International Seaways price attacks current resistance - Forecast today - 09-09-2025

AI Summary

- International Seaways stock is testing resistance at 47.95, supported by an upward trend line and trading above the 50-day SMA

- Negative crossover appearing in Stochastic indicators may limit upcoming gains if resistance is not broken

- Forecast for the stock is bullish, with potential to rise further if resistance at 47.95 is broken, targeting 54.85 next

International Seaways, Inc. (INSW) stock continued to rise in its latest intraday trading, advancing to test the important resistance level of 47.95. The stock is supported by trading along a short-term corrective upward trend line, while positive pressure also persists from trading above its previous 50-day SMA. On the other hand, a negative crossover has started to appear in the Stochastic indicators after reaching strongly overbought levels, which may limit the stock’s upcoming gains if it fails to break the mentioned resistance.

Therefore, we expect the stock to rise in its upcoming trading, especially if it breaks the resistance of 47.95, to then target its next resistance at 54.85.

Today’s price forecast: Bullish.

Revolve price stalls - Forecast today - 09-09-2025

Revolve Group (RVLV) stock declined slightly in its latest intraday trading, as it undergoes profit-taking from previous gains while attempting to gather positive momentum that could support recovery and renewed rise. The short-term corrective bullish trend remains in control, with trading moving along an upward slope line that supports this path. Positive pressure also continues from trading above its previous 50-day SMA, in addition to the flow of positive signals from the Stochastic indicators.

Therefore, we expect the stock to rise in its upcoming trading, especially as long as it remains above the key resistance of 23.46 to confirm the breakout, to then target its next resistance at 26.08.

Today’s price forecast: Bullish.

Toat price trims losses - Forecast today - 09-09-2025

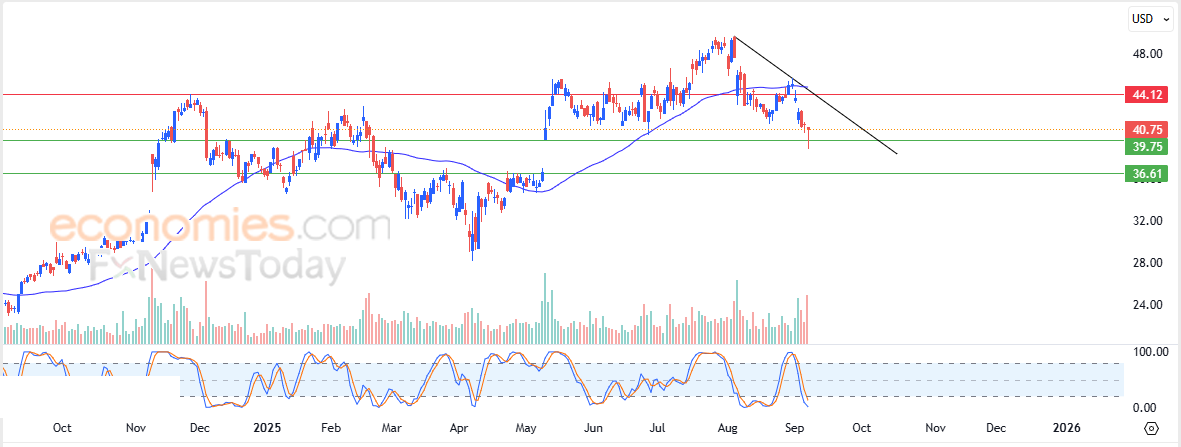

Toast (TOST) stock declined slightly in its latest intraday trading, reaching support at the key level of 39.75, which provided positive momentum that helped it rebound and trim much of its earlier losses. The short-term corrective bearish wave remains in control, with trading moving along a downward slope line that supports this path, while negative pressure continues from trading below its previous 50-day SMA. In addition, negative signals are flowing from the Stochastic indicators, despite being in strongly oversold territory.

Therefore, we expect the stock to decline in its upcoming trading, especially if it breaks the mentioned support of 39.75, to then target its next support at 36.60.

Today’s price forecast: Bearish.

Forecast update for Ethereum -09-09-2025

The price of (ETHUSD) rose in its last intraday levels, supported by the stability of the critical support at $4,250, besides the emergence of the positive signals on the (RSI), after reaching oversold levels, surpassing bearish correctional trend line on the short-term basis, in a key step for surpassing the negative pressure of the EMA50, announcing its full recovery and opening the way for achieving more of the gains.

VIP Trading Signals Performance by BestTradingSignal.com (September 1–5, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 1–5, 2025: