Spotify price breaches upward trend line - Forecast today - 06-10-2025

Spotify Technology (SPOT) declined in its latest intraday trading, as negative signals appeared on the RSI indicators. The stock broke a short-term ascending trendline and simultaneously slipped below its 50-day simple moving average, amplifying bearish pressure and signaling the potential extension of a short-term corrective downtrend.

Therefore, we expect the stock to fall in upcoming trading sessions, as long as it remains below 740.00, targeting the first support level at 652.65.

Today’s price forecast: Bearish.

International Paper price bolsters cautious gains - Forecast today - 06-10-2025

International Paper Company (IP) edged higher in its latest intraday trading, while remaining under the dominance of the main bearish trend. Persistent negative pressure continues as the stock trades below its 50-day simple moving average, amplifying downside risks and reducing the likelihood of a sustained recovery. Moreover, the RSI has begun to show a bearish crossover after reaching extremely overbought levels, indicating the formation of a negative divergence compared to price movement.

Therefore, we expect the stock to decline in upcoming trading, as long as it remains below 48.45, targeting the key support level of 43.60.

Today’s price forecast: Bearish.

Marvell Technology price pierces price target - Forecast today - 06-10-2025

Marvell Technology (MRVL) settled higher in its latest intraday trading, confirming a breakout above the key resistance level of 83.25, which had been our previous upside target. The move comes amid the dominance of a short-term corrective uptrend and the stock’s movement along a supporting trendline, reinforced by continued positive pressure from trading above its 50-day simple moving average. Moreover, RSI indicators are showing fresh bullish signals despite remaining in overbought territory.

Therefore, we expect the stock to rise in upcoming trading, as long as it holds above 83.25, targeting the next resistance level at 99.50.

Today’s price forecast: Bullish.

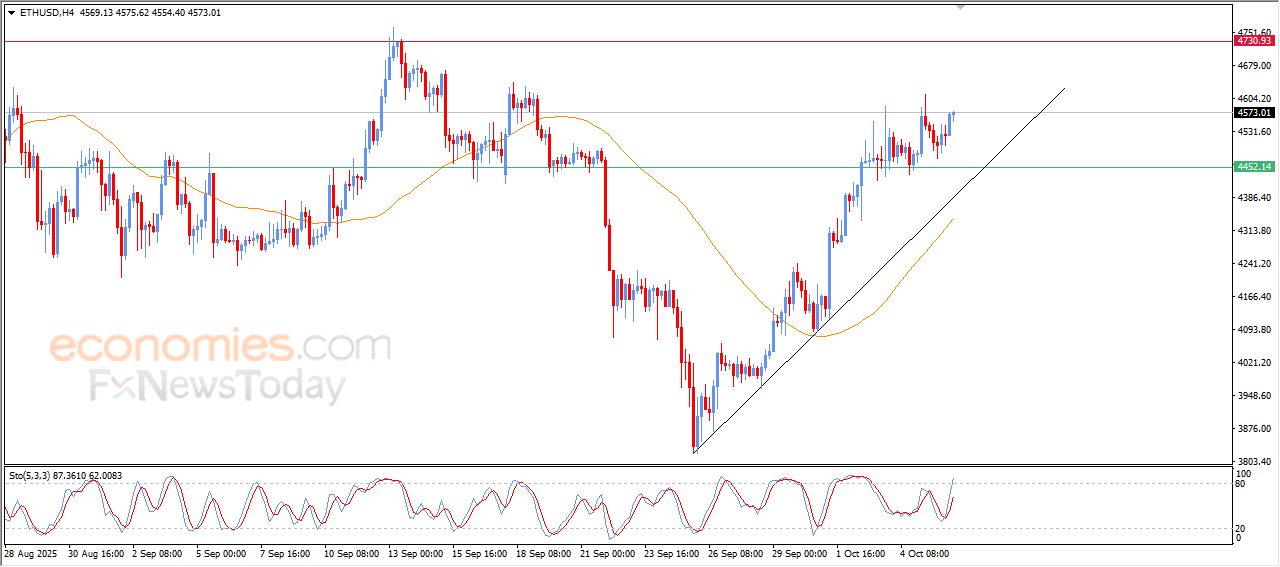

Forecast update for Ethereum -06-10-2025

The price of (ETHUSD) rose in its last trading on the intraday basis, amid its trading alongside bullish corrective trendline on the short-term basis, reinforced by its continued trading above EMA50, besides the emerging of the positive signals on the relative strength indicators, all these signs confirm continuing the rise in the upcoming period, if it kept the near critical support levels.

VIP Trading Signals Performance by BestTradingSignal.com (Sept 29 – Oct 3, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for Sept 29 – Oct 3, 2025: