Linde price receives some support - Forecast today - 05-09-2025

AI Summary

- Linde plc (LIN) stock received support at its previous 50-day SMA, indicating a bullish trend

- Stochastic indicators show oversold levels, suggesting a positive divergence and potential rise in stock price

- Forecast predicts Linde stock to continue rising, targeting a key resistance level of 487.50 as long as it remains stable above 468.00

Linde plc (LIN) stock advanced in its latest intraday trading, after finding support at its previous 50-day SMA. The short-term main bullish trend remains in control, with trading moving along an upward slope line that supports this path. In addition, the Stochastic indicators have reached strongly oversold levels, exaggerated relative to the stock’s movement, suggesting the beginning of a positive divergence, especially with a positive crossover starting to appear.

Therefore, we expect the stock to rise in its upcoming trading, as long as it remains stable above the support level of 468.00, to then target the key resistance level of 487.50.

Today’s price forecast: Bullish.

Dollar Tree price deepens losses - Forecast today - 05-09-2025

Dollar Tree, Inc. (DLTR) stock declined in its latest intraday trading, as a steep short-term corrective bearish wave remains in control. Negative pressure also continues from trading below its previous 50-day SMA, while the latest decline was accompanied by a noticeable increase in trading volumes. In addition, negative signals are flowing from the Stochastic indicators, despite remaining in strongly oversold areas.

Therefore, we expect the stock to decline in its upcoming trading, as long as it remains stable below the resistance level of 104.85, to then target the support level of 94.20.

Today’s price forecast: Bearish.

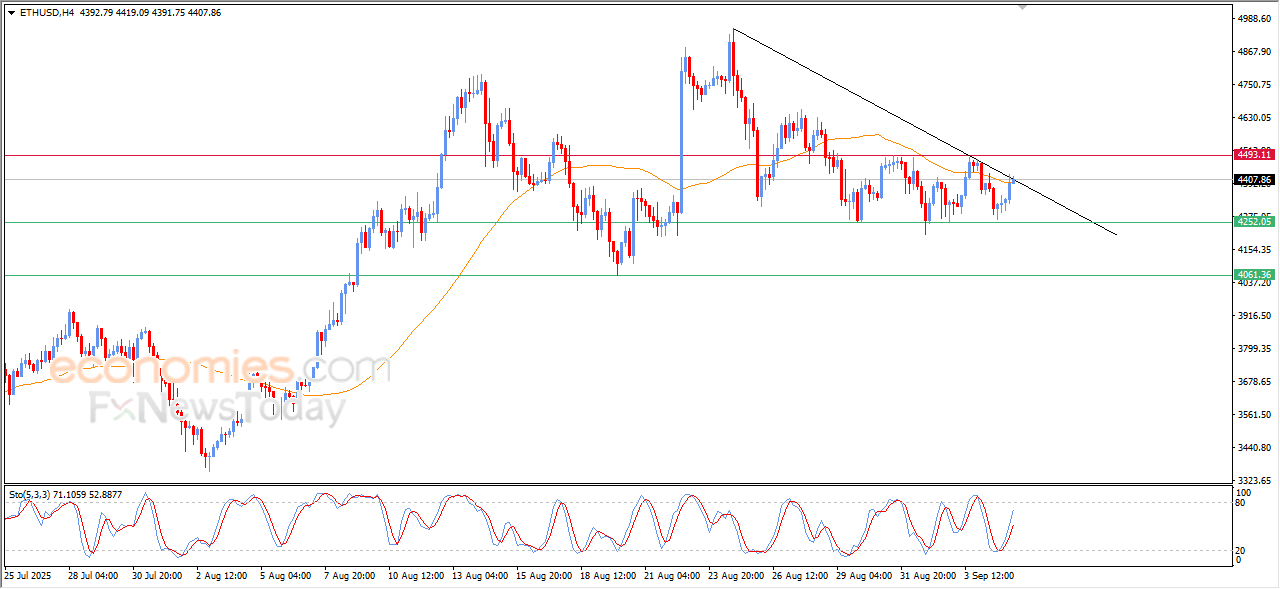

Forecast update for Ethereum -05-09-2025

The price of (ETHUSD) rose in its last intraday trading, supported by the emergence of the positive signals on the (RSI), to succeed in offloading its oversold conditions, reaching the resistance of EMA50, accompanied by testing bearish correctional bias line on the short-term basis, reducing the chances for breaching this area on a near-term basis.

VIP Trading Signals Performance by BestTradingSignal.com (August 25–29, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for August 25–29, 2025:

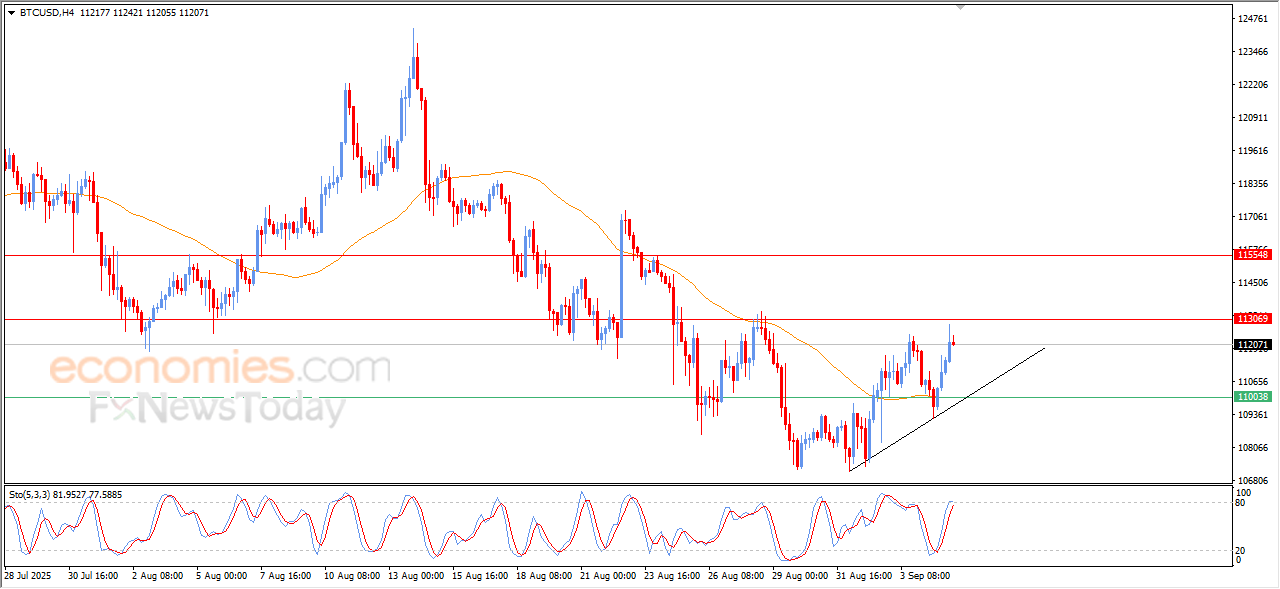

Forecast update for Bitcoin -05-09-2025

The price of (BTCUSD) settled with strong gains in its last intraday trading, affected by the stability of the key resistance at $109,000, after offloading its clear oversold conditions on the intraday basis, amid the continuation of the negative pressure that comes from its trading above EMA50, and under the dominance of the bullish correctional wave on the short-term basis and its trading alongside supportive bias for the track, besides the emergence of the positive signals on the (RSI), despite reaching overbought levels.

VIP Trading Signals Performance by BestTradingSignal.com (August 25–29, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for August 25–29, 2025: