Visa price deepens losses - Forecast today - 19-11-2025

Visa (V) continued to decline in its latest intraday trading, as a short-term corrective downtrend remains dominant with the price moving along a descending trendline. The bearish pressure persists due to trading below the 50-day simple moving average, accompanied by ongoing negative signals from the RSI despite its presence in deeply oversold areas.

Therefore, we expect the stock to fall in its upcoming trading, as long as it remains below 328.70$, targeting the support level at 302.85$.

Today's price forecast: Bearish

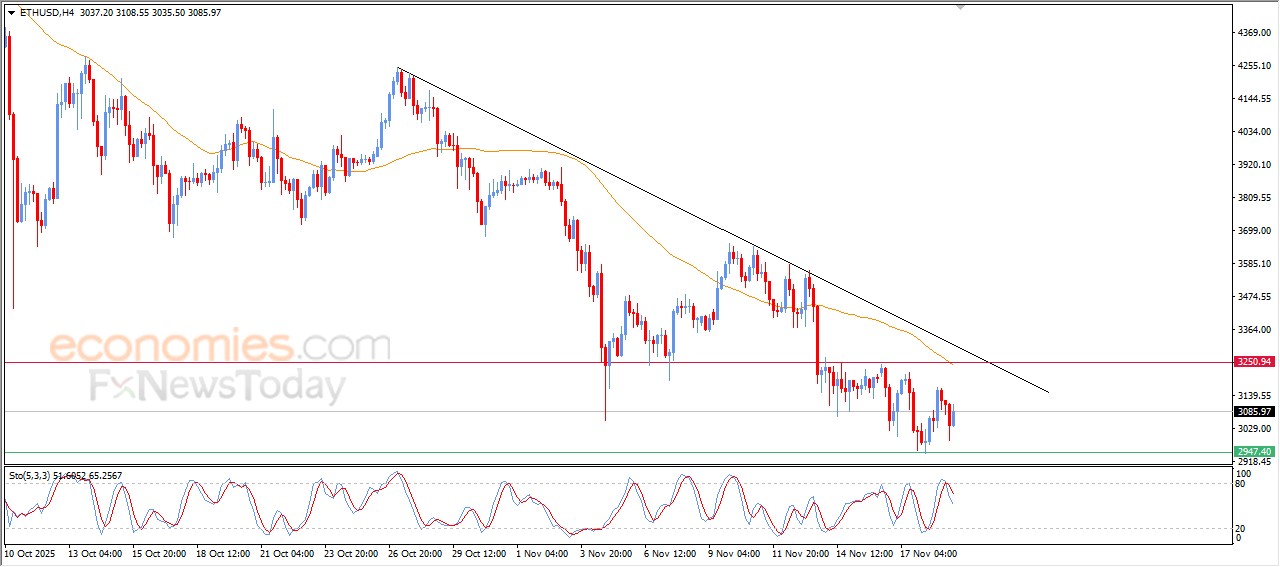

Forecast update for Ethereum -19-11-2025

The price of (ETHUSD) rose in its last intraday trading, amid the dominance of the main bearish trend on the short-term basis and its trading alongside supportive trend line for this trend, with the continuation of the negative pressure that is represented by its trading below EMA50, reducing the chances of its recovery on the near-term basis, with the emergence of the negative signals on the relative strength indicators after reaching overbought levels.

Forecast update for bitcoin -19-11-2025

Bitcoin (BTCUSD) prices settles lower on their last intraday trading, to reach the main support at $90,000, this support was our expected target in our previous report, accompanied by forming negative divergence on the relative strength indicators, after reaching overbought levels, amid the dominance of the bearish trend on the short-term basis, with its trading alongside main and minor trend line that reinforces the dominance of this track.

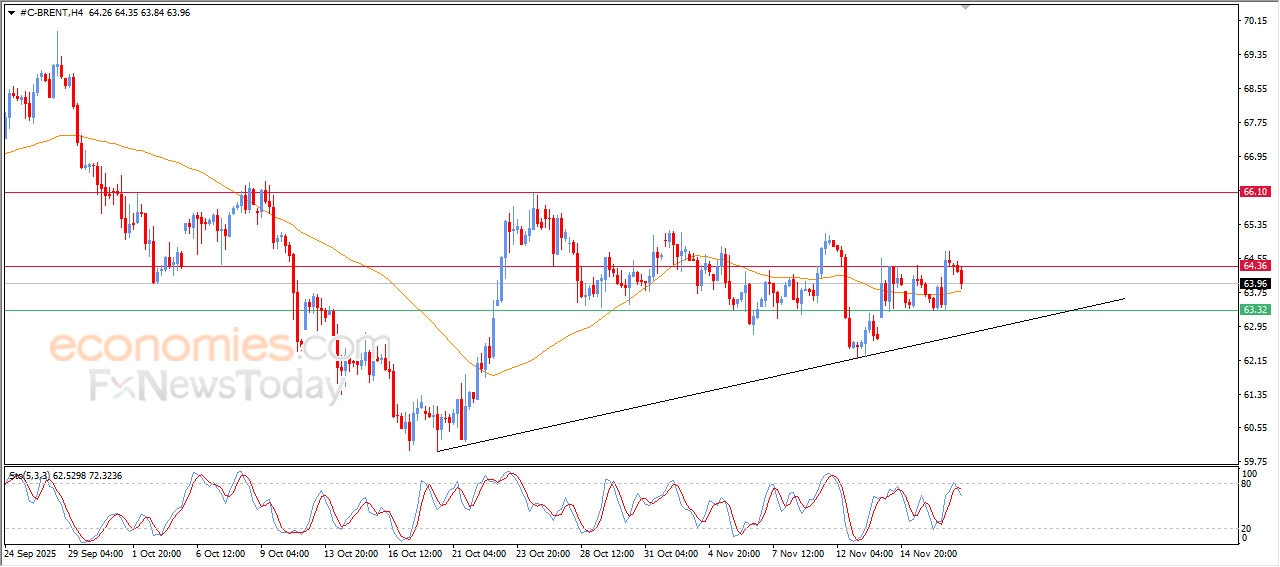

Forecast update for Brent crude oil -19-11-2025

Brent crude oil price declined in the last intraday trading, due to the stability of the key resistance at $64.35, leaning on the support of its EMA50, in attempt to gain bullish momentum and offloading its overbought conditions on the relative strength indicators, especially with the emergence of negative overlapping signals, to regain the bullish momentum that might help it to breach the mentioned resistance.