Generac price readies to tackle stubborn resistance - Forecast today - 20-10-2025

Generac Holdings Inc (GNRC) stock declined slightly in its latest intraday trading after repeatedly testing the key and stubborn resistance level of $195.95. The stock is trying to gain positive momentum that could help it break through that resistance while also correcting its overbought levels on the relative strength indicators, where a bearish crossover has started to appear. It remains supported by positive pressure from trading above the 50-day SMA and under the dominance of the main short-term bullish trend, with trading along an ascending line.

Therefore, we expect the stock to rise in its upcoming trading sessions, provided that it first breaks above the mentioned resistance level of $195.95, targeting the next resistance level at $221.60.

Today’s stock forecast: Bullish.

The Trade Desk price suffers from negative pressures - Forecast today - 20-10-2025

Ripple (XRPUSD) advanced slightly in its latest intraday trading, attempting to recover part of its previous losses while also working off its clearly oversold levels shown by the relative strength indicators, especially amid the start of positive signals emerging from them. However, ongoing dynamic pressure from trading below the 50-day SMA reduces the chances of a near-term recovery, while the main short-term bearish trend remains dominant, with trading along a descending line that reinforces this direction.

Therefore, we expect the cryptocurrency to decline in its upcoming intraday trading as long as the resistance level of $2.5397 holds, targeting the support level of $1.7710.

Today’s price forecast: Bearish.

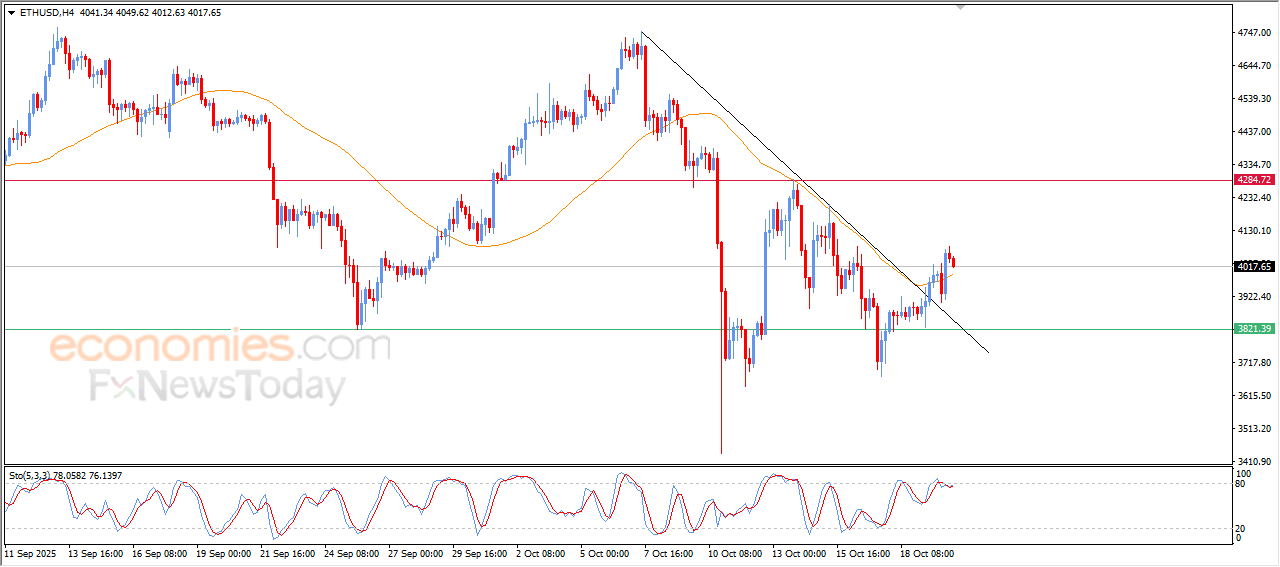

Forecast update for Ethereum -20-10-2025

The price of (ETHUSD) declined in its last intraday trading, gathering the gains of its previous rises, and attempting to offload some of its overbought conditions on the relative strength indicators, especially with the emergence of the negative signals, to gather its positive strength that might help it to recover and rise again, affected by breaching minor bearish trendline on the short-term basis, with the continuation of the dynamic support that is represented by its trading above EMA50, forming a dynamic support that reinforces the chances of its recovery.

VIP Trading Signals Performance by BestTradingSignal.com (13-17 Oct, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for 13-17, October 2025:

View Full Performance Report Telegram (https://t.me/besttradingsignalstocksbot?start=p88d632b0-66dd-11f0-a948-13815052d5ae)

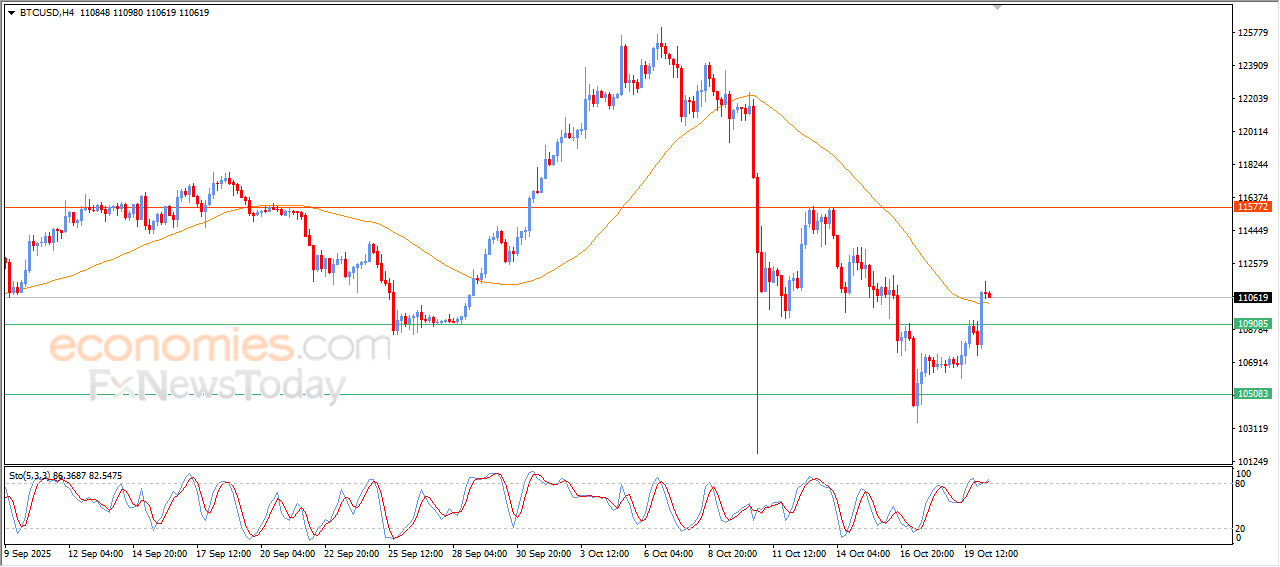

Forecast update for bitcoin -20-10-2025

Bitcoin (BTCUSD) prices settled with sharp decline during their last intraday trading, to stop in a short warrior’s rest to gather the gains and gains some of the positive momentum that helps it to resume the strong gains again, especially after surpassing the resistance of its EMA50, to get rid of its negative pressure with the emergence of the positive signals on the relative strength indicators, despite reaching overbought levels.

VIP Trading Signals Performance by BestTradingSignal.com (13-17 Oct, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for 13-17, October 2025:

View Full Performance Report Telegram (https://t.me/besttradingsignalstocksbot?start=p88d632b0-66dd-11f0-a948-13815052d5ae)