Qualcomm price faces negative outlook - Forecast today - 02-02-2026

Qualcomm Incorporated (QCOM) stock price recorded a continued decline in its latest intraday trading, amid ongoing negative pressure from trading below its SMA50. The stock was previously affected by breaking below a main medium-term upward trend line, which increases the surrounding bearish pressure, especially with incoming negative signals from the RSI after the stock managed to unwind its oversold conditions, opening the way for further near-term losses.

Therefore we expect the stock price to decline in upcoming trading, as long as the $159.10 resistance level remains intact, to target the important support at $144.10.

Today’s price forecast: Bearish

Amgen price tries to vent off overbought saturation - Forecast today - 02-02-2026

Amgen Inc. (AMGN) stock price recorded a pullback in its latest intraday trading, following the stabilization of the key resistance level at $346.35, as the stock attempts to build positive momentum that could help it recover and break above this level. At the same time, it is trying to unwind part of its overbought conditions on the RSI, especially with incoming negative signals, while continued dynamic support remains in place from trading above its SMA50, reinforcing the stability and dominance of the main short-term upward trend, with price action moving along a supportive minor trend line.

Therefore we expect the stock price to rise in upcoming trading, especially if it succeeds in breaking above the $346.35 resistance level, to target the next resistance at $344.40.

Today’s price forecast: Bullish

Forecast update for Ethereum -02-02-2026

The price of (ETHUSD) rose in its last intraday trading, with the continuation of the negative pressure due to its trading below EMA50, reinforcing the stability and dominance of the main bearish trend on short-term basis, especially with its trading alongside supportive trend line for this path, attempting to recover some previous losses, by the emergence of positive signals from relative strength indicators, after reaching oversold levels.

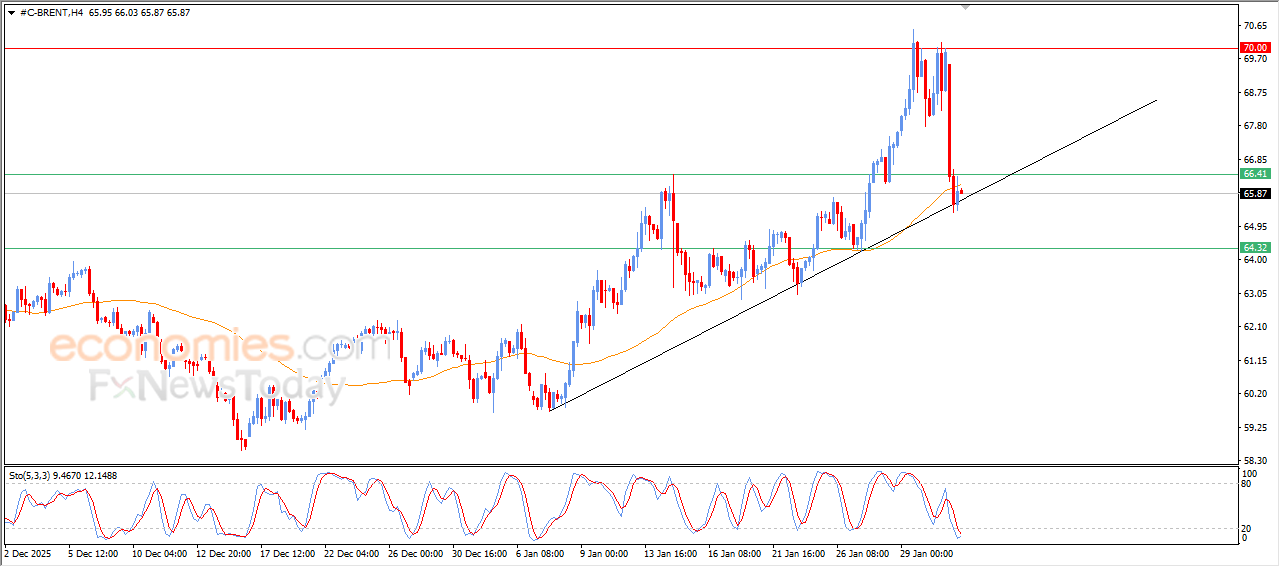

Forecast update for Brent -02-02-2026

Brent prices settle on strong losses in their last intraday trading, breaking our expected target in our previous analysis at $66.40 support, supporting the support of EMA50, intensifying the negative pressures, especially with the emergence of the negative signals from relative strength indicators, keeping the effect of the sharp declines on the near trading, despite gaining some bullish momentum due to it leaning on bullish trend line’s support on short-term basis, which limits this decline temporarily.