Delta Airline price readies to tackle important resistance - Forecast today - 16-10-2025

Delta Air Lines, Inc (DAL) stock advanced in its latest intraday trading, preparing to attack the important resistance level of 63.33$, under the dominance of a short-term upward wave and trading along an ascending line. The move is supported by continued trading above the previous 50-day SMA, in addition to positive signals appearing from the relative strength indicators, despite reaching extremely overbought levels.

Therefore, we expect the stock to rise in its upcoming trading sessions, especially if it breaks above the mentioned resistance of 63.33$, targeting the key resistance level of 69.45$.

Today’s stock forecast: Bullish.

General Motors price tries to shake off negative pressure - Forecast today - 16-10-2025

General Motors Company (GM) stock strengthened in its latest intraday trading after finding support at a main upward trend line on the short-term chart, gaining positive momentum that coincided with the appearance of bullish signals from the relative strength indicators after reaching extremely oversold levels. This further boosted the stock’s positive momentum, helping it overcome the negative pressure from the previous 50-day SMA and signaling a full recovery.

Therefore, we expect the stock to rise in its upcoming trading sessions as long as the support level of 54.35$ holds, targeting the key resistance level of 61.25$.

Today’s stock forecast: Bullish.

BlackRock price pierces pivotal resistance - Forecast today - 16-10-2025

BlackRock, Inc (BLK) stock rose in its latest intraday trading, successfully breaking through the key resistance level of 1,168.35$, supported by ongoing dynamic strength from trading above the previous 50-day SMA. The main short-term trend remains bullish, with trading along an ascending line that reinforces this direction. In addition, positive signals have started to appear from the relative strength indicators after reaching oversold areas.

Therefore, we expect the stock to rise in its upcoming trading sessions, especially as long as it remains above 1,168.35$, targeting the first resistance level at 1,275.40$.

Today’s stock forecast: Bullish.

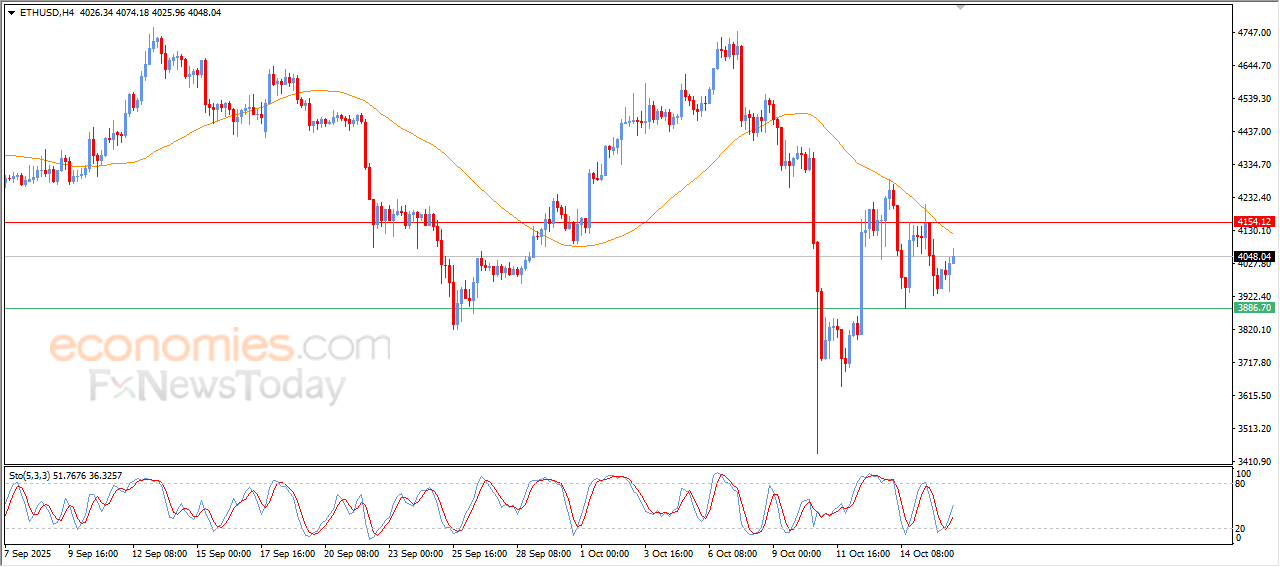

Forecast update for Ethereum -16-10-2025

The price of (ETHUSD) rose in its last intraday trading, attempting to offload its clear oversold conditions on the relative strength indicators, with the emergence of the positive signals from there, amid the continuation of the negative pressure that comes from its trading below EMA50, reinforcing the stability of the dominant bearish track on the short-term trading.

VIP Trading Signals Performance by BestTradingSignal.com (6-10 Oct, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for 6-10, October 2025: