American Airlines price shows more positive signs - Forecast today - 19-09-2025

AI Summary

- American Airlines Group, Inc. (AAL) showing positive signs with choppy intraday movements

- Stock supported by 50-day SMA and short-term corrective uptrend, positive divergence forming on RSI

- Predicted rise in stock price expected as long as it holds above support level of 12.15, targeting key resistance at 14.00

American Airlines Group, Inc. (AAL) saw choppy intraday movements in its latest trading, as the stock attempts to establish a higher bottom that could provide the base for positive momentum and recovery. It is currently supported by the 50-day SMA, within the context of a short-term corrective uptrend and trading along a supportive trend line. In addition, a positive divergence has started forming on RSI after previously plunging into deeply oversold levels, with a fresh bullish crossover emerging.

Therefore, we expect the stock to rise in the upcoming sessions, as long as it holds above the support level of 12.15, targeting the key resistance at 14.00.

Today’s price forecast: Bullish.

MONGODB price collects profits - Forecast today - 19-09-2025

MongoDB, Inc. (MDB) declined in its latest intraday trading, pressured by negative signals from RSI after previously reaching overbought zones. The stock is currently consolidating gains from prior advances while attempting to build positive momentum for recovery, supported by a short-term corrective uptrend and sustained trading above the 50-day SMA.

Therefore, we expect the stock to rise in the upcoming sessions, provided it first breaks above the resistance level of 250.95, targeting the next resistance at 298.90.

Today’s price forecast: Bullish.

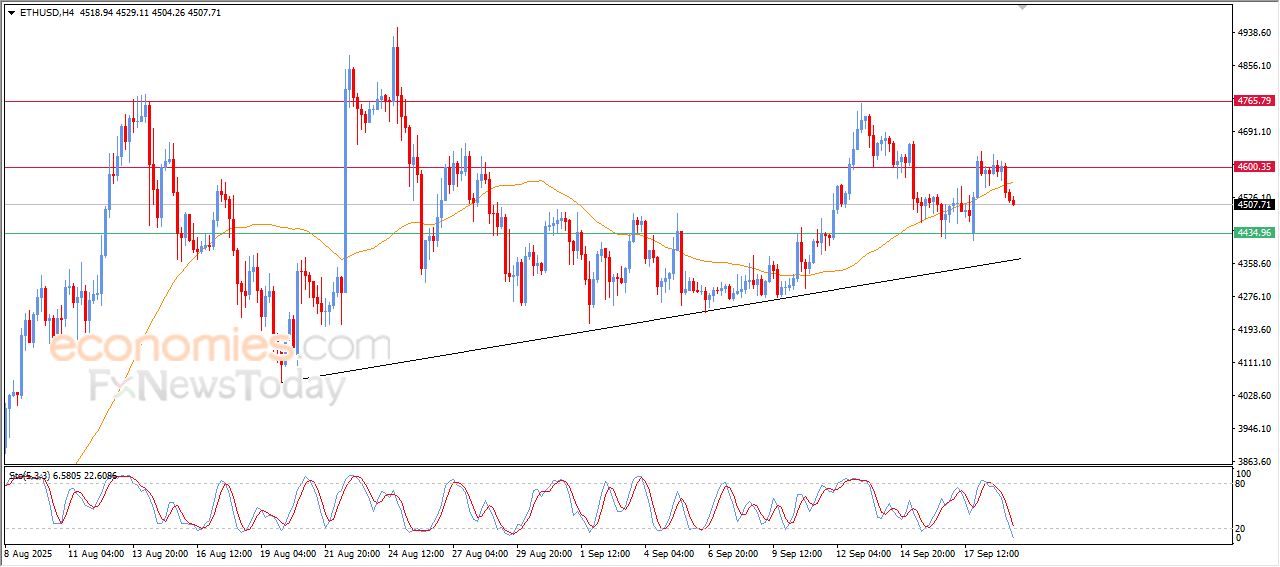

Forecast update for Ethereum -19-09-2025

The price of (ETHUSD) declined in its last intraday trading, amid the emergence of the positive signals on the relative strength indicators, despite reaching oversold levels, to surpass the support of its EMA50, forming intensified negative pressure on its upcoming trading, reinforcing the chance of extending its losses on the intraday basis.

VIP Trading Signals Performance by BestTradingSignal.com (September 8–12, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 8–12, 2025:

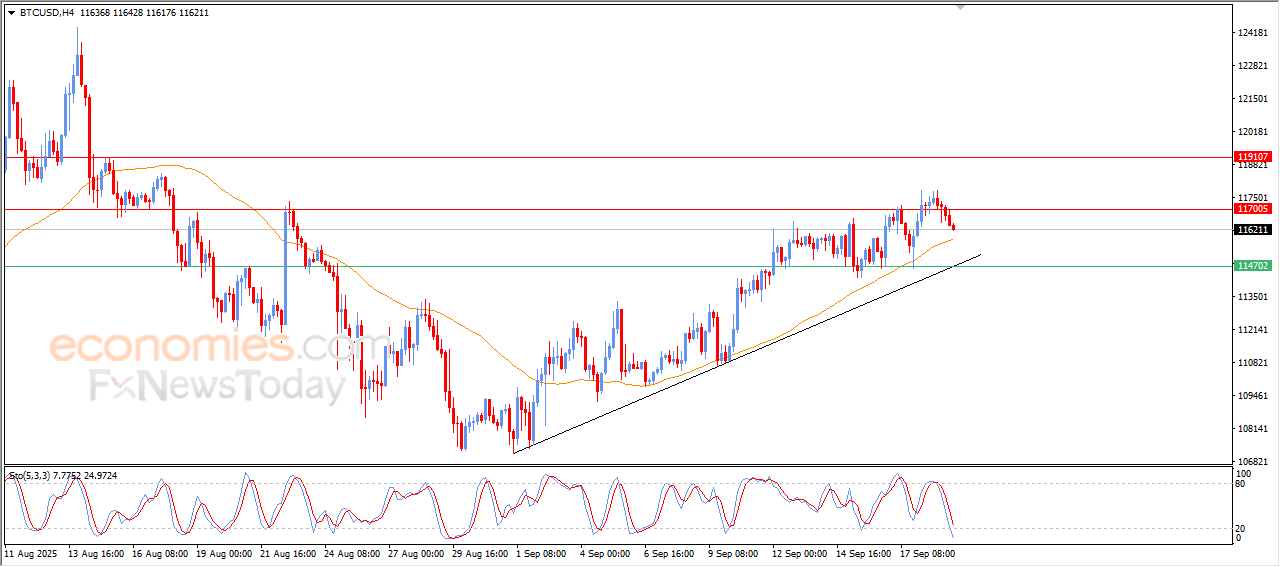

Forecast update for bitcoin-19-09-2025

The price of (BTCUSD) continued the decline in its last intraday trading, due to the stability of the stubborn resistance at $117,000, attempting to look for a rising low to take it as a base to gain the required positive momentum to recover and breach this resistance, amid the dominance of the bullish correctional trend on the short-term basis, with the continuation of the positive pressure that comes from its trading above EMA50, besides the reach of the relative strength indicators oversold levels, which suggest forming positive divergence.

VIP Trading Signals Performance by BestTradingSignal.com (September 8–12, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 8–12, 2025: