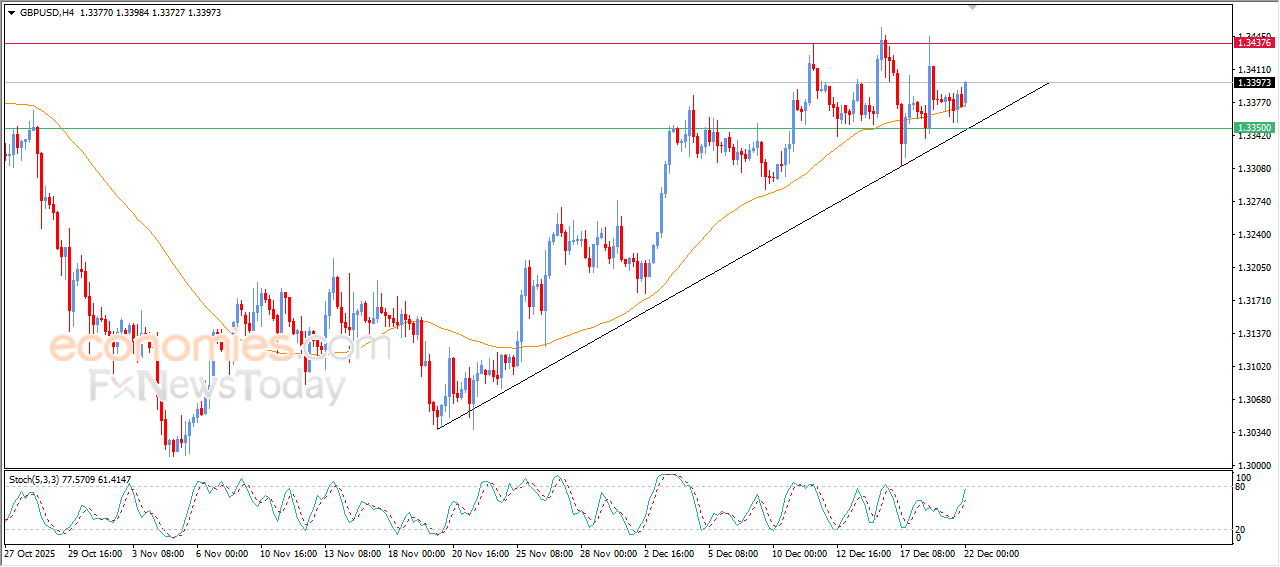

GBPUSD price is getting bullish push- Analysis- 22-12-2025

GBPUSD rose in its last intraday trading, as it is leaning on EMA50’s support, gaining bullish momentum that helped it to achieve these gains, amid the dominance of the main bullish trend and its trading alongside supportive trend line for this track, besides the emergence of positive signals on the relative strength indicators, despite reaching overbought levels.

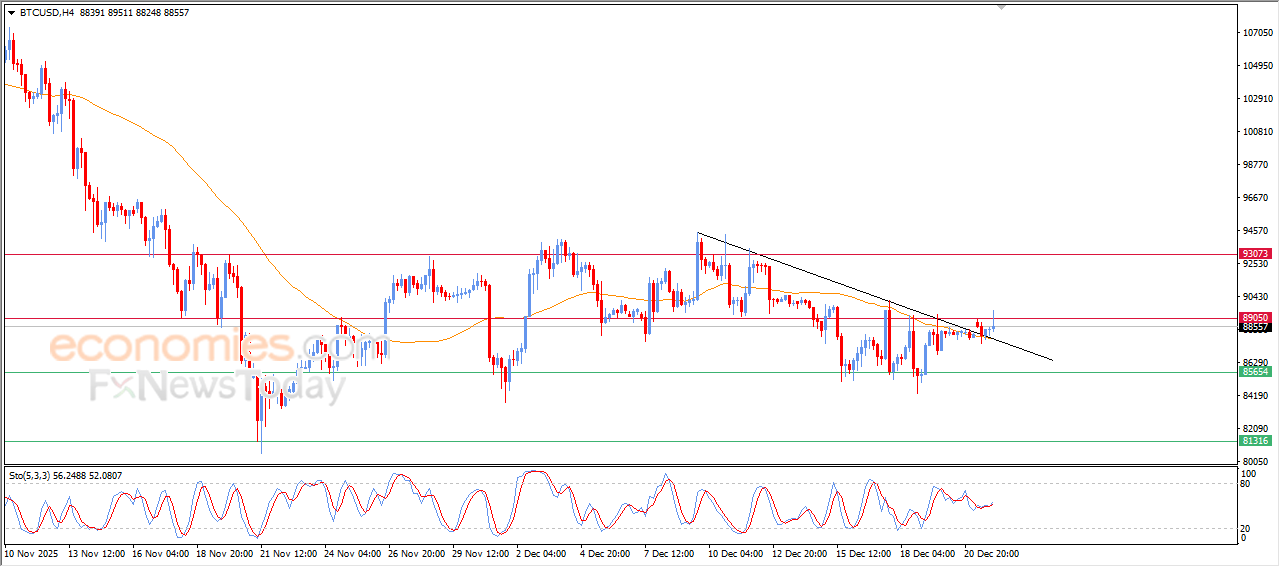

(BTCUSD) is attacking key resistance- Analysis-22-12-2025

Bitcoin’s price rose slightly in its last intraday trading, taking advantage of breaching minor bearish trend line on the short-term basis, besides its trading above EMA50, providing technical support that helped it to continue the positive rebound.

This rise attacks $89,000 key resistance, supported by the emergence of positive signals on the relative strength indicators, after offloading its overbought conditions, opening the way for achieving more gains on the near-term basis if it manages to breach this resistance.

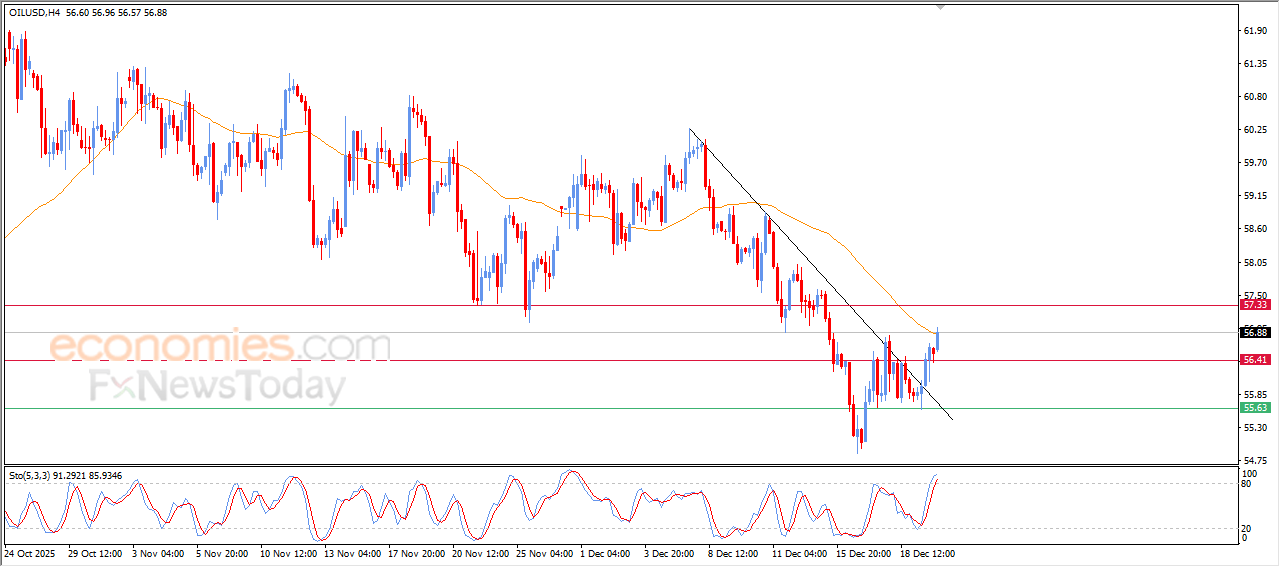

Crude oil price is in its way to surpass its negative pressures- Analysis-22-12-2025

Crude oil rose in its recent intraday trading, supported by the emergence of positive signals on the relative strength indicators, despite reaching overbought levels, indicating the strength of this dominant overbought momentum in the current time.

Breaching minor bearish trend line on the short-term basis helped to reduce the negative pressure gradually, with the price’s last attempts to surpass the EMA50, which reinforces the scenario of announcing full recovery on the near-term basis if the price settles above its current levels.

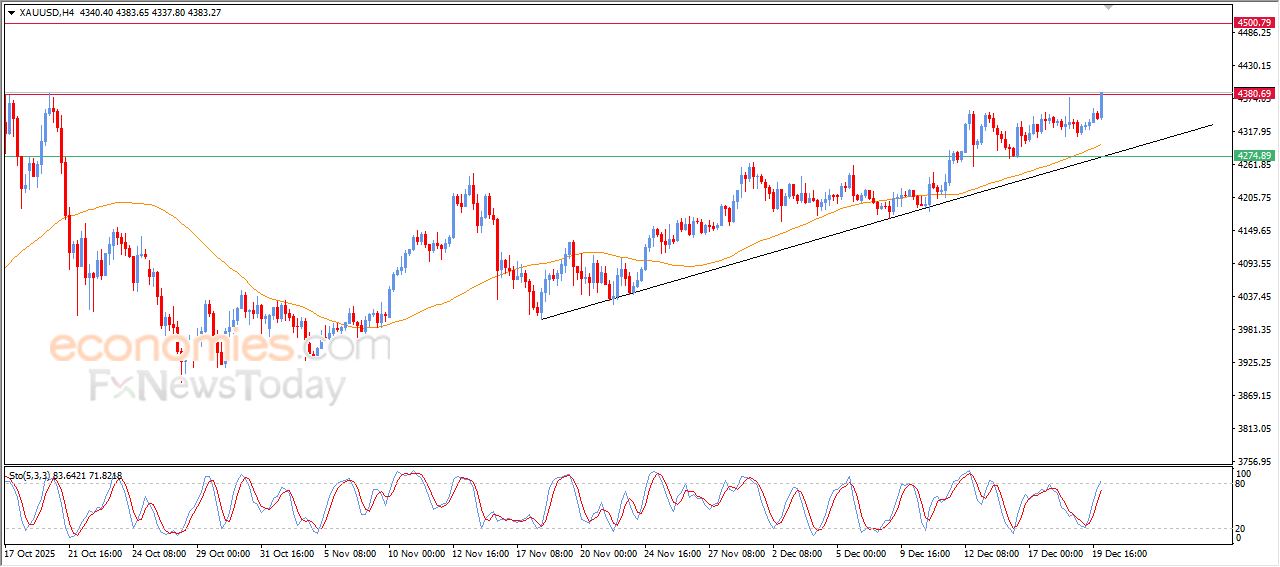

Gold prices record new historical level- Analysis-22-12-2025

Gold price jumped sharply in its recent intraday trading, attacking the historical resistance at $4,380, which represents a potential target in our previous analysis, to record new all-time high, accompanied by clear acceleration in the bullish momentum and the dominance of the buyers on the price movement.

This rise is supported by the continuous trading above EMA50, which provides solid dynamic support, accompanied by the dominance of the main bullish trend on the short-term basis and its trading alongside minor supportive trend line for this trend, besides the emergence of positive signals from relative strength indicators, reinforcing the chances of reinforcing the gains in the upcoming period.