Schlumberger price suffers from negative pressures - Forecast today - 12-08-2025

AI Summary

- Schlumberger N.V.'s stock price (SLB) has declined due to negative pressures, including exiting an ascending corrective price channel and trading below its previous 50-day SMA

- The stock is expected to continue declining in upcoming trading sessions, with a target support level of 31.10 as long as resistance at 34.10 remains intact

- Today's price forecast for Schlumberger is bearish

Schlumberger N.V.’s stock price (SLB) declined in its latest intraday trading, having earlier been impacted by exiting an ascending corrective price channel that had been guiding its previous short-term movements. This comes with continued negative pressure from trading below its previous 50-day SMA, in addition to negative signals from the RSI, despite it holding in oversold areas.

Therefore, we expect the stock to decline in its upcoming trading, as long as resistance at 34.10 remains intact, targeting the key support level of 31.10.

Today’s price forecast: Bearish.

Micron Technology price readies to tackle pivotal resistance - Forecast today - 12-08-2025

Micron Technology’s stock price (MU) jumped higher in its latest intraday trading, benefiting from the dynamic support of its previous 50-day SMA after successfully overcoming its negative pressure. This comes under the control of the main bullish trend and trading along a supporting trendline, with the stock now preparing to attack the key resistance level of 129.85. However, we note that the RSI has reached extremely overbought levels, excessively so compared to the stock’s movement, which may temporarily cap gains.

Therefore, we expect the stock to rise in its upcoming trading, provided it first breaks through the aforementioned key resistance of 129.85, confirming its intention to continue higher, targeting the next resistance at 146.00.

Today’s price forecast: Bullish.

Applied Materials price tries to gather positive momentum - Forecast today - 12-08-2025

Applied Materials, Inc.’s stock price (AMAT) fell slightly in its latest intraday trading, as the stock attempts to gain positive momentum that may help it recover and rise again. This comes under the control of a short-term corrective uptrend and trading along a supporting trendline, with ongoing dynamic support from trading above its previous 50-day SMA, in addition to positive signals appearing on the RSI.

Therefore, we expect the stock to rise in its upcoming trading, as long as the 176.40 support level holds, targeting the key resistance level of 201.00.

Today’s price forecast: Bullish.

Forecast update for Ethereum -12-08-2025

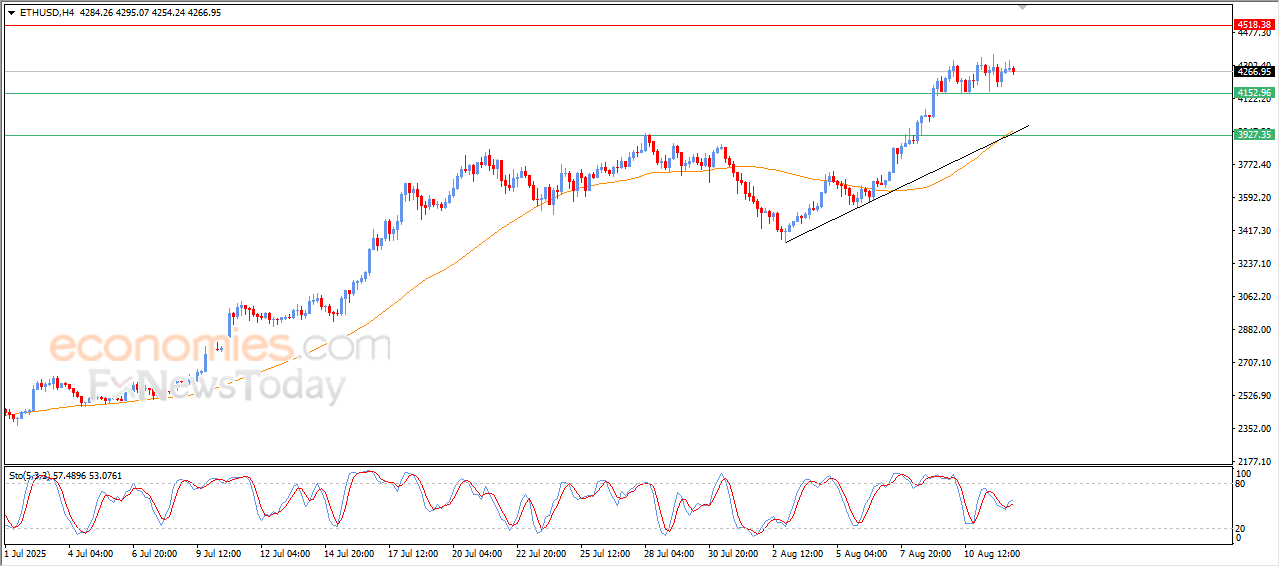

The price of (ETHUSD) settled high in its last intraday trading, amid its attempts to gain positive momentum that might help it to recover and begin a new strong bullish wave, amid the dominance of the main bullish trend on the short-term basis and its trading alongside a minor bias line on the short-term basis, with the continuation of the positive pressure due to its trading above EMA50, besides the return of the positive signs on the (RSI).

BestTradingSignal.com – Professional Trading Signals

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull performance report available here: