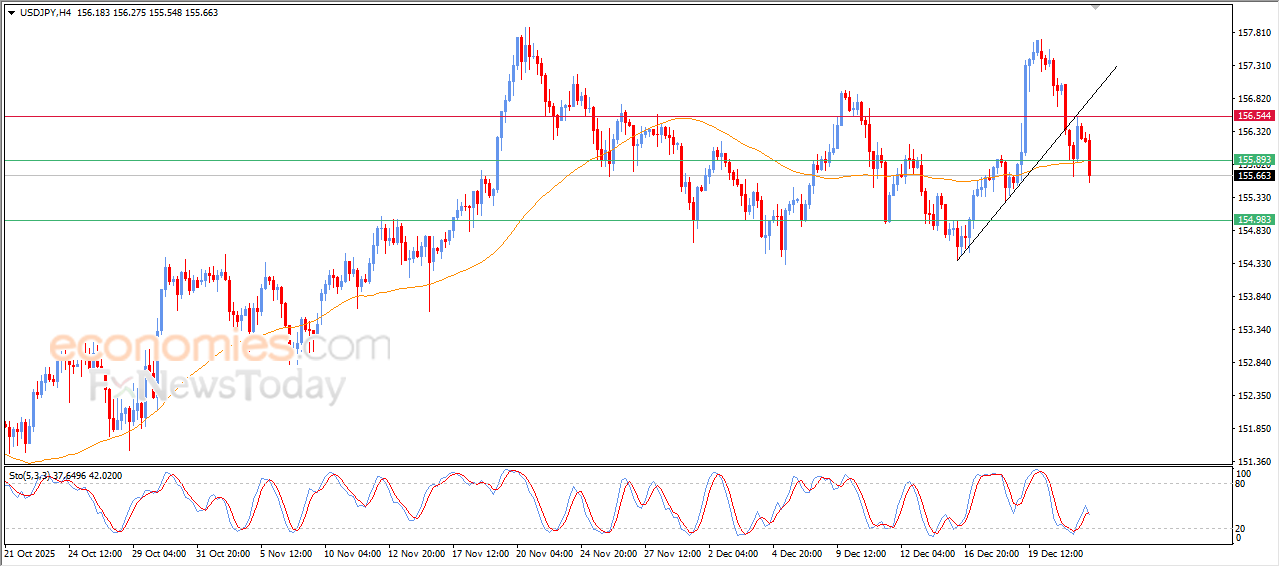

The USDJPY is under intensive negative pressure-Analysis-24-12-2025

The (USDJPY) witnessed sharp decline in its last intraday trading, affected by breaking minor bullish trend line on the short-term basis, to surpass EMA50’s support, intensifying the negative pressures, after offloading its oversold conditions on the relative strength indicators, to indicate fading any bullish momentum, especially with the emergence of negative overlapping signals from these indicators.

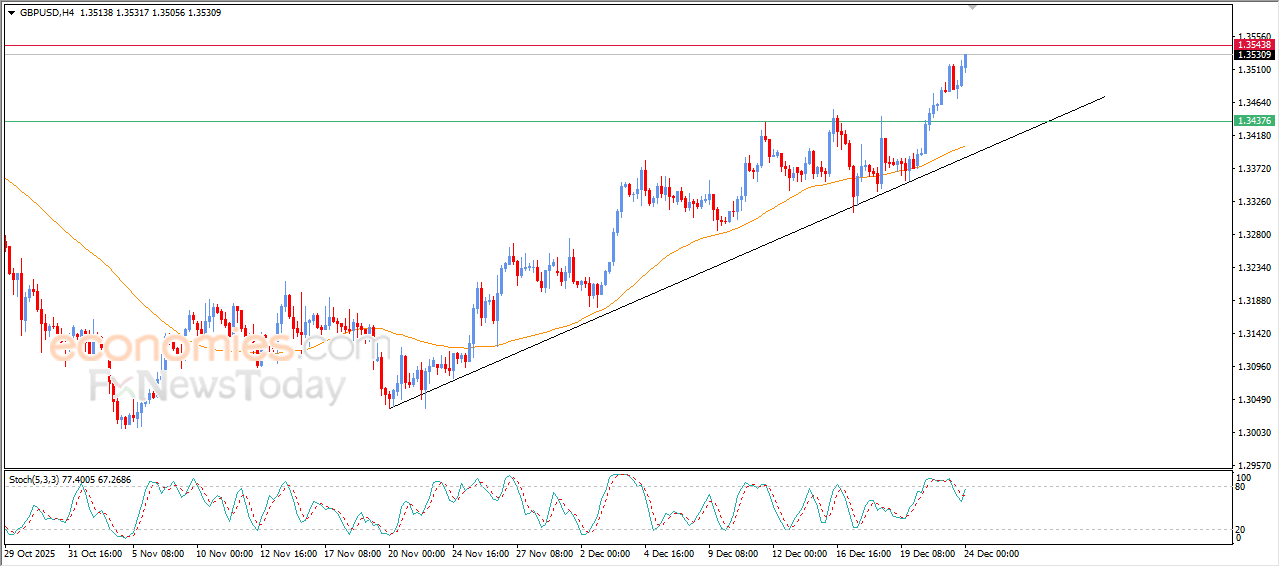

GBPUSD price surges higher- Analysis- 24-12-2025

GBPUSD rose in its last trading on the intraday levels, amid the continuation of the dynamic support that is represented by its trading above EMA50, reinforcing the strength and stability of the main bullish trend on the short-term basis, especially with its trading alongside trend line, besides the emergence of the positive signals on the relative strength indicators, after offloading its overbought conditions, providing more bullish momentum on the near-term basis.

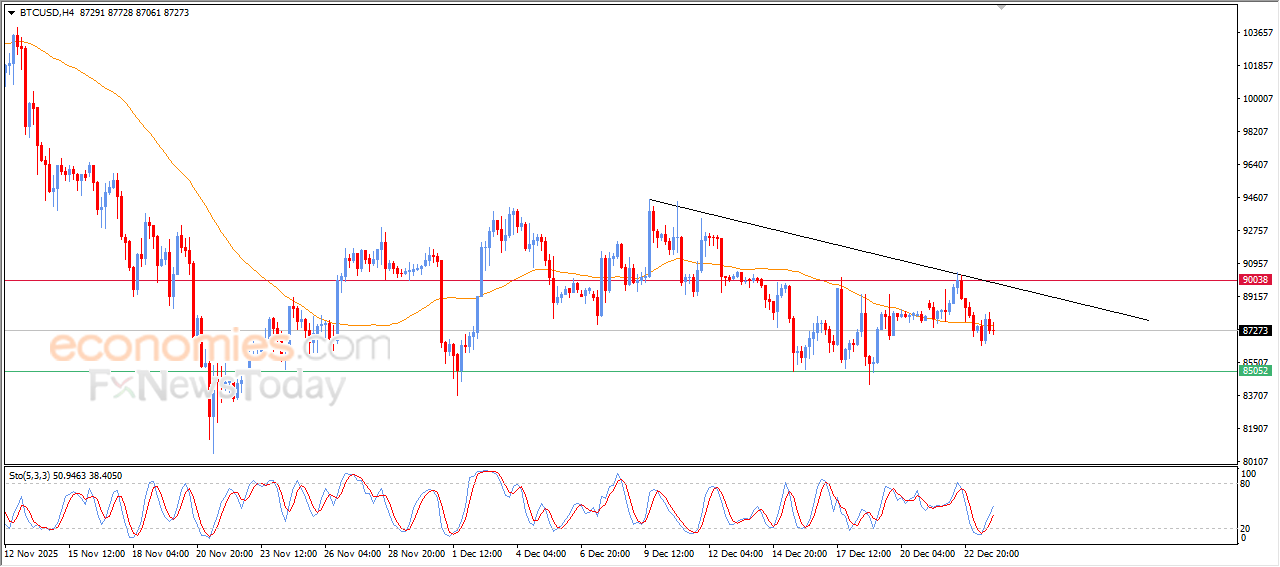

(BTCUSD) is under negative pressure- Analysis-24-12-2025

Bitcoin’s price declined in its last intraday trading, after offloading its oversold conditions on the relative strength indicators, however this improvement wasn’t enough to push the price to achieve new gains, as the price fails to settle above EMA50.

This decline comes amid the continuation of the main bearish trend dominance on the short-term basis, the trading alongside supportive minor trend line for this trend reinforces the negative pressures and limits the recovery chances in the near period.

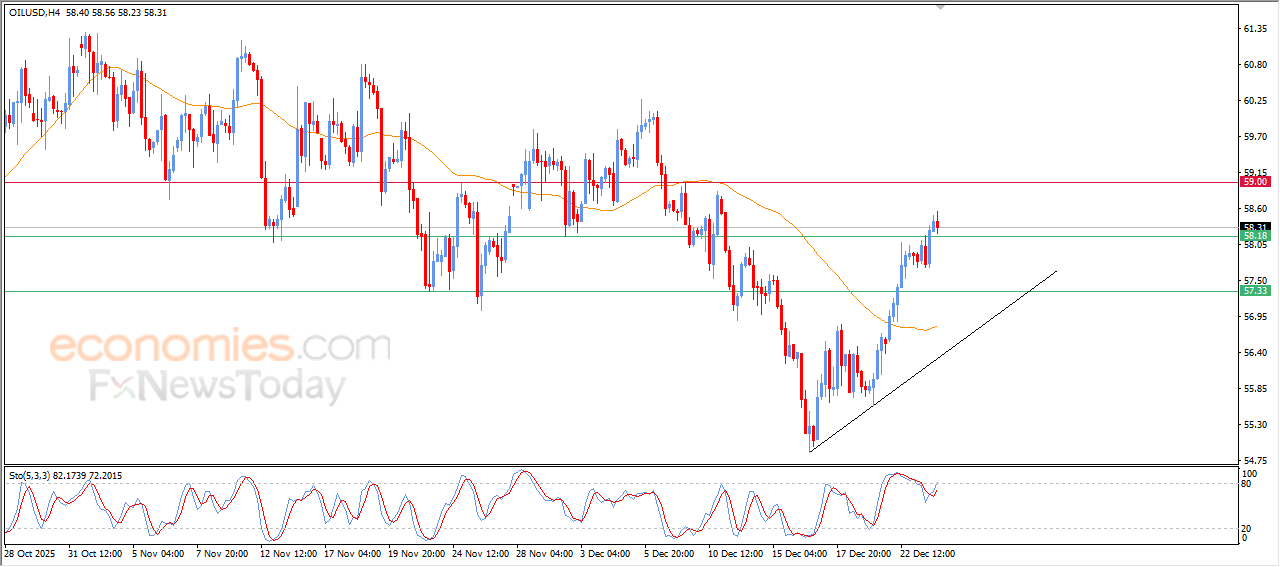

Crude oil price is gathering its gains- Analysis-24-12-2025

Crude oil declined slightly during its recent intraday trading, within a natural profit-taking phase after the previous strong rises, attempting to rearrange its technical position and gaining bullish momentum that might help it to resume the rise, amid the dominance of strong bullish corrective wave on a short-term basis.

The positive support continues due to its trading above EMA50, reinforcing the stability of the bullish trend, especially with the emergence of the positive signals on the relative strength indicators after offloading its overbought conditions, opening the way for achieving more gains in the upcoming period.