In July 2024, why did the Japanese yen outperform all other currencies?

• Bank of Japan intervenes in the foreign exchange market to support the local currency

- Accelerated unwinding of carry yen trades due to Japanese interest rate speculation

- Rising inflationary pressures on the Japanese Central Bank

- Bank of Japan raises interest rates to the highest level since 2008

- Bank of Japan announces an aggressive quantitative tightening plan

- More aggressive comments from Bank of Japan Governor "Kazuo Ueda"

- Increased likelihood of US interest rate cuts being fully priced in

The foreign exchange market ended its July 2024 trading session with the final settlement of prices on Wednesday, July 31. Throughout the month, the Japanese currency demonstrated an impressive performance, dominating the list of major currencies. This was due to the Bank of Japan's intervention to support the local currency against excessive weakness, as well as the accelerated unwinding of carry yen trades due to increasing speculation about additional Japanese interest rate hikes.

With rising inflationary pressures on policymakers at the Japanese Central Bank, the likelihood of a second interest rate hike this year increased, which indeed happened as the Bank of Japan raised the interest rate to its highest level since 2008.

The Bank of Japan also announced an aggressive quantitative tightening plan, gradually reducing government bond purchases over two years, aiming to halve them by the first quarter of 2026. Governor "Kazuo Ueda" stated that there is no specific cap for the benchmark interest rate during the current normalization cycle.

The Federal Reserve also strongly opened the door for US interest rate cuts in September, which would further narrow the interest rate gap between Japan and the United States, enhancing investment opportunities in the Japanese yen and accelerating the unwinding of carry yen trades.

Returning to the list of winning currencies in July, the Australian dollar came last, due to risk aversion in global markets and concerns related to the Chinese economy, Australia's largest trading partner.

Before detailing the factors that supported the Japanese yen and heavily pressured the Australian dollar, let's first review the performance of the eight major currencies in the foreign exchange market during July 2024.

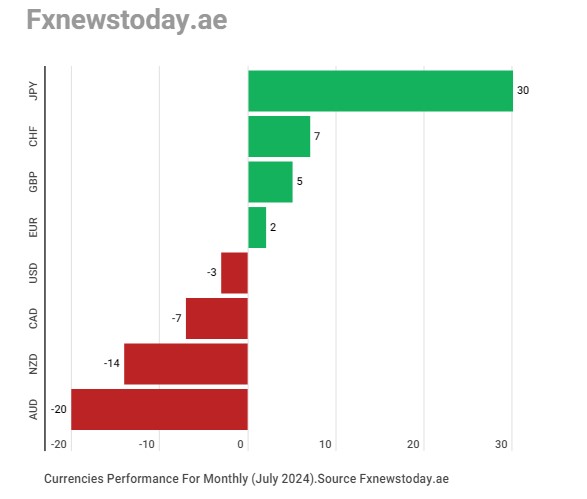

The Japanese yen rose by 30 points on the "FX News Today" monthly index for measuring currency strength, followed by the Swiss franc in second place with 7 points, and the British pound in third place with 5 points. The Australian dollar ranked last with a negative 20 points.

Japanese Yen

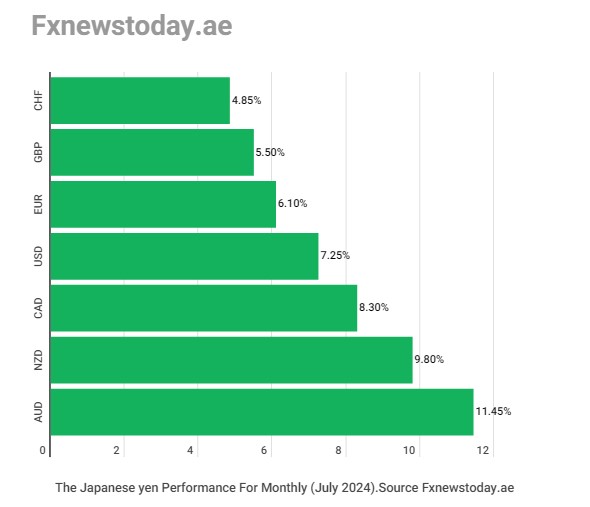

Looking at the detailed performance of the Japanese yen in July against the seven major currencies, it swept the Australian dollar with a gain of 11.45%, the largest monthly gain since May 2010, reaching a four-month high of 99.21 yen on Thursday, July 25.

It rose by 9.8% against the New Zealand dollar, the largest monthly gain since May 2012, reaching a six-month high of 89.80 yen on Thursday, July 15.

It climbed by 8.3% against the Canadian dollar, achieving the largest monthly gain since January 2015, reaching a six-month high of 108.33 yen on Thursday, July 25.

It increased by 7.25% against the US dollar, the largest monthly gain since November 2022, reaching a four-month high of 151.94 yen on Thursday, July 25.

It rose by 6.1% against the euro, the largest monthly gain since June 2016, reaching a four-month high of 162.01 yen on Thursday, July 25.

It added 5.5% against the British pound, the largest monthly gain since May 2019, reaching a two-month high of 192.16 yen on Thursday, July 25.

It climbed by 4.85% against the Swiss franc, the largest monthly gain since June 2016, reaching a two-month high of 170.31 yen on Thursday, July 25.

Bank of Japan Intervention

Recent daily transaction data from the Japanese Central Bank showed that the Bank of Japan spent nearly 6 trillion yen "35 billion US dollars" on Thursday and Friday, July 11-12, less than three months after the last intervention in the foreign exchange market.

The Bank of Japan intervened at the end of April and early May, spending nearly 9.8 trillion yen (61.55 billion dollars) to support the currency. There will be a report at the end of the month from the Ministry of Finance that will confirm the amount spent on the new intervention.

What is Carry Trade?

Carry trade is one of the best and most important strategies relied upon by many experts and traders in the world of trading. It is a way to build long-term trading positions to benefit from the interest rate differences between currencies in the forex market.

Carry trades in the forex market are executed by a trader selling a low-yield currency and buying a high-yield currency while financing the trading position daily, weekly, or over any period chosen by the trader, allowing them to benefit from the interest rate differential.

The low-yield currency is called the "funding currency," and the high-yield currency is called the "yield currency." In the USD/JPY pair, the yield currency is the US dollar, and the funding currency is the Japanese yen.

The trader borrows the low-yield yen through forward points daily, weekly, or over any other period and then lends the high-yield US dollar through forward points.

If we assume that the yields on the low-yield currency continue to fall or the yields on the high-yield currency continue to rise, financing this trade daily is an easy way to make profits.

Unwinding Carry Trade Positions

Currently, long-term carry trade positions on the Japanese currency are accelerating due to strong speculation regarding the upcoming Bank of Japan monetary policy meeting scheduled for late July.

Sources told Reuters that the Bank of Japan is likely to discuss whether to raise interest rates and unveil a plan to cut bond purchases by nearly half in the coming years, indicating its intention to steadily retreat from its massive monetary stimulus.

In contrast, weak economic data in the United States raised the likelihood of the Federal Reserve cutting US interest rates by 25 basis points in September from 94% to 100% and in November from 98% to 100%.

Thus, the Bank of Japan is taking new steps toward normalizing monetary policy for the world's third-largest economy, while the Federal Reserve is approaching easing monetary policy and beginning a cycle of US interest rate cuts.

Inflation in Tokyo

Government data showed that core inflation in Tokyo rose by 2.2% annually in July, from 2.1% in the previous month, matching market expectations of a 2.2% increase.

Prices in Japan are currently accelerating above the Bank of Japan's inflation target of 2.0%, increasing the likelihood of additional Japanese interest rate hikes this year.

Bank of Japan

On Wednesday, July 31, 2024, the Bank of Japan raised the benchmark interest rate by about 15 basis points to 0.25%, the highest level since 2008 during the global financial crisis, contrary to market expectations of keeping Japanese interest rates unchanged at 0.10%.

The new interest rate hike is the second this year, following the Bank of Japan's decision in March to exit the negative interest rate policy, raising the short-term interest rate by 20 basis points to 0.10%, the first Japanese interest rate increase since 2007.

The Bank of Japan stated that it would continue to raise the benchmark interest rate and adjust the degree of monetary easing, assuming its economic outlook is met.

The Bank of Japan also announced a quantitative tightening plan over two years, gradually reducing government bond purchases by about 400 billion yen per quarter, reaching around 3 trillion yen "20 billion dollars" monthly in the first quarter of 2026. The bank currently conducts government bond purchases of about 6 trillion yen monthly.

Kazuo Ueda

Bank of Japan Governor "Kazuo Ueda" said: We will continue to raise interest rates in the country while adjusting the pace of monetary easing if our current economic forecasts are met.

Ueda added: There are upside risks to price levels. Personal consumption remains strong despite the clear effects of inflation. Rising wages and income levels will provide additional support for personal consumption. Wage growth momentum has increased broadly, both among small and medium-sized companies. Import prices are rising again, warranting further attention.

Ueda clarified: I do not see that raising interest rates will have significant negative effects on the Japanese economy, and the Bank of Japan does not consider a cap on interest rates at 0.5%.

Federal Reserve

Federal Reserve Chairman "Jerome Powell" said on Wednesday, July 31: If we see inflation moving downward... somewhat in line with expectations, and growth remains reasonably strong, and the labor market remains consistent with current conditions, I think a rate cut may be on the table at the September meeting.

US Interest Rates

Global financial markets have long anticipated a 25 basis point cut in US interest rates in September, but after this week's Federal Reserve meeting, traders became more confident in this cut, expecting cuts of around 75 basis points this year.

Interest Rate Gap

Investors have relentlessly sold the yen for months, given Japan's low interest rates compared to anywhere else, especially the United States, leading to the accumulation of bearish positions on the Japanese currency that some have been forced to unwind.

The interest rate gap between the United States and Japan has created a highly profitable trading opportunity, as traders borrow the yen at low rates to invest in dollar-denominated assets for higher returns, known as carry trades.

After the recent decisions by the Bank of Japan and the Federal Reserve, the interest rate gap between Japan and the United States narrowed to 525 basis points in favor of US interest rates, the smallest gap since July 2023. It is expected to narrow to 475 basis points if the US central bank indeed cuts rates by around 75 basis points this year while keeping Japanese rates unchanged.

Australian Dollar

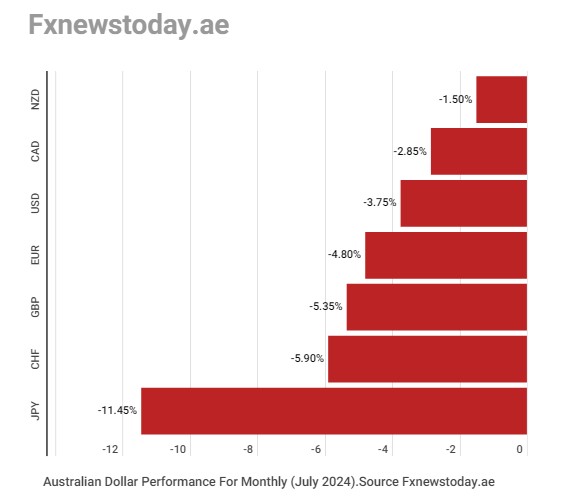

The image above shows the negative performance of the Australian dollar in July 2024 against the seven major currencies in the foreign exchange market due to risk aversion and concerns about the Chinese economy.

Risk Aversion

The massive rise in the Japanese yen levels has indeed turned markets upside down, triggering a broad wave of selling in most global stock markets, led by technology stocks, as well as a decline in precious metals, led by gold, and cryptocurrencies, led by Bitcoin.

Investors are reevaluating their leveraged bets, changing their investment strategies, and trying to mitigate increasing risks in the volatile market environment.

Chinese Economy

Sudden interest rate cuts in China have raised concerns that Chinese authorities are struggling to revive the world's second-largest economy. The People's Bank of China implemented a surprise interest rate cut on Monday, July 22, followed by a cut in the lending rate on its medium-term lending facilities on Thursday, July 25.

Gold continues to break records even as dollar gains ground

Gold prices rose on Thursday to a new record high even as the dollar rose against most major rivals.

Yesterday, the Federal Reserve decided to maintain interest rates unchanged at below 5.5%, but said that inflation control is progressing as planned.

Fed Chair Jerome Powell said it might be appropriate to cut interest rates at the September meeting as policymakers assess new data.

Earlier US data showed the manufacturing PMI down to 46.8 in July from 48.5 in June.

US unemployment claims rose to 249 thousand last week, while analysts expected a smaller increase to 236 thousand.

Otherwise, the dollar index rose 0.3% as of 21:26 GMT to 104.4, with a session-high at 104.4, and a low at 103.8.

On trading, gold spot prices rose 0.5% as of 21:28 GMT to $2486 an ounce.

US stock indices reverse lower after a positive opening

US stock indices declined on Thursday after a positive opening amid expectations the Fed will end the current cycle of policy tightening soon.

Yesterday, the Federal Reserve decided to maintain interest rates unchanged at below 5.5%, but said that inflation control is progressing as planned.

Fed Chair Jerome Powell said it might be appropriate to cut interest rates at the September meeting as policymakers assess new data.

On trading, Dow Jones fell 1.3%, or 525 points as of 16:38 GMT to 40317, while S&P 500 fell 0.9%, or 49 points to 5473, as NASDAQ gave up 1.3%, or 228 points to 17,371.

Bitcoin sharpens its losses to two-week lows as Trump support wanes

- Doubts about Trump’s ability to execute crypto support plans

- US Yields slide stems crypto losses

Bitcoin lost ground today and marked the fourth loss in a row, hitting two-week lows as support for Republican candidate for US presidency Donald Trump waned.

Crypto losses were stymied by losses in US 10-year treasury yields following weak data.

The Price

Bitcoin fell 1.9%, or $1,204 at Bitstamp to $63,408, the lowest since July 19, with a session-high at $64,917.

On Wednesday, bitcoin lost 2.4%, the third loss in a row.

Crypto Market Value

The market value of cryptocurrencies fell by over $40 billion on Thursday to a total of $2.393 trillion as both bitcoin and ethereum lost ground.

Trump

Polls indicate a close battle between Donald Trump and Kamala Harris, with Trump’s lead vanishing.

Trump has declared himself the major ally of cryptocurrencies in the field, and any waning of support for his presidential bid would hurt the markets.

US Yields

US 10-year treasury yields fell 1.6% today on track for the sixth decline in a row, plumbing six-month lows at 3.966% and boosting risk appetite in the markets.

The decline came after a stream of weak US data that boosted the odds of a September Federal Reserve rate cut, which in turn would boost liquidity into cryptocurrencies.