AMD price touches SMA resistance - Forecast today - 02-10-2025

Advanced Micro Devices Inc (AMD) advanced in its latest intraday trading, with the stock touching the resistance of its 50-day simple moving average. This comes while the short-term corrective downtrend remains in control, following an earlier break of a major ascending trendline. At the same time, the RSI has reached excessive levels relative to price movement, suggesting the formation of a negative divergence.

Therefore, we expect the stock to decline in upcoming trading, as long as resistance at 165.10 holds, targeting the support level of 149.20.

Today’s price forecast: Bearish.

Palo Alto price attacks stubborn resistance - Forecast today - 02-10-2025

Palo Alto Networks (PANW) rose in its latest intraday trading, pushing to test the key and strong resistance level of 206.18. The stock is supported by its continued trading above the 50-day simple moving average and remains under the control of the main short-term uptrend, moving along a supportive trendline. In addition, RSI indicators have begun showing positive signals after previously reaching oversold levels.

Therefore, we expect the stock to rise in upcoming trading, provided it first breaks above the resistance of 206.18, targeting the next resistance level at 225.90.

Today’s price forecast: Bullish.

Palantir price shows more positive signs - Forecast today - 02-10-2025

Palantir Technologies Inc (PLTR) advanced in its latest intraday trading, currently preparing to challenge the key resistance level of 189.45. The stock is supported by continued trading above the 50-day simple moving average, which acts as dynamic support reinforcing the stability of the main uptrend, especially with its movement along a short-term ascending trendline. In addition, RSI indicators have begun to show positive signals after successfully unwinding prior overbought conditions, giving the stock more room to achieve further gains in the near term.

Therefore, we expect the stock to rise in upcoming trading, especially if it breaks above the resistance of 189.45, targeting the next resistance level at 218.70.

Today’s price forecast: Bullish.

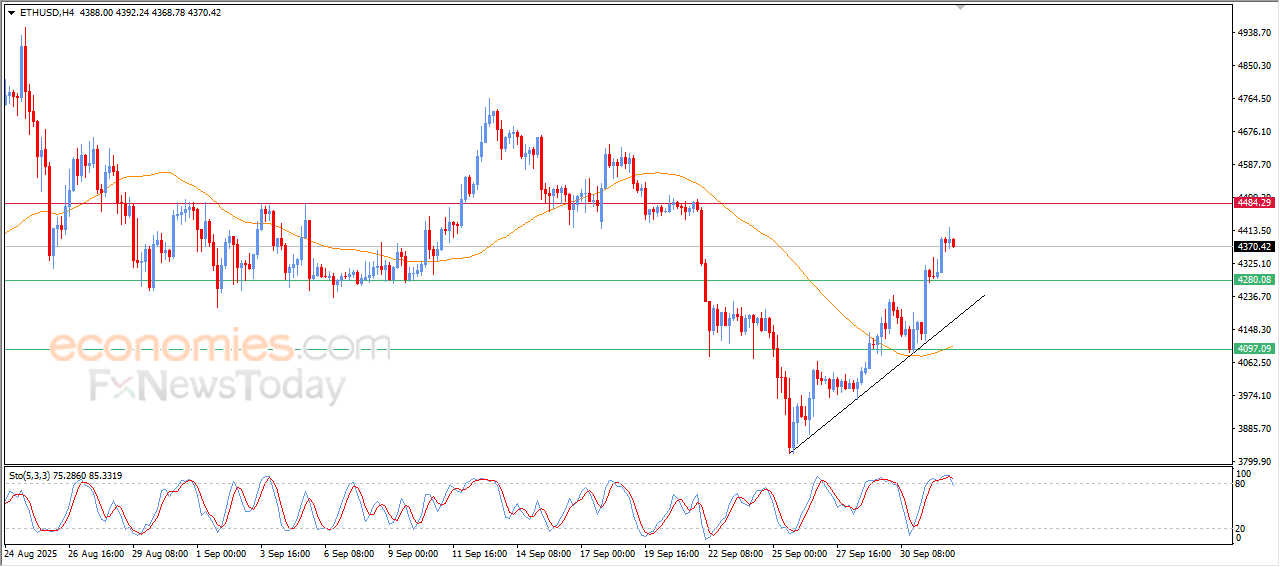

Forecast update for Ethereum -02-10-2025

The price of (ETHUSD) declined slightly in its last intraday trading, amid the dominance of bullish corrective wave on the short-term basis and its trading alongside trend line, with the continuation of the positive pressure that comes from its trading above EMA50, attempting to gather the gains of its previous rises, at the same time it attempt to offload some of its clear overbought conditions on the relative strength indicators, especially with the emergence of the negative signals from them, opening the way for achieving more gains.

VIP Trading Signals Performance by BestTradingSignal.com (September 22–26, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 22–26, 2025: