Nuclear Reactor Companies Leading the Charge to Power AI: Top 5 Stocks to Invest in Today

We are undoubtedly living in the era of artificial intelligence (AI), or as some prefer to call it, the era of machine learning. Like any new technology, AI is driving various support industries that aim to facilitate its development.

One of the main drawbacks of AI technology is its high energy consumption, creating a need for new ways to generate abundant and cost-effective energy. Tech giants have announced new data centers with a combined capacity of nearly 24 gigawatts—over three times the amount from the same period last year. This need leads us to today’s topic: small modular nuclear reactors (SMRs).

What Are Small Modular Reactors (SMRs)?

SMRs represent the latest type of nuclear reactors, smaller and more integrated than traditional large reactors. They are designed to generate electricity more flexibly, safely, and efficiently, making them suitable for smaller locations or even remote areas. SMRs offer a promising solution to the growing demand for energy, especially with the development of AI technology.

The nuclear energy industry is witnessing a revival with the rising demand for clean energy across the country, driven in part by the increased energy needs of AI data centers. Large tech companies, including Amazon, Microsoft, and Alphabet (Google's parent company), have signed nuclear energy deals to meet their increasing energy needs as AI takes on a bigger role in their operations.

The revival of nuclear energy has triggered major moves on Wall Street, with some stocks doubling within a few days last month after Amazon and Google signed historic energy supply deals, boosting efforts to deploy the first scalable small reactors in the United States.

The Future of Energy Consumption

Goldman Sachs estimates that global data center energy consumption will grow by 160% by 2030, driven by AI demand. Meanwhile, separate data from the International Atomic Energy Agency (IAEA) indicates that nuclear power production in North America could double by 2050. According to research cited by Citibank analysts, the SMR market could grow to $300 billion by 2040. Additionally, a report by the International Energy Agency (IEA) predicts that data centers may account for one-third of the electricity demand increase through 2026.

Here Are the Top Five Stocks in This Field Worth Watching:

Oklo (OKLO)

Oklo Inc. has been one of the most popular nuclear companies in recent weeks. Founded in 2013 and led by Sam Altman, CEO of OpenAI (the company behind ChatGPT), Oklo's stock surged about 140% last month, fueled by increased interest from major tech companies in nuclear energy.

NuScale Power (SMR)

NuScale Power aims to address some of the drawbacks associated with nuclear power through small reactor technology. Its stock surged nearly 500% this year as more investors turn to nuclear energy. If nuclear power shifts to small reactors and NuScale becomes the leading provider, there would be an almost unlimited demand for its products.

NANO Nuclear Energy (NNE)

NANO Nuclear focuses on micro-reactor technologies, including the ZEUS solid-core battery reactor and the ODIN low-pressure cooling reactor.

Constellation Energy (CEG)

Tech giant Microsoft (MSFT) has signed a 20-year deal with Constellation Energy (CEG) to power its data centers, which will also revive the Three Mile Island nuclear power plant.

Cameco (CCJ)

Cameco supplies uranium and nuclear fuel to 37 nuclear companies worldwide, with 58% of its business in the U.S. With the major cloud service providers being U.S.-based—Amazon Web Services, Microsoft’s Azure, and Google Cloud—Cameco is well-positioned to benefit in its home market.

Best AI Stock Investing Brokers November 2024

- Pepperstone - Best overall AI stocks trading broker for beginners. Founded 2010. Multiple regulated licenses. Minimum deposit: $0. 20% discount on deposit.

- Plus500 - Best licensed broker for investing in AI stocks (CFDs). Founded 2008. Multiple regulated licenses. Minimum deposit: $100.

- XM - Top AI stocks trading platform for educational materials and copy trading. Founded 2009. Multiple regulated licenses. Minimum deposit: $5. Periodic competitions and bonuses.

Why Long-Term Investing in Stocks Can Build Wealth: Key Benefits You Need to Know

Investing in stocks for the long term can be an effective way to build wealth and achieve your financial goals. This strategy involves holding investments for over 12 months and requires a degree of patience and discipline. While the stock market experiences short-term fluctuations, history shows that holding stocks over extended periods usually leads to growth and positive returns. For instance, between 1974 and 2023, the S&P 500 had only 13 years of annual losses, indicating that the stock market often yields returns that far exceed periods of loss.

This article highlights the numerous benefits of long-term investing and why it’s a strategy worth considering. Join us as we delve into each advantage.

Your Investments Can Grow Despite Market Fluctuations

Fluctuations in the U.S. stock market can be intimidating and often make even the most enthusiastic long-term investors reconsider their strategies. However, while past performance doesn’t guarantee future returns, history shows that the market has consistently recovered from downturns, continuing to offer positive returns to long-term investors. Over the past 35 years, the market has posted positive annual returns in roughly eight out of ten years.

Long-term investors have the opportunity to ride out these ups and downs over many years or even decades, resulting in better returns in the long run.

Looking back at stock market returns since the 1920s, it is rare for investors to have lost money by investing in the S&P 500 for a 20-year period. Despite major setbacks like the Great Depression, Black Monday, the tech bubble, and the financial crisis, those who invested in the S&P 500 and held on for 20 years would have generally seen gains. On average, the index has nearly tripled in value every 10 years.

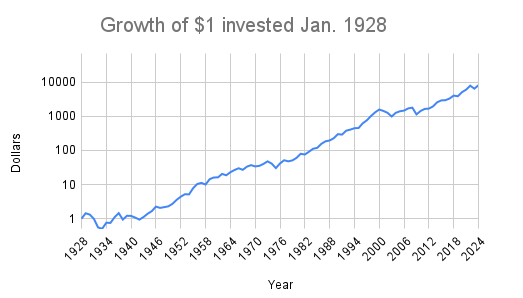

For instance, if you had invested just $1 in 1928, by 2024, that investment would be worth around $10,000. Over 95 years, the S&P 500 declined in consecutive years only five times, while it increased in 73% of those years (and declined in 27%).

Benefit from Every Market Movement

Timing the market is one of the most challenging aspects of investing. Historically, a significant portion of stock market gains and losses occurs within just a few days each year. Predicting these days is nearly impossible, making continuous long-term investment a more reliable approach to capitalize on these high-gain days, regardless of entry and exit timing.

Take Advantage of Compound Growth

One of the most powerful benefits of long-term investing is compound growth. While past performance doesn’t guarantee future returns, the S&P 500 has delivered an inflation-adjusted annual return averaging around 7%. This means, on average, the index’s value is about 7% higher at the end of each year than it was at the beginning. Over time, these gains accumulate, so the earlier you start investing, the longer your funds have to grow through compounding, potentially leading to significant growth.

You Won't Miss Out on Dividends

Many investors wait for the "right" time to start investing in the stock market, but by doing so, they miss out on an important opportunity to earn dividends.

Don’t underestimate the power of dividends. While individual payments may seem small, especially when investing for just a few years, dividends account for over 40% of the S&P 500's gains. As a stock market investor, you can choose to either cash out your dividends as they’re paid or reinvest them back into the market manually or automatically, creating further opportunities for capital growth.

Best Stock Investing Brokers November 2024

- Pepperstone - Best overall stocks trading broker for beginners in November 2024. Founded 2010. Multiple regulated licenses. Minimum deposit: $0. 20% discount on deposit.

- Plus500 - Best licensed broker for investing in stocks (CFDs) in November 2024. Founded 2008. Multiple regulated licenses. Minimum deposit: $100.

- XM - Top stocks trading platform for educational materials and copy trading in November 2024. Founded 2009. Multiple regulated licenses. Minimum deposit: $5. Periodic competitions and bonuses.

Ethereum price (ETHUSD) forecast update - 07-11-2024

Ethereum price (ETHUSD) fluctuates around 2823.00$ level that forms solid resistance against the price, and it needs to gather positive momentum that assist to push the price to resume the expected bullish trend for today, which targets 2915.00$ followed by 3040.00$ levels as next main stations.

On the other hand, we should note that breaking 2750.00$ will push the price to turn to decline and achieve intraday bearish correction before turning back to rise again.

The expected trading range for today is between 2750.00$ support and 2980.00$ resistance.

Trend forecast: Bullish

Bitcoin price (BTCUSD) forecast update - 07-11-2024

Bitcoin price (BTCUSD) shows negative trades to test the breached resistance of the bullish channel that appears on the chart, and the price needs to consolidate above these areas as a first condition to the continuation of the expected bullish trend for the upcoming period, which targets 78000.00$ as a next main station.

On the other hand, we should note that breaking 75000.00$ followed by 73820.00$ levels will stop the bullish trend and put the price under the correctional bearish pressure.

The expected trading range for today is between 73800.00$ support and 78000.00$ resistance.

Trend forecast: Bullish