Agilent Technologies price benefits from SMA support - Forecast today - 15-08-2025

AI Summary

- Agilent Technologies, Inc. (A) stock saw a slight decline but is expected to rise again with positive momentum

- Stock successfully overcame negative pressure of previous 50-day SMA and is trading along an upward sloping line

- Price forecast for today is bullish, with a target resistance level of 127.90 if support at 110.75 holds

Agilent Technologies, Inc. (A) stock saw a slight decline in its latest session, allowing it to gather positive momentum that may help it recover and rise again. This comes after it successfully overcame the negative pressure of the previous 50-day SMA in earlier trading, within the context of a short-term corrective uptrend and trading along an upward sloping line, supported by positive signals from RSI indicators, despite reaching overbought levels.

Therefore, we expect the stock to rise in its upcoming trading, as long as support at 110.75 holds, targeting the key resistance level of 127.90 in preparation to test it.

Today’s price forecast: Bullish

Qualcomm price extends gains - Forecast today - 15-08-2025

QUALCOMM Incorporated (QCOM) stock continued to climb in its latest intraday trading, benefiting from dynamic support provided by trading above its previous 50-day SMA. The move was fueled by positive signals from RSI indicators, all within the context of a short-term corrective uptrend and trading along an upward sloping line supporting this path.

Therefore, we expect the stock to rise in its upcoming trading, targeting the key and near resistance level of 163.60 in preparation to test it.

Today’s price forecast: Bullish

Amgen price trapped in a hesitant place - Forecast today - 15-08-2025

Amgen Inc. (AMGN) stock advanced in its latest intraday trading, with the short-term uptrend remaining dominant and trading along a minor upward sloping line supporting this path. Relative Strength Index indicators have started to show positive signals after reaching highly oversold levels. With its latest rise, the stock is attempting to overcome the negative pressure from its previous 50-day SMA, signaling a full recovery.

Therefore, we expect the stock to rise in its upcoming trading, as long as the 281.65 support level holds, targeting its first resistance level at 299.50.

Today’s price forecast: Bullish

Forecast update for Ethereum -15-08-2025

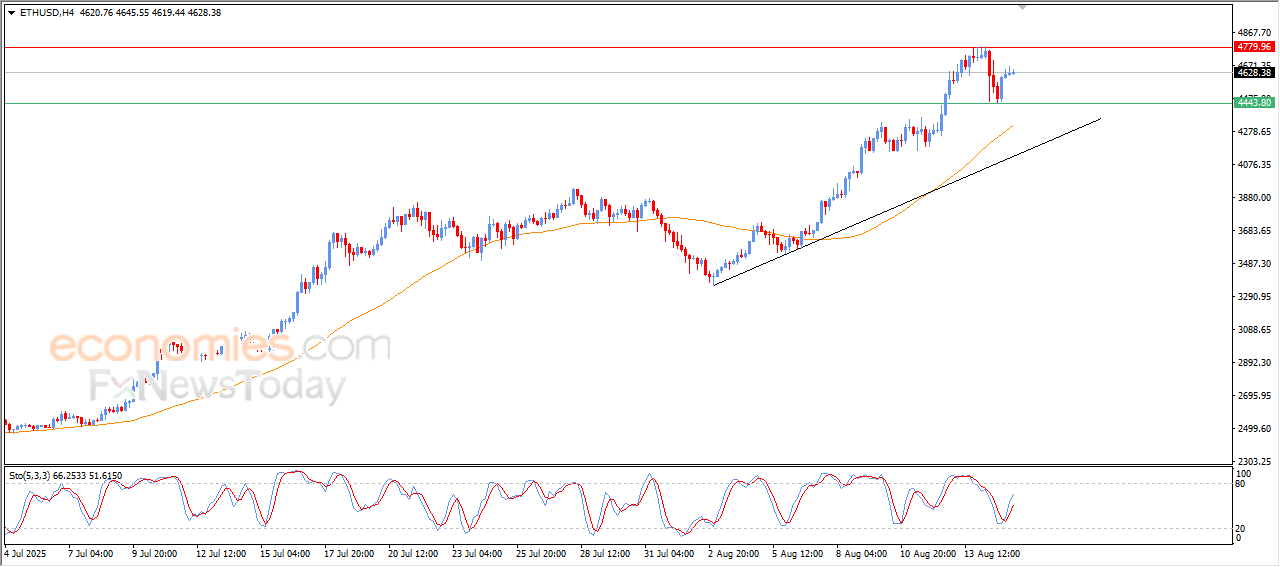

The price of (ETHUSD) settles with gains in its last intraday trading, taking advantage of the dynamic support that is represented by its trading above EMA50, and under the dominance of the main bullish trend on the short-term basis and its trading alongside a minor support bias line for this track, besides the emerging of the positive signals on the (RSI), after reaching oversold levels.

BestTradingSignal.com – Professional Trading Signals

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull performance report available here: