Schlumberger price tries to gather positive momentum - Forecast today - 27-11-2025

Schlumberger N.V. (SLB) declined slightly in its latest intraday trading, as the stock attempts to gain positive momentum that may help it rise again. The price found support at its previous 50-day SMA, while a short-term corrective upward wave continues to dominate. In the background, we also observe the beginning of a positive divergence forming on the RSI indicators after they reached extremely oversold levels compared to the price movement, accompanied by the early arrival of positive signals from the relative strength indicators.

Therefore we expect the stock to rise in its upcoming trading, as long as it remains above the support level of $34.65, targeting the pivotal resistance level of $38.00.

Today’s price forecast: Bearish

Micron Technology price surrounded with positive pressures - Forecast today - 27-11-2025

Micron Technology (MU) rose in its latest intraday trading, supported by the beginning of positive signals from the RSI indicators after reaching extremely oversold levels, along with ongoing positive momentum from trading above its 50-day SMA. All of this comes under the dominance of the main short-term ascending trend.

Therefore we expect the stock to rise in its upcoming trading, as long as it remains above the support level of $192.40, targeting the pivotal resistance level of $257.00.

Today’s price forecast: Bullish

Forecast update for Ethereum -27-11-2025

The price of (ETHUSD) witnessed fluctuated trading on its last intraday levels, settling with strong gains affected by the dynamic support that is represented by its trading above EMA50, attempting to breach main bearish trend line on the short-term basis, the emergence of negative overlapping signals decelerate the rise, after reaching overbought levels, where the price begins to offload some of these conditions before rising in the upcoming period.

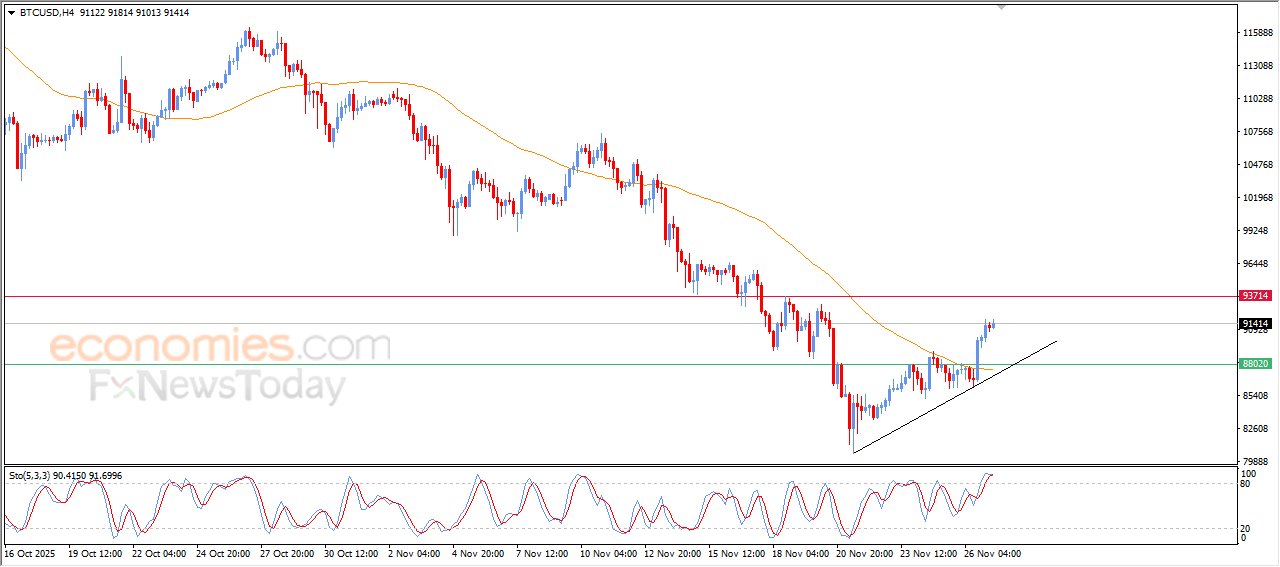

Forecast update for bitcoin -27-11-2025

Bitcoin (BTCUSD) prices rose during the last intraday trading, amid the dominance of bullish corrective wave on the short-term basis that is represented by its trading above EMA50, on the other hand we notice the emergence of negative overlapping signals on the relative strength indicators, after reaching overbought levels, which may reduce the upcoming gains.