The GBPUSD surrenders to the negative pressures -Analysis-17-07-2025

AI Summary

- GBPUSD price declined after retesting resistance of 1.3445

- Bearish correctional trend dominant on short-term basis

- Negative pressure continues due to trading below EMA50 and negative signals on RSI emerging

The (GBPUSD) price declined in its last trading, after it succeeded in its previous move to retest the resistance of 1.3445 and offloaded its clear oversold condition on the (RSI), to bounce lower due to the stability of this resistance, amid the dominance of the bearish correctional trend on the short-term basis and its trading alongside a bias line, with the continuation of the negative pressure due to its trading below EMA50, besides the beginning of the negative signals emergence on the (RSI) again, which intensifies the negative pressures around the pair.

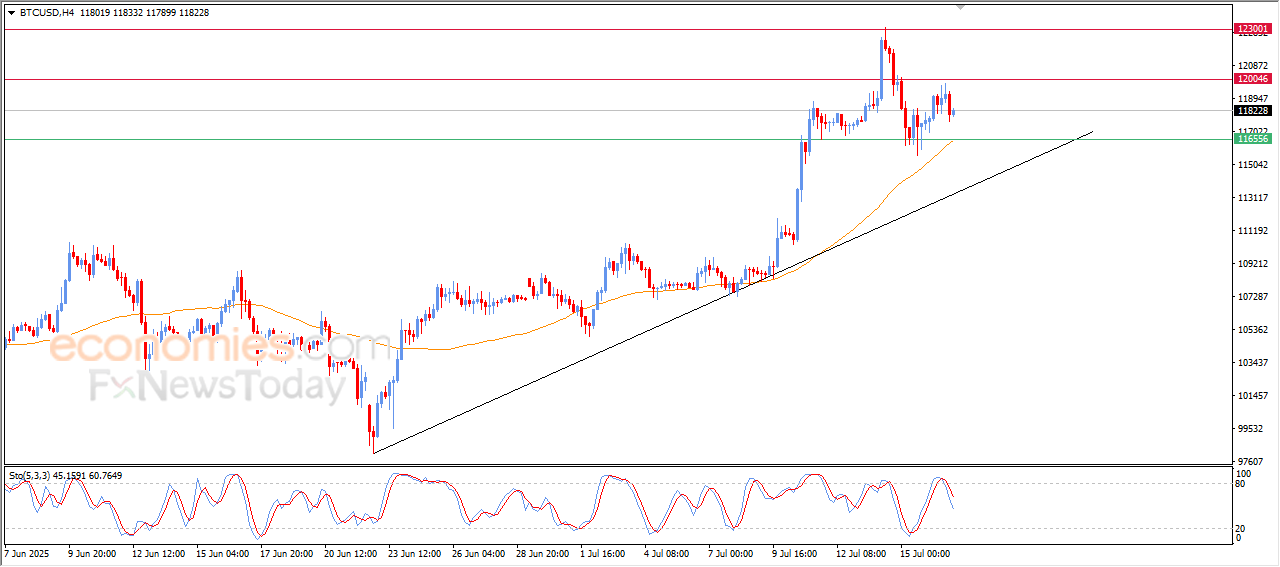

Bitcoin (BTCUSD) is attempting to offload it overbought condition-Analysis-17-07-2025

The price of Bitcoin (BTCUSD) settled low in its last intraday trading, amid cautious attempts to gain a positive momentum that supports its recovery and resuming the bullish trend, this comes amid its attempt to offload its clear overbought conditions on the (RSI), that begin showing negative signals that might limit any potential rise.

Despite these pressures, the price remains supported by its trading above EMA50, besides the dominance of the main bullish trend on the short-term basis, with its continuation to move alongside a supportive bias line.

Therefore, our bullish scenario remains valid for the (BTCUSD) price in the upcoming intraday sessions, conditioned by the stability of the support at $116,500, targeting the current resistance levels at $120,000 preparing to attack it.

The expected trading range is between $116,500 support and $121,000 resistance.

