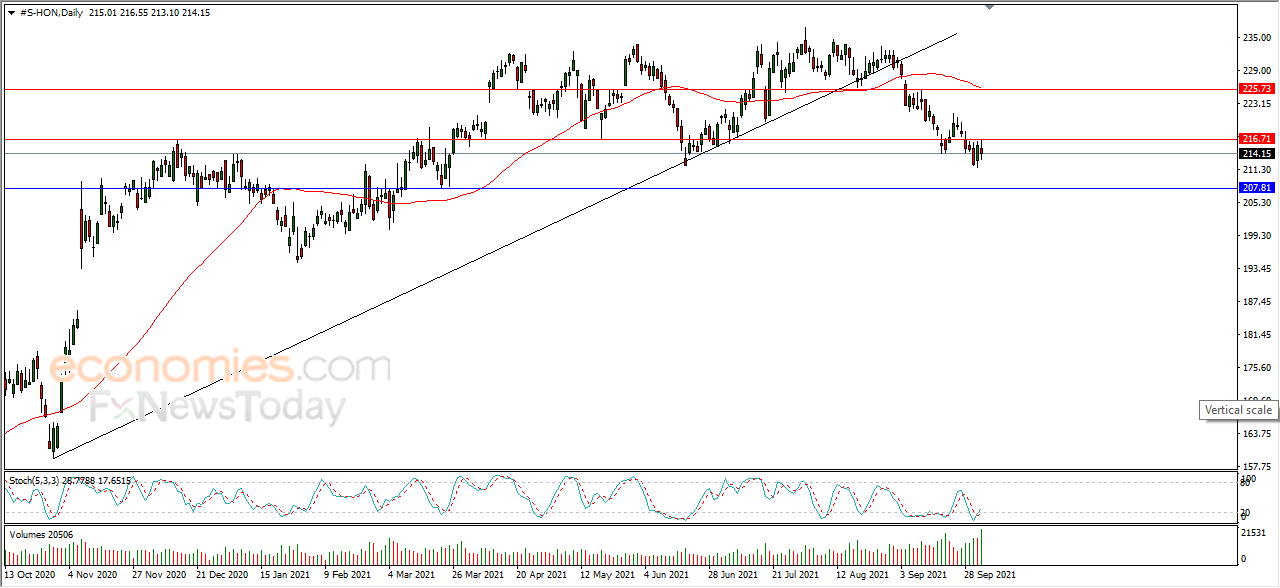

Honeywell returns lower - Analysis - 05-10-2021

Honeywell's stock (HON) returned lower with a 0.67% in the last session, while hurt by piercing the main upward trend line recently, amid the dominance of the short-term correctional wave, with negative pressure from the 50-dy SM, s the stock tries to vent off oversold saturation in the RSI.

Therefore we expect more losses for the stock, targeting the support at 207.80, provided it holds below 216.70.

Expected trend for today: Bearish

Midday update for the NZDUSD 05-10-2021

The NZDUSD pair trades positively now after leaning on 0.6945 level, waiting for bearish rebound to resume the correctional bearish trend, which targets 0.6890 initially, noting that breaching 0.6990 will stop the negative scenario and lead the price to turn to rise.

The expected trading range for today is between 0.6880 support and 0.6990 resistance

The expected trend for today: Overall bearish

Midday update for the AUDUSD 05-10-2021

The AUDUSD pair found good support at 0.7245 to rebound bullishly and approach the key resistance 0.7290, and as we mentioned this morning, the price needs to hold below this level to keep the bearish trend active, noting that breaking 0.7245 is required to head towards 0.7170 direct.

The expected trading range for today is between 0.7210 support and 0.7310 resistance

The expected trend for today: Bearish

Midday update for Brent oil 05-10-2021

Brent oil price shows slight bullish bias to move around 81.50 level, waiting for more rise to achieve our positive targets at 82.00 and 82.70, noting that the EMA50 keeps supporting the expected bullish wave, which will remain valid conditioned by the price stability above 79.90.

The expected trading range for today is between 80.00 support and 82.70 resistance.

The expected trend for today: Bullish