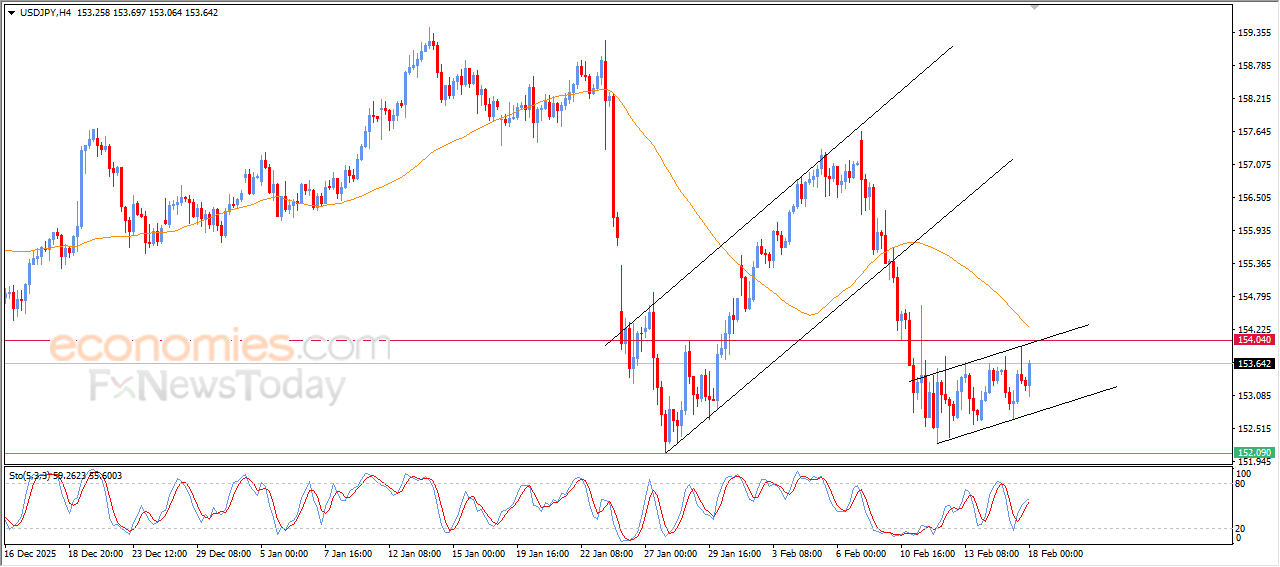

The USDJPY attempts to correct the bearish trend-Analysis-18-02-2026

The (USDJPY) rose in its last intraday trading, benefiting from the emergence of negative signals from the relative strength indicators, after reaching overbought levels, to move within bullish corrective channel’s range on intraday levels, in attempt to recover some previous losses, amid the continuation of the negative pressure due to its trading below EMA50, which makes any current bullish attempts threatened by a rebound under the continued technical pressure.

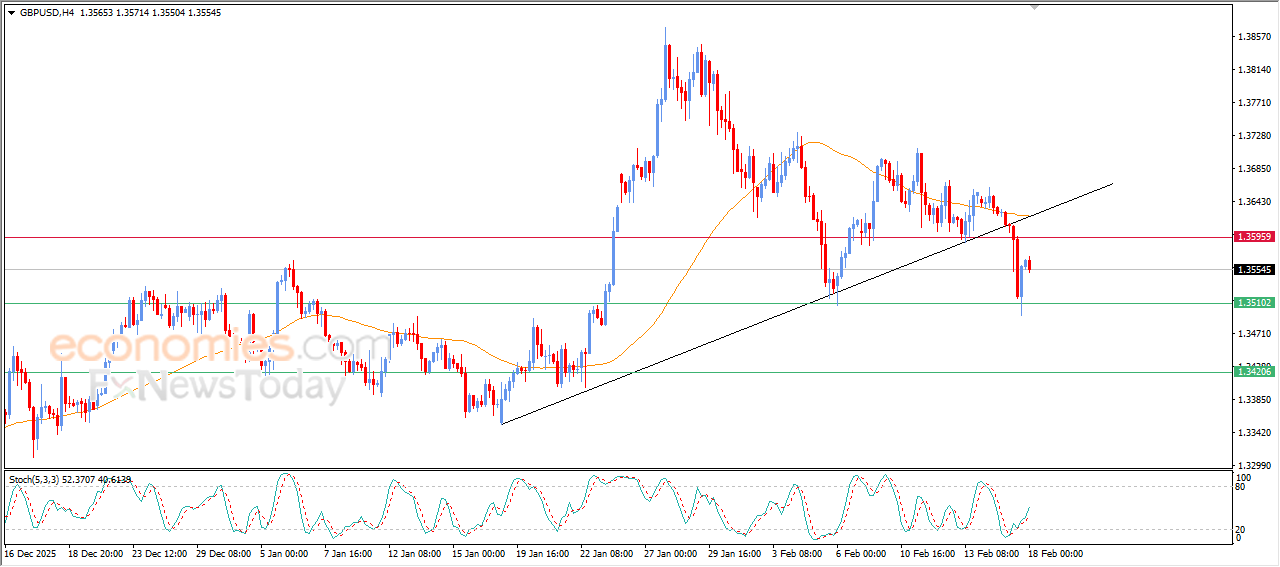

GBPUSD price begins to decline again - Analysis- 18-02-2026

GBPUSD declined in its last intraday trading, after it rebounded higher due to the stability of the current support at 1.3510, gaining bullish momentum that helped the pair to recover some previous losses and it’s succeeded in offloading its oversold conditions on relative strength indicators.

Affected by breaking short-term bullish trend line previously, with the continuation of the negative and dynamic pressure that is represented by its trading below EMA50, which reduces the chances of sustainable recovery on near-term basis.

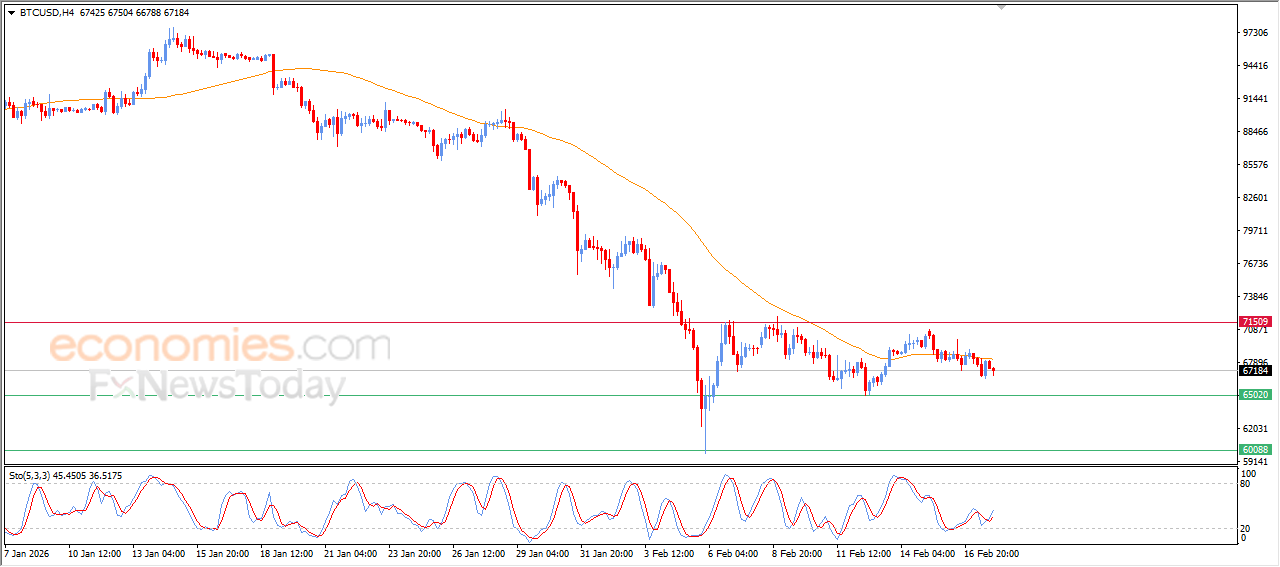

Bitcoin (BTCUSD) remains under selling pressures- Analysis-18-02-2026

Bitcoin’s price declined in its last intraday trading, continuing its negative movement, despite the emergence of positive signals from relative strength indicators after reaching oversold levels, indicating technical attempts to take a breather that might pave the way for limited corrective move, however these signals remain facing clear selling pressure that confirms the continuation of sellers’ dominance on the near-term trading.

This performance comes amid the stability of the price below EMA50, reinforcing the stability of the main bearish trend on short-term basis and supporting the negative overview; therefore any potential rising attempt depends on the price ability to breach this level and hold above it.

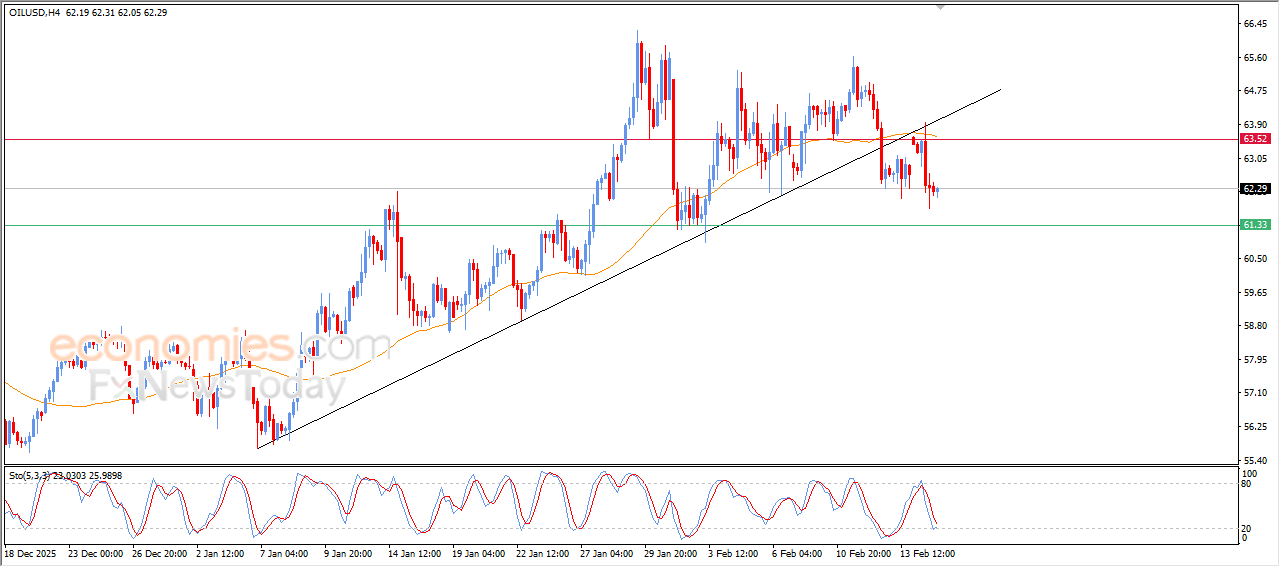

Crude oil prices are under negative pressures- Analysis- 18-02-2026

Crude oil prices declined in their last trading on intraday levels, affected by its previous break to main bullish trend line on short-term basis, in technical signal that turn the selling pressures, and this pressure continues with the stability of the price below EMA50, reinforcing the negativity and limits the chances of near recovery.

These developments coincide with emerging negative signals from relative strength indicators, which supports the likelihoods of the bearish track continuation in the upcoming period.