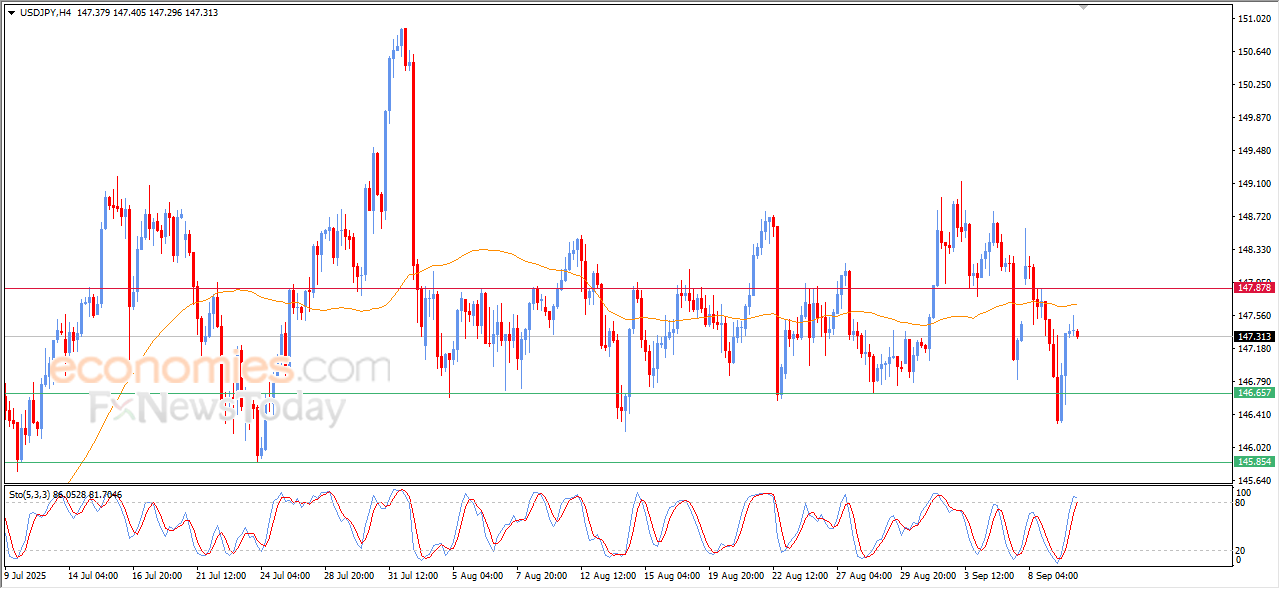

The USDJPY shows clear overbought signals -Analysis-10-09-2025

AI Summary

- USDJPY shows overbought signals with potential negative divergence

- VIP Trading Signals Performance by BestTradingSignal.com offers high-accuracy signals for US stocks, crypto, forex, and more

- Subscription packages available for different markets, with detailed performance reports for September 1-5, 2025.

The (USDJPY) declined slightly in its last intraday trading, after strong bullish wave led the (RSI) to reach overbought levels, which suggest the beginning of forming negative divergence, especially with the emergence of negative overlapping signals from them, amid the continuation of the negative pressure that comes from its trading below EMA50, and under the dominance of minor bearish trend on the short-term basis.

VIP Trading Signals Performance by BestTradingSignal.com (September 1–5, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 1–5, 2025:

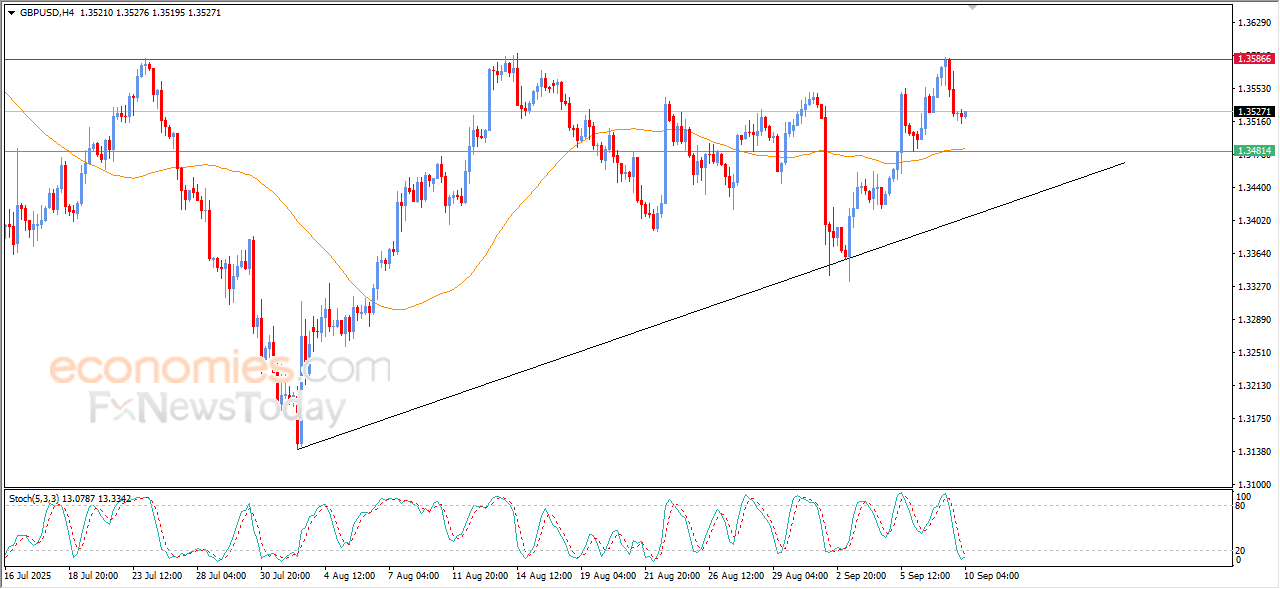

The GBPUSD shows more of the positive signs -Analysis-10-09-2025

The (GBPUSD) price rose in its last intraday trading, after its decline in yesterday’s trading, affected by the stability of the critical resistance at 1.3585, attempting to gain bullish momentum that might help it to breach this resistance, and it kept declining until the (RSI) indicators entered oversold levels, to indicate forming positive divergence, indicating the wanning of bearish factors and the beginning of gaining the bullish momentum, amid the continuation of the positive pressure that comes from its trading above EMA50, and under the dominance of the bullish trend on the short-term basis and its trading alongside a bias line.

VIP Trading Signals Performance by BestTradingSignal.com (September 1–5, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 1–5, 2025:

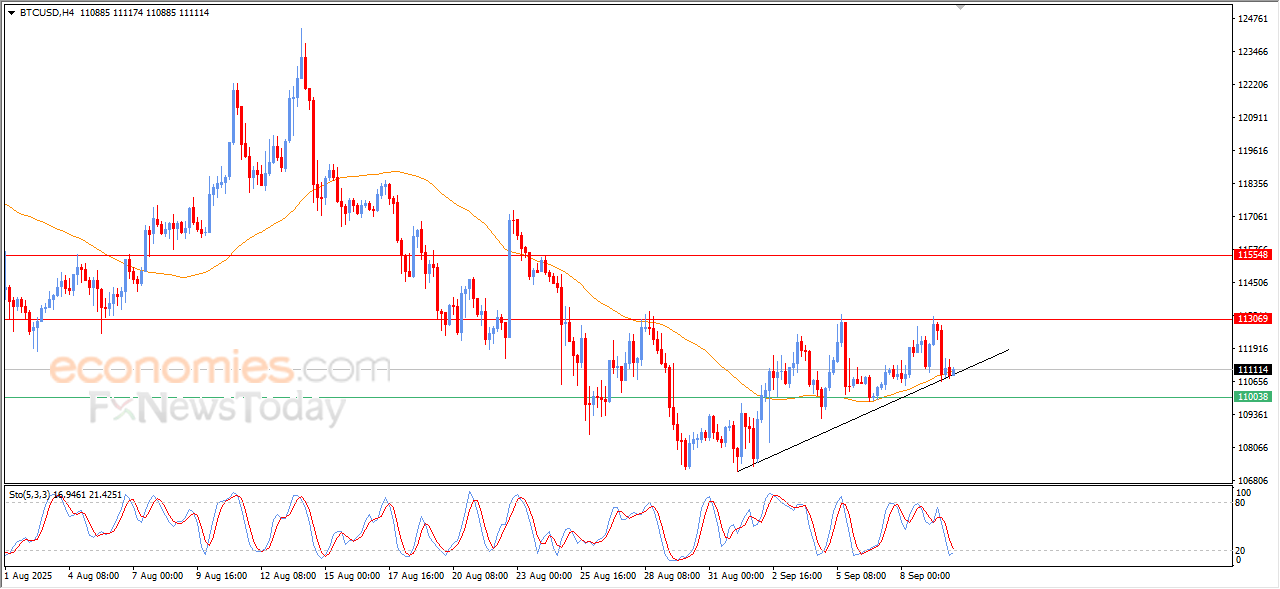

Bitcoin (BTCUSD) exhausted its positive opportunities-Analysis-10-09-2025

The price of Bitcoin (BTCUSD) settled with slight decline in its last intraday trading, after repeated attempts to gain bullish momentum that supports its recovery again, this performance came after the stability of the stubborn and critical resistance level at 113,000, where the price couldn’t surpass it to lean on the support of EMA50.

The (RSI) indicators reached sever oversold levels, exaggeratedly compared to the price movement, to suggest forming positive divergence that might indicate easing of pressure, this comes with the continuation of the bullish correctional trend dominance on the short-term basis, showing the balance between the bullish bouncing attempts and the continuation of the pressing resistance on the price.

VIP Trading Signals Performance by BestTradingSignal.com (September 1–5, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 1–5, 2025:

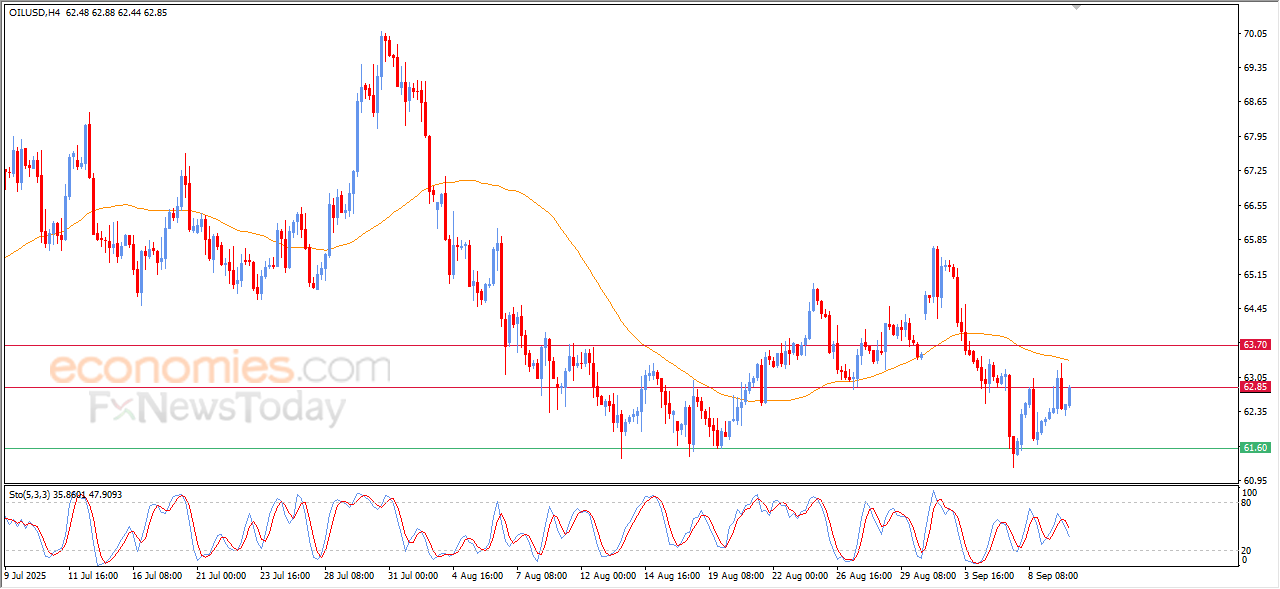

Crude oil prices test critical resistance- Analysis-10-09-2025

The (crude oil) price rose in the last intraday trading, retesting the critical resistance at $62.85, in attempt to test its strength after wave of mixed trading, despite this rise the main trend on the short-term basis remains under clear negative pressure, especially with the trading below EMA50.

The main indicators reinforce this negative scene, where the (RSI) showed Signs of buying exhaustion after reaching overbought levels, leaving the gate open for a potential return for the selling pressure again, unless the price manages to breach the mentioned resistance and holds above it.