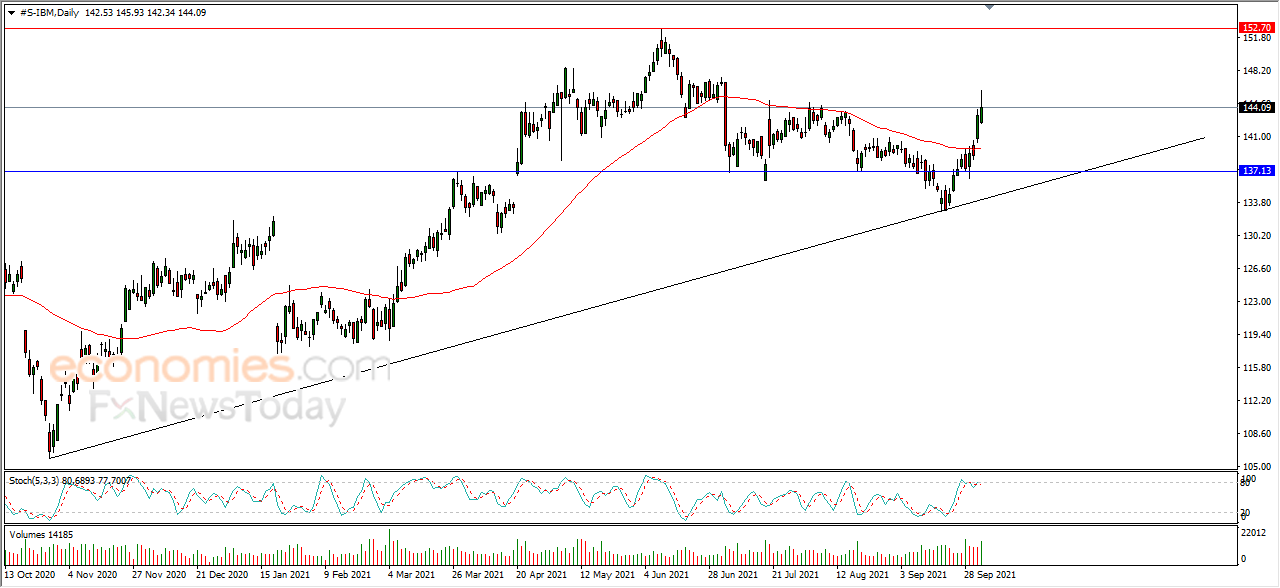

IBM widens gains - Analysis - 05-10-2021

IBM's stock rose 0.55% in the last session and settled at 144.11, amid the dominance of the main upward trend in the medium term, with positive support from the 50-day SMA, countered by negative signals from the RSI after reaching overbought levels.

Therefore we expect more gains for the stock, provided the support of 137.10 holds on, targeting the pivotal resistance of 152.70.

Expected trend for today: Bullish

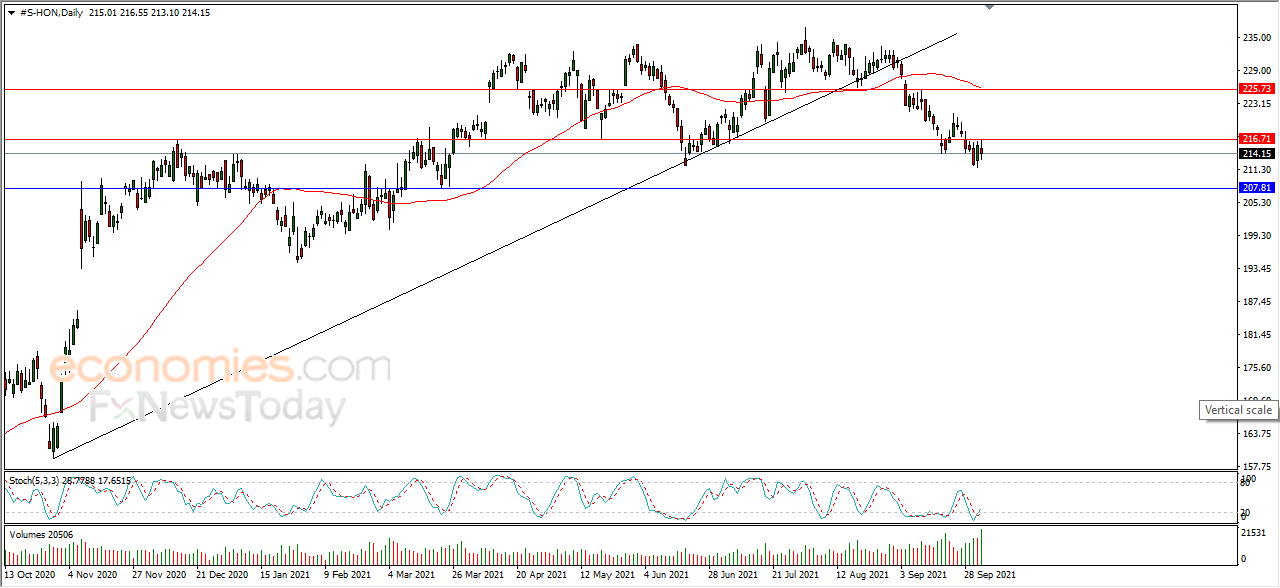

Honeywell returns lower - Analysis - 05-10-2021

Honeywell's stock (HON) returned lower with a 0.67% in the last session, while hurt by piercing the main upward trend line recently, amid the dominance of the short-term correctional wave, with negative pressure from the 50-dy SM, s the stock tries to vent off oversold saturation in the RSI.

Therefore we expect more losses for the stock, targeting the support at 207.80, provided it holds below 216.70.

Expected trend for today: Bearish

Hewlett-Packard climbs within descending price channel - Analysis - 05-10-2021

Hewlett-Packard's stock (HPQ) rose 0.04% in the last session while trading within a descending price channel that guided recent short-term trading, amid negative pressure from the 50-day SMA.

Therefore we expect the stock to return lower, targeting the pivotal support of 26.90, provided the resistance of 29.00 holds on.

Expected trend for today: Bearish

Midday update for the NZDUSD 05-10-2021

The NZDUSD pair trades positively now after leaning on 0.6945 level, waiting for bearish rebound to resume the correctional bearish trend, which targets 0.6890 initially, noting that breaching 0.6990 will stop the negative scenario and lead the price to turn to rise.

The expected trading range for today is between 0.6880 support and 0.6990 resistance

The expected trend for today: Overall bearish