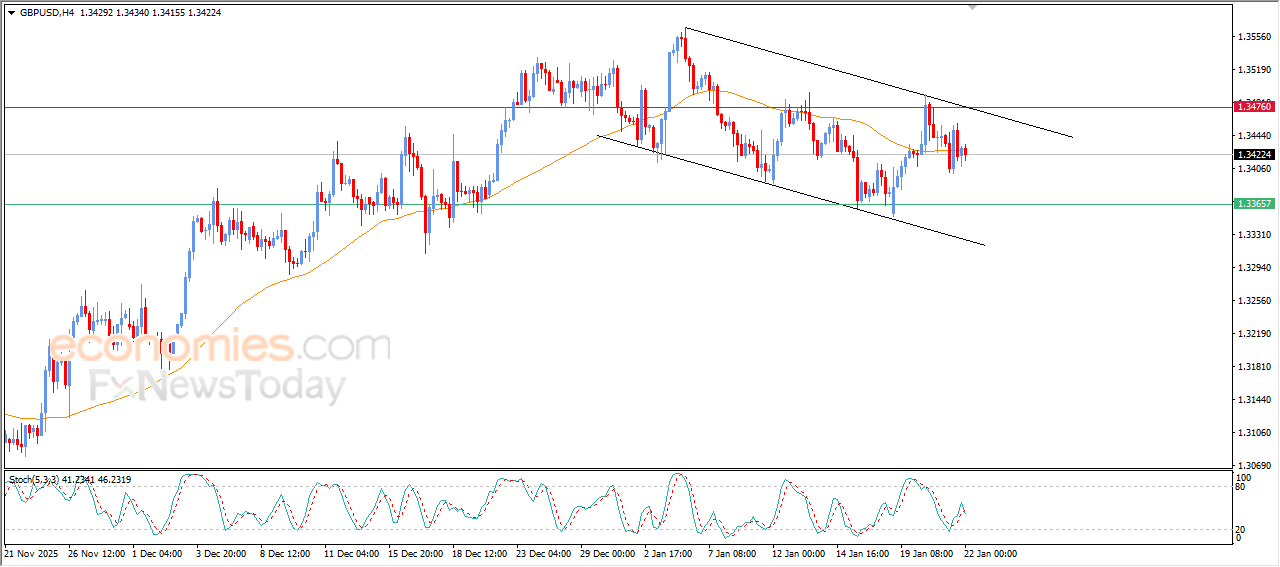

GBPUSD price is showing new negative signals- Analysis- 22-01-2026

GBPUSD declined in its last intraday trading, amid the continuation of negative pressure due to its trading below EMA50, which prevents the recovery in the last session, especially with its trading within bearish corrective channel’s range that limits its previous trading on short-term basis, besides the emergence of negative overlapping signals on relative strength indicators, after offloading its oversold levels, opening the way for recording new losses on near term basis.

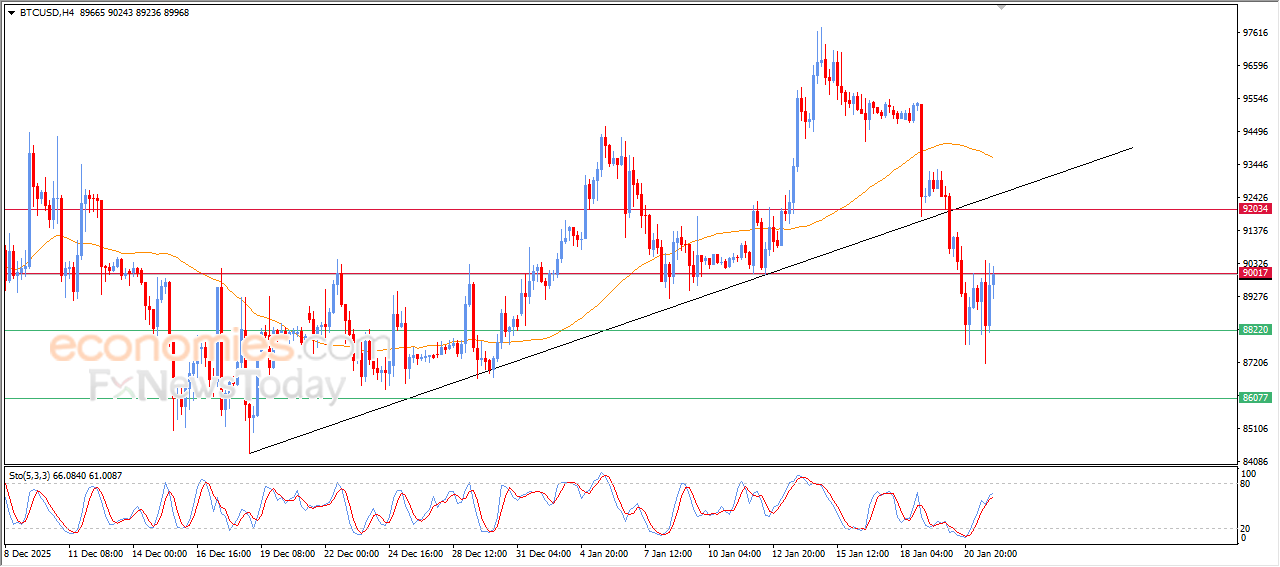

Bitcoin (BTCUSD) is retesting key resistance- Analysis-22-01-2026

Bitcoin’s price rose during its last intraday trading, supported by the emergence of positive signals by relative strength indicators, to reset $90,000 key resistance. However, the relative strength indicators reaching exaggerated overbought levels compared to the price move indicate the weakness of this momentum and a likelihood of declining quickly in the upcoming trading.

The price is affected negatively by its previous break to main bullish trend line on short-term basis, besides the continuation of the negative pressure due to its trading below EMA50, which reduces the chances of the price sustainable recovery in the near period.

Therefore, our expectations suggest a decline in BTCUSD price in its upcoming intraday trading, especially if $90,000, to target $88,000 support and there are chances to break it.

Expected trading range is bewteen$88,000 support and $92,000 resistance.

Today’s forecast: Bearish

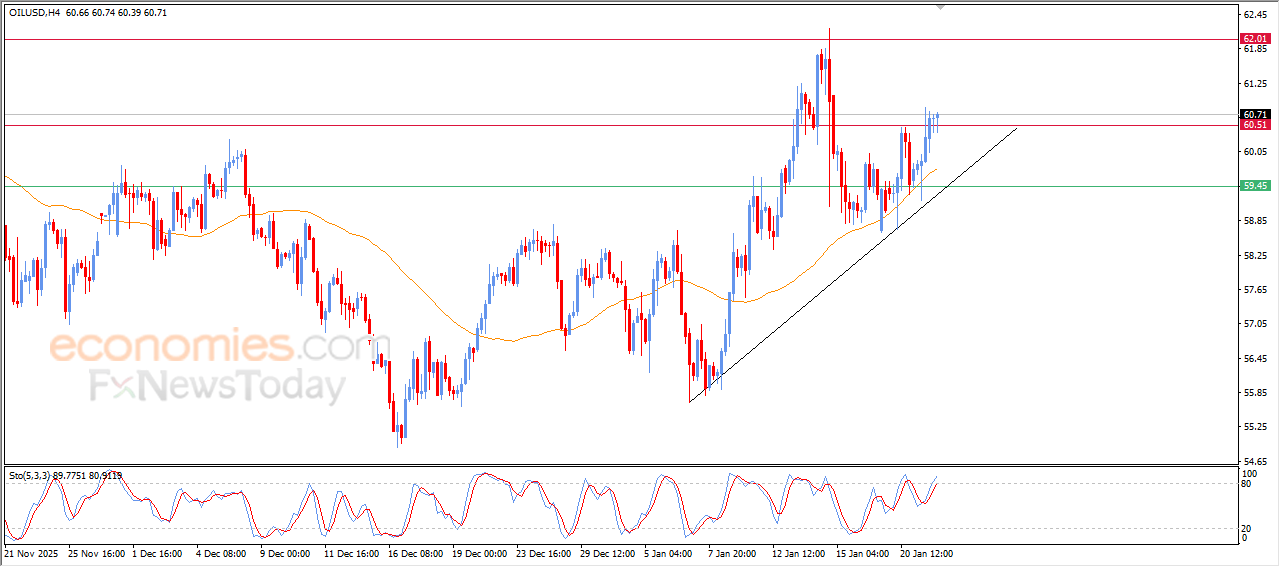

Positive signals are driving crude oil prices to stabilize their gains - Analysis-22-01-2026

Crude oil prices keep their gains in the last intraday trading, breaching $60.50 resistance, which represented a target in our previous analysis. This positive performance was supported by the positive signals from the relative strength indicators, reinforcing the strength of the current bullish momentum.

At the same time, the price is taking advantage of the continued dynamic support due to its trading above EMA50, reinforcing the stability and dominance of the main bullish trend on short-term basis, especially with its trading alongside supportive trend line for this trend, preferring the continuation of attempting to extend the gains in near period.

Therefore, we expect crude oil to rise in upcoming intraday trading, conditioned by stability above $60.50 to target $62.00 key resistance, and the bullish scenario remains valid if support level settles at $59.45.

The expected trading range for today is between $59.45 support and $62.00 resistance.

Today’s forecast: Bullish

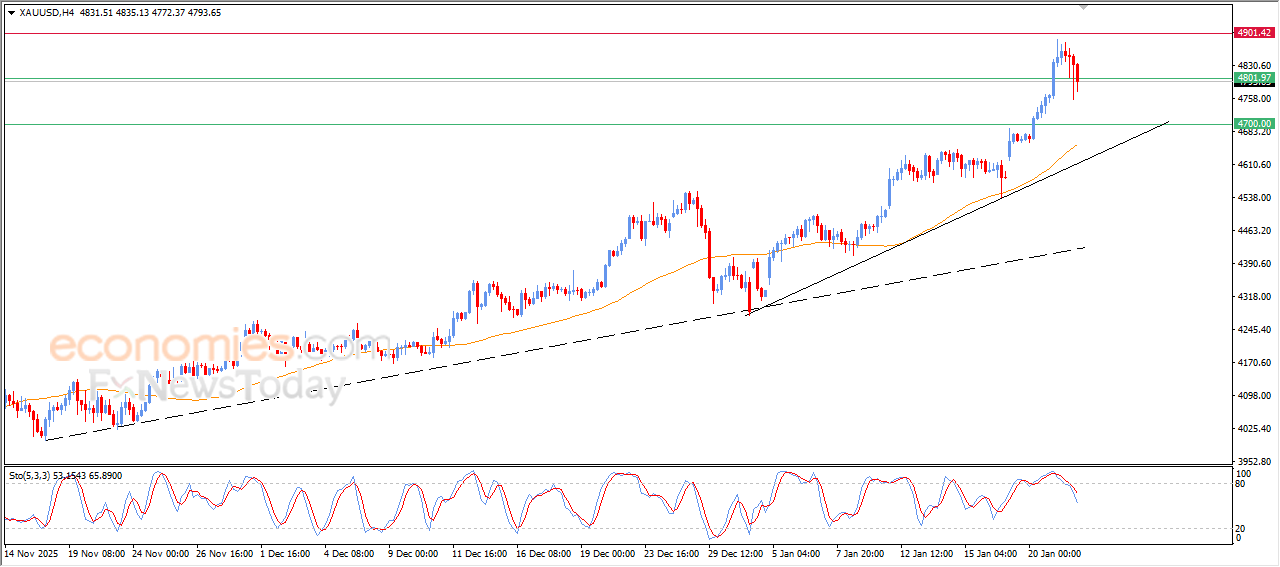

Gold price is experiencing justified profit-taking- Analysis-22-01-2026

Gold declined in its last trading on the intraday levels, while gathering the gains after the previous strong rises, attempting to gain new bullish momentum that might help it recover and rise again, this decline comes amid clear attempts to offload some overbought conditions on relative strength indicators, especially with the emergence of negative signals from them.

The dynamic support remains valid with the trading above EMA50, which reinforces the stability and dominance of the main bullish trend on a short-term basis. The precious metal benefits from its trading alongside main and minor supportive lines for this trend, keeping the bullish scenario valid in the upcoming period.

therefore, we expect gold to rise in upcoming intraday trading, conditioned by the stability of $4,700 support, to target the main resistance at $4,900.

The expected trading range is between $4,700 support and $4,900 resistance.

Today’s forecast: Bullish