Today’s forecast: Bullish

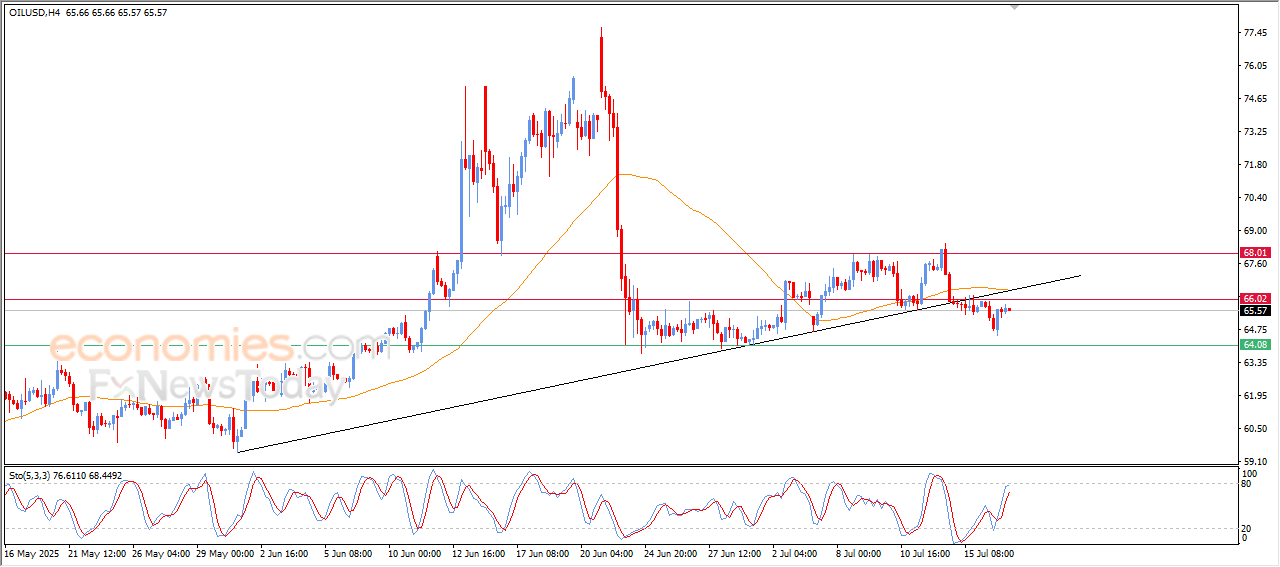

Crude oil prices are under negative pressure -Analysis-17-07-2025

The (crude oil) prices settled in its last intraday trading, keeping the achieved gains in the end of yesterday’s session, in attempt to recover some of its previous losses, but these moves needs enough momentum, amid the continuation of the negative pressure that comes from the stability of the price below EMA50, besides its affection by breaking a main bullish trend on the short-term basis.

The (RSI) indicators began showing an exaggerated overbought condition, indicating the weakness of the bullish momentum and supporting the possibilities to return to decline in its upcoming moves.

Therefore, our expectations suggest a decline in (crude oil) prices in the upcoming intraday trading, if the resistance settles at $66.00, to target the support at $64.00.

The expected trading range is between $64.00 support and $67.00 resistance.

Today’s forecast: Bearish

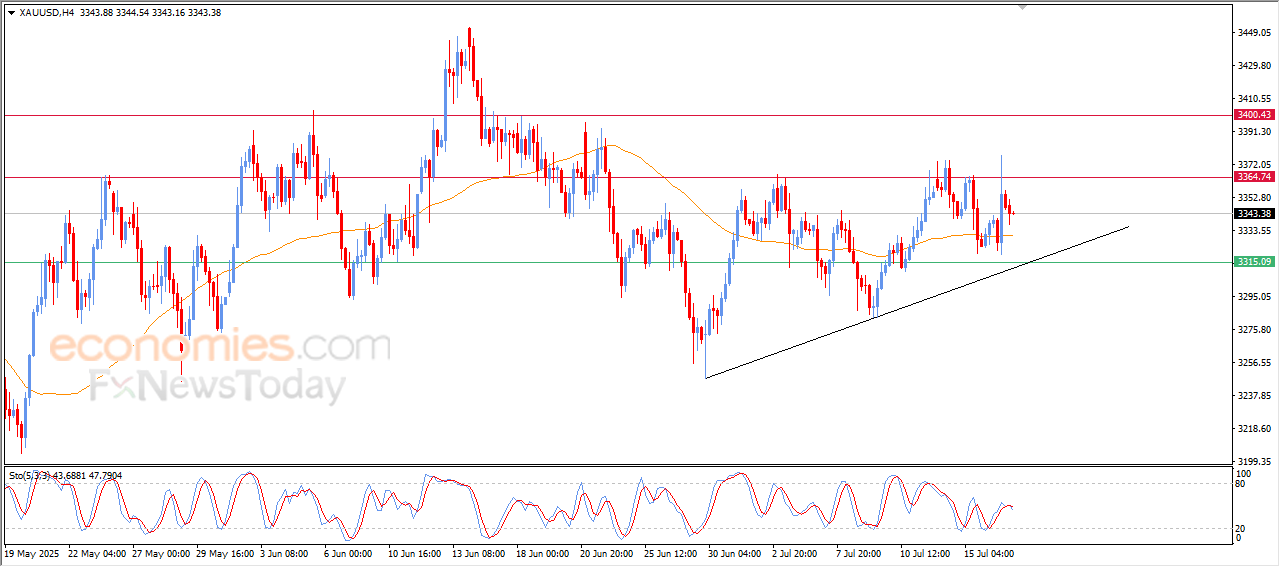

Gold price is attempting to gain positive momentum -Analysis-17-07-2025

The (Gold) price declined in its last intraday trading, affected by the stability of the strong resistance at $3,365, which remains representing an obstacle against the upside track, the price is attempting to catch its breath and gain a new bullish momentum that might allow it to surpass this resistance in the future.

This comes amid the continuation of the dynamic support from the trading above EMA50, besides the dominance of the main bullish trend on the short-term basis, with the continuation of the trading alongside a supportive minor bias line.

Therefore, our expectations suggest a rise in the (Gold) price in its upcoming intraday trading, conditioned by the stability of the support at $3,315, targeting the resistance at $3,365 getting ready to attack it.

The expected trading range is between $3,315 support and $3,380 resistance.

Today’s forecast: Bullish