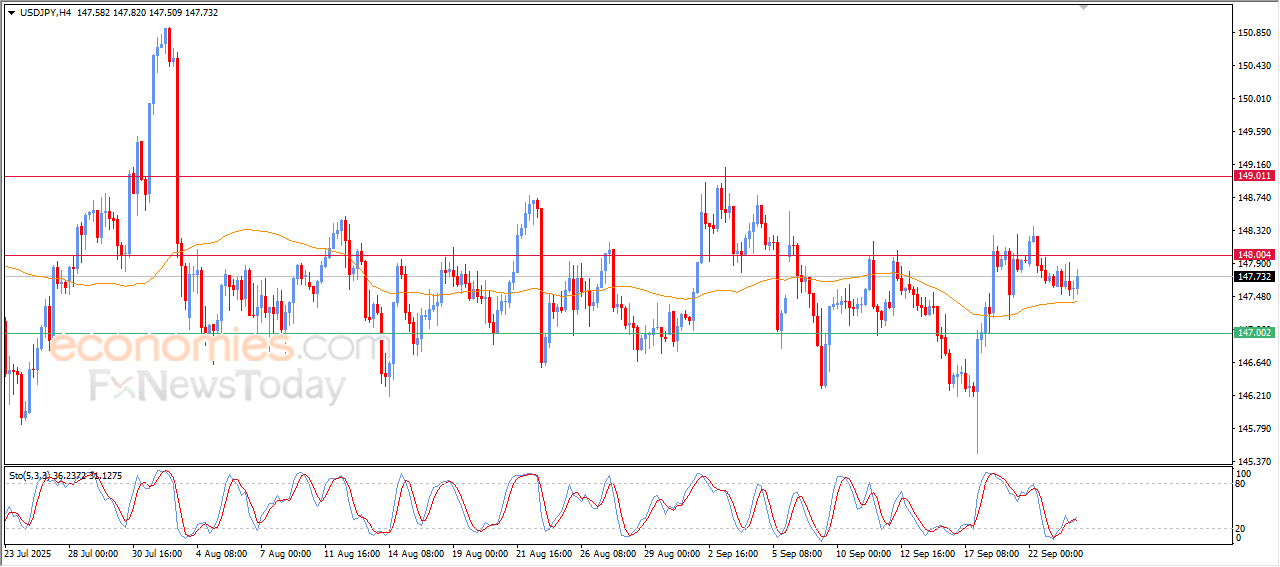

The USDJPY gets some support -Analysis-24-09-2025

AI Summary

- USDJPY rose in trading, holding above EMA50 support and gaining bullish momentum

- Positive signals on relative strength indicators emerged after reaching oversold levels, reinforcing bullish momentum

- BestTradingSignal.com offers high-accuracy trading signals for US stocks, crypto, forex, and VIP signals for various markets

The (USDJPY) rose in its last trading on the intraday levels, as it holding above the support of its EMA50, gaining bullish momentum that helped it to achieve these gains, especially with the emergence of the positive signals on the relative strength indicators, after reaching oversold levels, reinforcing the bullish momentum, amid the dominance of strong bullish sub-wave on the short-term basis.

VIP Trading Signals Performance by BestTradingSignal.com (September 15–19, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 15–19, 2025:

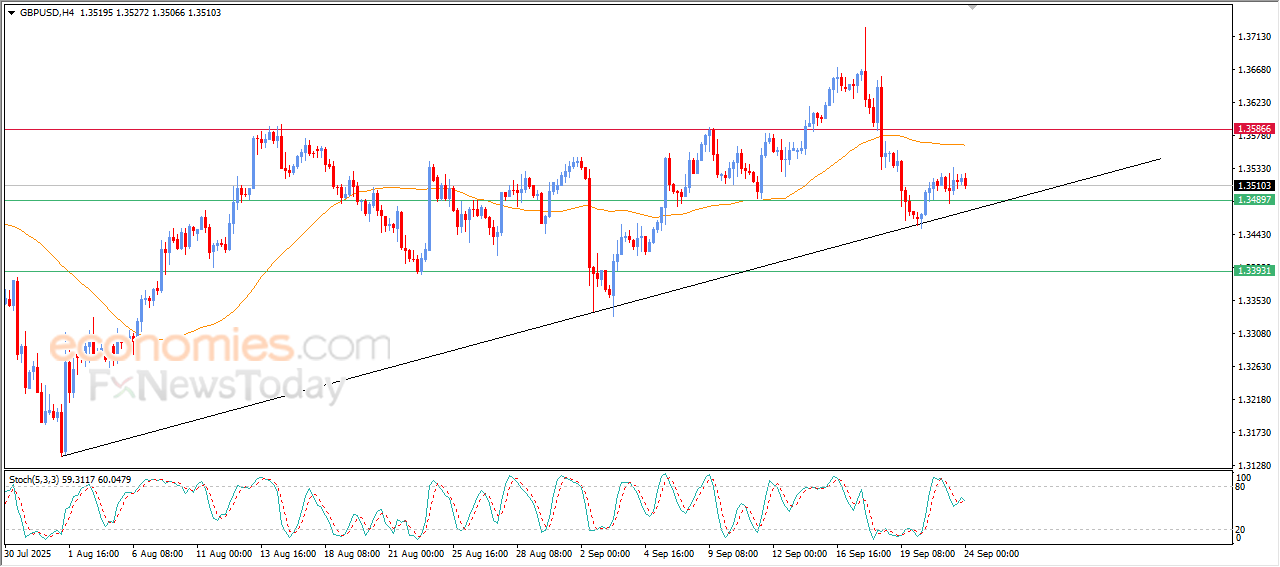

GBPUSD is witnessing fluctuated trading- Analysis-24-09-2025

The (GBPUSD) price witnessed tight sideways trading in yesterday’s trading, in an attempt to gain positive momentum that might help it to recover and rise again, amid the dominance of the main bullish trend on the short-term basis and its trading alongside bias line, with the emergence of the positive signals on the relative strength indicators, after offloading its overbought conditions, opening the way for achieving more of the upside moves on the near-term basis.

On the other hand, the negative pressure that comes from its trading below EMA50 remains valid, potentially hindering the price’s recovery attempts in the near term.

VIP Trading Signals Performance by BestTradingSignal.com (September 15–19, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 15–19, 2025:

Bitcoin (BTCUSD) is rising, affected by significant support-Analysis-24-09-2025

The (BTCUSD) rose slightly in its last intraday trading, taking advantage of the stability of the key support level at $112,000, gained positive momentum and assisted it to record these limited gains, after its success in stopping sever losses wave in the beginning of this week.

The price remains under negative pressure that comes from its trading below EMA50, accompanied by forming negative divergence on the relative strength indicators, after reaching exaggerated overbought levels compared to the price movement, which reinforces the chances of the selling pressures returning on a near-term basis.

VIP Trading Signals Performance by BestTradingSignal.com (September 15–19, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 15–19, 2025:

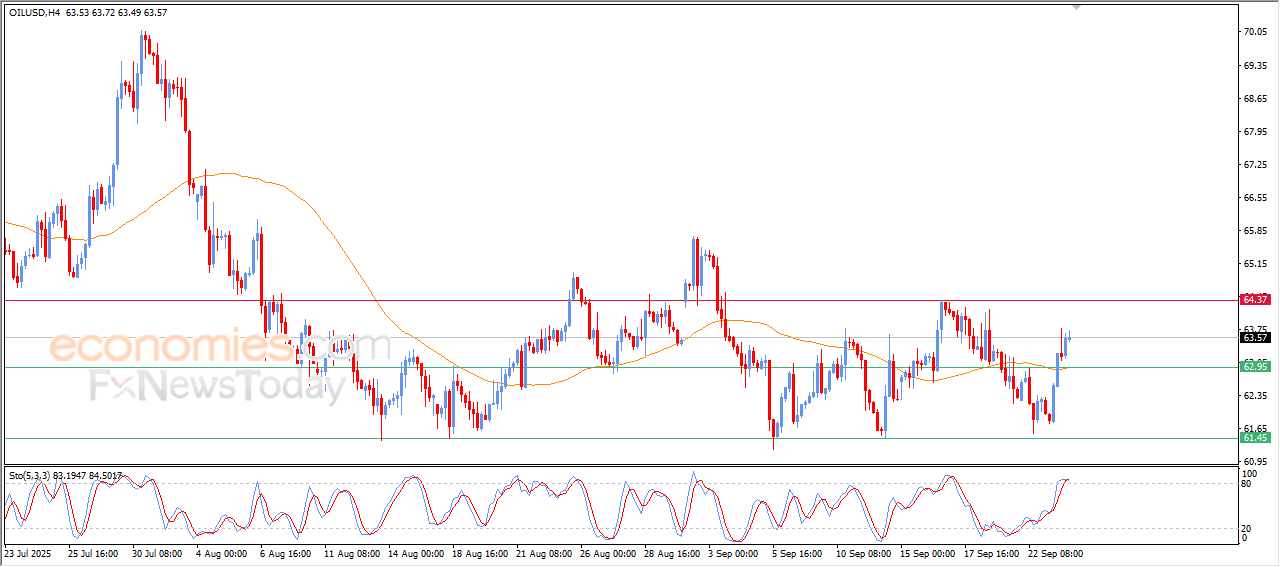

Crude oil price extends its gains- Analysis-24-09-2025

The (crude oil) price kept rising in its last intraday trading, taking advantage of its stability above EMA50, and under the dominance of strong bullish correction sub-wave, providing positive momentum that reinforces its attempts to recover.

On the other hand, we notice the appearance of negative overlapping signals on the relative strength indicators after reaching overbought levels, which might decelerate the strength of the rise on the near-term basis, and increase the chances of facing correctional rebounds.

VIP Trading Signals Performance by BestTradingSignal.com (September 15–19, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 15–19, 2025: