American Express price strives to pierce stubborn resistance - Forecast today - 17-09-2025

AI Summary

- American Express Company (AXP) price struggling to break through resistance level of 329.14

- Short-term uptrend intact with price supported by trading above 50-day SMA

- Forecast predicts stock to rise if it breaks through resistance and targets next level at 354.60

American Express Company (AXP) price slipped slightly in its latest intraday trading after holding below the strong resistance level of 329.14, as the stock attempts to gain enough positive momentum to break above that level. The broader short-term uptrend remains intact with price action moving along an upward slope, supported by continued trading above the 50-day SMA. Moreover, the RSI has reached oversold territory, excessively compared to the price action, which hints at potential renewed buying momentum.

Therefore, we expect the stock to rise in its upcoming trading, provided it first breaks through the mentioned resistance of 329.14, to then target its next resistance at 354.60.

Today’s price forecast: Bullish.

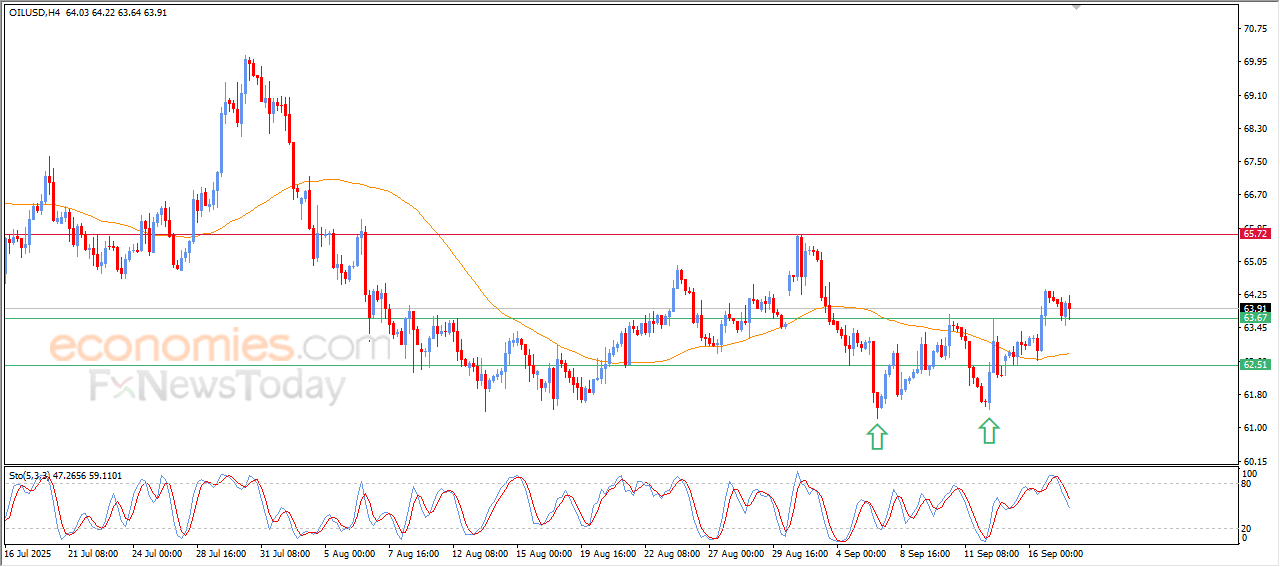

Evening update for crude oil -17-09-2025

The (crude oil) witnessed fluctuated moves on its last intraday levels, with its attempts to gains bullish momentum that might help it to recover and rise again, the price managed to offload some of its overbought conditions on the relative strength indicators, opening the way for achieving new gains, amid its affection by positive technical formation on the short-term basis(double top pattern).

VIP Trading Signals Performance by BestTradingSignal.com (September 8–12, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 8–12, 2025:

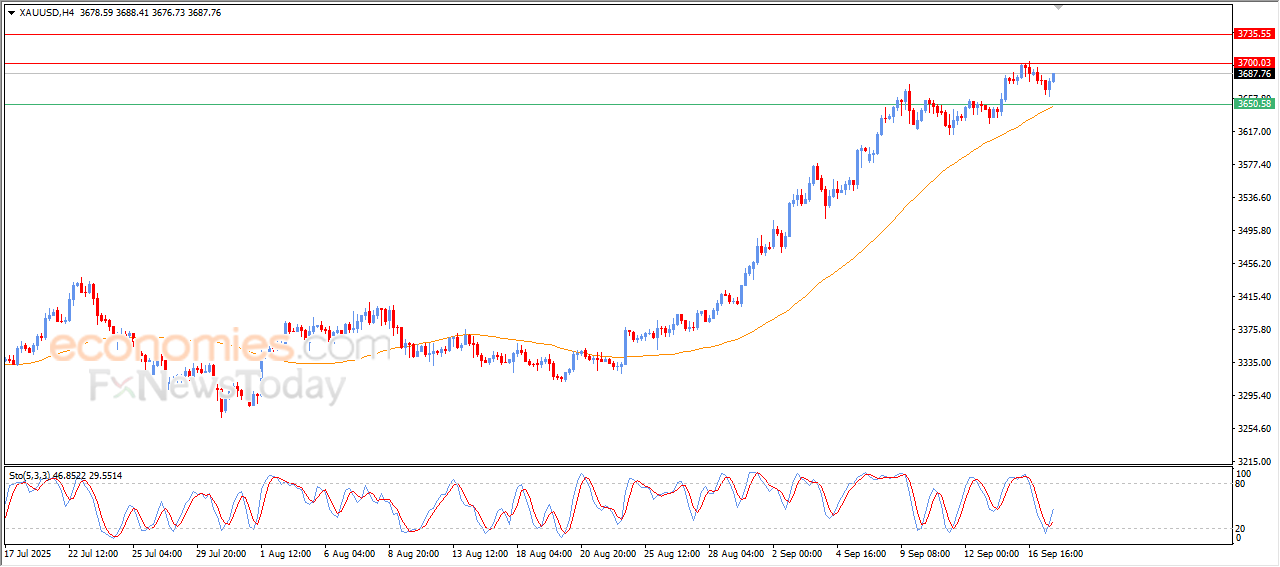

Evening update for Gold -17-09-2025

The (Gold) price recovered in its last intraday levels, preparing to attack the main resistance level at $3,700, supported by forming bullish divergence on the relative strength indicators, after reaching oversold levels, exaggeratedly compared by the price movement, with the continuation of the positive pressure that comes from its trading above EMA50, and under the dominance of the main bullish trend on the short-term basis.

VIP Trading Signals Performance by BestTradingSignal.com (September 8–12, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 8–12, 2025:

Evening update for EURUSD -17-09-2025

The (EURUSD) rose in its last intraday trading, after it succeeded in its previous trading by offloading its overbought conditions on the relative strength indicators, opening the way for achieving mor of the gains, amid the dominance of the main bullish trend on the short-term basis and its trading alongside supportive main and minor trend lines.

VIP Trading Signals Performance by BestTradingSignal.com (September 8–12, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 8–12, 2025: