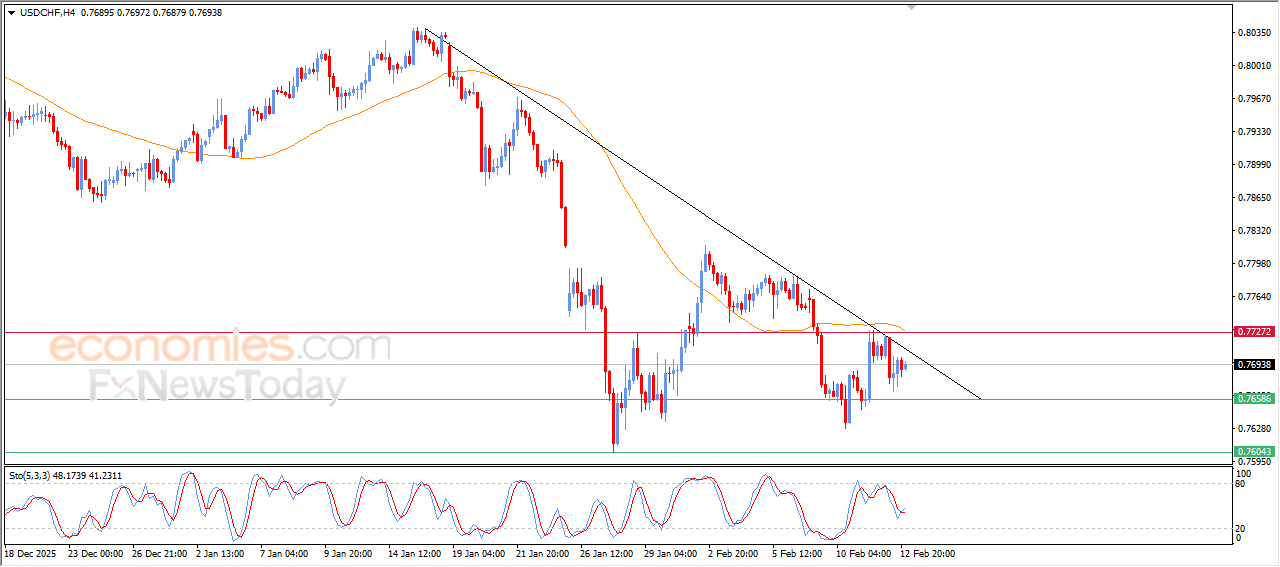

The USDCHF Price is under negative pressure- Analysis-13-02-2026

The (USDCHF) price is witnessing fluctuating trading that prefers moving higher on its last intraday levels, with the emergence of positive signals from relative strength indicators. This performance comes amid the dominance of the main bearish trend on short-term basis, with its trading alongside supportive trend line for this path, with the continuation of the dynamic negative pressure that is represented by its trading below EMA50, reducing the chances of full recovery on bear-term basis.

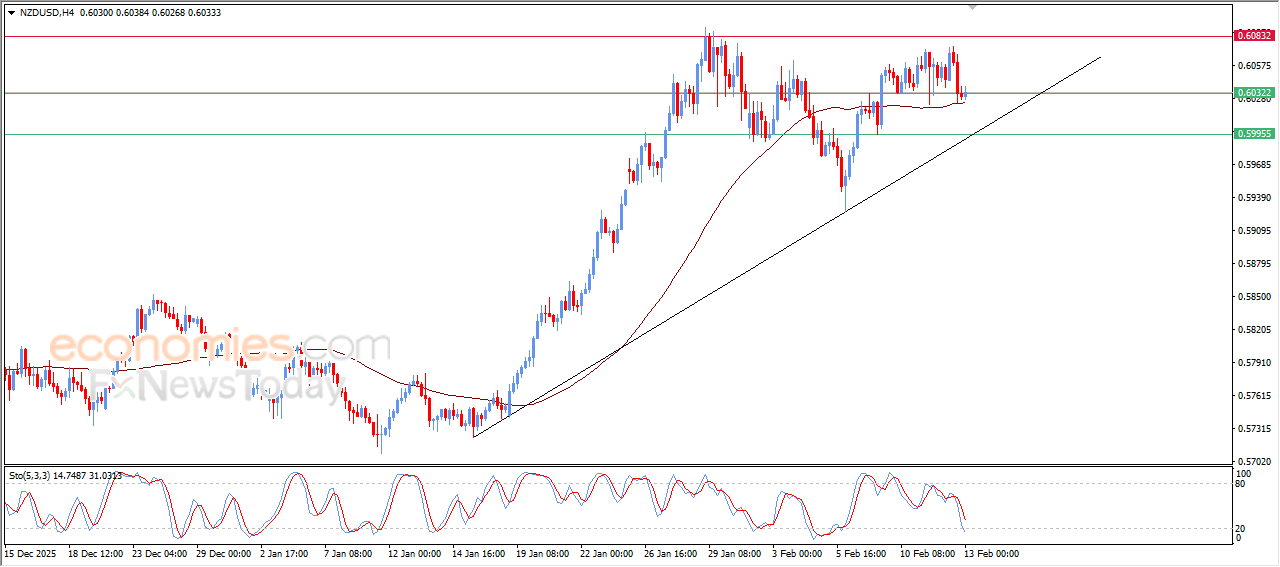

NZDUSD is leaning on its simple moving average-Analysis-13-02-2026

The (NZDUSD) price settles on a decline in its last intraday trading, amid the emergence of negative signals from relative strength indicators, after reaching overbought levels, which indicate entering a new bullish momentum that might help it to recover and rise again, especially with its leaning on EMA50’s support, amid the dominance of the main bullish trend on short-term basis, with its trading alongside supportive trend line.

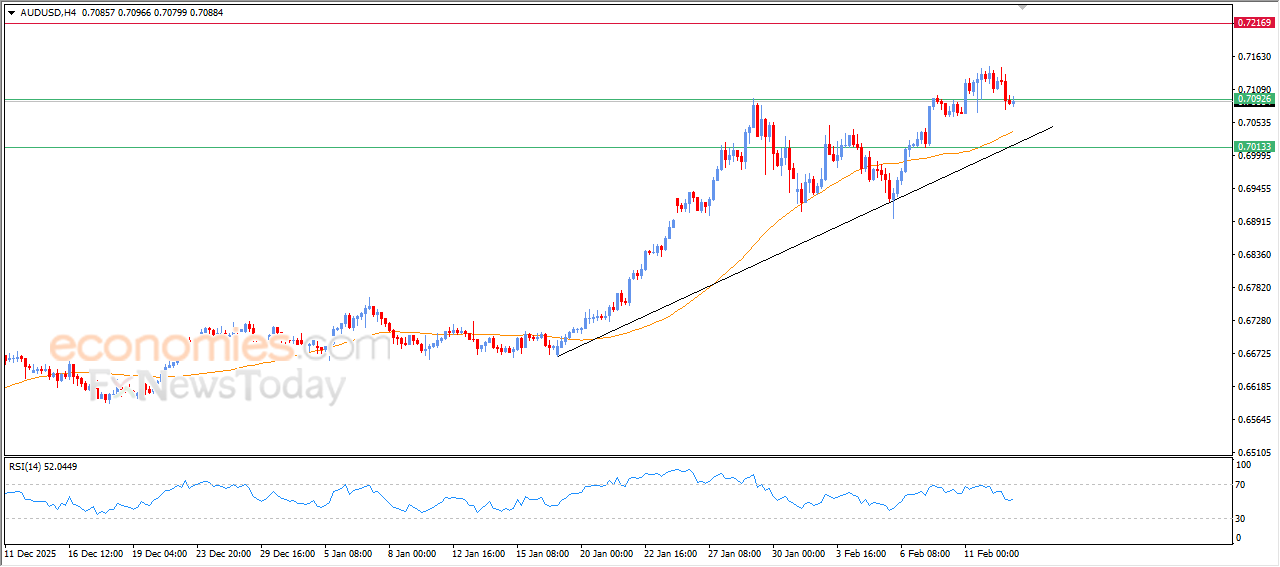

The AUDUSD price attempts to gain bullish momentum- Analysis-13-02-2026

The (AUDUSD) price declined in its last intraday trading, to gain bullish momentum that might help it to recover and rise again, leaning on 0.7090 key support, amid the continuation of the dynamic support that is represented by its trading above EMA50, which reinforces the stability and dominance of the main bullish trend on short-term basis, especially with its trading alongside supportive trend line for this path, noticing the emergence of positive overlapping signals on relative strength indicators, after offloading its overbought conditions, opening the way for the recovery and rising again.

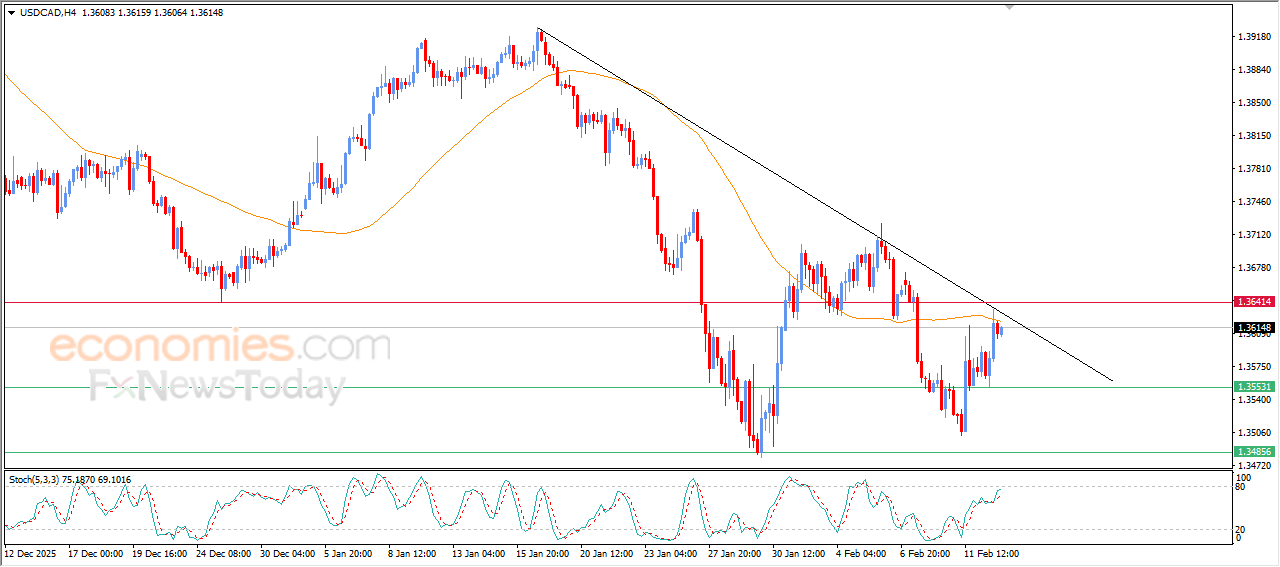

The USDCAD prices reach the resistance level of their simple moving average- Analysis-13-02-2026

The (USDCAD) price settles on strong gains in its last intraday trading, supported by the emergence of positive signals from relative strength indicators, reaching EMA50’s resistance, which curbed its recent gains, especially with the relative strength indicators reach exaggerated overbought levels compared to the price, indicating a quick fading to the bullish momentum, amid the dominance of the main bearish trend on short-term basis, with its trading alongside supportive trend line for this track.