Hewlett-Packard price extends losses - Forecast today - 23-12-2025

HP Inc. (HPQ) declined in its latest intraday trading, under continued negative pressure as it trades below its 50-day SMA, reinforcing the stability and dominance of the main downward trend on the medium term, especially with its movement along a downward-sloping trend line. In addition, negative signals continue to emerge from momentum indicators, despite their arrival at extremely oversold levels.

Therefore we expect the stock price to decline in its upcoming trading, as long as it remains below the key resistance level at $25.95, targeting the pivotal support level at $22.25.

Today’s price forecast: Bearish

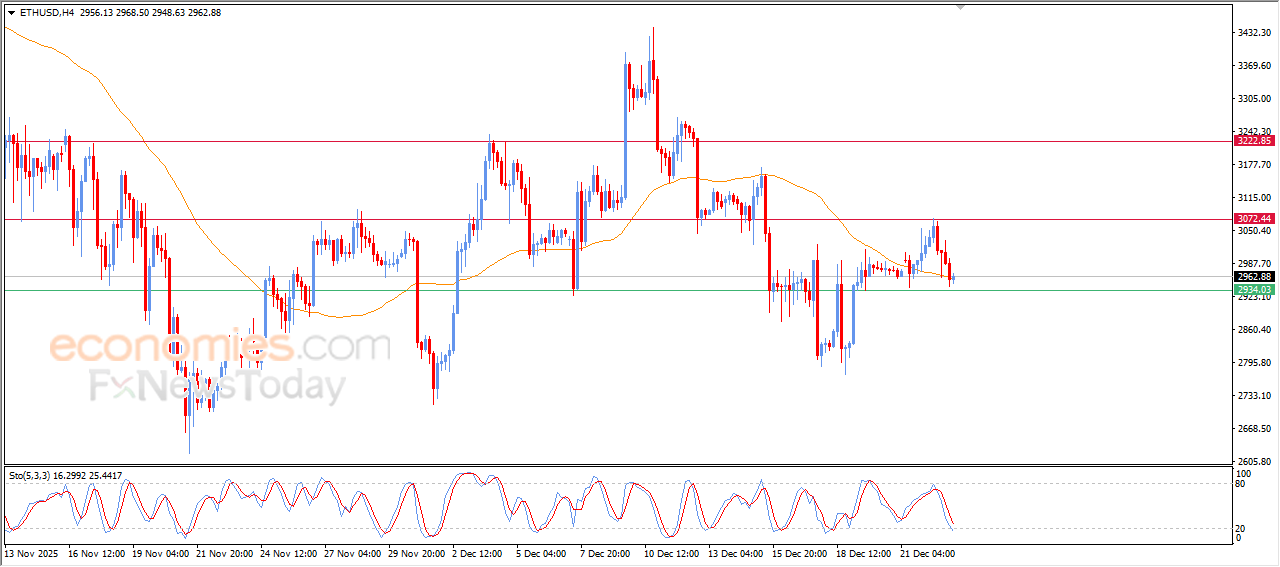

Forecast update for Ethereum -23-12-2025

The price of (ETHUSD) settles with sharp gains in the last intraday trading, amid the emergence of the negative signals on the relative strength indicators, despite reaching oversold levels, exhausting its positive chances that might help it to recover and rise again, where it leans on EMA50’s support as a last attempt to gain this bullish momentum, amid the dominance of minor bullish waves on the short-term basis.

