General Mills price readies to pierce pivotal support - Forecast today - 14-10-2025

General Mills (GIS) declined in its latest intraday trading, under continued negative pressure as it remains below the 50-day simple moving average. The stock appears ready to break the key support level of 48.30, with the medium-term downtrend still dominating its movement. Meanwhile, the RSI continues to show negative signals, despite reaching heavily oversold areas.

Therefore, we expect the stock to fall in upcoming trading sessions, especially if it breaks below the mentioned support level of 48.30, targeting the next support at 46.35.

Today’s price forecast: Bearish.

General Electric price returns higher - Forecast today - 14-10-2025

General Electric Company (GE) resumed its rise in its latest intraday trading, supported by continued trading above the 50-day simple moving average, which reinforces the stability of the prevailing upward trend. The stock continues to move along a short-term ascending trendline supporting this trajectory. In addition, a positive crossover is beginning to appear on the RSI after reaching heavily oversold areas.

Therefore, we expect the stock to rise in upcoming trading sessions, as long as it remains above the 281.50 support level, targeting the key resistance level of 307.25 in preparation to test it.

Today’s price forecast: Bullish.

CrowdStrike price readies to tackle pivotal resistance - Forecast today - 14-10-2025

CrowdStrike Holdings (CRWD) rose in its latest intraday trading, preparing to attack the key resistance level of 517.95, supported by continued trading above the 50-day simple moving average, which maintains the bullish momentum. The stock remains under the dominance of the medium-term uptrend, moving along a short-term ascending trendline, while positive signals are starting to appear on the RSI after reaching oversold areas.

Therefore, we expect the stock to rise in upcoming trading sessions, provided it breaks above the 517.95 resistance level, to target the next resistance at 547.50.

Today’s price forecast: Bullish.

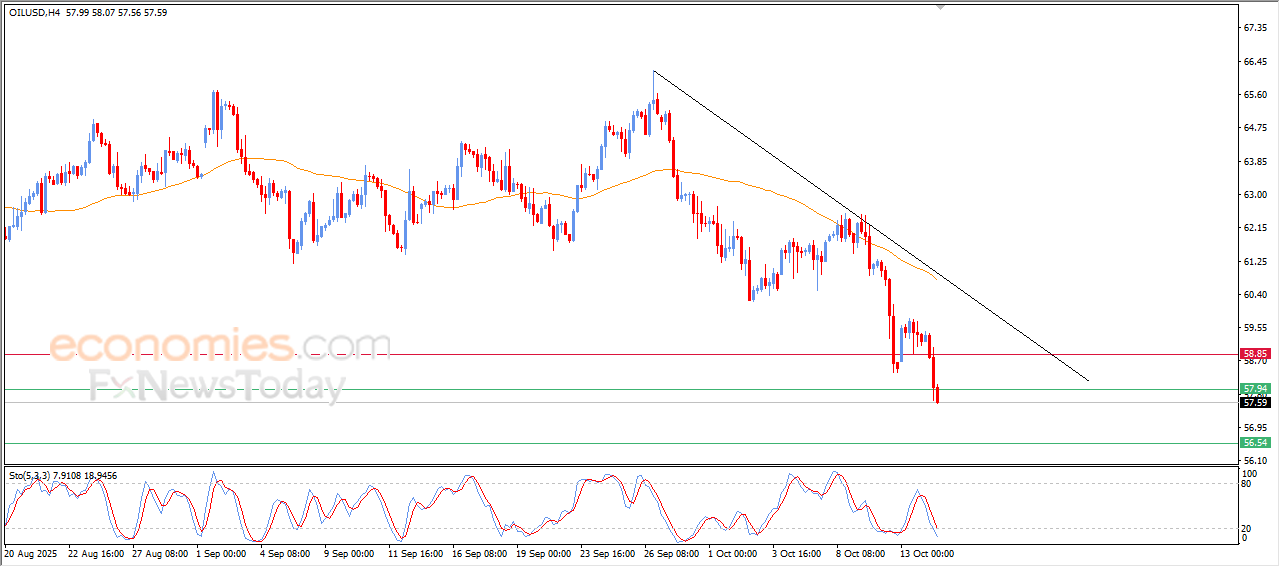

Forecast update for crude oil -14-10-2025

The price of (crude oil) deepened its losses in its last intraday trading, breaking $58.40 support which represents our expected target in our previous analysis, amid the dominance of the main bearish trend on the short-term basis, and its trading alongside supportive trend line for this track, with the emergence of the negative signals on the relative strength indicators, despite reaching oversold levels, indicating the volume of the bullish momentum.

VIP Trading Signals Performance by BestTradingSignal.com (6-10 Oct, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for 6-10, October 2025: