Fedex price ends cautiously higher - Forecast today - 04-09-2025

AI Summary

- FedEx stock advanced slightly in latest trading but remains under negative pressure

- Medium-term main bearish trend is in control with downward slope line

- Stock expected to decline as long as resistance level of 238.00 holds, targeting support level of 216.00

FedEx Corporation (FDX) stock advanced slightly in its latest intraday trading, but remains under negative pressure from trading below its previous 50-day SMA. The medium-term main bearish trend also stays in control, with trading moving along a downward slope line that adds to the surrounding bearish outlook. This is further reinforced by negative signals in the Stochastic indicators, after previously reaching strongly overbought levels.

Therefore, we expect the stock to decline in its upcoming trading, as long as the resistance level of 238.00 holds, to then target the important support level of 216.00.

Today’s price forecast: Bearish.

Lockheed Martin price tries to vent off overbought saturation - Forecast today - 04-09-2025

Lockheed Martin Corporation (LMT) stock declined in its latest intraday trading, as the stock attempts to gain positive momentum that may support recovery and a renewed rise. At the same time, it is working to unwind part of its clear overbought levels in the Stochastic indicators, especially as negative signals have begun to appear. With this decline, the stock found support at its previous 50-day SMA, while the short-term corrective bullish wave remains in control.

Therefore, we expect the stock to rise in its upcoming trading, provided the current support level of 445.00 holds, to then target the resistance level of 479.00.

Today’s price forecast: Bullish.

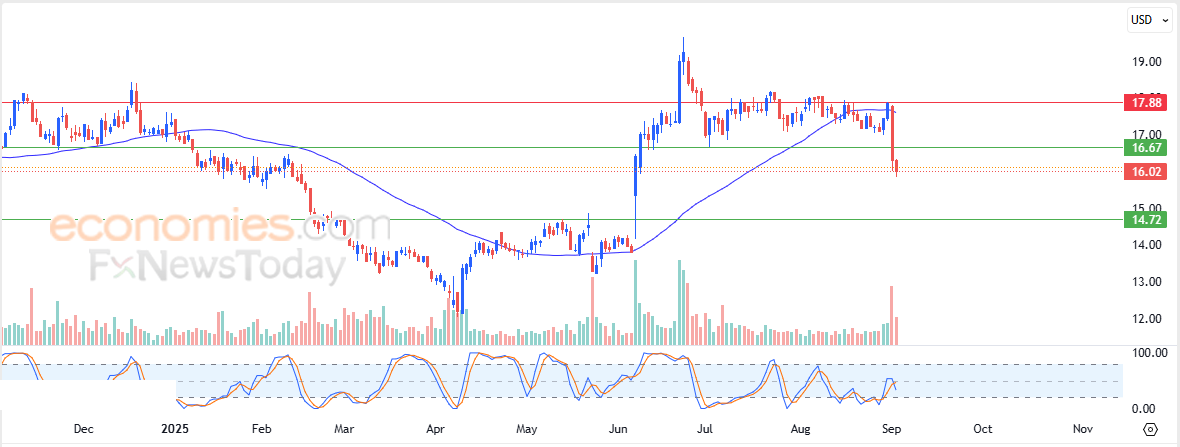

Manchester United price breaches pivotal support - Forecast today - 04-09-2025

Manchester United (MANU) stock deepened its losses in its latest intraday trading, confirming with its last close a break below the key support level of 16.67. Ongoing negative pressure continues from trading below its previous 50-day SMA, which has acted as dynamic resistance preventing recovery. In addition, negative signals have started to appear in the Stochastic indicators, after the stock had earlier unwound its oversold levels, giving it more room to record further losses.

Therefore, we expect the stock to decline in its upcoming trading, especially as long as it remains stable below 16.67, to then target its next support level at 14.75.

Today’s price forecast: Bearish.

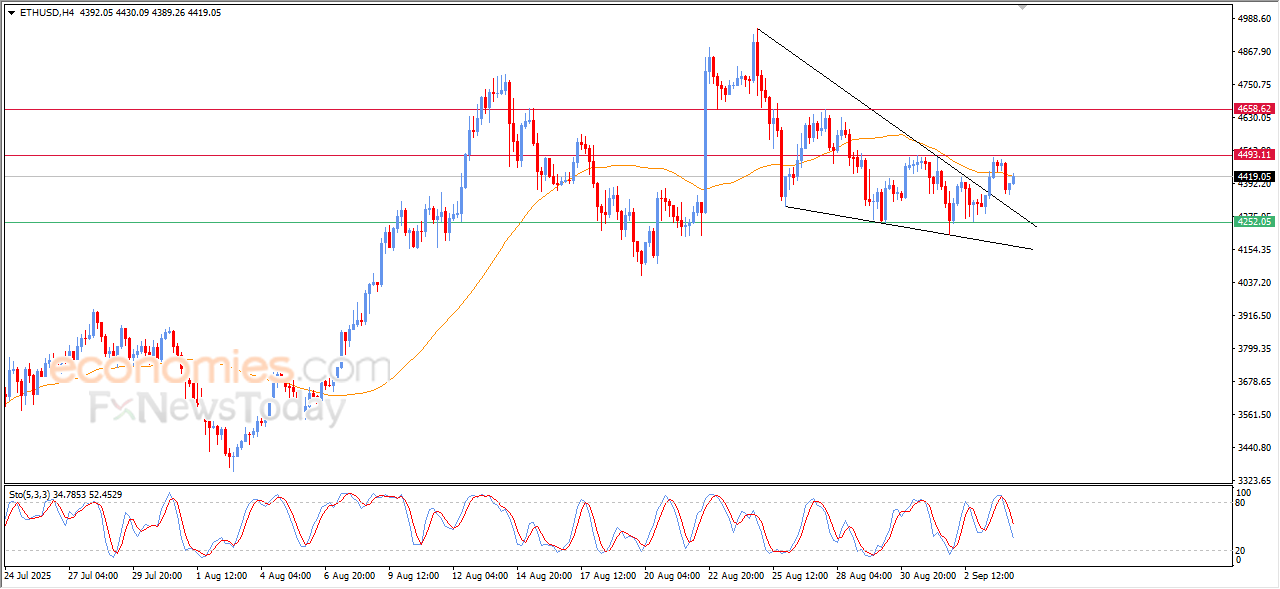

Forecast update for Ethereum -04-09-2025

The price of (ETHUSD) rose in its last intraday trading, after its success in offloading its overbought conditions on the (RSI), amid its affection by technical positive formation on the short-term basis, represented by the falling wedge pattern, that appears on the bearish correctional wave, which increases the chances for the price recovery on the near-term basis, especially when breaching the current resistance levels.

VIP Trading Signals Performance by BestTradingSignal.com (August 25–29, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for August 25–29, 2025: