Nvidia price attacks pivotal resistance - Forecast today - 05-05-2025

Nvidia Corporation’s stock price (NVDA) rose in latest intraday trading, trespassing the resistance of the 50-day SMA in an important step aimed at shaking off its negative pressure, with the price tackling the pivotal resistance of $115.10, representing a major fork in the road that will decide the path ahead, with the dominance of the upward correctional trend, coupled with positive signals from the Stochastic despite reaching overbought levels.

Therefore we expect more gains for the price, provided the aforementioned resistance of $115.10 is reliably breached, targeting the next one at $129.00.

Today’s price forecast: Bullish

Generac price emits more negative signs - Forecast today - 05-05-2025

Generac Holdings’ stock price (GNRC) edged higher in latest intraday trading and tested the pivotal resistance of $115.65, amid the dominance of the main downward trend in the short term, with ongoing negative pressure due to trading below the 50-day SMA, coupled with negative signals from the Stochastic after reaching overbought levels.

Therefore we expect the stock to return lower and target the support of $99.50, provided the resistance of $115.65 holds on.

Today’s price forecast: Bearish

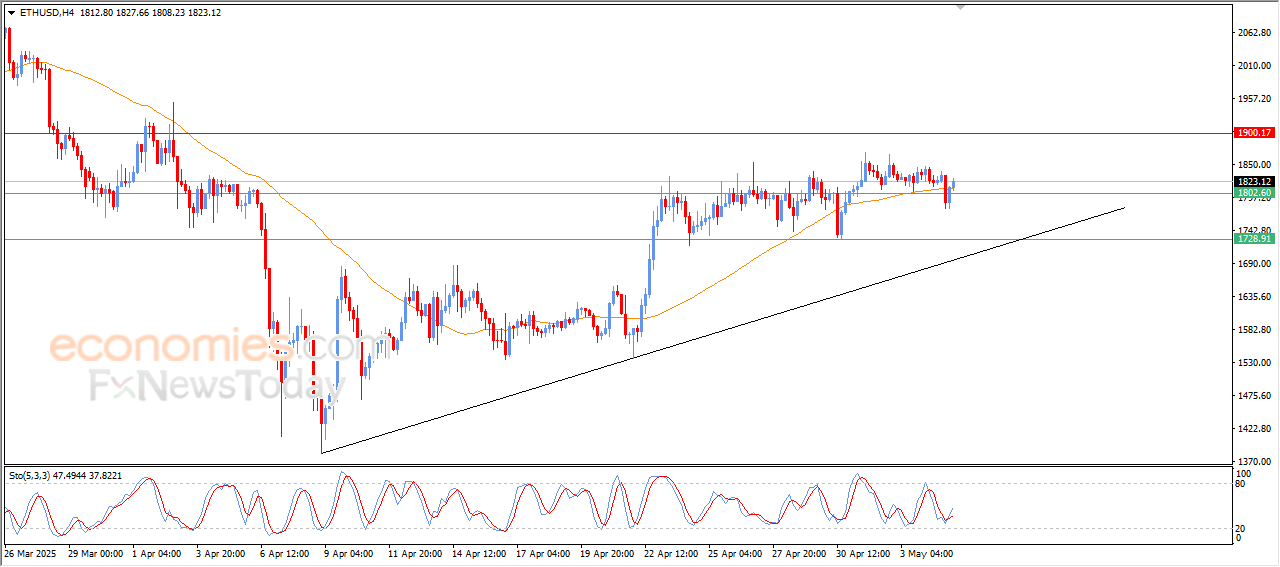

Forecast update for Ethereum -05-05-2025

The price of Ethereum (ETHUSD) managed to recover a large portion of its early-week losses on the intraday levels, stabilizing once again above the key resistance level of $1,800. This indicates resilience against further decline, especially with the emergence of positive signals from the Relative Strength Index (RSI), which has entered oversold territory.

Forecast update for Bitcoin -05-05-2025

Bitcoin price settled on an intraday rise, where it attempted to recover its early losses, and offloading some of its oversold conditions on the (RSI), affected by breaking a bullish bias line on the short-term basis, with the continuation of the negative pressure that was caused by its trading below EMA50.