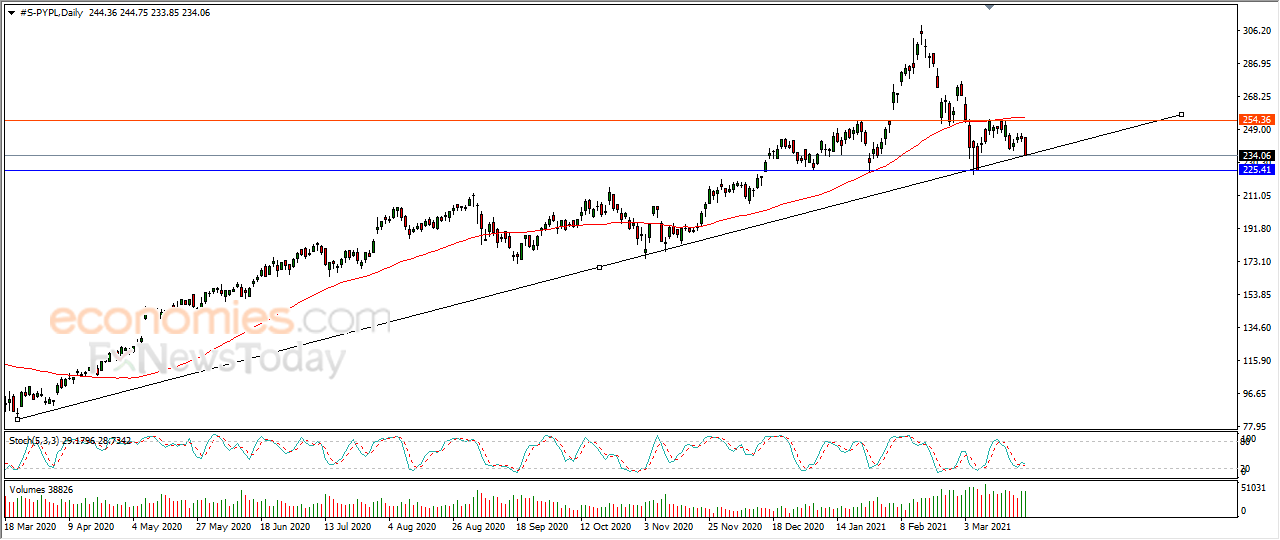

PayPal exhausts positive chances - Analysis - 25-03-2021

PayPal Holdings' stock (PYPL) fell 3.90% in the last session amid negative pressure from the 50-day SMA, with negative signals from the RSI, leaning on the main upward medium-term trend line in an attempt to gather positive momentum.

Therefore we expect the stock to return higher, targeting the first resistance at 254.35, provided the pivotal support of 225.40 holds on.

Expected trend for today: Bullish

Starbucks parks at pivotal support - Analysis - 25-03-2021

Starbucks' stock (SBUX) fell 1.20% in the last session, while gathering positive momentum to help it recover anew, while leaning on the support of the 50-day SMA, as it also leaned on the main upward medium-term trend line, as the RSI reached oversold levels compared to the stock's movements.

Therefore we expect the stock to return higher, targeting the important resistance of 112.25 anew.

Expected trend for today: Bullish

American International Group seeks a bottom to bounce it higher - Analysis - 25-03-2021

American International Group's stock (AIG) rose 0.02% in the last session while seeking a bottom to bounce it higher, amid the dominance of the upward medium-term trend, with positive pressure from the 50-day SMA as the RSI reached oversold levels.

Therefore we expect more gains for the stock, targeting the resistance of 48.85.

Expected trend for today: Bullish

Boeing sharpens decline - Analysis - 25-03-2021

\Boeing's stock (BA) kept falling with 0.83% in the last session, while trading alongside the upward short-term trend line, with positive pressure from the 50-day SMA, as the RSI reached oversold levels, while the stock gathers momentum to help it rise anew

Therefore we expect the stock to return higher, targeting the first resistance at 253.60, provided the support of 234.00 holds on.

Expected trend for today: Bullish