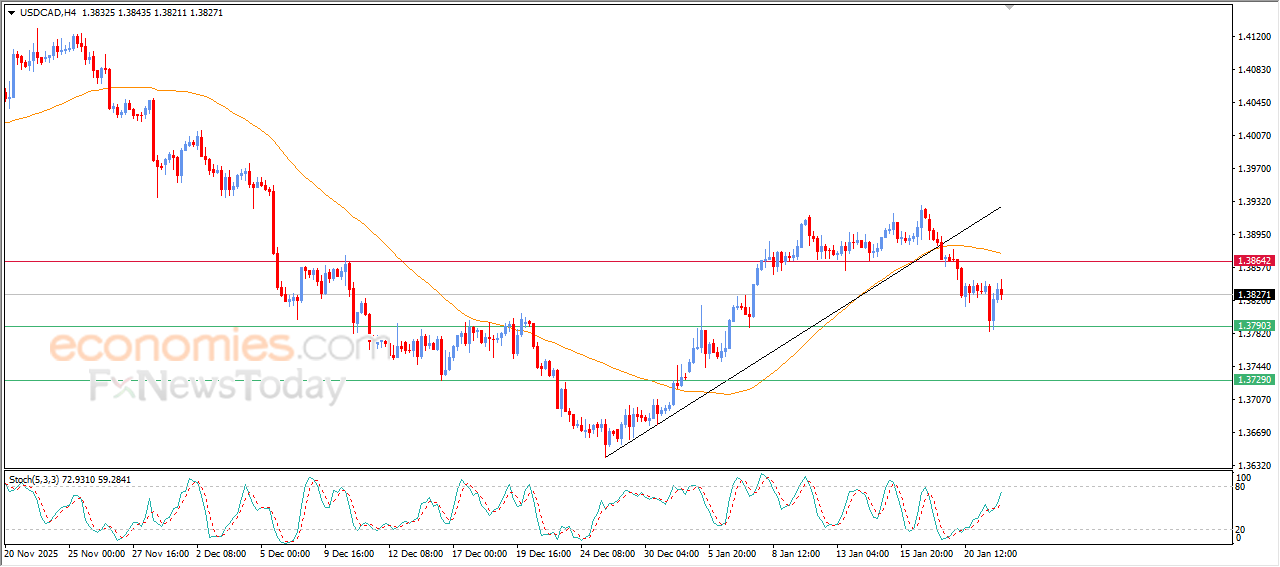

The USDCAD prices offloads its oversold conditions- Analysis-22-01-2026

The (USDCAD) price declined in its last intraday trading, after recovering some of its previous losses, and it offloaded its oversold conditions on relative strength indicators, to enter exaggerated overbought areas compared to the price move, indicating a quick decline in the bullish momentum, amid the continuation of the negative pressure due to its trading below EMA50, affected by breaking bullish corrective trend line on the short-term basis.

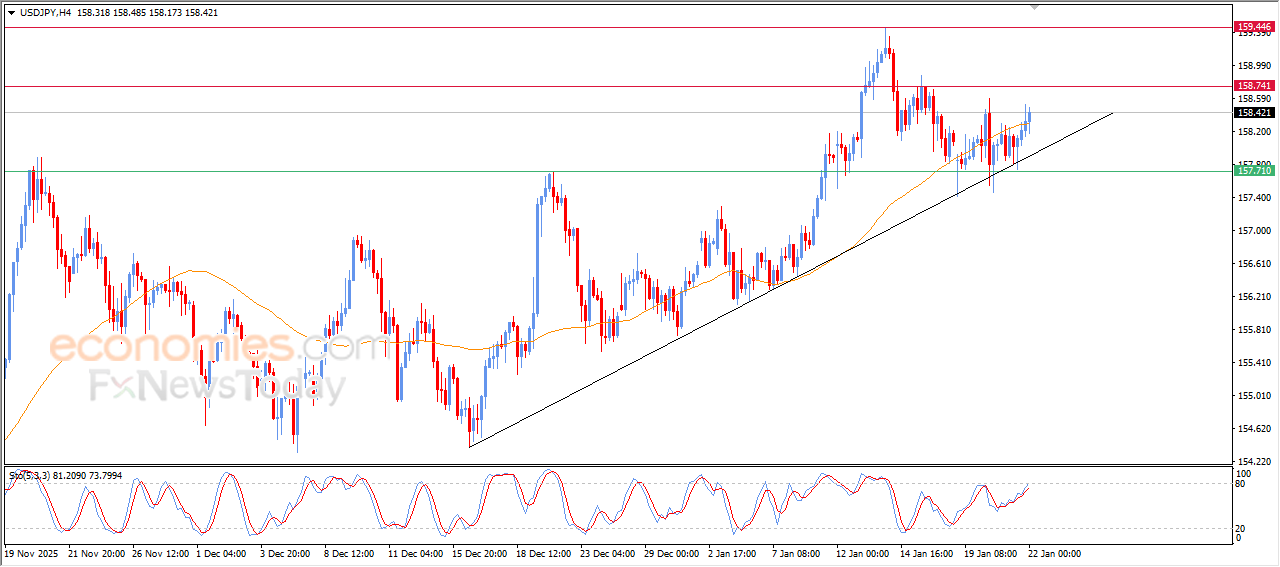

The USDJPY is getting rid of its negative pressure-Analysis-22-01-2026

The (USDJPY) extended its gains in its last intraday trading, preparing to attack 158.75 resistance, taking advantage of the main bullish trend dominance on the short-term basis, with its trading alongside supportive trendline, surpassing EMA50’s resistance, in a significant step to get rid of its negative pressure, supported by the emergence of positive signals from relative strength indicators.

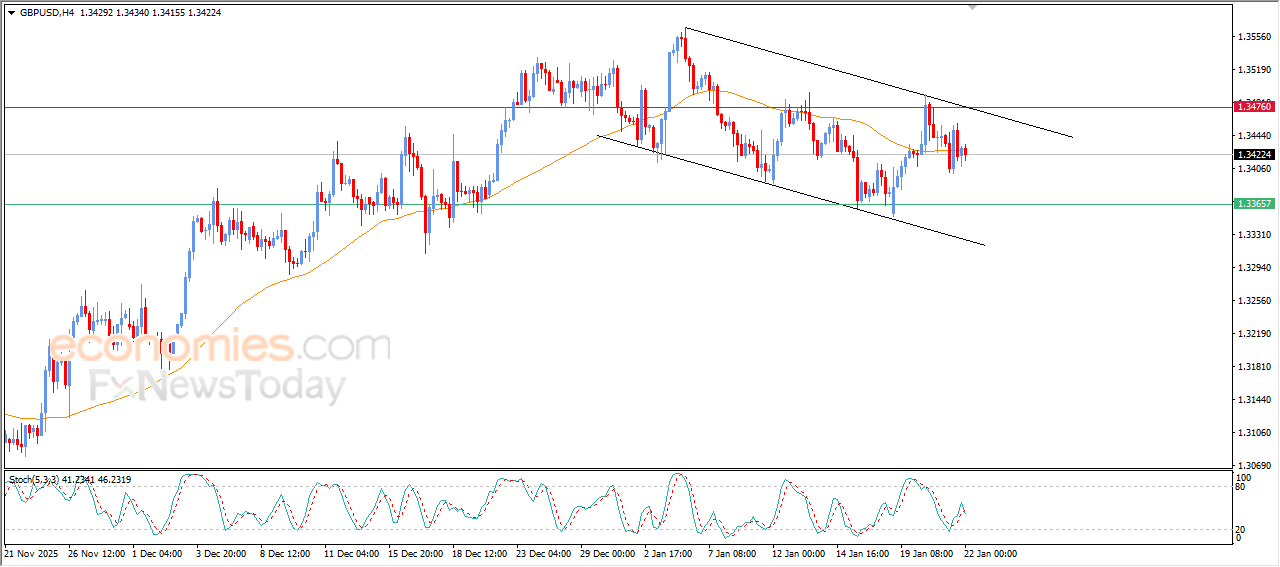

GBPUSD price is showing new negative signals- Analysis- 22-01-2026

GBPUSD declined in its last intraday trading, amid the continuation of negative pressure due to its trading below EMA50, which prevents the recovery in the last session, especially with its trading within bearish corrective channel’s range that limits its previous trading on short-term basis, besides the emergence of negative overlapping signals on relative strength indicators, after offloading its oversold levels, opening the way for recording new losses on near term basis.

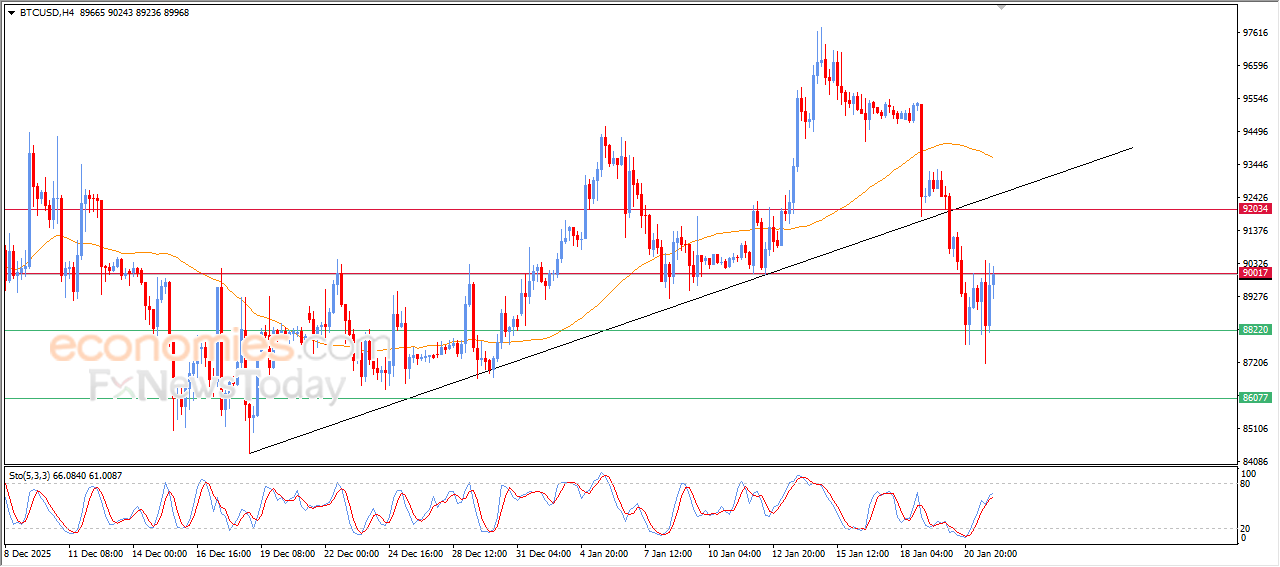

Bitcoin (BTCUSD) is retesting key resistance- Analysis-22-01-2026

Bitcoin’s price rose during its last intraday trading, supported by the emergence of positive signals by relative strength indicators, to reset $90,000 key resistance. However, the relative strength indicators reaching exaggerated overbought levels compared to the price move indicate the weakness of this momentum and a likelihood of declining quickly in the upcoming trading.

The price is affected negatively by its previous break to main bullish trend line on short-term basis, besides the continuation of the negative pressure due to its trading below EMA50, which reduces the chances of the price sustainable recovery in the near period.

Therefore, our expectations suggest a decline in BTCUSD price in its upcoming intraday trading, especially if $90,000, to target $88,000 support and there are chances to break it.

Expected trading range is bewteen$88,000 support and $92,000 resistance.

Today’s forecast: Bearish