Nvidia (NVDA) stock will reach $2,000 in 2024? Forecast and best way to trade it

Table of Contents

- Technical Analysis of Nvidia Stock ( Nvidia ) – NVDA

- Daily Time Frame

- Four-Hour Chart

- Technical Indicators

- Main Uptrend Continues

- Best Broker to Trade Nvidia Stock 2024

- Best 3 Platforms and Brokers to Trade Nvidia Stock NVDA

- Nvidia Stock Analysis and Forecasts for 2024

- Summary Analysis and Forecasts for Nvidia Stock

- About Nvidia Company

- Nvidia Company History

- Nvidia Company Products

- Nvidia Company Financial Status

- Nvidia Company Technological Innovations

- Nvidia Role in AI and Cloud Computing

- Self-Driving Cars: Key Investment of Nvidia

- Nvidia Challenges and Opportunities

- Historic Earnings of Nvidia in Q1 2024

- Factors Affecting Nvidia Stock

- Key Price Milestones of Nvidia Stock

- Best Performance of Nvidia Stock in History

- Worst Performance of Nvidia Stock in History

- Key Events in Nvidia Stock History

- In May 2023, Nvidia Enters the Elite Club

- Largest Companies in the World by Market Cap in 2024

- Major Forecasts for Nvidia Stock in 2024

- Frequently Asked Questions About Nvidia Stock

Technical Analysis of Nvidia Stock ( Nvidia ) – NVDA

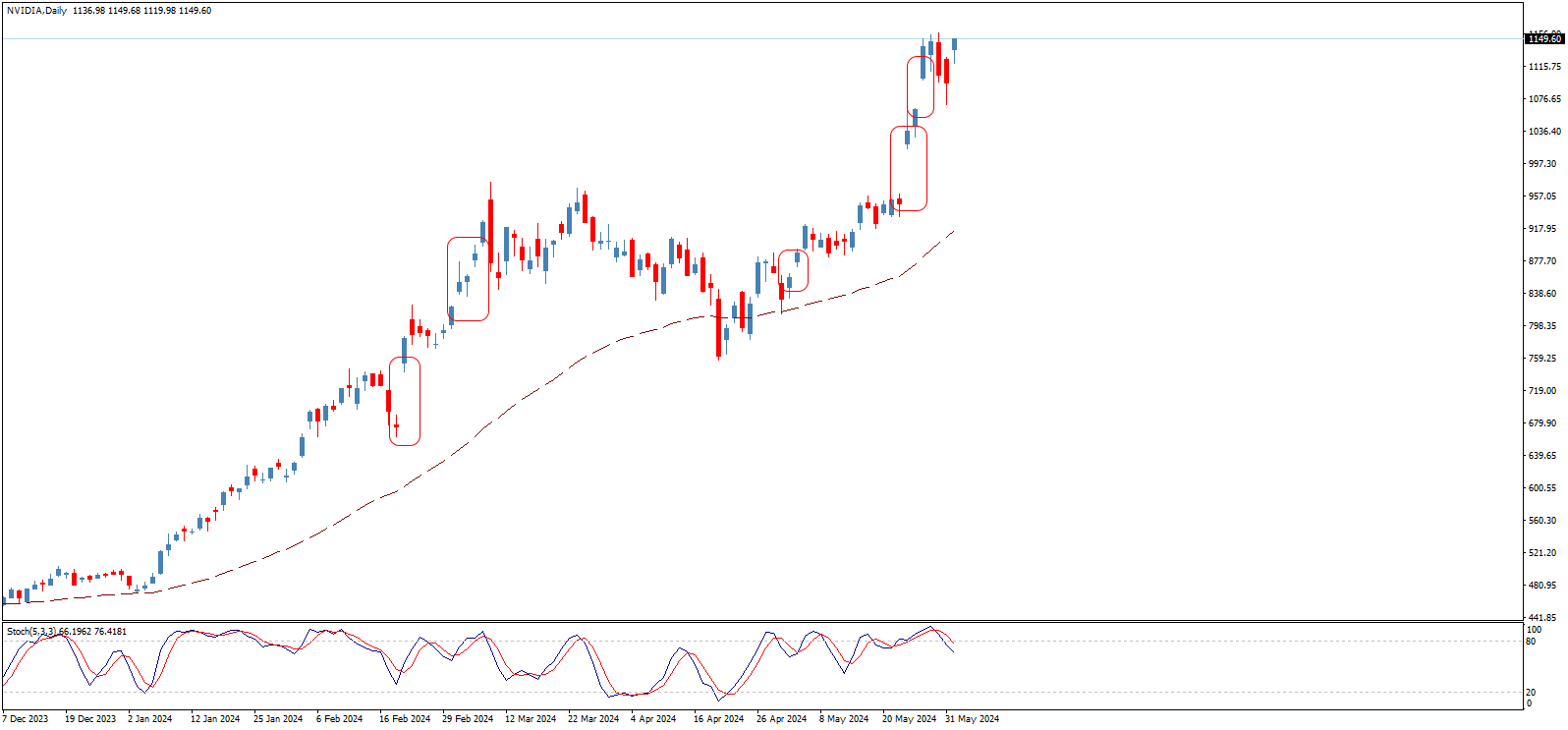

- The weekly chart of Nvidia stock (Nvidia) shows how the price started building a long-term upward wave at the beginning of the third quarter of 2022, moving from the $108.08 region and entering an upward path that took the price to record unprecedented historical levels, reaching the current levels around the $1150.00 barrier.

- This significant rise was interrupted by a temporary downward correction period between March 26 and April 19 of this year, followed by the resumption of the upward wave until today.

Daily Time Frame

- We notice that the price opened several sessions with upward gaps, as shown in the following chart, indicating strong demand for the stock, enhancing the chances of the continuation of the upward trend in the medium and long term.

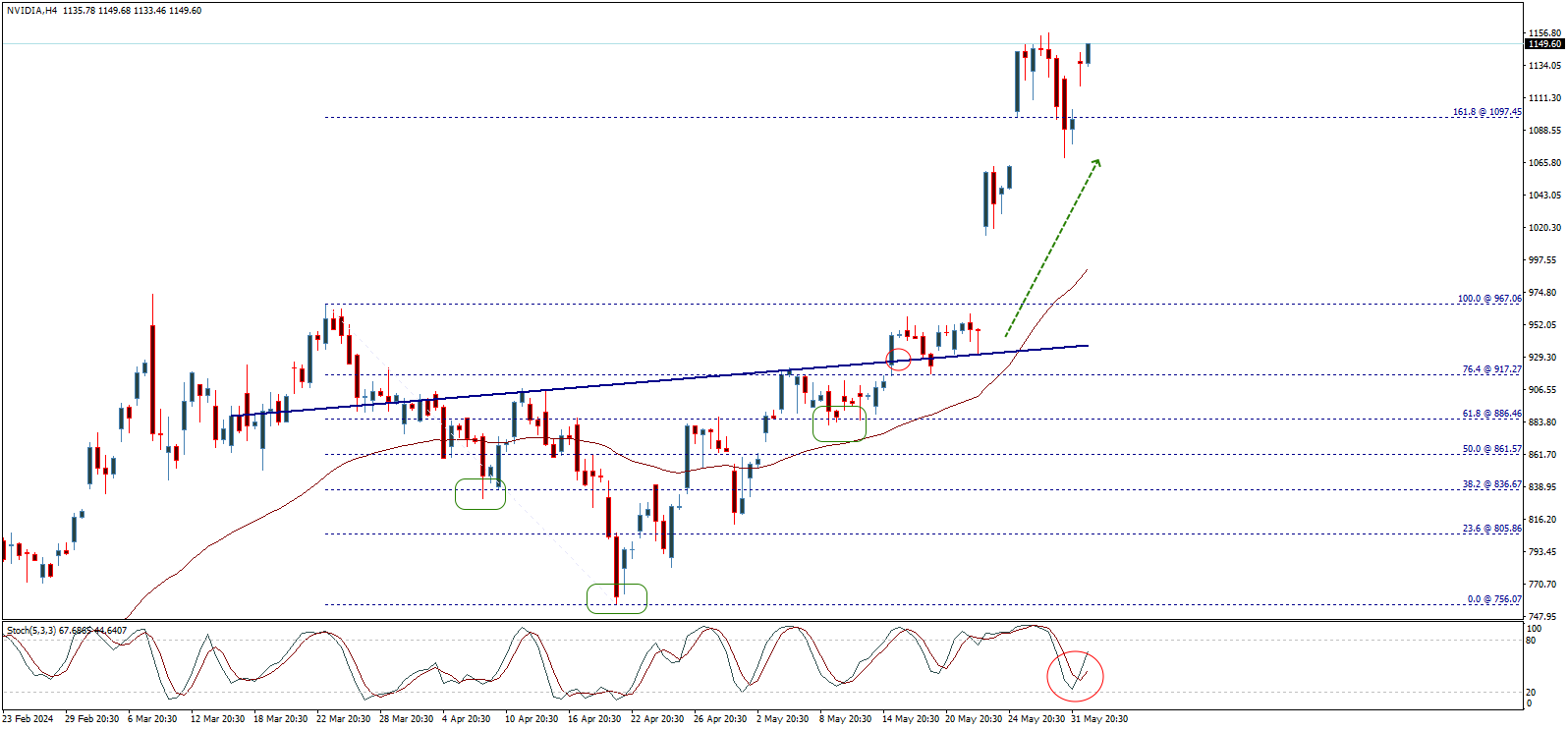

Four-Hour Chart

- By studying shorter time frames, we find that the price has recently pushed higher after receiving a positive incentive represented by the completion of an inverted head and shoulders pattern, whose full targets have already been achieved. The price is heading towards achieving additional gains that we expect to reach the $1308.00 region as the next major station, which represents the 261.8% Fibonacci extension level for the last downward wave shown in the picture.

Technical Indicators

- We find that the 50 exponential moving average supports the price well from below, enhancing expectations for the continuation of the upward trend. At the same time, the Stochastic indicator provides positive signals that we expect will encourage the price to continue rising and achieving more gains, noting that surpassing the $1300.00 barrier will lead the stock to achieve more record levels that could reach the $1500.00 region in the near term.

Main Uptrend Continues

- The next targets start at $1308.00 then $1500.00, noting that breaking $1067.00 may force the price to undergo a new downward correction and head to test the $1009.00 regions, possibly extending to $915.50 before rising again. Breaking the $915.50 level represents the key to a shift in the main trend towards a decline, halting the upward wave and starting a downward correction in the short and medium term, targeting levels that may reach $756.45 before any new attempt to restore the main upward trend.

Best Broker to Trade Nvidia Stock 2024

Best 3 Platforms and Brokers to Trade Nvidia Stock NVDA

- Pepperstone, the best global trusted and licensed company to trade Nvidia stock.

Pepperstone holds licenses from several leading regulatory authorities worldwide, ensuring its reliability and transparency in the financial market. These aspects make Pepperstone a preferred broker for traders looking for opportunities to trade US stocks with confidence and security.

- Plus500, the best global trusted and licensed company to trade Nvidia stock.

Plus500 holds licenses from several leading regulatory authorities worldwide, ensuring its reliability and transparency in the financial market. These aspects make Plus500 a preferred broker for traders looking for opportunities to trade US stocks with confidence and security.

- XM, the best trading platform and broker suitable for beginners to trade Nvidia stock.

Trading CFDs with XM provides affordable and direct access to global stock markets, allowing investors to trade without commissions. It also allows speculation on the rising and falling trends of the market, giving traders the flexibility to buy or sell according to market movements. This opportunity also helps diversify the portfolio and trade portions of stocks in CFDs, making it a flexible option suitable for various trading strategies.

Nvidia Stock Analysis and Forecasts for 2024

- After Nvidia announced its quarterly results for the first quarter of this year, which exceeded expectations on Wall Street on May 22, the Nvidia stock surpassed the important psychological barrier of $1,000 for the first time in history, and the stock has continued to record new historical levels since then.

- In yesterday's session on Tuesday, June 5, 2024, Nvidia stock reached its all-time high at $1,166, with a new record closing level at $1,164.

- According to most forecasts from major institutions and banks, Nvidia stock is likely to continue recording a series of new historical levels during the second half of this year.

- Therefore, it is currently not far-fetched for Nvidia stock to continue its broad rise in the coming period, possibly reaching the important psychological barrier of 2,000 points before the end of this year.

- In general, analysts at major economic institutions and global banks expect Nvidia stock's performance in 2024 to be positive, with expectations of an increase ranging from 150% to 300%.

- The year 2024 is full of challenges and opportunities for Nvidia stock, as a combination of economic and technological factors interacts to determine its trends.

- Despite the challenges, there are optimistic expectations that innovation and investment in artificial intelligence technology will strongly support the continuation of Nvidia stock's remarkable rise.

Summary Analysis and Forecasts for Nvidia Stock

- Nvidia stock forecast this week: After recording a new all-time high at $1,1666, some analysts expect the stock to continue rising until it surpasses the psychological barrier at $1,200.

- Nvidia stock forecast for June: The stock is likely to continue rising throughout this month's sessions, with a strong possibility of recording new historical levels above $1,200.

- Nvidia stock forecast for 2024: Most analysts on Wall Street expect Nvidia stock to reach new historical levels above $1,500 to the $2,000 barrier.

- Nvidia stock forecast for 2025: With the Federal Reserve implementing an easing cycle, more liquidity is expected to enter Wall Street markets, meaning Nvidia stock could continue towards the $2,500 level in 2025.

About Nvidia Company

Nvidia (NVIDIA) is one of the world's leading companies in information technology, specializing in designing graphics processing units (GPUs), artificial intelligence (AI), and advanced computing.

Nvidia products are widely used in personal computers, video games, data centers, smartphones, self-driving cars, and artificial intelligence.

Nvidia is one of the largest and most successful semiconductor companies in the world, enjoying a strong reputation for innovation and quality.

Nvidia Company History

Nvidia was founded in 1993 by Jensen Huang and is headquartered in Santa Clara, California, USA.

Huang aimed to develop graphics processing units that could provide a more realistic and immersive video game experience.

The company achieved early success with the launch of the "GeForce" GPUs in 1999, which quickly became the industry standard for PC gaming.

Nvidia Company Products

- Graphics Processing Units (GPUs): Nvidia GPUs are used in personal computers, video games, data centers, smartphones, and self-driving cars.

- Cloud Computing Platforms: Nvidia offers cloud computing platforms that allow developers to create and run AI-powered applications.

- Artificial Intelligence Software: Nvidia provides AI software that helps companies develop and run AI applications.

- Tegra Chips: Nvidia's Tegra chips are used in smartphones, tablets, laptops, and self-driving cars.

Nvidia Company Financial Status

In recent years, Nvidia has achieved tremendous growth in its revenues and profits, driven by the increasing demand for powerful GPUs, which have become the foundation of many modern technologies.

In fiscal year 2023, Nvidia reported record revenues exceeding $26.9 billion, a 61% increase over the previous year. This growth was attributed to strong performance in the gaming and data center sectors, with increased sales of gaming GPUs thanks to new releases and improved consumer demand.

Nvidia Company Technological Innovations

Nvidia is considered a leader in technological innovation, particularly in AI and advanced computing. The company's products, such as the "GeForce" and "Quadro" GPU series, are widely used in gaming, graphic design, and engineering.

Nvidia has also developed advanced AI platforms such as "NVIDIA DRIVE" for self-driving cars and "NVIDIA DGX" for high-performance computing.

Nvidia Role in AI and Cloud Computing

Nvidia plays a significant role in AI, providing comprehensive solutions that include hardware and software. Nvidia platforms are used in major data centers to accelerate AI-related computing processes, helping companies analyze big data and develop advanced machine learning models.

The company has also expanded into cloud computing through partnerships with tech giants like Google, Amazon, and Microsoft to offer cloud computing services based on Nvidia processors.

Self-Driving Cars: Key Investment of Nvidia

One of the key areas of innovation that Nvidia invests in is the development of self-driving car technologies. Through the "NVIDIA DRIVE" platform, the company provides integrated AI solutions, including hardware and software, enabling car manufacturers to develop and operate self-driving cars safely and efficiently.

This technology uses deep learning capabilities to process and analyze data from sensors to make real-time driving decisions.

Nvidia Challenges and Opportunities

Despite its significant successes, Nvidia faces some challenges, including intense competition in the GPU market from companies like AMD and Intel. Global supply chain disruptions also sometimes affect the availability of its products.

However, the opportunities available to Nvidia are enormous, especially with the continuous expansion in AI applications, the growth of the gaming sector, and increased reliance on cloud computing.

Additionally, investment in self-driving car technology represents a huge future opportunity for the company.

Historic Earnings of Nvidia in Q1 2024

The semiconductor giant "Nvidia" revealed its Q1 2024 earnings report on May 22 after the closing bell on Wall Street.

The results were historic, exceeding expectations and aligning with the magnitude of the chipmaker whose products have become central amid the AI boom worldwide.

The company achieved earnings of about $6.12 per share, compared to expectations of about $5.59. Revenues reached $26.04 billion, compared to expectations of $24.65 billion.

Nvidia also announced a 262% increase in sales, indicating the continued AI boom. The company expects Q2 sales of $28 billion, compared to expectations of $26.61 billion.

Factors Affecting Nvidia Stock

- Company Financial Performance

Nvidia's financial performance is one of the main factors affecting its stock price. This performance includes revenues, profits, and overall financial growth. Quarterly and annual earnings reports play a crucial role in determining investor expectations about the company's future performance.

- Technological Innovation and Development

Nvidia is known for its continuous innovations in GPUs and AI. Investment in research and development and the announcement of new products can enhance investor confidence in the company and contribute to raising the stock price.

- Demand for Company Products

Demand for Nvidia products in gaming, AI, data centers, and self-driving cars plays a significant role in determining its stock performance. Increased demand for GPUs in gaming and AI applications can lead to higher stock prices.

- Global Economic Trends

Global economic fluctuations can significantly affect Nvidia stock. Global economic growth boosts demand for advanced technology, while economic crises can negatively impact consumer and investment spending in the technology sector.

- Market Competition

Nvidia faces intense competition from companies like AMD and Intel. Competitors' performance and the launch of new products may affect Nvidia's market share and thus its stock price.

- Government and Trade Policies

Government policies related to international trade, taxes, and environmental regulations can affect Nvidia's business. Changes in tariff policies or economic sanctions can impact the company's supply chain and operational costs.

- Technological Developments

Technological advancements and innovations in the technology sector affect Nvidia stock performance. For example, advancements in AI technologies, cloud computing, and IoT can open new opportunities for the company and increase its stock attractiveness to investors.

- Performance of Similar Companies in the Industry

The performance of similar companies in the technology sector can be a strong indicator for investors. If competing companies perform well, it can enhance confidence in Nvidia and vice versa.

- Analyst Reports and Credit Ratings

Financial analyst reports and their ratings of Nvidia stock significantly affect investor decisions. Positive evaluations from financial analysts and credit rating agencies can lead to a rise in the stock price.

- Geopolitical and Health Crises

Geopolitical crises such as trade wars and international conflicts, as well as health crises like the COVID-19 pandemic, affect global financial markets, including Nvidia stock. These crises can lead to sharp fluctuations in stock prices based on market reactions.

Key Price Milestones of Nvidia Stock

- April 1999: Nvidia stock index recorded its all-time low at $0.31.

- June 2024: Nvidia stock reached its all-time high at $1,166.

- May 1999: Nvidia stock recorded its all-time low closing at $0.3261.

- June 2024: Nvidia stock recorded its all-time high closing at $1,164.

Best Performance of Nvidia Stock in History

- 2001: The best annual performance of Nvidia stock ever, with a 308% increase.

- Q3 1999: The best quarterly performance of Nvidia stock ever, with a 144% increase.

- May 2003: The best monthly performance of Nvidia stock ever, with an 83% increase.

Worst Performance of Nvidia Stock in History

- 2002: The worst annual performance of Nvidia stock ever, with an 83% decrease.

- Q2 2002: The worst quarterly performance of Nvidia stock ever, with a 61% decrease.

- June 2002: The worst monthly performance of Nvidia stock ever, with a 49% decrease.

Key Events in Nvidia Stock History

- 1999: Nvidia stock began trading for the first time in history in June 1999 at $0.4013.

- 2000: Nvidia stock traded above $1 for the first time in February 2000.

- 2001: Nvidia stock surpassed the $5 mark for the first time in December 2001.

- 2016: Nvidia stock surpassed the $10 mark for the first time in May 2016.

- 2017: Nvidia stock surpassed the $50 mark for the first time in October 2017.

- 2020: Nvidia stock surpassed the $100 mark for the first time in July 2020.

- 2024: Nvidia stock surpassed the $500 mark for the first time in January 2024.

- 2024: Nvidia stock surpassed the $1,000 mark for the first time in May 2024.

In May 2023, Nvidia Enters the Elite Club

"Nvidia Corp" joined the elite club of American companies with a market value of one trillion dollars in May 2023, marking a historic turning point in the company's over thirty-year history, benefiting from the global race to adopt AI tools.

The semiconductor maker became one of the biggest winners in the AI race due to the massive demand for the "H100" graphics chip, described as legendary, enabling Nvidia to achieve historic revenues that exceeded economists' and experts' expectations.

Largest Companies in the World by Market Cap in 2024

- "Microsoft" with a market value of $3.092 trillion

- "Apple" with a market value of $2.980 trillion

- "Nvidia" with a market value of $2.864 trillion

- "Alphabet (Google)" with a market value of $2.156 trillion

- "Amazon" with a market value of $1.886 trillion

- "Saudi Aramco" with a market value of $1.819 trillion

- "Meta (Facebook)" with a market value of $1.209 trillion

- "Berkshire Hathaway" with a market value of $888 billion

Major Forecasts for Nvidia Stock in 2024

- HSBC: The bank expects Nvidia stock to reach $1,350 by the end of 2024, thanks to continued growth in the technology sector and AI industry.

- Jefferies Financial Group: The group expects Nvidia stock to reach $1,200 by the end of 2024, thanks to the strong long-term growth of the technology sector.

- Wells Fargo: The group expects Nvidia stock to reach 1,150 points by the end of 2024, thanks to strong corporate investments in research and development and the launch of new products and services.

- Barclays Bank: The bank expects Nvidia stock to reach $1,100 in 2024, thanks to global economic recovery and increased demand for technology.

Frequently Asked Questions About Nvidia Stock

- Is Nvidia stock suitable for investment?

Nvidia stock is trading at its all-time highs above $1,100, close to reaching the $1,200 barrier, and within the target range of $1,350 to $2,000 as projected by major institutions and global banks. We believe that investing in Nvidia at these levels does not involve high risk.

- How to invest in Nvidia Company?

You cannot invest directly in Nvidia Company as it is a joint-stock company and not a tradable instrument. However, there are two main ways to invest indirectly in Nvidia:

- Buy Nvidia shares (NASDAQ: NVDA):

- You can buy Nvidia shares through a broker or an online trading platform.

- When you buy Nvidia shares, you own a small part of the company and benefit from its profits and future growth.

- Nvidia shares are a risky investment, and their value can fluctuate significantly.

- Exchange-Traded Funds (ETFs) that include Nvidia:

- ETFs track the performance of an index or a basket of stocks.

- There are several ETFs that include Nvidia, such as QQQ and VGT.

- ETFs provide an easy and diversified way to invest in Nvidia.

- ETFs are less risky than individual company shares as they are spread over a range of stocks.

- Buy Nvidia shares (NASDAQ: NVDA):

- Will Nvidia stock reach $2,000?

In light of the extensive and phenomenal development in the technology sector and the AI industry, it is not entirely out of the question that Nvidia stock will continue to rise to $2,000 this year, with a strong surpassing of this level in the coming years.

- Is Nvidia stock expected to rise in 2024?

Yes, Nvidia stock is expected to continue rising this year. Most forecasts from major institutions, banks, and experts are stable around the bullish market for the stock as it approaches the $1,200 barrier.

- Will Nvidia stock crash in 2024?

It is unlikely and improbable that Nvidia stock will crash this year, especially since the company has become the third largest company in terms of market value in the world and is strongly expected to become the largest company in the world before the end of this year.

The AUDCAD prepares for the correctional decline – Forecast today – 6-6-2024

AUDCAD Price Analysis

Expected Scenario

The AUDCAD price returned to test the 0.9130 barrier and settle below it, hinting the end of the bullish attack for now and starting to activate the correctional bearish track by fluctuating near 0.9095, taking advantage of stochastic negative momentum by settling below the 80 level.

Facing continuous negative pressures allows us to target the 50% Fibonacci correction level at 0.9055, while breaking this obstacle will push the price to target additional negative stations that might start at 0.9025 and 0.8990.

Expected Trading Range

Between 0.9125 support and 0.9055 resistance.

Trend Forecast: Bearish

No news for natural gas price – Forecast today – 6-6-2024

Natural Gas Price Analysis

Expected Scenario

No news for natural gas price, to continue providing weak sideways trades by settling near $2.750 without recording any new positive target due to the frequent stability below $2.880 resistance, while the major indicators agree to provide the positive momentum to allow us to wait for the reaction to the positive pressures and ease the mission of breaching the resistance and start recording additional gains by rallying towards $3.220 and $3.500.

Expected Trading Range

Between $2.620 support and $2.880 resistance.

Trend Forecast: Bullish

The EURJPY tests the barrier – Forecast today – 6-6-2024

EURJPY Pair Analysis

Expected Scenario

The EURJPY pair faced new positive pressures this morning, caused by stochastic attempts to rally above the 50 level, forcing it to postpone the correctional decline and form a bullish wave to test the first additional barrier at 170.05.

The suggested scenario for today depends on the strength of this barrier, as its stability allows us to expect forming new negative waves, attempting to target many negative stations that start at 169.50 and 168.90, while breaching the barrier will open the way to renew the bullish attempts, waiting to reach 170.35 and 170.70 levels.

Expected Trading Range

Between 170.10 support and 168.90 resistance.

Trend Forecast: Bearish