Spotify price gathers positive momentum - Forecast today - 18-12-2024

Spotify Technology’s stock price (SPOT) fell in the intraday levels while gathering positive momentum to rise anew, amid the dominance of the main upward trend, as the stock trades alongside the secondary short-term trend line.

Positive pressure is ongoing due to trading above the 50-day SMA, while a positive divergence forms in the RSI after reaching oversold levels compared to the stock’s movements, with positive signals streaming out of it.

Therefore we expect the stock to return higher and target the resistance of $506.47, provided the support of $445.00 holds on.

Trend forecast for today: Likely Bullish

United Airlines price emits more positive signals - Forecast today - 18-12-2024

United Airlines’ stock price (UAL) inched down in the intraday levels while seeking a bottom to bounce it higher anew, amid the dominance of the main upward trend in the short term, with positive pressure due to trading above the 50-day SMA, coupled with positive signals from the RSI after reaching oversold levels compared to the stock’s movements, hinting at positive divergence.

Therefore we expect the stock to return higher, targeting the resistance of $105.09, provided the support of $88.60 holds on.

Trend forecast for today: Likely Bullish

This is the stock seeing the best surge with Bitcoin’s recovery

MicroStrategy Stock Reaches Highest Level Ever at $543 Following Donald Trump's Election

In the final third of November trading, specifically on November 21, 2024, the MicroStrategy stock managed to record its highest level ever at $543. This achievement came supported by the positive atmosphere dominating global markets following the election of Donald Trump as the new president of the United States.

The digital asset markets were among the biggest beneficiaries of this massive positive momentum, as the world’s largest cryptocurrency, Bitcoin, managed to surpass the historic psychological barrier of $100,000 for the first time ever.

With Bitcoin rising to new historic levels, interest in MicroStrategy, one of the largest institutional players in the world of digital currencies, was renewed.

The company, which in recent years has transformed into what can be described as a “Bitcoin investment fund,” has become a living example of how digital asset markets intertwine with traditional markets.

The story of MicroStrategy’s association with Bitcoin goes back to 2020, when the company, under the leadership of its CEO Michael Saylor, decided to redirect its financial strategy toward digital currencies, especially Bitcoin.

In a bold and unprecedented step for a company listed on U.S. markets, MicroStrategy invested billions of dollars in purchasing the digital currency, considering it a hedge against inflation and the weakening U.S. dollar.

Since then, the company’s stock price has been closely tied to Bitcoin’s ups and downs, raising questions about how much the stock stands to benefit from the recent bullish trends.

This year, MicroStrategy’s stock performance was stunning, rising nearly 6-fold, taking advantage of the return of momentum in the digital currency market.

However, the key question remains: to what extent can the stock continue hitting new historic levels? And can MicroStrategy leverage its inclusion in the Nasdaq 100 index to reinforce its position as a main hub in the digital currency market?

The current stage is characterized by optimism, and thus most expectations indicate that MicroStrategy’s stock may be on the verge of a new wave of record gains, supported by positive momentum in digital currencies and the company’s bold investment strategies.

About MicroStrategy

MicroStrategy is a global American company specializing in the development of software solutions for data analysis and business intelligence (BI).

The company was founded in 1989 by Michael Saylor and Sanju Bansal, and is headquartered in Tysons Corner, Virginia.

The company is known for providing advanced software platforms that help institutions make decisions based on in-depth data analysis.

Who Is Michael Saylor?

Michael Saylor is an American entrepreneur, a prominent investor, and the co-founder of MicroStrategy. He is known as one of the most prominent advocates for Bitcoin in the global financial arena.

A Brief Biography:

- Born: February 4, 1965 in Lincoln, Nebraska, United States.

- Education: He received a Bachelor of Science degree from the Massachusetts Institute of Technology (MIT) in 1987, majoring in Aeronautics & Astronautics. He also studied Information Technology.

Career Path:

- In 1989, Michael Saylor founded MicroStrategy with his partner Sanju Bansal, making the company one of the leading providers of data analytics and business intelligence solutions.

- As the company’s CEO for more than three decades, Saylor led MicroStrategy’s growth to become a top player in the analytics software market.

The Shift Toward Bitcoin:

In 2020, Michael Saylor became a prominent figure in the cryptocurrency world after his company, MicroStrategy, embarked on an unconventional strategy of investing its cash reserves in Bitcoin.

- Investment Strategy: MicroStrategy began buying Bitcoin as a hedge against inflation and to enhance the value of its assets.

- Number of Units Owned: The company acquired more than 439,000 Bitcoin units as of December 16, 2024, making it the world’s largest corporate holder of Bitcoin.

- Bitcoin Advocate: Saylor is known for his supportive statements on Bitcoin, describing it as “digital gold” and the ideal asset to hedge against the volatility of fiat currencies.

His Role as a Thought Leader:

- Saylor is also an author and presented his famous book, “The Mobile Wave,” where he discussed how digital technology affects the economy and society.

- He continues to play a leading role in promoting the idea that Bitcoin is the perfect solution for individuals and companies looking to protect their wealth from inflation.

Michael Saylor’s Vision:

Michael Saylor is considered one of the most influential voices in the cryptocurrency industry, focusing on raising awareness about the importance of Bitcoin as a long-term digital asset and its role in the global financial future.

Top MicroStrategy Products

MicroStrategy is one of the leading companies in the field of software and data analytics, aiming to provide Business Intelligence solutions that help companies analyze data and make strategic, information-based decisions. Here are MicroStrategy’s top products:

- MicroStrategy Analytics

This is MicroStrategy’s flagship product, helping companies analyze and process big data quickly and efficiently. It offers analytical tools to extract valuable insights from data to guide business decisions. It features a flexible user interface and a set of advanced tools for data visualization and interaction.

- MicroStrategy Cloud

MicroStrategy Cloud is a solution aimed at enterprises that want to host and analyze their data in the cloud. This product enables companies to deploy data analytics solutions in the cloud faster and more securely, providing data access from anywhere.

- MicroStrategy Desktop

This is a free version of the MicroStrategy Analytics platform. It allows users to create reports and analytical dashboards using local or cloud data. It’s an ideal option for users who need advanced analytical tools but do not want to invest in the enterprise edition.

- MicroStrategy Mobile

This product provides interactive dashboards and reports on mobile devices, allowing users to access data on the go. It aims to improve productivity by enabling executives and employees to view data and analytics anytime and anywhere.

- MicroStrategy Intelligence Server

This product is the analytical engine that manages data and provides tools for businesses to analyze it in an integrated way. Intelligence Server can be integrated with various systems and supports security and data management on a large scale.

- MicroStrategy Usher

Usher is a security product that enables companies to use user data for authentication and protection across mobile applications. It is used to enhance enterprise security with biometric recognition and identity authentication.

- MicroStrategy HyperIntelligence

This product enables users to access information and analytics through “Smart Cards” that appear directly on the user interface without the need for separate queries. It relies on artificial intelligence to provide instant and contextual insights.

Bitcoin Investment Fund

• A Unique Model

MicroStrategy is considered a unique model in the global stock market, having transformed from a mere traditional software company into what resembles a giant “investment fund” dedicated to investing in Bitcoin. Since 2020, led by its former CEO Michael Saylor, the company began a bold strategy of purchasing large amounts of Bitcoin as a hedge against inflation and as a long-term store of value.

• Strategic Shift

While MicroStrategy specializes in providing software and data analytics solutions, its primary interest has become linked to the digital currency market, especially Bitcoin. By directing most of its cash reserves to buying Bitcoin, the company has attracted the attention of investors and traders who want exposure to Bitcoin without having to purchase the cryptocurrency directly.

• An Indirect Investment Fund

MicroStrategy can be considered an “indirect investment fund” in Bitcoin, as its stock offers investors the opportunity to enter the digital currency market via the traditional stock gateway. This option is attractive to those who do not wish to deal with cryptocurrency trading platforms due to regulatory or security complexities.

• Risks and Opportunities

Although MicroStrategy’s strategy achieved huge profits during Bitcoin’s bullish periods, it exposes the stock to high risks when the cryptocurrency’s price falls. Thus, the stock’s performance has become a direct reflection of Bitcoin’s performance, increasing its volatility.

A Bold Strategy

The co-founder and Chairman of MicroStrategy, Michael Saylor, made the decision to invest in Bitcoin in 2020 as a hedge against inflation. The company began using its cash liquidity to purchase these digital assets, and later relied on proceeds from stock offerings and convertible debt sales to bolster its ability to expand its cryptocurrency holdings.

This year, Saylor reaffirmed his commitment to this strategy, announcing that the company seeks to raise $42 billion over the next three years to support its investments in Bitcoin.

Michael Saylor rejoices over a “Bitcoin return” of 75% in 2024. The entrepreneur sees every Bitcoin acquired as a massive growth lever, making his company a unique model in financial history.

This bold strategy impresses as much as it intrigues digital currency investors. By purchasing Bitcoin at such a high price, MicroStrategy sends a strong signal: Bitcoin remains a valuable asset even near its highest historical levels.

Moreover, the company does not hide its objectives; it seeks to maximize shareholder value by making Bitcoin a central pillar of its financial strategy.

Total Bitcoin Holdings

- By the end of 2023, MicroStrategy’s total Bitcoin holdings amounted to 190,000 units, purchased for a total of $5.93 billion, meaning an average cost of $31,224 per unit.

- From the start of 2024 until December 15, MicroStrategy bought 249,000 units, purchased for a total of $21.17 billion, meaning an average cost of $85,020 per unit.

- Total holdings so far: 439,000 units purchased for a total of $27.1 billion, meaning an average cost of $61,731 per unit.

Huge Investment Returns

Referring to the current Bitcoin price of about $108,000, the market value of MicroStrategy’s Bitcoin holdings is about $47.4 billion, which means the company is currently making about $20 billion in profits, or about 75%.

An Inspiring Experience

MicroStrategy’s success has become a source of inspiration for other companies. For example, Semler Scientific recently purchased 297 Bitcoin for $29.1 million, raising its total holdings to 1,570 Bitcoin. For these companies, the leading digital currency has become a “war chest” used as a strategic asset to enhance financial value.

However, this bet remains fraught with risks, as fluctuations in the digital currency market can turn these assets into a “ticking time bomb.” If Bitcoin’s value drops sharply, investors may face severe losses that threaten their long-term financial strategies.

Joining the Nasdaq 100

The global Nasdaq exchange stated that “MicroStrategy” will join the Nasdaq 100 index, with the change becoming effective before the market opens on December 23. MicroStrategy, known for its strong investments in the world’s largest digital asset, has seen its shares surge more than sixfold this year, boosting its market value to nearly $94 billion. It is now the largest company holding Bitcoin globally.

Chris Weston, Head of Research at Pepperstone Group, said that the market anticipates that Michael Saylor, the CEO of MicroStrategy, will benefit from the potential rise in the company’s stock price, given the expected negative flows from its listing in the “Nasdaq 100” index, as it is assumed he will sell more shares and buy more Bitcoin.

MicroStrategy’s Q3 2024 Earnings

Key Financial Results for Q3:

• Revenues:

Total revenues: $116.1 million, down 10.3% year-over-year. Subscription Services Revenue: $27.8 million, up 32.5% year-over-year. Product Licenses and Subscription Services Revenue: $38.9 million, down 13.6% year-over-year. Product Support Revenue: $61.0 million, down 8.7% year-over-year. Other Services Revenue: $16.2 million, down 8.0% year-over-year.

• Gross Profit:

Gross profit reached $81.7 million with a gross margin of 70.4%, compared to $102.8 million and a 79.4% gross margin in Q3 2023.

• Operating Expenses:

Operating expenses amounted to $514.3 million, a massive increase of 301.6% year-over-year. These operating expenses include impairment losses on the company’s digital assets, which amounted to $412.1 million compared to $33.6 million in Q3 2023.

• Loss from Operations and Net Income (Loss):

Operating loss reached $432.6 million, compared to $25.2 million in Q3 2023. Net loss amounted to $340.2 million, or $1.72 per diluted share, compared to a net loss of $143.4 million, or $1.01 per diluted share in Q3 2023.

• Cash and Equivalents:

As of September 30, 2024, cash and equivalents stood at $46.3 million, compared to $46.8 million on December 31, 2023, a decrease of $0.5 million.

Short Analyses and Forecasts for MicroStrategy Stock

- MicroStrategy Stock Forecast This Week: If the stock succeeds in surpassing the $445 resistance, it will continue rising towards the $500 levels.

- MicroStrategy Stock Forecast in December: The stock is likely to achieve monthly gains in December, thanks to the positive sentiment dominating the global markets.

- MicroStrategy Stock Forecast in 2024: It is widely expected that the stock will trade again above the $500 barrier before the end of this year.

- MicroStrategy Stock Forecast in 2025: If the MicroStrategy stock surpasses the $500 barrier, the next target will be the $1,000 barrier before the end of 2025, for the first time in history.

Key Price Milestones for MicroStrategy Stock:

- July 2002: MicroStrategy stock recorded its all-time low at $0.42.

- November 2024: MicroStrategy stock recorded its all-time high at $543.

- June 2002: MicroStrategy stock recorded its lowest closing price ever at $0.50.

- November 2024: MicroStrategy stock recorded its highest closing price ever at $474.

Best Historical Performance for MicroStrategy Stock:

- 1999: Best annual performance ever for MicroStrategy stock with a 567% increase.

- Q4 1999: Best quarterly performance ever for MicroStrategy stock with a 275% increase.

- October 2001: Best monthly performance ever for MicroStrategy stock with a 143% increase.

Worst Historical Performance for MicroStrategy Stock:

- 2000: Worst annual performance ever for MicroStrategy stock with a 91% decrease.

- Q2 2002: Worst quarterly performance ever for MicroStrategy stock with an 84% decrease.

- April 2000: Worst monthly performance ever for MicroStrategy stock with a 70% decrease.

Major Events in MicroStrategy Stock History:

- June 1998: MicroStrategy’s stock began trading on Wall Street at $8.13.

- June 1998: MicroStrategy’s stock traded above $10 for the first time ever.

- July 1998: MicroStrategy’s stock surpassed $20 for the first time in history.

- November 1999: MicroStrategy’s stock traded above $50 for the first time ever.

- December 1999: MicroStrategy’s stock surpassed $100 for the first time in history.

- March 2000: MicroStrategy’s stock traded above $200 for the first time ever.

- March 2000: MicroStrategy’s stock surpassed $300 for the first time in history.

- November 2024: MicroStrategy’s stock traded above $400 for the first time ever.

- November 2024: MicroStrategy’s stock surpassed $500 for the first time in history.

Price Surges

- MicroStrategy’s stock has risen by more than 550% since the beginning of this year to date, on track to achieve its second consecutive annual gain and its largest annual gain since 1999.

- The stock rose by 346% in 2023, quickly resuming its annual gains after they halted in 2022 for the first time in four years.

- Accordingly, MicroStrategy’s stock has risen by about 896% since the start of 2023 until now, spanning nearly two years.

Top Expectations for MicroStrategy Stock in 2025

- JPMorgan: The bank expects the MicroStrategy stock to reach $700 by the end of 2025.

- Goldman Sachs: The group expects the MicroStrategy stock to reach $750 by the end of 2025.

- Morgan Stanley: The group expects the MicroStrategy stock to reach $600 by the end of 2025.

- Citigroup: The group expects the MicroStrategy stock to reach $700 by the end of 2025.

- Deutsche Bank: The German bank expects the MicroStrategy stock to reach $700 by the end of 2025.

- ARK Invest: The company expects the MicroStrategy stock to reach $800 before the end of 2025.

Factors Affecting MicroStrategy Stock Forecast in 2025:

-

Bitcoin Price Movements:

• MicroStrategy relies primarily on Bitcoin as a key asset in its investment strategy, making the stock price highly sensitive to Bitcoin’s movements.

• If Bitcoin’s price rises to new record levels, the company’s stock could reach historic levels, while any Bitcoin decline leads to a significant drop in the stock. -

Company Financial Policy:

• The company’s continued Bitcoin purchases through new financing methods, such as issuing debt or selling shares, may affect confidence in the stock and increase volatility.

• Any new decision by the management, led by Michael Saylor, to increase Bitcoin holdings could reinforce positive expectations for the stock. -

Regulatory Environments for Digital Currencies:

• Laws and regulations imposed by governments and central banks on cryptocurrency markets directly affect Bitcoin’s price, and thus MicroStrategy’s performance.

• Strict regulations may put negative pressure on the stock, while more flexible policies support its rise. -

Quarterly Company Results:

• Revenues from MicroStrategy’s core software segment play an important role in supporting the overall stock performance.

• Declining revenues or rising operating costs may limit the stock’s attractiveness. -

Global Market Trends:

• Movements in global financial markets, especially Wall Street, affect investor sentiment towards high-risk assets such as tech stocks and digital currencies.

• Any positive momentum in financial markets may support MicroStrategy’s stock, and vice versa. -

Monetary Policies and Interest Rates:

• Rising global interest rates, especially in the U.S., increase borrowing costs and pressure stocks linked to digital assets like MicroStrategy.

• Lower interest rates or accommodative monetary policies may boost demand for Bitcoin and the company’s shares. -

Competitor Movements:

• If other major companies adopt the same strategy as MicroStrategy by purchasing Bitcoin, competition may increase and the company’s uniqueness and leadership position may diminish.

-

The Investment Climate for Cryptocurrencies:

• The entry of major financial institutions into the digital currency market enhances confidence in Bitcoin, and therefore in MicroStrategy’s stock.

• On the other hand, high volatility or concerns about market bubbles may prompt some investors to exit. -

Media Coverage and Leadership Statements:

• Statements by the company’s CEO, Michael Saylor, about Bitcoin or the company’s future decisions greatly influence investor sentiment.

• Any positive news about growth strategies or expansion plans contributes to supporting the stock. -

Global Economic Reports:

• Indicators of inflation, employment figures, and global monetary policy decisions affect digital assets and stock markets in general, and thus MicroStrategy’s performance.

Most Frequently Asked Questions About MicroStrategy

Is MicroStrategy’s price suitable for investment?

Currently, MicroStrategy’s stock is trading around $400. In light of most forecasts pointing to an upward trend until the end of the year, we believe that levels around $350–$300 are suitable for investment, targeting above $500 in 2024 and near $1,000 by the end of 2025.

How to Invest in MicroStrategy?

Investing in MicroStrategy is one of the prominent opportunities that interest investors in the technology sector. Here are some common ways to invest in MicroStrategy:

-

Buying Shares Directly:

Buying MicroStrategy (MSTR) shares on the stock exchange is the most straightforward way to invest. MicroStrategy is listed on the Nasdaq, and its shares can be purchased through a brokerage account. You should pay attention to the market volatility associated with MicroStrategy shares, as they often witness sharp price fluctuations.

-

Investing Through Exchange-Traded Funds (ETFs):

You can indirectly invest in MicroStrategy through ETFs or mutual funds that include MicroStrategy shares in their portfolios. This type of investment helps diversify your portfolio and reduce the risks associated with holding a single stock.

-

Long-Term Investment:

Some investors prefer to hold MicroStrategy shares for the long term to benefit from the company’s potential future growth. Long-term investment strategies rely on confidence that the company will continue to lead in the technology sector.

-

Speculating in Stocks:

Investors can also use speculative or day-trading strategies to benefit from daily price swings in MicroStrategy’s stock. However, this type of trading requires experience and good market knowledge due to the high risks involved.

-

Investing in Convertible Bonds:

MicroStrategy issues convertible bonds, a type of debt that can be converted into shares. This gives investors the opportunity to earn bond interest plus the potential to participate in any future stock price rise.

-

Financial Options (Options Contracts):

Some investors prefer trading options on MicroStrategy stock, which gives them the right to buy or sell the stock at a specified price in the future. This strategy requires a deep understanding of the options market and carries high risks.

Tips for Investing in MicroStrategy:

Long-term Planning: MicroStrategy is a leading company but may face performance fluctuations. Experts advise thinking long-term.

Market Analysis: Follow MicroStrategy’s financial performance, quarterly reports, developments in the technology and data analytics sector.

Portfolio Diversification: Do not put all your money into one stock, even if it’s MicroStrategy. Instead, distribute investments across several stocks and sectors.

Will MicroStrategy’s stock reach $1,000 in 2025?

In light of recent developments in the digital asset market and other global markets, especially after Donald Trump’s election win in the United States, it is not entirely out of the question that MicroStrategy’s stock could rise to $1,000 by the end of 2025.

Is it expected that MicroStrategy’s prices will rise in 2025?

Yes, MicroStrategy’s stock is expected to continue rising next year. Most expectations from major institutions, banks, and experts remain stable around the presence of MicroStrategy’s stock in a bullish market.

Best US Stock Investing Brokers 2025

- Pepperstone - Best overall US stocks trading broker for beginners. Founded 2010. Multiple regulated licenses. Minimum deposit: $0. 20% discount on deposit.

- Plus500 - Best licensed broker for investing in US stocks (CFDs). Founded 2008. Multiple regulated licenses. Minimum deposit: $100.

- XM - Top US stocks trading platform for educational materials and copy trading. Founded 2009. Multiple regulated licenses. Minimum deposit: $5. Periodic competitions and bonuses.

Summary: Best US Stock Trading Brokers

| Broker | Rating | Best For |

|---|---|---|

| Pepperstone |

4.5/5

|

Best US Stock Trading broker offering advanced Trading tools |

| XM |

4/5

|

Best US Stock Trading platform especially for trader education and training |

| Plus500 |

4/5

|

Best US StockTrading broker with a user-friendly interface |

Compare the Best US Stock Trading Brokers

| Broker | Trade Now | Market Change Forecast (2025) | Special Features | Regulation | Account Types | Leverage for US Stocks | Spread for US Stocks | Minimum Deposit | Trust Score |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | Trade Now | 8-15% | Fast execution, low spreads on US stocks | ASIC, FCA, DFSA, SCB | Standard, Razor | Up to 1:500 | From 0.1% | $0 | 9.5/10 |

| XM | Trade Now | 8-15% | Loyalty program, negative balance protection | IFSC, CySEC, ASIC | Micro, Standard, Zero, Ultra | Up to 1:888 | From 0.2% | $5 | 9/10 |

| Plus500 | Trade Now | 8-15% | Commission-free trading, easy-to-use platform | FCA, CySEC, ASIC, FMA | Retail, Professional | Up to 1:30 | From 0.3% | $100 | 9/10 |

Technical Analysis of MicroStrategy Incorporated (MSTR)

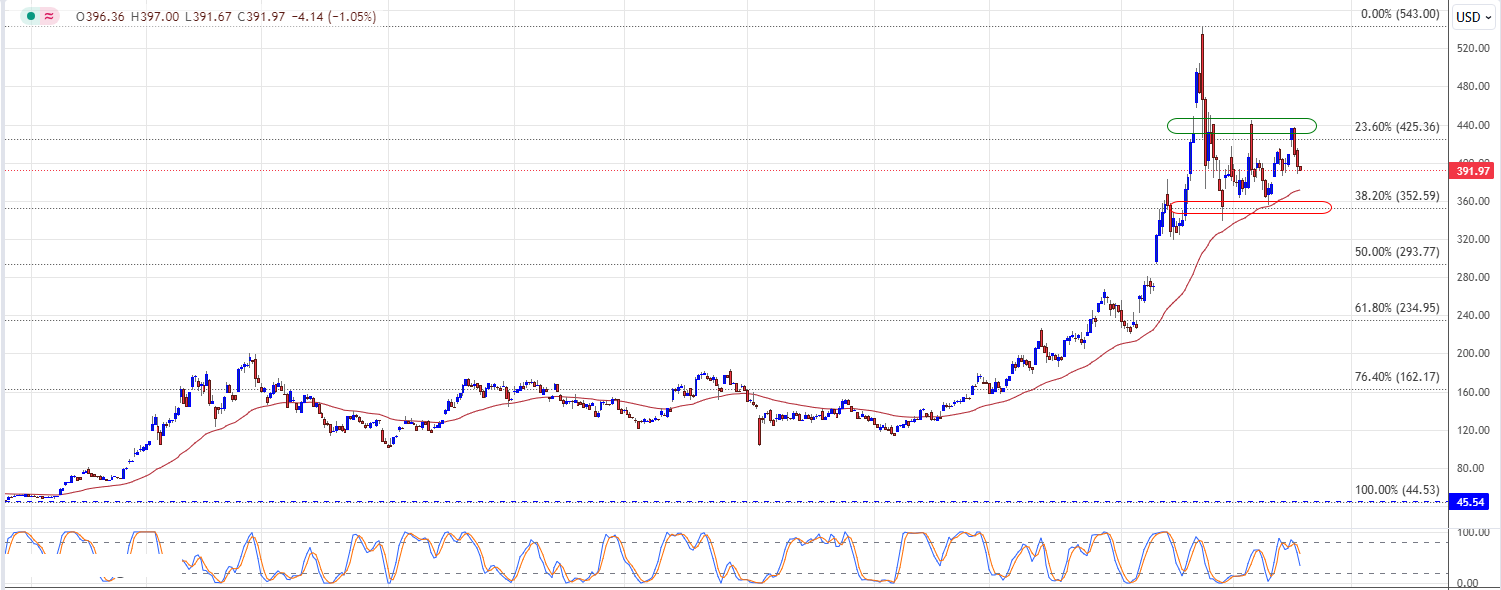

MicroStrategy’s stock started 2024 on a bullish trajectory, beginning from the $45.55 area, achieving strong gains and reaching record levels at around $543 last month. We note that the price recently faced negative pressures that were contained within a symmetrical triangle pattern visible on the following chart. The stock managed to break the resistance of this pattern and remain above it, indicating a resumption of the main upward trend:

Meanwhile, the Stochastic oscillator shows clear positive signals on the daily time frame, providing a positive impetus that we expect will push the price higher in the coming period, in addition to the 50-day moving average that is supporting the price from below.

The decline from the previously mentioned peak was a natural corrective move for the long-term bullish wave. We note that the price stopped at the 38.2% Fibonacci retracement level, which formed good support around $352.60, prompting the price to attempt rising again. The price needs to overcome the resistance formed between $425.35 and $440.00 to confirm the continuation of the upward thrust and head towards achieving more gains in the short and medium term.

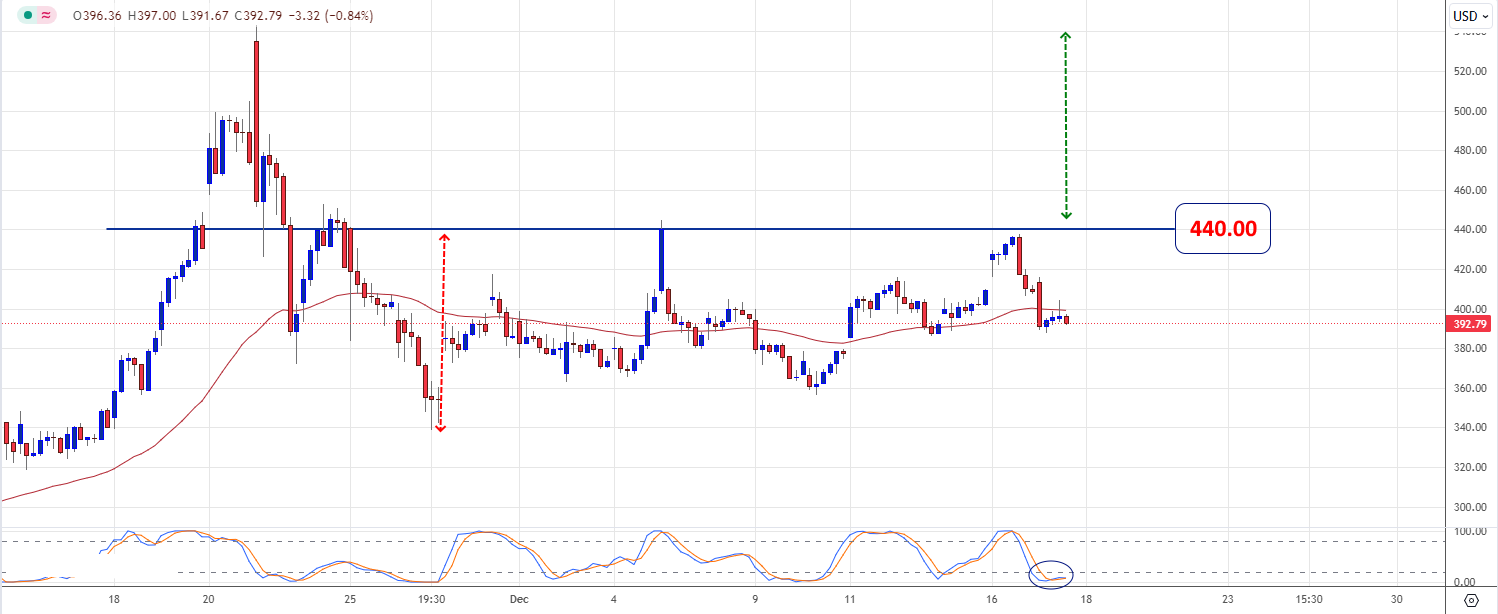

Zooming in on the stock’s recent trading and examining the short-term frames, we find that the price is forming a double-bottom pattern, with its confirmation level at the key resistance of $440.00. This means that breaking this resistance will provide a positive catalyst, pushing the price towards new rises that will start at $540.00 and extend towards $560.00, then $585.00.

In conclusion, we see that opportunities are available for further upside in the coming period, relying on the mentioned positive technical factors, with the need to be cautious that breaking the $352.60 level would halt the upward wave and force the price into a new short-term downward correction. Targets would start at $294.00 and could extend to $235.00 before any new attempt to resume the main upward trend.

Update: Brent oil price attempts positively

Brent oil price attempts to breach 73.90$ level now, and as we mentioned this morning, the price needs to hold below this level to keep the bearish trend scenario valid for today, as confirming the breach will lead the price to build bullish wave that its targets begin by visiting 75.36$ areas mainly, while the main target of the expected bearish wave is located at 72.06$.