Illumina price breaches upward correctional trend line - Forecast today - 30-09-2025

AI Summary

- Illumina, Inc. (ILMN) is experiencing downward pressure in trading, breaking a short-term corrective uptrend line

- The stock is expected to decline further, especially if it breaks below the current support at 92.20

- Today's price forecast for Illumina is bearish

Illumina, Inc. (ILMN) slipped lower in its latest intraday trading, pressured by trading below the 50-day SMA, confirming the breakdown of a short-term corrective uptrend line and erasing near-term recovery prospects. Additional downside pressure is reinforced by bearish signals on the RSI, despite reaching heavily oversold levels, which may temporarily slow further losses.

Therefore, we expect the stock to decline in upcoming trading, especially if it breaks below the current support at 92.20, targeting the next support at 80.20.

Today’s price forecast: Bearish.

Alibaba price soars - Forecast today - 30-09-2025

Alibaba Group Holdings (BABA) continued to rise in its latest intraday trading, testing resistance at 181.00. The medium- and short-term uptrend remains intact, supported by trading above the 50-day SMA. The recent move higher came after the stock successfully unwound its overbought conditions on the RSI, giving it more room for further gains in the near term.

Therefore, we expect the stock to rise in upcoming trading, especially if it confirms a breakout above resistance at 181.00, targeting the next major resistance level at 200.00.

Today’s price forecast: Bullish.

Western Digital price hits fresh record highs - Forecast today - 30-09-2025

Western Digital Corporation (WDC) surged in its latest intraday trading, recording a new all-time high. The stock remains supported by trading above its 50-day SMA, with the medium-term uptrend intact and price action moving along a short-term ascending trendline. In addition, a positive divergence has started to appear on the RSI after it reached extreme oversold levels compared to price action, alongside the emergence of a bullish crossover, which reinforces the positive outlook.

Therefore, we expect the stock to rise in upcoming trading, as long as support at 100.45 holds, targeting the next resistance at 132.00.

Today’s price forecast: Bullish.

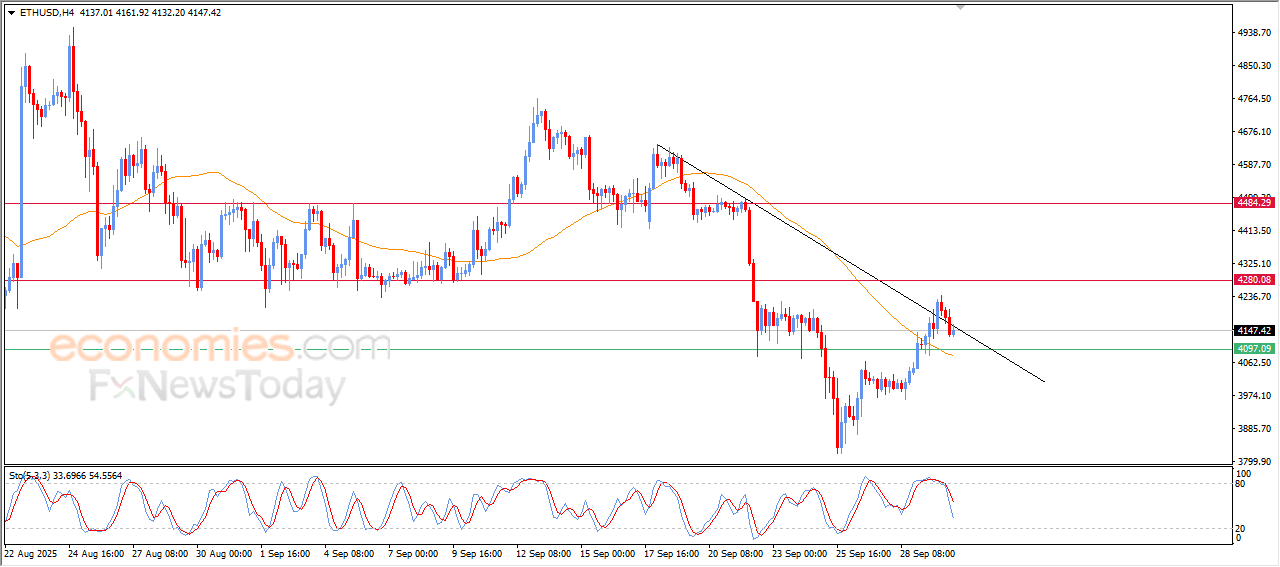

Forecast update for Ethereum -30-09-2025

The price of (ETHUSD) declined in its last intraday trading, with the emergence of the negative signals on the relative strength indicators, after reaching overbought levels, to return to move alongside minor bearish trend on the short-term basis, on the other hand, the price takes advantage of the dynamic support that is represented by its trading above EMA50, reinforcing the chances of its recovery on the near-term basis, especially with the relative strength indicators reaching oversold levels, to indicate fading the negative pressure around the price.

VIP Trading Signals Performance by BestTradingSignal.com (September 22–26, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 22–26, 2025: