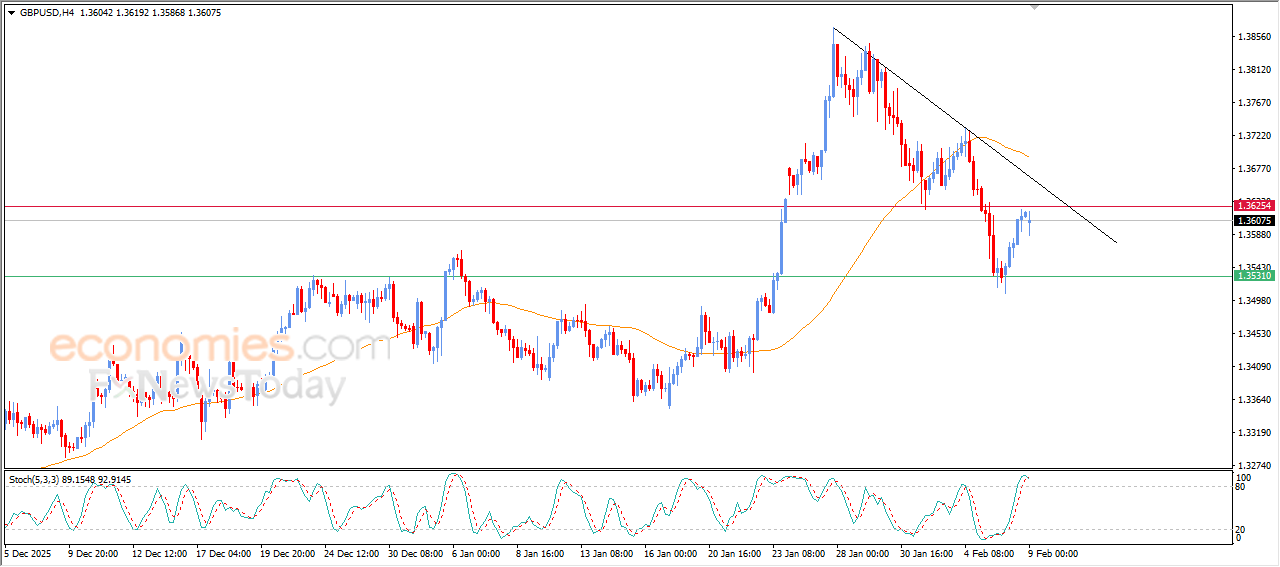

GBPUSD price is witnessing a fading of positive momentum- Analysis- 09-02-2026

GBPUSD declined in fluctuating trading on its last intraday levels, amid the dominance of the bearish corrective trend on short-term basis, with its trading alongside supportive trend line, besides the continuation of the negative and dynamic pressure that is represented by its trading below EMA50, which reduces the chances of sustainable recovery on near term, especially with the beginning of forming negative divergence on relative strength indicators, after reaching overbought levels, exaggeratedly compared to the price move, with the emergence of negative overlapping signals.

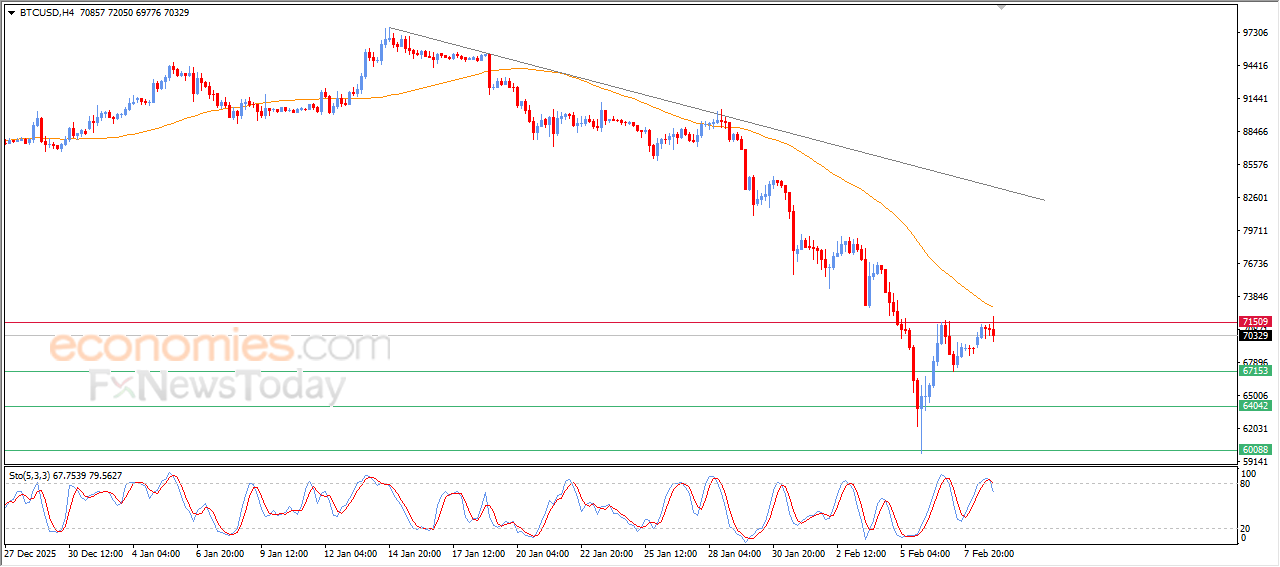

Bitcoin (BTCUSD) is showing negative signals that keeps it trapped within bearish trend- Analysis-09-02-2026

Bitcoin’s price declined in its last intraday trading, after the stability of $71,500 key resistance, which stopped the rising attempts, to keep the price under continued negative pressure within its trading below EMA50, which reinforces the continuation and dominance of the main bearish trend on short-term basis.

The relative strength indicators began to send new negative signals after reaching exaggerated overbought levels, and there are signals for forming negative divergence, which might open the way for more downside moves in the near period.

Therefore, we suggest a decline in BTCUSD in its upcoming intraday trading, if the resistance settles at $71,500 to target the initial support levels at $67,000.

Expected trading range is bewteen$67,000 support and $75,000 resistance.

Today’s forecast: Bearish

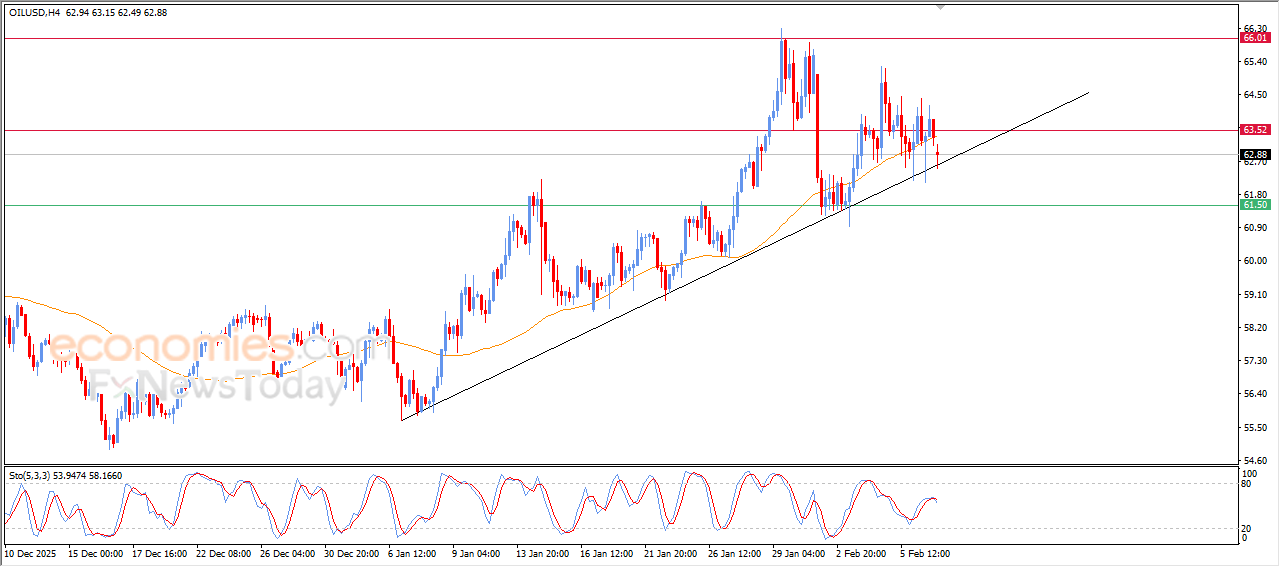

Crude oil prices get ready to break bullish trend line- Analysis-09-02-2026

Crude oil prices declined in their last intraday trading, reaching below EMA50, as a signal that adds negative pressure on its current trading, and it might pave the way for breaking main bullish trend.

Accompanied by the emergence of negative signals from relative strength indicators, after offloading the oversold conditions, opening the way to continue the decline and record extra losses on near-term basis.

Therefore, we expect crude oil to decline in upcoming intraday trading, especially if it settles below $63.50, to target $61.50 initial support.

The expected trading range for today is between $61.50 support and $65.00 resistance.

Today’s forecast: Neutral

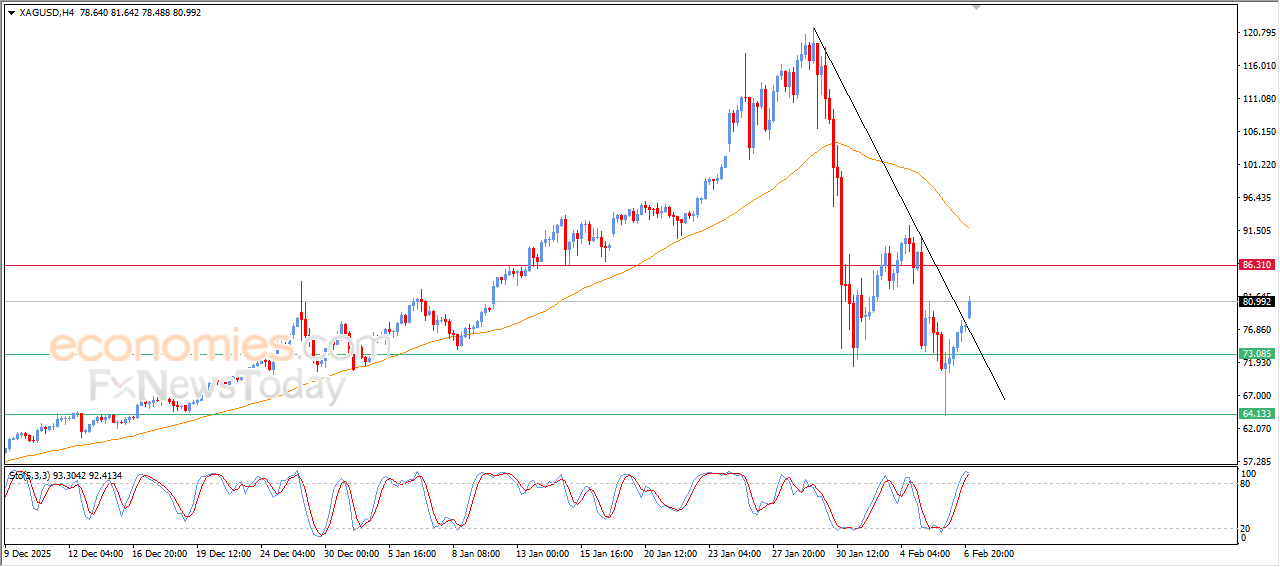

Silver Price is extending its cautious gains– Analysis-09-02-2026

Silver prices (SILVER) surged higher in their recent intraday trading, breaching steep bearish trend line on short-term basis, providing a chance for extending the rises in the near period, especially with the stability of $73.00 key support.

On the other hand, the negative pressures remain valid due to the trading below EMA50, accompanied by forming negative divergence by the relative strength indicators after reaching exaggerated overbought levels compared to the price move, with the emergence of negative overlapping signals that reinforces the likelihoods of the bullish momentum slowness.

Accordingly, we suggest a decline in sliver’s upcoming intraday trading, especially if $86.00 resistance settles, and there are strong chances for retesting this resistance, if it declines, our initial target will be $73.00 support.

The expected trading range is between $73.00 support and $86.00 resistance.

Today’s forecast: Neutral