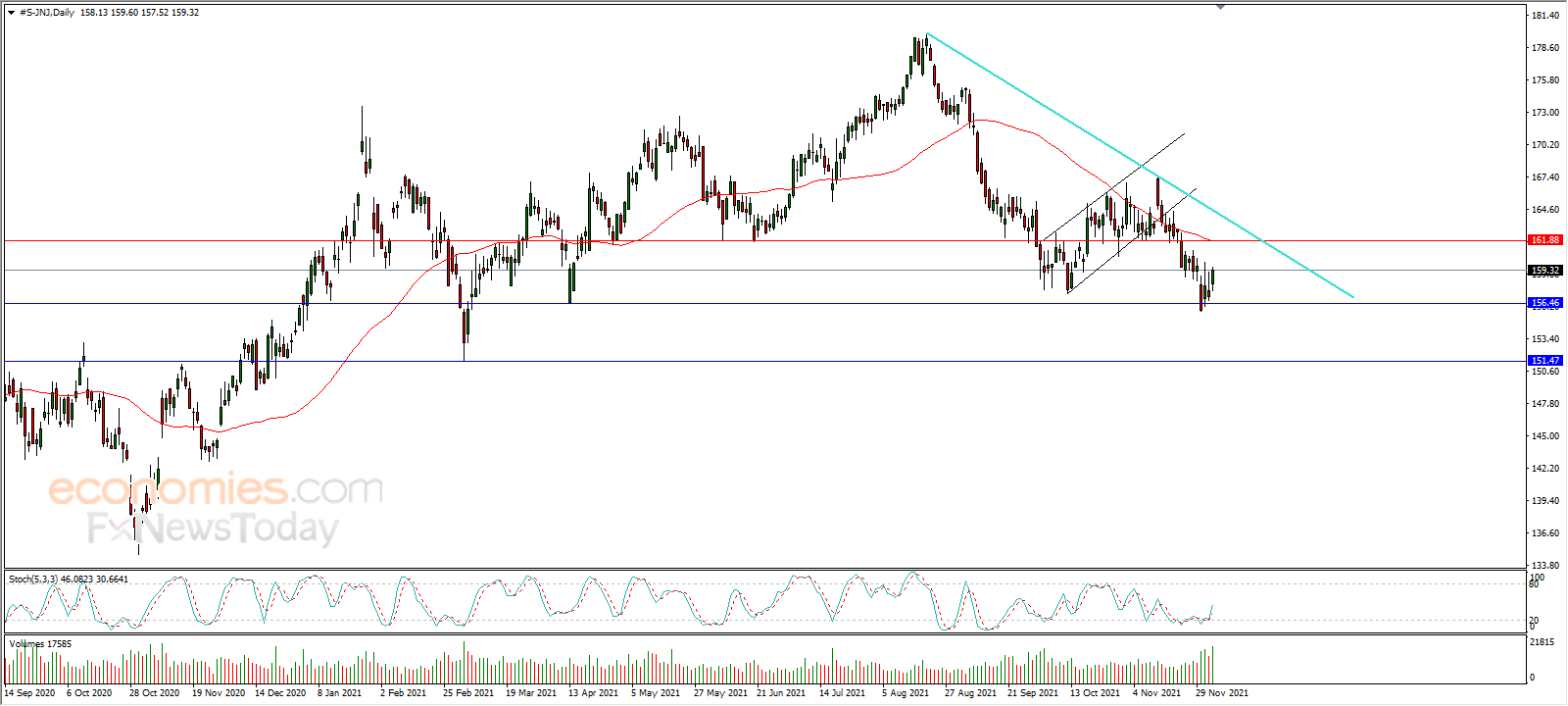

Johnson & Johnson tries to vent off oversold saturation - Analysis - 06-12-2021

Johnson & Johnson's stock (JNJ) rose 1.46% in the last session while trying to vent off oversold saturation in the RSI amid positive signals out of them, settling at 159.38, amid the dominance of the downward correctional short-term trend, with negative pressure from the 50-day SMA.

Therefore we expect the stock to return lower, targeting the support of 151.50, provided the support of 156.45 was breached.

Expected trend for today: Bearish

IBM tries to recoup losses - Analysis - 06-12-2021

IBM's stock rallied 1.66% in the last session in the intraday levels while recouping some past losses, amid the dominance of the downward correctional trend in the short term, with negative pressure from the 50-day SMA after reaching overbought levels.

Therefore we expect the stock to return lower, targeting the support of 113.40, provided the resistance of 118.30 holds on.

Expected trend for today: Bearish

Hewlett-Packard collects profits - Analysis - 06-12-2021

Hewlett-Packard's stock (HPQ) fell 0.24% in the last session on profit-taking while venting off overbought saturation in the RSI, settling at 37.55, amid the dominance of the main upward trend in the medium term, with support from the 50-day SMA.

Therefore we expect the stock to rise and target the resistance of 42.00, provided it settles above the support of 35.95.

Expected trend for today: Bullish

Midday update for Brent oil 06-12-2021

Brent oil price still stuck between the trend keys represented by 69.60 support and 72.70 resistance, thus, our neutrality still valid, waiting to surpass one of these levels to detect the next destination clearly.

Note that the details of the expected targets after the breach are explained in our morning report.

The expected trading range for today is between 69.00 support and 72.70 resistance.

The expected trend for today: Neutral