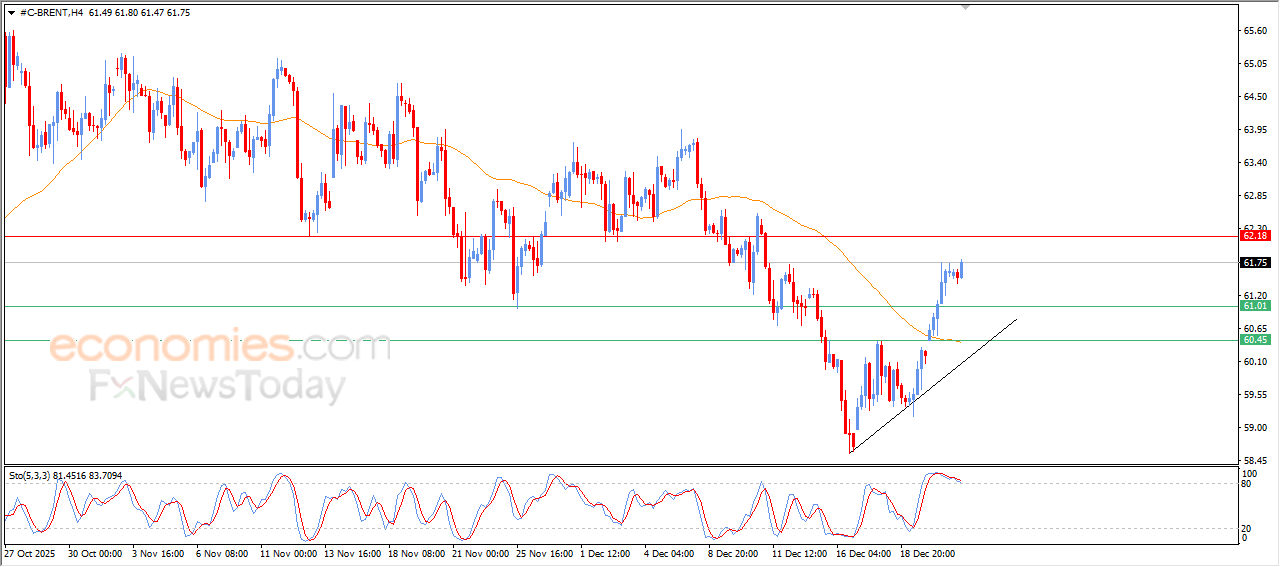

Forecast update for brent crude oil -23-12-2025

Brent crude oil’s prices resumes its rise in its last intraday trading, after gathering its gains and it managed to offload its overbought conditions on the relative strength indicators, providing renewed bullish momentum that helps it to extend its strong gains, amid the dominance of steep trend line, with a dynamic support that is represented by its trading above EMA50.

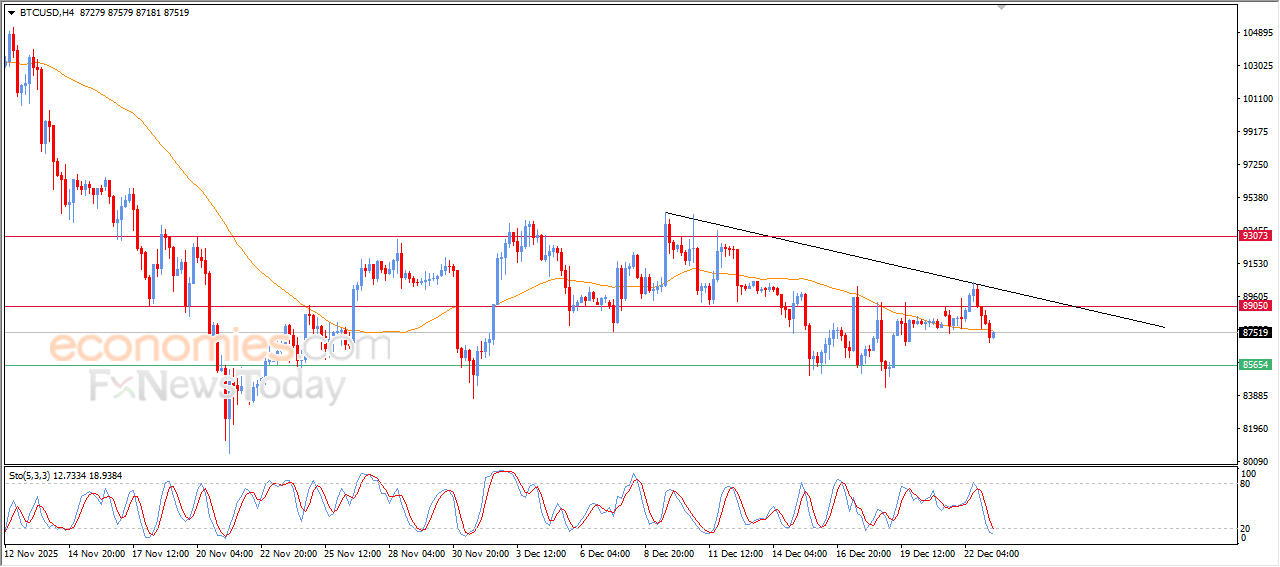

Forecast update for Bitcoin -23-12-2025

BTCUSD’s price kept declining in its recent intraday trading, putting it under negative pressure in its upcoming trading, especially with the emergence of negative signals from the relative strength indicators, despite reaching overbought levels, amid the dominance of the main bearish trend and its trading alongside minor trend line on the short-term basis that supports this trend.