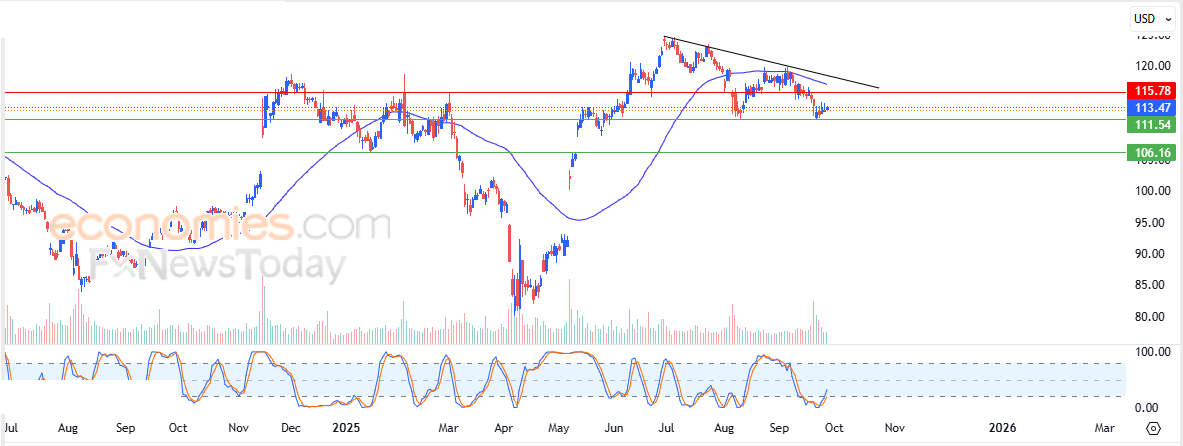

Disney price tries to vent off oversold saturation - Forecast today - 29-09-2025

AI Summary

- Disney stock rose slightly in latest trading, supported by key level at 111.55

- Attempts to unwind oversold levels on RSI with positive signals emerging

- Forecast predicts decline if support at 111.55 is broken, targeting next support at 106.20

Walt Disney Company (DIS) rose slightly in its latest intraday trading, supported by the stability of the key support level at 111.55, which provided some positive momentum and helped the stock recover part of its previous losses. At the same time, it attempts to unwind part of its clear oversold levels on the RSI, especially with positive signals emerging. However, downward pressure remains as the stock trades below its 50-day SMA, under the dominance of a short-term corrective downtrend.

Therefore, we expect the stock to decline in upcoming trading, especially if it breaks the mentioned support of 111.55, targeting the next support at 106.20.

Today’s price forecast: Bearish.

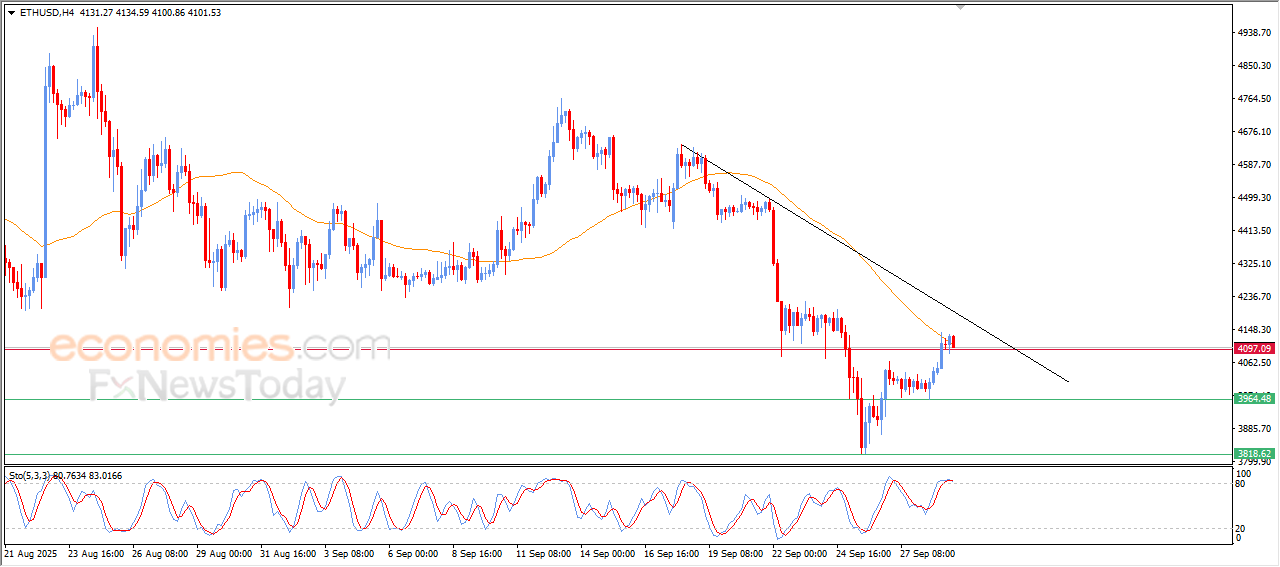

Forecast update for Ethereum -29-09-2025

The price of (ETHUSD) declined in its last intraday trading, affected by reaching the resistance of its EMA50, the negative overlapping signals that appeared on the relative strength indicators intensified the negative pressure on its trading, after reaching overbought levels, and the overall scenario remains bearish on the short-term basis and its trading alongside trendline.

VIP Trading Signals Performance by BestTradingSignal.com (September 22–26, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 22–26, 2025:

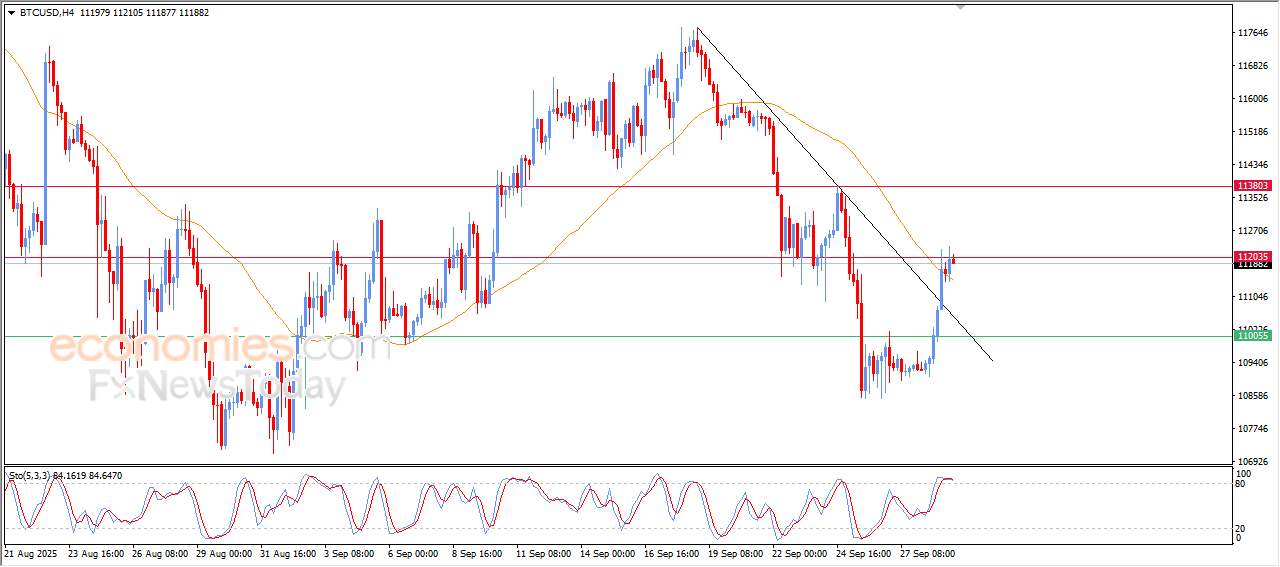

Forecast update for bitcoin-29-09-2025

The price of (BTCUSD) settled with gains in its last intraday trading, after surpassing the resistance of EMA50, in a significant step to get rid of the negative pressure, especially with its affection by breaching minor bearish trendline on the short-term basis, the current resistance at $112,000 represents an obstacle that reduce its gains on the intraday basis, accompanied by the emergence of the negative overlapping signals on the relative strength indicators, after reaching overbought levels.

VIP Trading Signals Performance by BestTradingSignal.com (September 22–26, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 22–26, 2025:

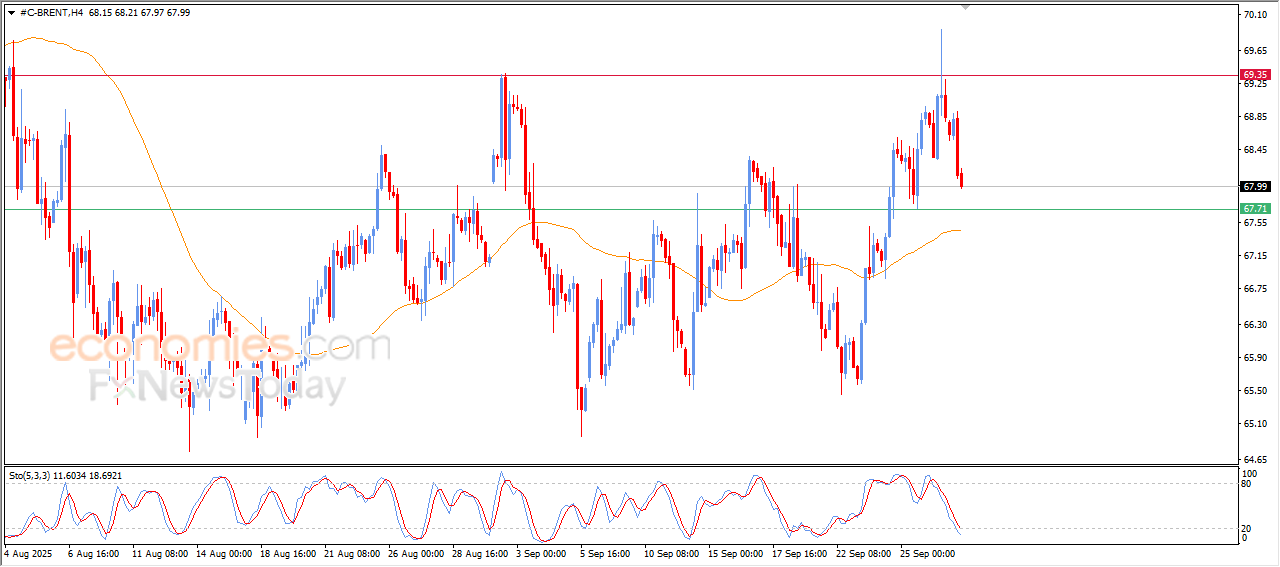

Forecast update for Brent crude oil -29-09-2025

Brent crude oil prices witnessed strong decline in its last intraday trading, supported by the emergence of the negative signals on the relative strength indicators, affected by the stability of the critical resistance level at $69.35, attempting to gain bullish momentum that might help it to recover and rise again, especially with the relative strength indicators reaching oversold level, exaggeratedly compared to the price movement, representing a sign for the negative pressure fading in the upcoming period, amid the dominance of the bullish correction trend on the short-term basis, with the continuation of the positive pressure due to its trading above EMA50, which reinforces the chances for the price recovery.

VIP Trading Signals Performance by BestTradingSignal.com (September 22–26, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 22–26, 2025: