NZ Dollar at the Top, while the US Dollar at the Bottom in August 2024!

The foreign exchange market trading for August 2024 concluded with the settlement of prices on Friday, August 30, where the New Zealand dollar delivered an impressive performance throughout the month, outperforming most major and minor currencies.

- Reserve Bank of New Zealand Faces Persistent Economic Pressures

- Weak Prospects for Additional Cuts in New Zealand Interest Rates

- More Pessimistic Comments from the Federal Reserve Chairman

- Jerome Powell: It's Time to Adjust Monetary Policy

New Zealand Dollar Performance

The wide activity of buying the New Zealand dollar as the best available investment is based on weak prospects for additional cuts in New Zealand interest rates this year.

With the improvement of economic conditions and the highest level of business confidence in ten years, the Reserve Bank of New Zealand is widely expected to adopt a more aggressive approach to lowering New Zealand interest rates.

Gains in the New Zealand dollar were also supported by improved risk sentiment in global financial markets, with the impending launch of the monetary easing cycle in the United States, the world's largest economy.

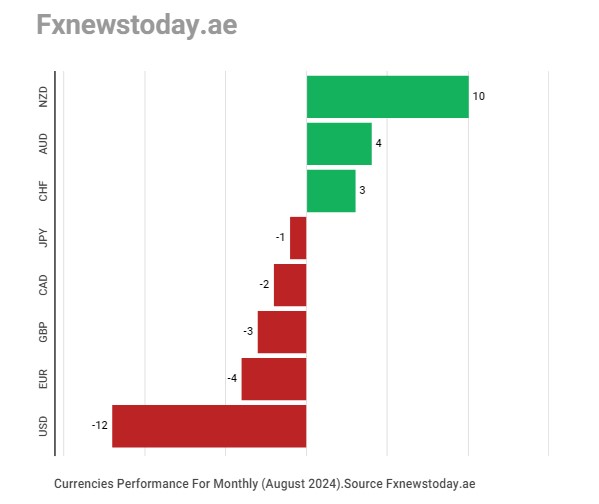

Currency Performance in August

Returning to the list of winning currencies in August, the US dollar was at the bottom of the list due to accelerated open selling after more pessimistic comments from Federal Reserve Chairman Jerome Powell at the Jackson Hole Forum, which strongly boosted the prospects of a significant rate cut starting in September.

| Currency | Performance (Points) |

|---|---|

| New Zealand Dollar | +10 |

| Australian Dollar | +4 |

| Swiss Franc | +3 |

| US Dollar | -12 |

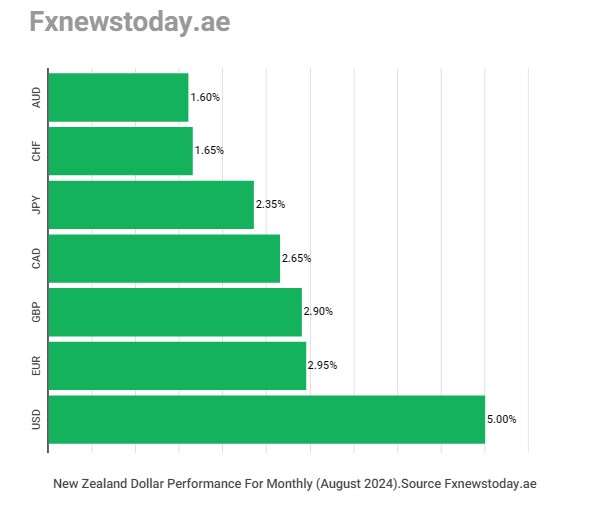

New Zealand Dollar vs Major Currencies

- New Zealand Dollar soared by 5.4% against the US Dollar, marking the biggest monthly gain in 2024 since November 2023, reaching a seven-month high at 62.99 cents on August 29.

- Rose by 2.95% against the Euro, the largest monthly gain since September 2023, reaching a seven-week high at 1.7651 on August 29.

- Increased by 2.9% against the British Pound, the biggest monthly gain since August 2023, reaching a seven-week high at 2.0981 on August 29.

- Gained 2.65% against the Canadian Dollar, the largest monthly gain since May, reaching a two-month high at 0.8474 on August 29.

- Rose by 2.35% against the Japanese Yen, reaching a four-week high at 91.42 on August 30.

- Added 1.65% against the Swiss Franc, the largest monthly gain since May, reaching a four-week high at 0.5321 on August 30.

- Increased by 1.6% against the Australian Dollar, the largest monthly gain since November 2022, reaching a two-month high at 1.0798 on August 29.

Reserve Bank of New Zealand

J.P. Morgan stated that the Reserve Bank of New Zealand's early action on interest rate cuts provided some support for the New Zealand dollar, with improved economic prospects reducing pressure on high rates.

Ben Key Garman, an analyst at J.P. Morgan, commented that markets had already priced in a significant amount of easing, but starting the process earlier than expected has provided greater comfort that the New Zealand economy will stabilize through 2025, allowing for reduced risk premiums for more severe slowdowns.

Garman added that interest rates are not as much of a headwind as might be assumed, as the Reserve Bank of New Zealand has roughly matched the implied easing in terminal interest rates.

In other words, the market may have reached peak pessimism on the New Zealand dollar, with any improvement in the economic cycle reducing the need for further interest rate cuts from the Reserve Bank of New Zealand.

Best Available Investment

Investors focus on buying the New Zealand dollar as one of the best available investment opportunities in the foreign exchange market, with the Reserve Bank of New Zealand maintaining a high-interest rate, ranking second only to the Federal Reserve among the eight major currencies.

As the Federal Reserve approaches an expected rate cut in September, New Zealand interest rates are expected to top the list of major and minor currency interest rates.

Business Confidence in New Zealand

A survey by ANZ Bank showed that business confidence in New Zealand jumped to its highest level in ten years in August, with strong forward-looking activity indicators.

A key measure of business confidence showed that 50.6% of respondents expect the New Zealand economy to improve over the next year, compared to 27.1% in the previous July survey.

Sharon Zollner, Chief Economist at ANZ, stated: "Things are looking up, though from a very dark place for many companies."

New Zealand Interest Rates

The probability of the Reserve Bank of New Zealand cutting rates by 25 basis points at the October 9 meeting remains below 50%, pending further data on inflation, unemployment, and growth in New Zealand in the coming period.

Risk Sentiment

Most global stock markets, led by U.S. equities on Wall Street, rose amid strong risk sentiment, particularly with increasing expectations of the Federal Reserve easing monetary policy and cutting U.S. rates.

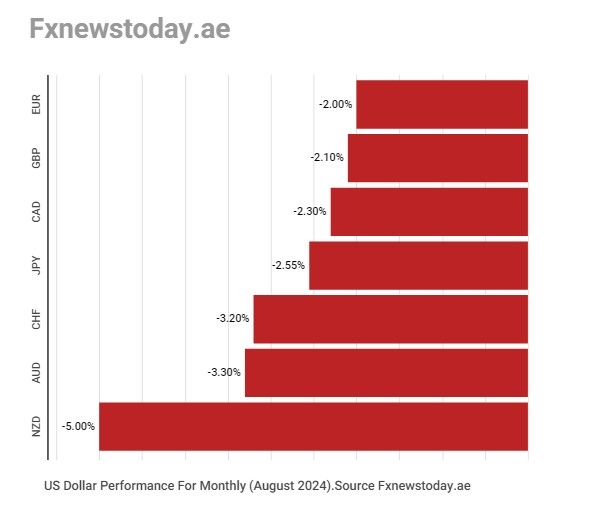

US Dollar Performance

The image above illustrates the negative performance of the US dollar in August 2024 against the seven major currencies in the foreign exchange market, due to more pessimistic comments from the Federal Reserve Chairman.

Jerome Powell

Federal Reserve Chairman Jerome Powell stated at the Jackson Hole Economic Forum: "It's time to adjust monetary policy." Powell added that his confidence had increased that inflation is on a sustainable path back to the 2% target.

Powell emphasized: "We do not seek or welcome further slowing in labor market conditions," and noted that the current interest rate level provides ample room to respond to risks, including additional unwanted weakness in the labor market.

He also stated that the labor market slowdown is unmistakable, and we are no longer in an overheated state. Powell added that inflation has decreased significantly, and we are now much closer to the target.

Powell further explained: "The balance of risks to our mandates has changed. The upside risks to inflation have diminished, and the downside risks to employment have increased."

US Interest Rates

- Following Powell’s comments, according to CME Group's FedWatch tool, the pricing of a 50 basis point cut in U.S. interest rates at the September meeting rose from 25% to 33%, while the pricing of a 25 basis point cut dropped from 75% to 67%.

- Based on current interest rate futures, markets are pricing in cuts totaling 100 basis points in U.S. interest rates before the end of the year.

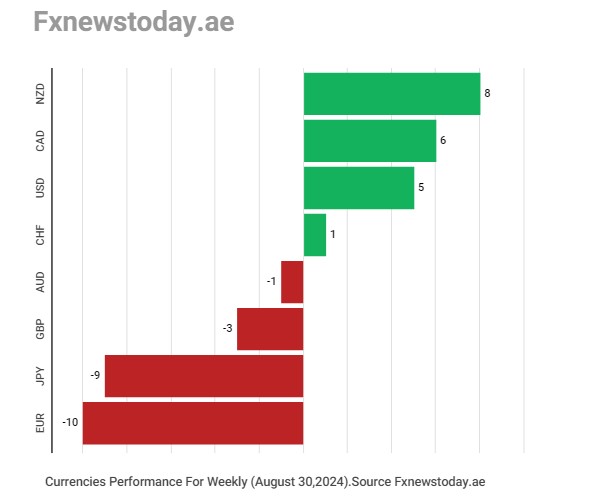

NZ Dollar Leads Forex Market for the Second Week in a Row!

Weak Prospects for Additional Cuts in New Zealand Interest Rates

At the end of last week's trading, the New Zealand dollar led the foreign exchange market for the second consecutive week, outperforming most major and minor currencies. This was due to increased buying of the New Zealand currency as the best available investment, based on weak prospects for additional cuts in New Zealand interest rates this year.

With the improvement in the country's economy and the highest level of business confidence in ten years, the Reserve Bank of New Zealand is widely expected to adopt a more aggressive pace in cutting New Zealand interest rates.

The New Zealand dollar gains were also supported by improved risk sentiment in global financial markets, as the U.S. is set to start a new round of monetary easing, the world's largest economy.

Declining Inflation Pressures on European Monetary Policy Makers

Returning to the list of winning currencies, the euro was at the bottom of the list due to accelerated selling after key inflation data in Europe for August showed declining inflation pressures on European Central Bank policy makers, increasing the likelihood of a European interest rate cut in September.

Before delving into the reasons that supported the New Zealand dollar and heavily pressured the euro, let's first look at the performance of the eight major currencies in the foreign exchange market last week.

| Currency | Performance |

|---|---|

| New Zealand Dollar | +8 points |

| Canadian Dollar | +6 points |

| US Dollar | +5 points |

| Euro | -10 points |

New Zealand Dollar

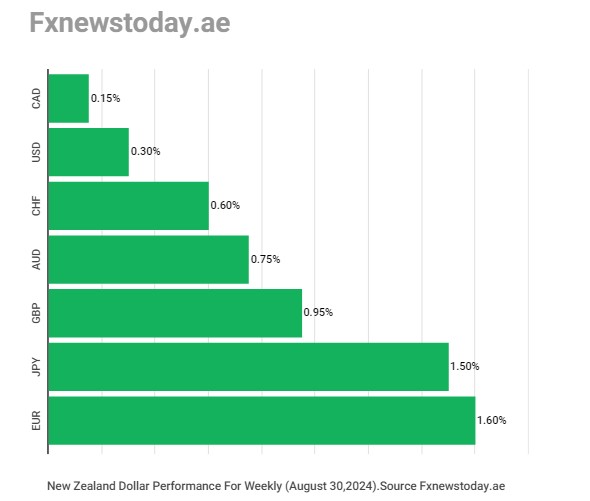

Reviewing the performance of the New Zealand dollar against the seven major currencies last week, it surged by 1.6% against the euro, reaching a seven-week high at 1.7651 on Thursday.

- Increased by 1.5% against the Japanese yen, reaching a four-week high at 91.42 on Friday.

- Rose by 0.95% against the British pound, hitting a seven-week high at 2.0981 on Thursday.

- Gained 0.75% against the Australian dollar, reaching a two-month high at 1.0798 on Thursday.

- Up 0.60% against the Swiss franc, reaching a four-week high at 0.5321 on Friday.

- Increased by 0.30% against the US dollar, reaching a seven-month high at 62.99 cents on Thursday.

- Up 0.15% against the Canadian dollar, reaching a two-month high at 0.8474 on Thursday.

Investment Opportunities

Investors focus on buying the New Zealand dollar as one of the best investment opportunities in the foreign exchange market, with the Reserve Bank of New Zealand maintaining a high interest rate, second only to the Federal Reserve's rates among the eight major currencies.

As the Federal Reserve nears an expected rate cut in September, New Zealand rates are expected to top the list of major and minor currency interest rates.

Reserve Bank of New Zealand

- J.P. Morgan stated that the Reserve Bank of New Zealand’s early move on rate cuts provided some support for the currency, with better economic prospects easing pressure on high rates.

- Ben Key Garman, an analyst at J.P. Morgan, noted that markets had already priced in significant easing, but with the actual process beginning slightly earlier, there’s now slightly more comfort that the New Zealand economy will stabilize through 2025, allowing for some reduction in risk premiums.

- Garman added that rates are not as counterproductive as might be assumed, as the Reserve Bank of New Zealand has only roughly matched the implied degree of easing in aggregate terminal rates.

- He concluded that the market may have reached its peak pessimism about the New Zealand dollar, with any economic improvement reducing the scope for required rate cuts.

Business Confidence in New Zealand

A survey conducted by ANZ Bank last week showed that New Zealand business confidence surged in August to its highest level in ten years, with strong forward-looking activity indicators.

A key measure of the New Zealand business confidence survey indicated that 50.6% of respondents expect the economy to improve over the next year, compared to 27.1% in the previous July survey.

Sharon Zollner, ANZ's Chief Economist, said in a statement: "Things are looking up, though from a very dark place for many companies."

New Zealand Interest Rates

The likelihood of the Reserve Bank of New Zealand cutting rates by 25 basis points at the October 9 meeting remains below 50%, awaiting more data on inflation, unemployment, and growth in New Zealand in the coming period.

Risk Sentiment

Most global stock markets, led by U.S. equities on Wall Street, rose amid strong risk sentiment, particularly with increasing expectations of the Federal Reserve easing monetary policy and cutting U.S. rates.

Euro

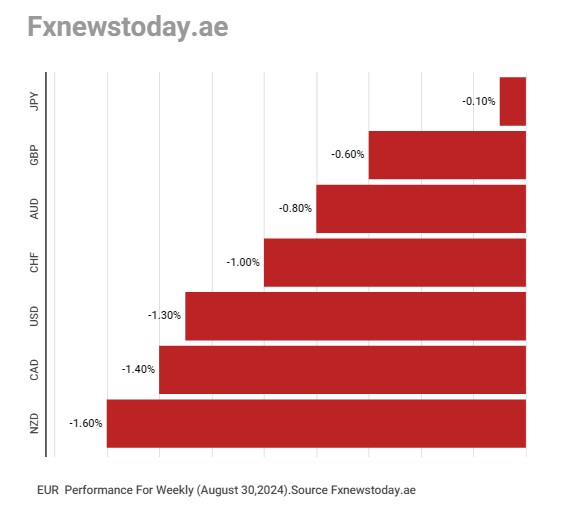

The image above shows the extensive losses the euro suffered last week against the seven major currencies in the foreign exchange market due to key inflation data in Europe for August.

European Inflation Slowdown

Official data released on Friday showed that inflation levels in Europe slowed in August, thereby reducing inflationary pressures on European Central Bank policymakers.

| Indicator | August | July |

|---|---|---|

| Overall CPI | 2.2% | 2.6% |

| Core CPI | 2.8% | 2.9% |

European Interest Rates

The data above indicate declining inflation pressures on European Central Bank policymakers, leading to a rise in the futures market pricing of a 25 basis point rate cut by the ECB in September, increasing from 60% to 80% probability.

US stock indices end the month with strong gains, Dow Jones closes with fresh record highs

US stock indices rose on Friday amid optimism about the Federal Reserve’s policies after earlier data confirmed inflation has subsided in the US.

Official data showed US personal income rose 0.3% in July, beating estimates of a 0.2% rise, and up from June's 0.2% increase.

US personal spending rose 0.5% in July, matching expectations and up from 0.3% in the previous reading.

The University of Michigan’s consumer confidence index rose 2.3% m/m to 67.9 in August from 66.4 in July.

Dow Jones rose 0.5% at the close to 41,563, with a weekly profit of 1%, and a monthly profit of 1.75%.

S&P 500 rose 1% at the close to 5648, with a weekly profit of 0.25%, and a monthly profit of 2.3%.

NASDAQ bucked the trend with a 1.1% loss to 17,713, with a weekly loss of 0.9%, but a monthly profit of 0.6%.

Ethereum registers hefty loss of 9% this week

Most cryptocurrencies lost ground on Friday as traders shun high-risk assets and shrug off earlier US data that bolstered the case for multiple Fed rate cuts this year.

Official data showed US personal income rose 0.3% in July, beating estimates of a 0.2% rise, and up from June's 0.2% increase.

US personal spending rose 0.5% in July, matching expectations and up from 0.3% in the previous reading.

The University of Michigan’s consumer confidence index rose 2.3% m/m to 67.9 in August from 66.4 in July.

Ethereum

On trading, ethereum fell 1.1% to $2508.8, marking a loss of 9% this week.

Ripple

Ripple fell 0.3% as of 21:26 GMT to $0.5608, with a weekly loss of 8% as well.