Amgen price collects profits - Forecast today - 07-10-2025

Amgen (AMGN) declined in its latest intraday trading, as the stock took profits from previous gains while attempting to build positive momentum that could help it recover and rise again. At the same time, it is unwinding its overbought conditions on the RSI, especially with a bearish crossover emerging. Despite this, the stock remains supported by a bullish technical pattern — a falling wedge — while maintaining positive momentum from trading above its 50-day simple moving average.

Therefore, we expect the stock to rise in upcoming sessions, as long as it remains above the support level of 287.25, targeting the key resistance level of 311.25.

Today’s price forecast: Bullish.

TJX price readies to attack important resistance - Forecast today - 07-10-2025

TJX Companies, Inc. (TJX) rose in its latest session, preparing to attack the key resistance level of 145.00, supported by continued trading above its 50-day simple moving average and under the control of a short-term bullish trend moving along an ascending line. The latest rise came after the stock successfully unwound its previous overbought conditions on the RSI, giving it more room to extend its gains in the near term.

Therefore, we expect the stock’s price to rise in upcoming trading sessions, particularly if it breaks above the mentioned resistance of 145.00, targeting its next resistance level at 151.00.

Today’s price forecast: Bullish.

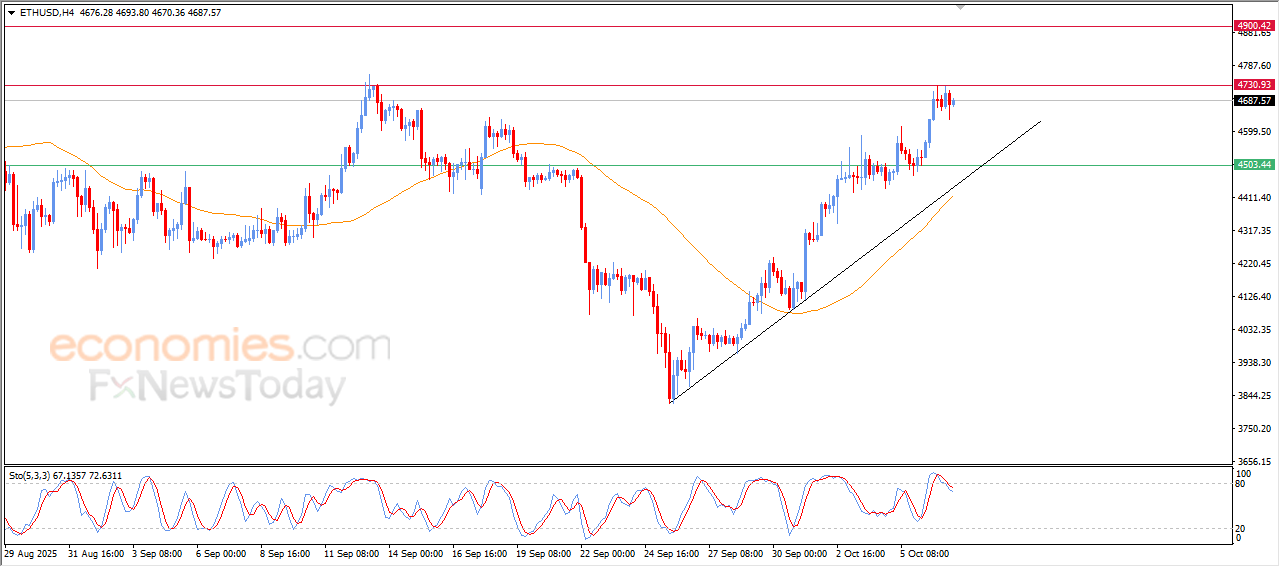

Forecast update for Ethereum -07-10-2025

The price of (ETHUSD) witnessed fluctuated moves in its last intraday trading, in attempt to gain bullish momentum that might help it to breach the critical resistance at $4,730, besides its attempt to offload its overbought conditions on the relative strength indicators, with the emergence of the negative signals from there, amid the dominance of the main bullish trend on the short-term basis and its trading alongside trendline, with the continuation of the positive pressure due to its trading above EMA50, reinforcing the chances of the price recovery on the near-term basis.

VIP Trading Signals Performance by BestTradingSignal.com (Sept 29 – Oct 3, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for Sept 29 – Oct 3, 2025:

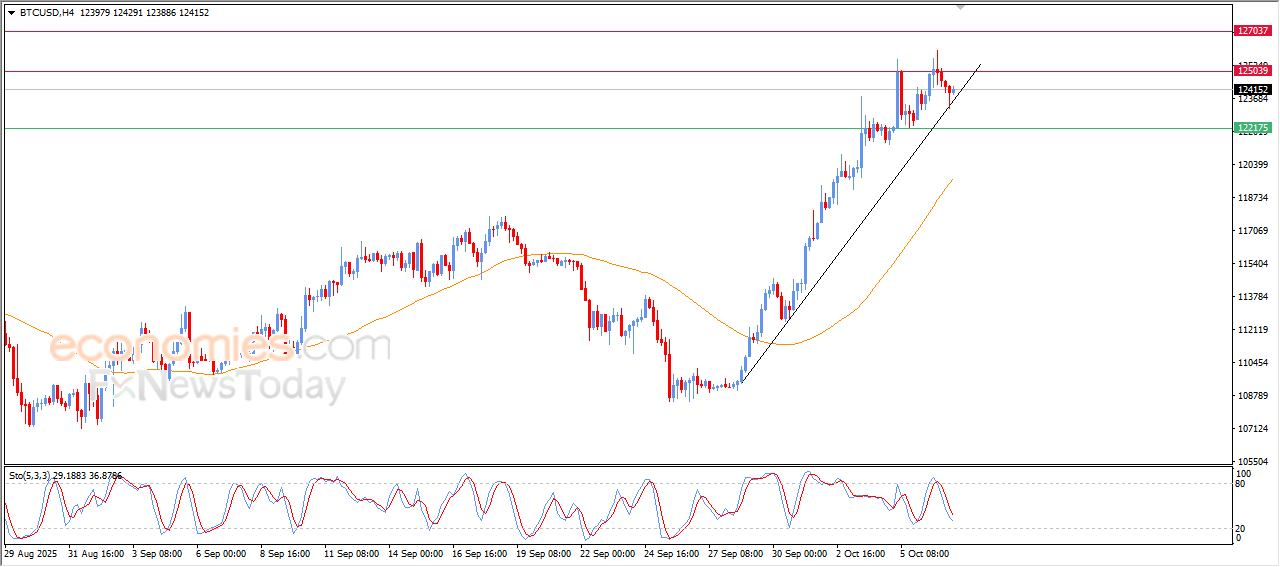

Forecast update for bitcoin -07-10-2025

Bitcoin (BTCUSD) prices declined in their last intraday trading, duet o the stability of the critical resistance level at $125,000, with the emergence of the negative signals on the relative strength indicators, attempting to look for a higher low to take it as a base that might help it to gain the required bullish momentum to recover and breach this resistance, amid the dominance of the main bullish trend and its trading alongside supportive minor trend line until now.

VIP Trading Signals Performance by BestTradingSignal.com (Sept 29 – Oct 3, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for Sept 29 – Oct 3, 2025: