Dick's Sporting price leans on SMA support - Forecast today - 02-09-2025

AI Summary

- Dick's Sporting Goods Inc. stock is currently leaning on support from the previous 50-day SMA

- Short-term corrective bullish trend is expected to continue, with a target resistance level of 239.30

- Price forecast for today is bullish, with potential for the stock to rise if support level of 212.60 holds

Dick’s Sporting Goods Inc. (DKS) stock slipped lower in its latest intraday trading, as negative signals appeared in the Stochastic indicators after previously reaching strongly overbought levels. The stock is attempting to find a higher bottom that could serve as a base to gain the positive momentum needed for recovery, with its latest decline resting on support from the previous 50-day SMA. The short-term corrective bullish trend remains in control.

Therefore, we expect the stock to rise in its upcoming trading, but on the key condition that the support level of 212.60 holds, to then target the resistance level of 239.30.

Today’s price forecast: Bullish.

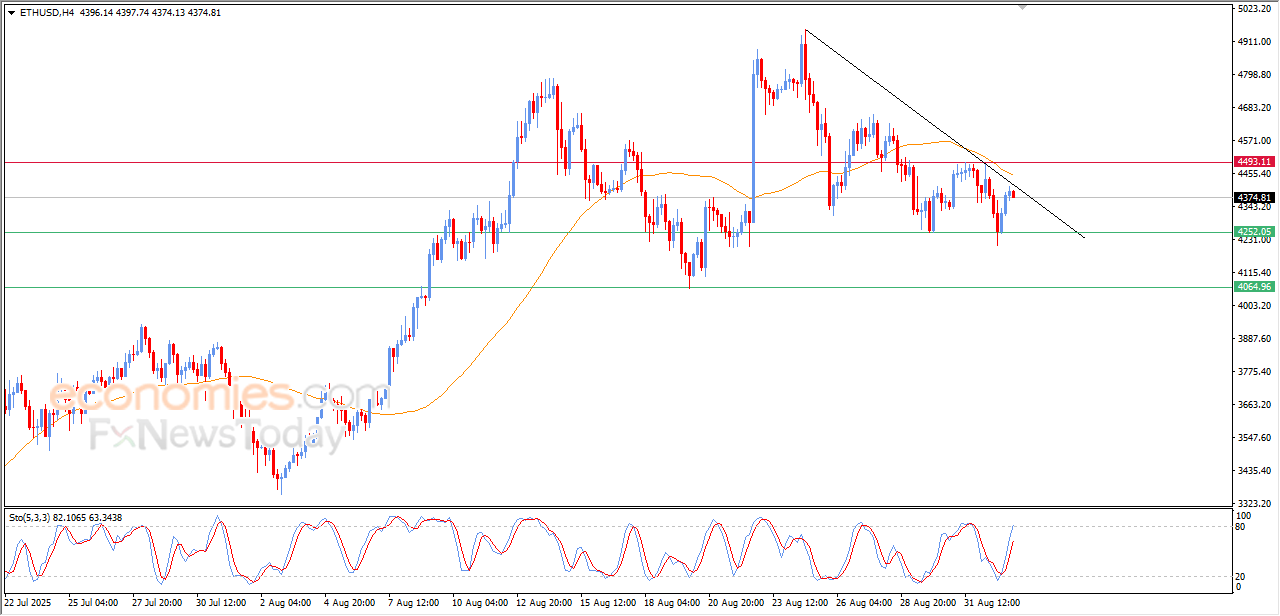

Forecast update for Ethereum -02-09-2025

The price of (ETHUSD) settles with gains in its last intraday levels, after recovering big part of its previous losses, and it managed to offload its oversold conditions on the (RSI), however the price remains suffering from the continuation of the negative pressure due to its trading below EMA50, especially with its trading alongside bearish correctional trend line on the short-term basis, which shrinks the chances for the price recover on the near-term basis.

VIP Trading Signals Performance by BestTradingSignal.com (August 25–29, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for August 25–29, 2025:

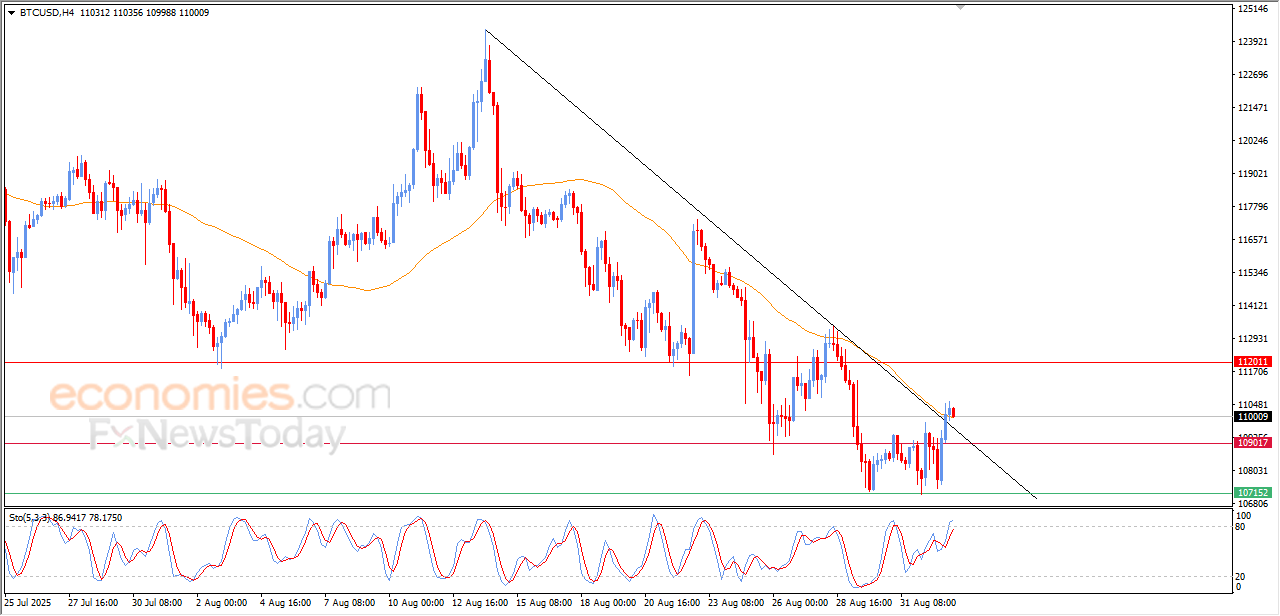

Forecast update for Bitcoin -02-09-2025

The price of (BTCUSD) settled high in its last intraday trading, after it managed to surpass the resistance of its EMA50, accompanied by its attempts to breach a main bearish trend on the short-term basis, in a strong and significant step for surpassing the negative pressures, taking advantage of the positive momentum that comes from the emergence of the positive signals on the (RSI).

VIP Trading Signals Performance by BestTradingSignal.com (August 25–29, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for August 25–29, 2025:

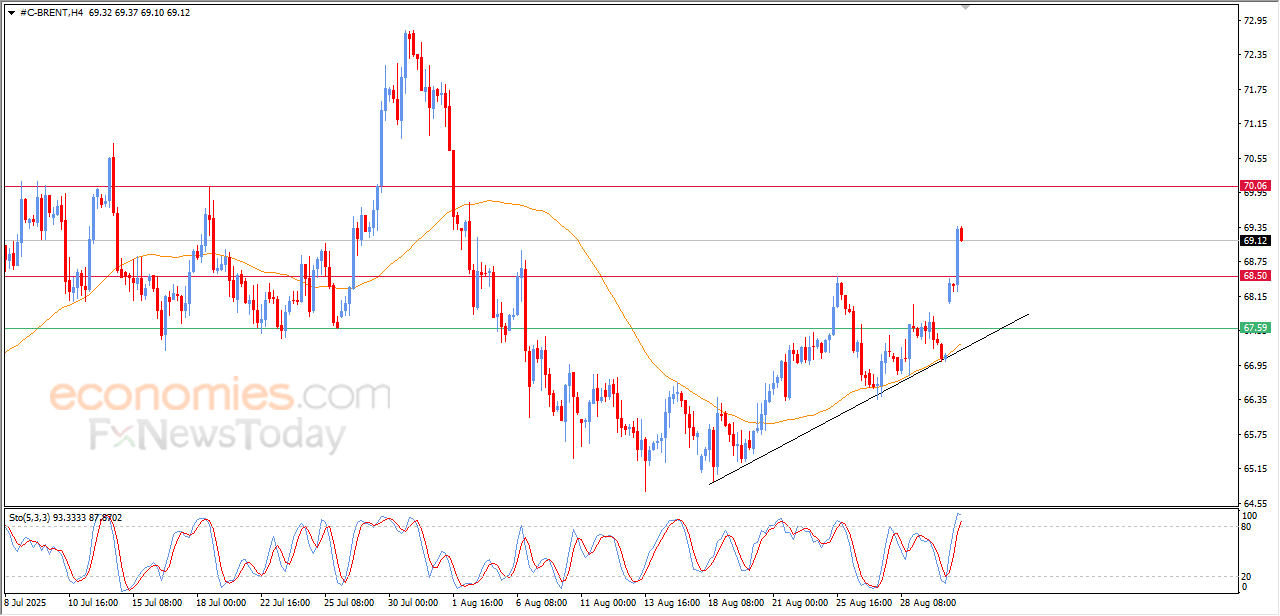

Forecast update for Brent crude oil -02-09-2025

The price of (Brent) wore green in its last intraday trading, supported by its trading above EMA50, providing renewed bullish momentum, amid the dominance of the bullish correctional trend on the short-term basis and its trading alongside a bias line, to breach the critical resistance level at $68.50, supported by the emergence of the positive signals on the (RSI), despite reaching overbought levels, which might reduce the rise temporarily on the intraday basis.

VIP Trading Signals Performance by BestTradingSignal.com (August 25–29, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for August 25–29, 2025: