Artista Networks price exposed to negative pressure - Forecast today - 15-10-2025

Arista Networks (ANET) stock slipped lower in its latest intraday trading after confirming resistance at 153.70$, breaking below the 50-day SMA support level in the process. This exposes the stock to increasing negative pressure, further reinforced by the appearance of bearish signals from the relative strength indicators after reaching extremely overbought levels, accompanied by a noticeable rise in trading volumes.

Therefore, we expect the stock to decline in its upcoming trading sessions as long as the resistance level of 153.70$ holds, targeting the support level of 127.60$.

Today’s stock forecast: Bearish.

UiPath price collects ready profits - Forecast today - 15-10-2025

UiPath, Inc (PATH) stock declined in its latest intraday trading, taking profits from its previous gains while attempting to gain new positive momentum that could help it rise again. At the same time, the stock is working off its overbought levels shown by the relative strength indicators, especially amid the emergence of negative signals from them. Nevertheless, the main short-term trend remains bullish, supported by continued positive pressure from trading above the 50-day SMA, which enhances the chances of a near-term recovery.

Therefore, we expect the stock to rise in its upcoming trading sessions as long as the support level of 15.40$ holds, targeting the resistance level of 18.75$.

Today’s stock forecast: Bullish.

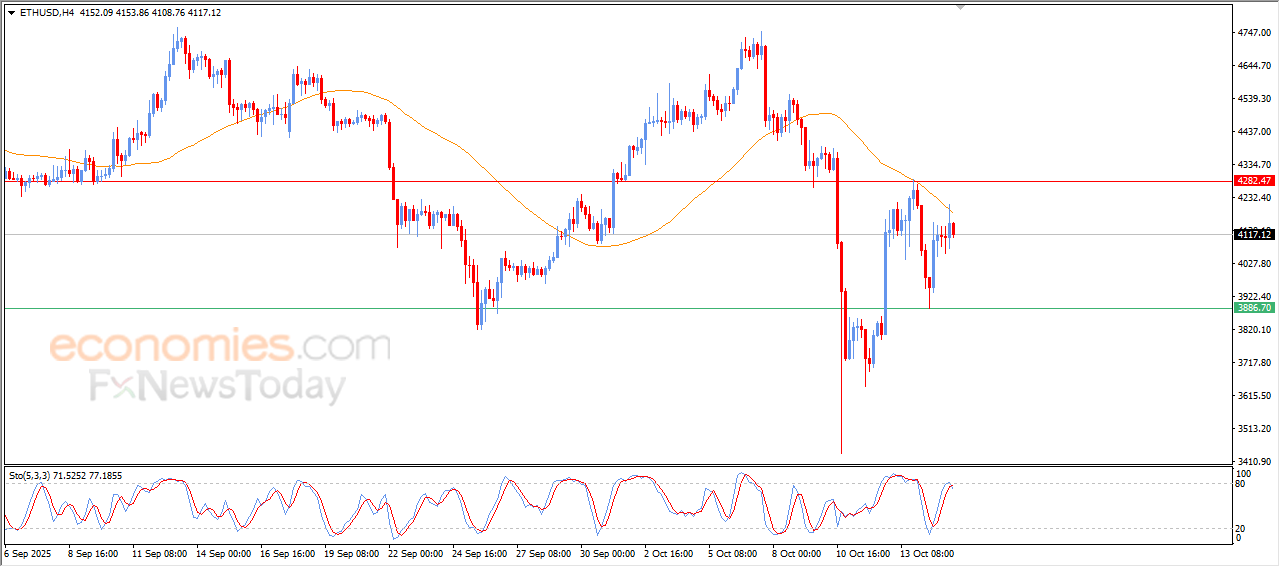

Forecast update for Ethereum -15-10-2025

The price of (ETHUSD) declined in its last intraday trading, affected by reaching the resistance of its EMA50, which prevented its recovery in the last sessions, amid the dominance of the bearish trend on the short-term basis, with the emergence of negative crossovers on the relative strength indicators, after reaching overbought levels, intensifying the negative pressure around the price.

VIP Trading Signals Performance by BestTradingSignal.com (6-10 Oct, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for 6-10, October 2025:

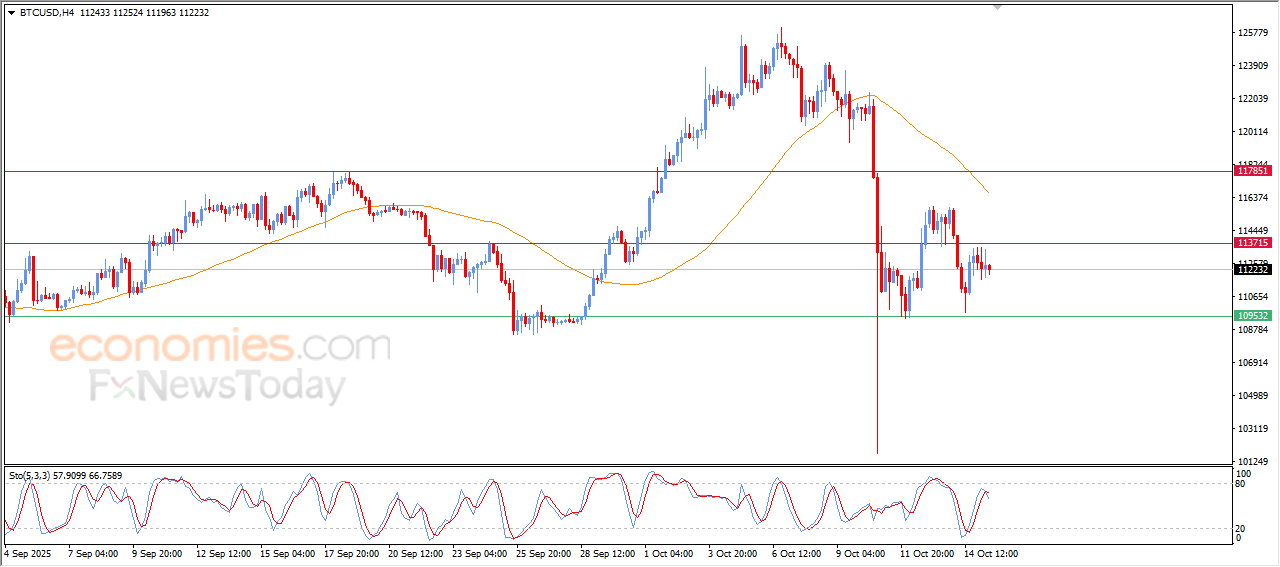

Forecast update for bitcoin -15-10-2025

Bitcoin (BTCUSD) prices declined in their last trading on the intraday levels, amid the dominance of strong bearish wave on the short-term basis, with the continuation of the negative pressure due to its trading below EMA50, reducing the chances for the price recovery on the near-term basis, amid the emergence of the negative signals on the relative strength indicators, after reaching overbought levels.

VIP Trading Signals Performance by BestTradingSignal.com (6-10 Oct, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for 6-10, October 2025: