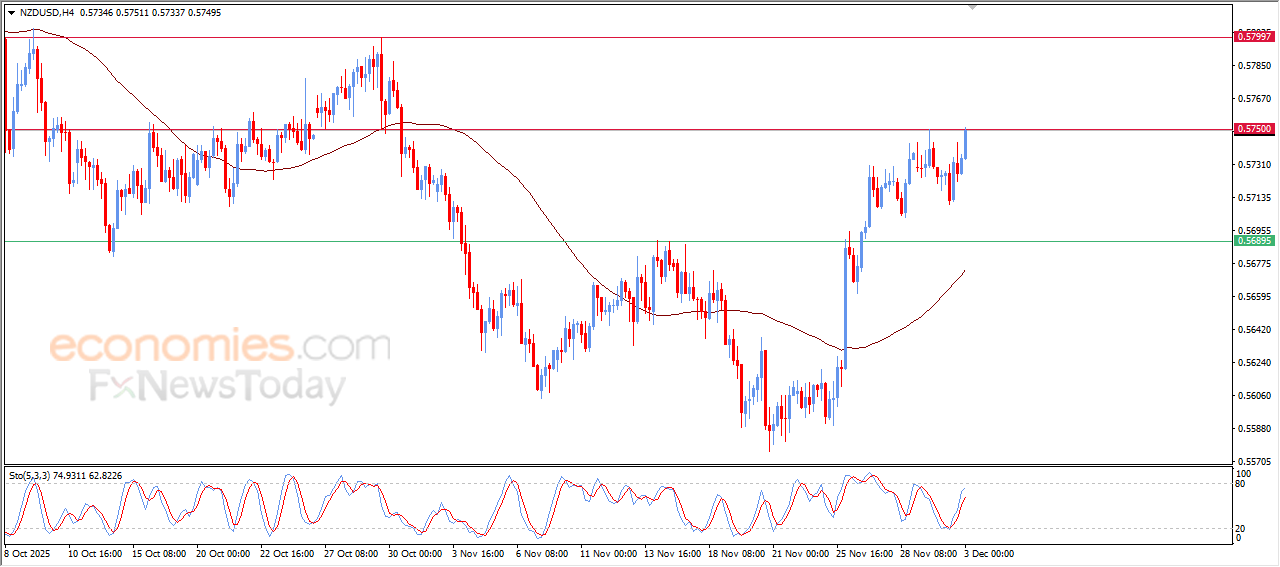

The AUDUSD price is getting ready to reach our expect target- Analysis-03-12-2025

The (AUDUSD) price reinforced its gains in its last intraday trading, preparing to reach the current resistance level at 0.6580, this resistance was our target in our previous analysis, taking advantage of the dynamic support that is represented by its trading above EMA50, besides the emergence of the positive signals on the relative strength indicators, despite reaching overbought levels, amid the dominance of minor bullish wave on the short-term basis, indicating the strength and volume of the bullish momentum around the pair.

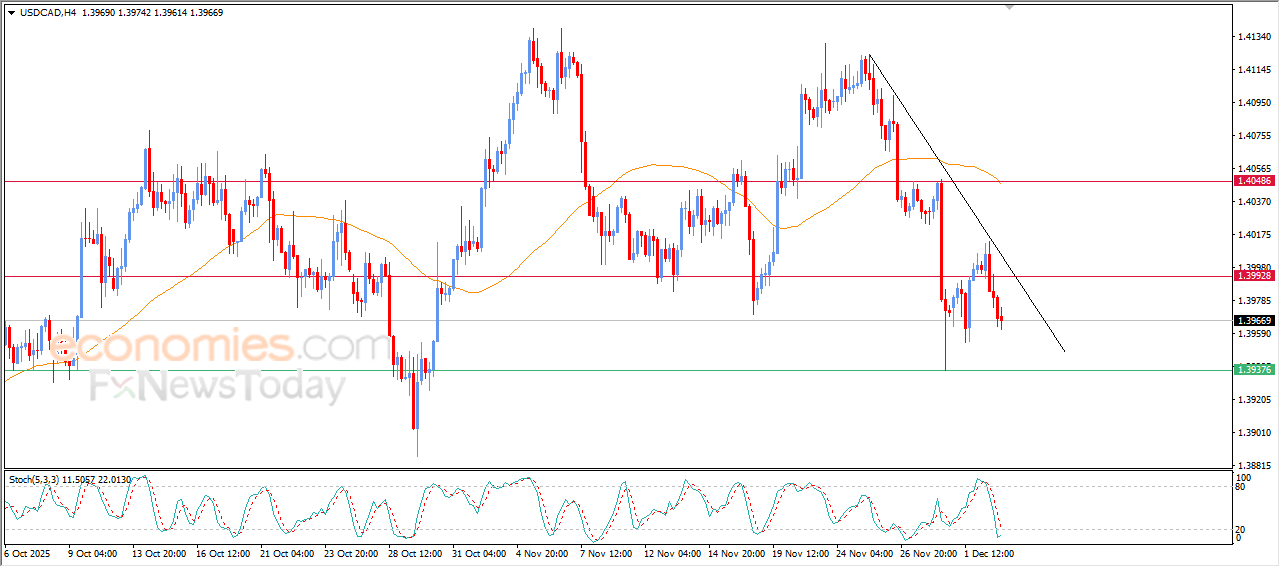

The USDCAD price keeps declining- Analysis-03-12-2025

The (USDCAD) price continued its decline in its last intraday trading, amid the dominance of bearish corrective wave on the short-term basis with its trading alongside steep bearish trend line that indicates the volume of bearish momentum, especially with its trading below EMA50, besides the emergence of the negative signals on the relative strength indicators, despite reaching oversold levels.

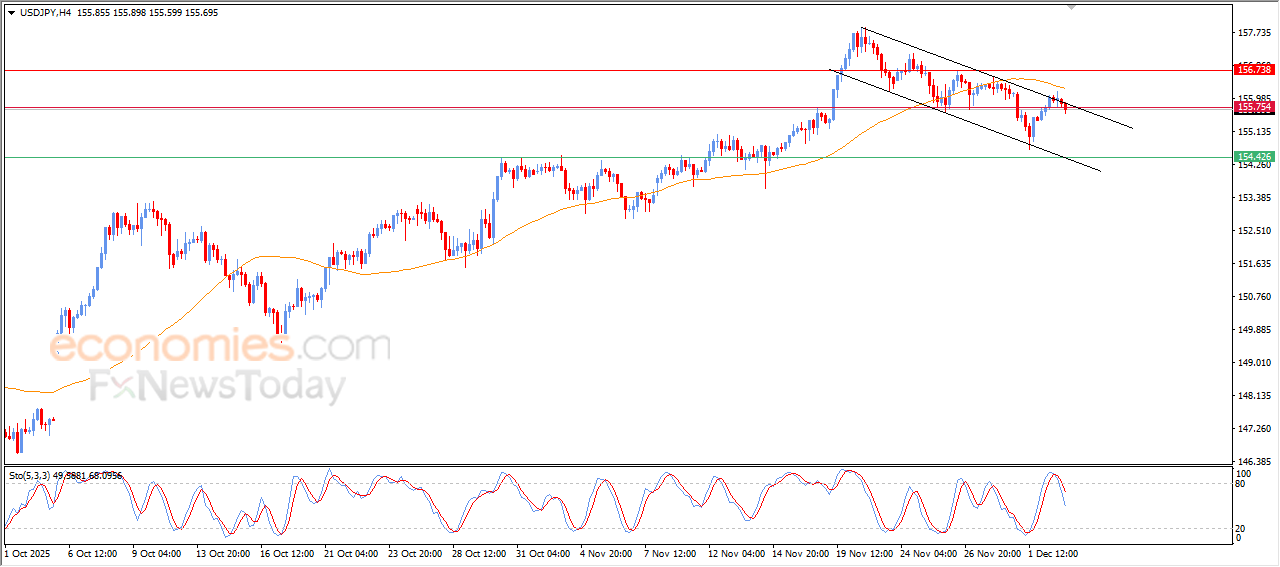

The USDJPY surrenders to the negative pressures-Analysis-03-12-2025

The (USDJPY) declined in its last intraday trading, after testing the top pf bearish corrective channel that limits its previous trading on the short-term basis, which put it under negative pressure especially with the beginning of forming negative divergence on the relative strength indicators, after reaching overbought levels, exaggeratedly compared to the price move, with the emergence of negative signals from there, this comes amid the continuation of the negative pressure that comes from its trading below EMA50, reducing the chances of the price recovery on the near-term basis.