. We will look at them from several aspects. Starting from the weekly time frame, we see that the price made a downward correction for the entire rise from $23.37 to $414.40, which stopped at 76.4% Fibonacci levels around $115.65, and then resumed the upward trend again. However, we notice that the upward wave is facing strong resistance that formed at the 38.2% Fibonacci level, which turned into a strong barrier at $265.05 after being broken previously.

The strength of this resistance, along with the negative signals shown by the Stochastic indicator, may force the stock to decline again and make new downward corrections, with targets starting at testing the $218.88 level, which is considered an important support level that will determine the fate of the next short-term and medium-term trend.

On the other hand, on the daily time frame, when we measure the correction of the downward wave that started from the aforementioned peak at $414.40, we find that the price began correcting upwards after reaching areas of $101.74, and it reached the 61.8% Fibonacci level at $294.96 at the beginning of the third quarter of last year. It then declined but did not continue to fall, recovering again and recording a higher low, presenting the possibility of forming a positive pattern that meets its confirmation level at $294.96, meaning that breaking through this level will provide the possibility of an upward push and a resumption of the long-term upward trend, achieving positive targets that surpass the aforementioned historical peak to reach areas of $485.00.

The Stochastic indicator shows us positive signals that may form a motivating factor for the price to rise and activate the positive impact of the aforementioned pattern, continuing the rise in the short-term and short-term period.

Reaching the intraday time frames – specifically the 4-hour time frame – shows us a temporary downward correction that the stock recently started, testing the 23.6% Fibonacci level, which forms important support now at $239.54. Breaking it will complete the formation of a double top pattern that will push the price to visit the next correction level at $220.28 directly, followed by an attempt to resume the main upward trend again.

As a conclusion to the above, we indicate that technical factors favor the return to the main upward trend, and the price needs to surpass the $294.96 level, which forms the strongest positive trigger that will push the price to achieve the strong gains mentioned above, starting from $414.40 and reaching $485.00.

Despite the positive factors mentioned, it is essential to note that facing negative pressures and breaking $218.88 will stop the positive scenario and push the price to incur additional losses, reaching $172.74 in the near term before any attempt to recover again.

Brent oil price forecast update 10-10-2024

Brent oil price trades positively now to approach our waited target at 78.66$, and we suggest breaching this level to open the way to achieve additional gains that reach 80.00$ on the near term basis, to keep the bullish trend valid and active for the rest of the day, reminding you that the continuation of the bullish wave depends on the price stability above 76.84$.

The expected trading range for today is between 76.40$ support and 79.40$ resistance.

Trend forecast: Bullish

Crude oil price forecast update 10-10-2024

Crude oil price shows positive trades now to move away from 73.70$ level, reinforcing the expectations of continuing the bullish trend for the upcoming sessions, and the way is open to achieve our next target at 75.65$.

The EMA50 supports the suggested bullish wave, which will remain valid unless breaking 73.70$ and holding below it.

The expected trading range for today is between 73.00$ support and 76.00$ resistance

Trend forecast: Bullish

Silver price forecast update 10-10-2024

Silver price didn’t show any strong move since morning, to continue moving around 30.50$ level, thus, no change to the expected bearish trend scenario for today, which depends on the price stability below 31.00$ level, reminding you that our targets begin by breaking 30.06$ to confirm heading towards 29.30$ as a next main station.

The expected trading range for today is between 30.06$ support and 30.90$ resistance.

Trend forecast: Bearish